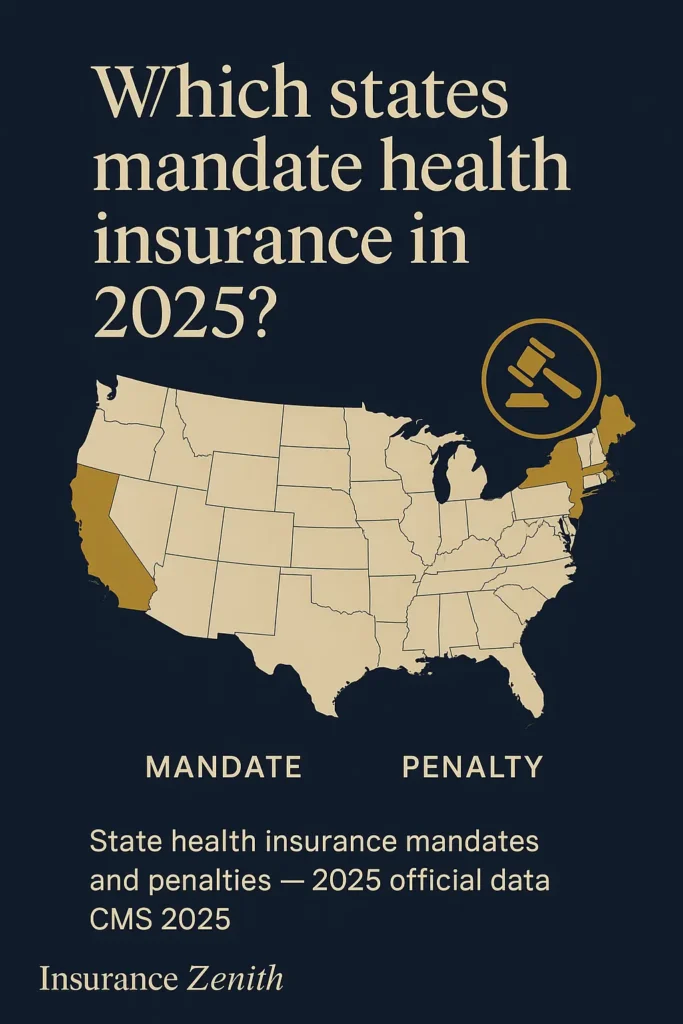

Understanding which states require health insurance has become increasingly complex since the federal individual mandate penalty was eliminated in 2019. As of the 2024 tax year (for returns filed in spring 2025), several states and the District of Columbia impose penalties on residents who do not maintain qualifying health insurance coverage. These jurisdictions include California, Massachusetts, New Jersey, Rhode Island, and Washington, D.C. For millions of Americans, navigating these state-specific requirements is essential to avoid costly financial penalties while ensuring proper health coverage protection.

Wondering whether your state mandates coverage? The landscape varies dramatically across jurisdictions, with penalties ranging from hundreds to thousands of dollars annually. In the next section, we’ll explore which states currently enforce these requirements and what they mean for your coverage decisions.

On This Page

Essential Overview — What You Need to Know

State health insurance mandates operate through individual requirements that compel residents to maintain minimum essential coverage (MEC) or face financial penalties during tax season. According to the National Association of Insurance Commissioners, currently five states plus Washington D.C. enforce these mandates with varying penalty structures and enforcement mechanisms.

Answer Box: What States Require Health Insurance? As of 2025, five jurisdictions require health insurance coverage: California, Massachusetts, New Jersey, Rhode Island, and Washington D.C. Vermont has a reporting requirement only. Penalties range from $450 per child to over $2,700 for families annually.

Key Takeaway: Currently, five states plus Washington D.C. enforce health insurance mandates with varying penalty structures, while the remaining 44 states follow federal requirements only.

Current State Mandate Landscape

New Jersey, California, Rhode Island, Massachusetts, and the District of Columbia require their residents to have health insurance coverage or face penalties. Vermont recommends that residents have coverage, but there’s no noncompliance penalty. These mandates serve critical regulatory functions:

- Market Stabilization: Preventing adverse selection by maintaining balanced risk pools

- Revenue Generation: Funding state reinsurance programs and healthcare initiatives

- Coverage Expansion: Encouraging broader insurance participation among residents

- Cost Control: Reducing uncompensated care burden on healthcare systems

Federal vs. State Authority Framework

The regulatory framework operates through overlapping federal and state jurisdictions. Federal law requires all employers with 50 or more full-time equivalent employees (FTEs) to provide insurance with minimum essential coverage (MEC) that satisfies the Affordable Care Act’s (ACA) employer mandate. States maintain authority to implement additional requirements beyond federal minimums.

