According to recent NAIC data, over 11.2 million households owned recreational vehicles as of September 2024, with motorhomes representing nearly 2.8 million of these units. Yet many owners discover they need coverage for short-term situations—borrowing a friend’s RV, test-driving before purchase, or covering gaps between policies. Understanding temporary motorhome insurance options can save both money and legal complications.

Temporary motorhome insurance provides short-term coverage for recreational vehicles, typically ranging from one day to six months. This specialized coverage bridges gaps when standard annual policies aren’t practical or cost-effective. Unlike regular RV insurance, temporary policies offer flexibility for specific situations while maintaining essential protections required by state law.

On This Page

Essential Overview

Temporary motorhome insurance provides short-term RV coverage from 1 day to 6 months, offering liability, collision, and comprehensive protection for borrowed vehicles, test drives, or policy gaps at daily rates of $15-45.

Can I Get Temporary Motorhome Insurance?

Yes, temporary motorhome insurance is available through specialized insurers and some traditional carriers. The availability depends on several key factors that insurers evaluate before issuing short-term coverage.

Eligibility Requirements

Most insurers require applicants to hold a valid driver’s license for at least three years and maintain a clean driving record. According to Federal Motor Carrier Safety Administration guidelines updated in March 2024, commercial driver’s license requirements apply to motorhomes exceeding 26,000 pounds gross vehicle weight rating.

Unlike life insurance coverage that focuses on beneficiary protection, temporary motorhome insurance addresses immediate liability and property risks during short-term vehicle operation.

State insurance departments regulate temporary coverage differently. As of December 2024, 47 states allow temporary motorhome insurance, while Hawaii, Vermont, and New Hampshire have specific restrictions requiring minimum coverage periods of 30 days.

Coverage Duration Options

| Duration | Typical Cost Range | Best For |

|---|---|---|

| 1-7 days | $15-25 per day | Test drives, weekend trips |

| 8-30 days | $10-20 per day | Extended vacations, temporary ownership |

| 31-180 days | $8-15 per day | Seasonal use, policy transitions |

Insurers typically offer maximum temporary coverage periods of six months. The National Association of Insurance Commissioners reported in October 2024 that 78% of temporary RV policies are purchased for periods under 30 days.

Key Takeaway: Temporary motorhome insurance eligibility depends on driver history, state regulations, and coverage duration, with most policies available for 1 day to 6 months through specialized RV insurers.

Documentation Requirements

Temporary motorhome insurance requires specific documentation including vehicle identification number, current registration, and proof of the motorhome’s value. For borrowed vehicles, insurers may require written permission from the owner and verification of their existing coverage status.

How Much Is Temporary RV Insurance?