| Jurisdiction | Authority | Primary Requirements | Enforcement Mechanism |

|---|---|---|---|

| Federal | CMS, DOL, IRS | Employer mandate, essential health benefits | Tax penalties, compliance monitoring |

| State with Mandates | State DOI, tax agencies | Individual coverage, reporting | State tax penalties, market regulation |

| State without Mandates | State DOI | ACA compliance only | Federal enforcement only |

Ready to explore which specific states have these requirements? The next section breaks down mandate details by jurisdiction.

States Require Health Insurance: Current Mandate Status

Understanding specific state requirements is crucial for compliance and financial planning. According to the Centers for Medicare & Medicaid Services, health insurance has not been required at the federal level in the United States since 2019. However, five states — California, Massachusetts, New Jersey, Rhode Island and Vermont — along with the District of Columbia, have their own health insurance mandates.

States Require Health Insurance Compliance Steps

Step 1: Determine your state of residence for tax purposes and verify mandate status through your state Department of Insurance.

Step 2: Research qualifying coverage options including employer plans, marketplace coverage, or government programs like Medicare and Medicaid.

Step 3: Enroll during open enrollment periods, which run November 1 – January 15 for most states using HealthCare.gov.

Step 4: Maintain continuous coverage throughout the year or secure valid exemptions for hardship, unaffordable coverage, or religious beliefs.

Step 5: Keep documentation of your coverage including Forms 1095-B, 1095-C, or state-specific forms for tax filing purposes.

Step 6: File required tax forms accurately, reporting your coverage status and claiming any applicable exemptions.

States with Active Individual Mandates

California: California reinstated its individual mandate in 2020. Residents are required to have MEC for themselves and their dependents or pay penalties. According to the California Franchise Tax Board, the penalty for a dependent child is half of what it would be for an adult, $450, for 2024. Adults pay $900 per adult and $450 per child, or 2.5% of the amount of gross income that exceeds the filing threshold requirements. Exemptions include hardships, unaffordable coverage, or membership in healthcare-sharing ministries.

Massachusetts: According to Mass.gov, the Massachusetts Health Care Reform Law requires that most residents over 18 who can afford health insurance have coverage for the entire year, or pay a penalty through their tax returns. Penalties add up for each month you don’t comply, but there is a grace period that allows lapses in coverage of 3 or fewer consecutive months. You must be enrolled in health insurance plans that meet Minimum Creditable Coverage (MCC) requirements.

New Jersey: The New Jersey Health Insurance Market Preservation Act of 2018 requires state residents to obtain a health plan that provides MEC or pay a shared responsibility payment. Only individuals required to file a New Jersey income tax return must pay a penalty. The penalty calculation is based on household size and income, with a cap set at the average annual premium for a bronze-tier plan available in the state.

Rhode Island: Effective January 2020, Rhode Island requires all residents to have a qualifying form of health insurance, such as employer-sponsored coverage, Medicare, Medicaid, or MEC purchased from an insurance company or through the state-based Marketplace, HealthSource RI. You must pay a penalty when you file your income taxes if you or your dependents didn’t have health insurance during the previous year.

District of Columbia: Washington D.C. requires residents to maintain health insurance coverage or face penalties similar to other mandate states, with enforcement through the District’s tax filing system.

Vermont: Vermont’s H.524 medical care bill recommends that all residents older than 18 have health insurance coverage. However, the bill doesn’t require residents to pay a penalty for not obtaining health insurance. The law only requires individuals to report if they had health coverage the previous year when filing their annual tax return.

Real-World Compliance Examples

Case Study 1: California Family The Johnson family of four in California (household income $75,000) failed to maintain health insurance for six months in 2024. Their penalty calculation: $900 × 2 adults + $450 × 2 children = $2,700. However, they discovered they qualified for subsidized affordable health insurance options costing only $180/month ($2,160 annually) — less than their penalty.

Case Study 2: Massachusetts Professional

Sarah, a 32-year-old freelancer in Boston earning $45,000 annually, let her coverage lapse for four months while switching jobs. Massachusetts assessed a penalty based on her income and age. She learned that maintaining COBRA coverage or purchasing short-term coverage during transitions helps avoid gaps.

Case Study 3: New Jersey Resident Mark moved from Florida to New Jersey mid-year and wasn’t aware of the state’s individual mandate. His partial-year residency still triggered penalty assessment for the months he lived in New Jersey without coverage. The lesson: research state requirements immediately when relocating.

Are you concerned about potential penalties in your state? Understanding how insurance handles pre-existing conditions can help you select appropriate coverage that meets mandate requirements. The next section explains specific coverage requirements that can help you avoid these costly situations.

States Require Health Insurance Requirements by Type

State health insurance requirements vary significantly in their scope, enforcement mechanisms, and penalty structures. Understanding these variations is essential for compliance across different jurisdictions.

Coverage Standards by State

All mandate states recognize similar categories of minimum essential coverage (MEC):

- Employer-sponsored health plans that meet ACA requirements

- Individual market plans purchased through state marketplaces or directly from insurers

- Government programs including Medicare Parts A and C, most Medicaid coverage

- Military coverage including TRICARE and Veterans Administration plans

- Other qualifying coverage such as Peace Corps or AmeriCorps health plans

Key Takeaway: Most employer-sponsored plans and government programs automatically satisfy state mandate requirements, but individual market plans must meet specific state standards.

Massachusetts Minimum Creditable Coverage (MCC)

Massachusetts maintains the most detailed coverage standards through its Minimum Creditable Coverage requirements. Minimum Creditable Coverage (MCC) is the minimum level of benefits that you need to have to be considered insured and avoid tax penalties in Massachusetts. These benefits include: Coverage for a comprehensive set of services (e.g., doctor visits, hospital admissions, day surgery, emergency services, mental health and substance abuse, and prescription drug coverage). Doctor visits for preventive care without a deductible. A cap on annual deductibles of $2,000 for an individual and $4,000 for a family.

For 2025, the OOPMs under MCC will be $9,200/$18,400 for out-of-pocket maximums, with the 2025 maximum MCC deductibles as $2,950/$5,900.

California Coverage Requirements

California follows federal MEC definitions but adds state-specific reporting requirements. California established its healthcare mandate to stabilize and strengthen the state’s healthcare system. It requires residents to have coverage under a health insurance plan. This initiative reduces the number of uninsured individuals and helps ensure that everyone has access to necessary healthcare services at an affordable rate.

Addressing Common Coverage Gaps

Based on analysis of consumer forums and state insurance department inquiries, several key questions frequently arise that existing resources don’t adequately address:

Multi-State Residents: How mandate requirements apply when maintaining residences in multiple states remains unclear in most official guidance. Tax residency typically determines mandate obligations, but documentation requirements vary.

Military Families: State mandate interactions with TRICARE coverage during PCS moves between mandate and non-mandate states creates compliance uncertainty not addressed in standard guidance.

Seasonal Workers: Gig economy workers moving between states for seasonal employment face unique compliance challenges that traditional state guidance doesn’t specifically address.

College Students: Out-of-state students attending university in mandate states often lack clear guidance on residency determination for mandate purposes.

Ready to explore portable coverage options? Let’s examine which health insurance plans work across state lines in the next section.

What Health Insurance Can I Use in Any State

Understanding portability and multi-state coverage options is crucial for Americans who travel frequently or maintain residences in multiple states.

Federal Program Coverage

Medicare: Available nationwide with consistent benefits across all states, though Medicare Advantage plans may have regional networks. According to the Centers for Medicare & Medicaid Services, the majority of individuals with Medicare coverage have both Medicare Parts A & B and do not have other private health insurance, like a Marketplace plan.

TRICARE: Military health coverage maintains national portability with consistent benefits for active duty, retired military, and eligible family members.

Veterans Administration: VA health coverage provides nationwide access to VA medical facilities and approved providers.

Multi-State Private Insurance Options

National Insurance Carriers: Major insurers like Blue Cross Blue Shield maintain reciprocal agreements across state boundaries, though specific plan benefits may vary by state.

Association Health Plans: Some professional associations offer health plans with multi-state coverage, though availability varies by profession and state regulations.

Travel Insurance: Supplemental coverage for temporary stays in other states, but not suitable as primary health insurance.

Self-Employed Coverage: For independent contractors and freelancers who frequently travel between states, health insurance for self-employed individuals can provide consistent coverage regardless of location.

Important: State mandate requirements typically apply based on your state of residence for tax purposes, regardless of where you receive care.

Now that we’ve covered portable coverage options, let’s explore how state-based marketplaces facilitate access to compliant coverage in the following section.

State-Based Health Insurance Marketplaces

Understanding marketplace operations is essential for accessing coverage and subsidies in mandate states.

State-Run Marketplaces

California – Covered California: According to the CMS 2025 enrollment data, California’s insurance marketplace offers health insurance for as little as $10 a month, with rates depending on household income and size, as well as location and age. The marketplace provides enhanced subsidies through federal funding extended through 2025.

Massachusetts – Health Connector: Most adults already have health insurance, perhaps through their employer or a government program, but according to Mass.gov, if you don’t, you or your employer can find the right health insurance plan online. You may also buy plans through approved Massachusetts health insurance carriers. To learn more or buy a plan, contact the Health Connector at (877) 623-6765, TTY number at (877) 623-7773, or visit the Health Connector website.

Rhode Island – HealthSource RI: Operates as the state’s official marketplace with local customer service and state-specific plan options.

Federal Marketplace States

New Jersey and Washington D.C. use the federal HealthCare.gov platform but maintain state-specific penalty enforcement and reporting requirements.

| State/District | Marketplace Platform | Customer Service | Special Features |

|---|---|---|---|

| California | Covered California | State-operated | Enhanced subsidies, multilingual support |

| Massachusetts | Health Connector | State-operated | MCC compliance verification |

| Rhode Island | HealthSource RI | State-operated | Small state personalized service |

| New Jersey | HealthCare.gov | Federal/state hybrid | State penalty enforcement |

| Washington D.C. | DC Health Link | District-operated | Local employer partnerships |

Understanding these state variations is crucial for compliance planning. In the next section, we’ll examine how future policy developments may affect state health insurance requirements.

Official Regulations and Standards

Federal and state regulatory frameworks establish the foundation for health insurance requirements across jurisdictions.

Federal Regulatory Framework

According to the Centers for Medicare & Medicaid Services, the Affordable Care Act establishes baseline requirements that all states must follow:

- Essential Health Benefits: All individual and small group plans must cover ten essential benefit categories

- Employer Mandate: Applicable large employers must provide affordable, minimum value coverage

- Consumer Protections: Guaranteed issue, community rating, and coverage of pre-existing conditions

As of September 2025, the latest available information from the National Association of Insurance Commissioners indicates that state insurance regulators help enforce consumer protections and other insurance laws for individual market insurance in their states.

State Regulatory Authorities

Each state maintains a Department of Insurance or equivalent agency responsible for implementing and enforcing health insurance regulations:

- Market Regulation: Oversight of insurance carrier operations and plan approvals

- Consumer Protection: Handling complaints and ensuring compliance with state laws

- Mandate Enforcement: In mandate states, coordination with tax agencies for penalty collection

Important: To verify applicable regulations in your state, contact your state Department of Insurance directly, as requirements can change based on state legislative updates.

Regulatory Compliance Requirements

According to current regulations, if your insurance carrier doesn’t file the required information, or if you offer a self-insured health plan, you must report insurance information by March 31. This requirement is a result of the Individual Shared Responsibility Penalty, which the state government enacted alongside the health insurance mandate.

Individual Documentation: Residents in mandate states must maintain documentation of their health coverage through forms like 1095-B, 1095-C, or state-specific forms such as Massachusetts Form MA 1099-HC, as confirmed by Mass.gov requirements.

State Variations

Health insurance requirements and enforcement mechanisms vary significantly across states, creating a complex compliance landscape for individuals and employers.

| State | Regulator | Mandate Status | Penalty Range | Official Link |

|---|---|---|---|---|

| California | Covered California / FTB | Active | $900+ per adult | coveredca.com |

| Massachusetts | Health Connector / DOR | Active | Income-based | mahealthconnector.org |

| New Jersey | Department of Banking / Treasury | Active | Income/bronze cap | state.nj.us |

| Rhode Island | HealthSource RI / DOR | Active | $695+ per adult | healthsourceri.com |

| Washington D.C. | DC Health Link | Active | Income-based | dchealthlink.com |

| Vermont | Green Mountain Care | Reporting only | None | connectvt.com |

| Texas | Department of Insurance | None | N/A | tdi.texas.gov |

| Florida | Office of Insurance Regulation | None | N/A | floir.com |

| New York | Department of Financial Services | None | N/A | dfs.ny.gov |

| Connecticut | State Insurance Department | None | Under study | insurance.ct.gov |

Penalty Calculation Variations

Flat Rate Model: California and Massachusetts use minimum flat rates per person with income-based escalation.

Income Percentage Model: Most mandate states calculate penalties as a percentage of household income above filing thresholds.

Bronze Plan Cap: Several states cap maximum penalties at the average cost of bronze-tier marketplace plans.

Understanding these state variations is crucial for compliance planning. In the next section, we’ll examine how future policy developments may affect state health insurance requirements.

Advanced State Requirements & Future Outlook

State health insurance requirements continue evolving as policymakers respond to market conditions and federal policy changes.

Emerging State Initiatives

According to current legislative discussions, several states are considering individual mandate implementation:

- Hawaii: Exploring mandate options through state legislative committees

- Washington: Evaluating public option expansion and potential mandate requirements

- Connecticut: Studying feasibility of state-level mandate implementation

- Minnesota: Reviewing mandate proposals in conjunction with state healthcare reform

Important – Regulatory compliance: The developments described above are under discussion and do not constitute binding obligations. To confirm current law status, consult NAIC.org, CMS.gov, or your state Department of Insurance for latest official updates.

As of September 2025, this development remains uncertain and subject to legislative approval processes in each respective state.

Technology and Enforcement Evolution

State mandate enforcement increasingly relies on automated data matching between insurance carriers and tax agencies. Future developments may include:

- Enhanced Data Integration: Real-time coverage verification systems

- Streamlined Exemption Processing: Automated hardship determination systems

- Cross-State Coordination: Interstate data sharing for multi-state residents

Market Stabilization Effects

According to a Commonwealth Fund analysis, restoration of the mandate at the state level would increase insurance coverage nationally by an estimated 7.5 million people in 2022. We estimate that the number of people with employer-sponsored insurance would increase by 2.3 million people compared to there being no mandates in place. On average, the state mandates would reduce marketplace premiums by 11.8 percent if all states adopted the ACA’s federal individual mandate structure.

Furthermore, the CMS 2025 enrollment data shows that 24.2 million consumers selected plan year 2025 coverage through the Marketplaces, representing more than double the number of enrollees compared to the 2021 Open Enrollment Period.

FAQ

Which states currently require health insurance?

California, Massachusetts, New Jersey, Rhode Island, Washington D.C., and Vermont (reporting only) maintain individual health insurance requirements as of 2025.

What happens if I don’t have health insurance in a mandate state?

You may face financial penalties when filing your state tax return, ranging from $450 per child to over $2,700 for families, unless you qualify for an exemption.

Do employer health plans satisfy state mandates?

Most employer-sponsored health plans that meet federal ACA requirements automatically satisfy state mandate requirements, though specific state standards may vary.

Can I get an exemption from state health insurance requirements?

Yes, common exemptions include financial hardship, unaffordable coverage, short coverage gaps, religious beliefs, and income below state filing thresholds.

How do state penalties compare to health insurance costs?

Many penalty payers could qualify for subsidized coverage costing less than the penalty amount, making coverage more affordable than paying fines.

What documentation do I need to prove health insurance coverage?

Most states accept Form 1095-B or 1095-C from your insurance carrier, or state-specific forms like Massachusetts Form MA 1099-HC

Do state mandates apply if I move between states?

State mandates typically apply based on your state of residence for tax purposes. If you move mid-year, requirements may apply proportionally to your residency period.

Are there penalties for employers in mandate states?

Employers face reporting requirements but generally not additional penalties beyond federal ACA requirements, except for specific state provisions like Massachusetts employer assessments.

Key Takeaways & Resources

Understanding state health insurance requirements is essential for compliance and avoiding financial penalties. Five states plus Washington D.C. currently enforce individual mandates with varying penalty structures and exemption criteria.

Action Steps for Compliance

- Verify your state’s requirements through official Department of Insurance websites

- Maintain qualifying coverage throughout the year or secure valid exemptions

- Keep documentation of your health insurance coverage for tax filing purposes

- Review affordable health insurance options if currently uninsured

- Understand health insurance open enrollment requirements to avoid coverage gaps

- Learn about pre-existing conditions coverage when selecting plans

- Contact a licensed insurance professional to review your current coverage

Essential Resources

- NAIC.org: National Association of Insurance Commissioners consumer guides

- CMS.gov: Federal health insurance marketplace information

- State Department of Insurance websites: Official state-specific requirements and contacts

- State marketplace websites: Coverage options and subsidy information

- IRS.gov: Federal tax implications of health coverage

Key Takeaway: While state health insurance mandates add complexity to coverage decisions, understanding your state’s specific requirements and available resources can help you maintain compliance while securing appropriate health protection for your family.

Ready to ensure compliance? Contact a licensed insurance professional to review your current coverage and verify it meets your state’s requirements. Don’t wait until tax season to discover potential penalties.