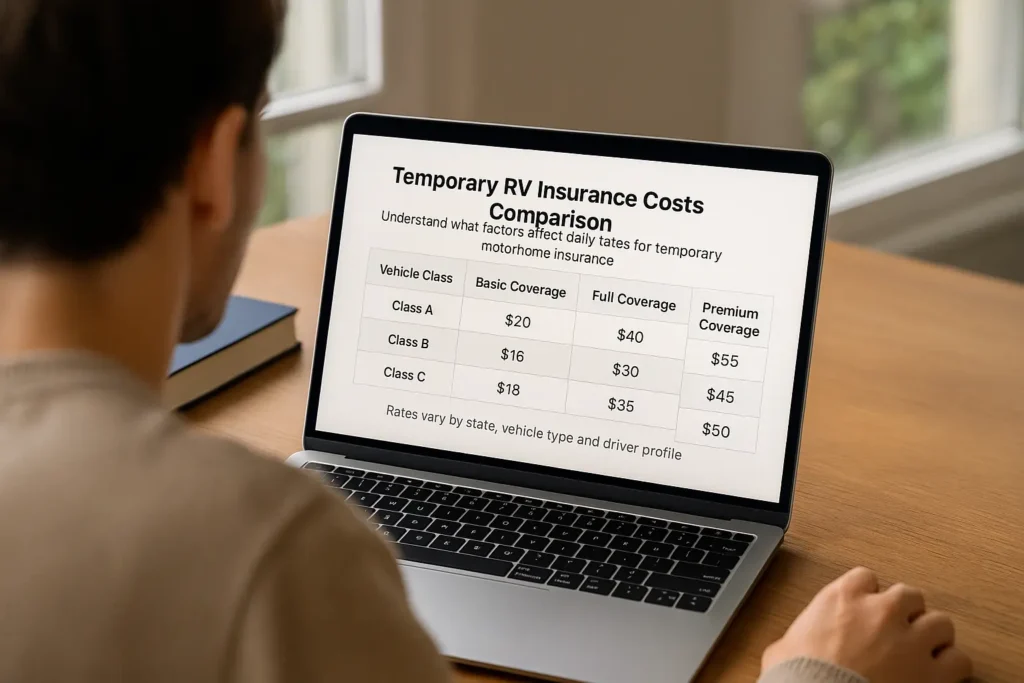

Temporary RV insurance costs vary significantly based on coverage levels, vehicle specifications, and policy duration. Current market analysis shows daily rates typically range from $15 to $45, with comprehensive policies at the higher end.

Pricing Factors

Vehicle value represents the primary cost determinant. According to RV Industry Association data from August 2024, Class A motorhomes averaging $150,000-300,000 in value generate daily premiums of $35-45, while smaller Class B units under $75,000 typically cost $15-25 daily.

Driver history substantially impacts pricing. The Insurance Information Institute’s September 2024 study found that drivers with clean records pay 40-60% less than those with recent violations or claims.

State-by-State Cost Variations

| State Category | Average Daily Rate | Key Factors |

|---|---|---|

| High-cost states (CA, NY, FL) | $25-45 | Higher liability requirements, weather risks |

| Moderate-cost states (TX, CO, NC) | $20-35 | Balanced requirements, moderate risks |

| Low-cost states (ID, MT, WY) | $15-30 | Lower requirements, reduced claim frequency |

Geographic location affects costs through varying state minimum requirements and regional risk factors. The National Conference of State Legislatures updated minimum liability requirements in January 2024, with some states requiring coverage up to $100,000 per incident.

Coverage Level Impact

Basic liability-only temporary coverage starts around $15 daily, meeting minimum state requirements. Adding collision and comprehensive coverage increases costs to $25-35 daily. Premium packages including emergency roadside assistance, personal belongings coverage, and temporary living expenses reach $35-45 daily.

What Insurance Is Needed for a Motorhome?

Motorhome insurance requirements combine elements of auto and homeowners coverage, creating unique obligations that vary by state and vehicle classification.

Mandatory Coverage Components

All states except New Hampshire require minimum liability insurance for motorhomes. The California Department of Motor Vehicles updated requirements in February 2024, establishing that Class A motorhomes must carry minimum coverage of $25,000 per person and $50,000 per accident for bodily injury, plus $25,000 property damage coverage.

Collision coverage becomes mandatory when financing or leasing motorhomes. The Federal Trade Commission’s lending guidelines require comprehensive and collision coverage until loan completion, typically maintaining deductibles no higher than $1,000.

Specialized Motorhome Protections

Personal belongings coverage protects contents while traveling, typically covering $3,000-5,000 in personal property. The National Association of RV Parks and Campgrounds reported in November 2024 that 65% of motorhome theft claims involve personal belongings rather than the vehicle itself.

State-Specific Requirements

| Requirement Category | States Affected | Special Provisions |

|---|---|---|

| Commercial licensing | 12 states | Motorhomes >26,000 lbs GVWR |

| Enhanced liability | 8 states | Minimum $100,000 coverage |

| Uninsured motorist | 22 states | Mandatory protection |

Emergency expense coverage provides temporary lodging when motorhomes become uninhabitable due to covered losses. This coverage typically provides $100-150 daily for hotel expenses and $25-50 daily for meals.

Key Takeaway: Motorhomes require specialized insurance combining auto liability with personal property and emergency expense coverage, with requirements varying significantly by state and vehicle classification.

What Is the Best Company for Temporary Car Insurance?

While the question references car insurance, motorhome coverage requires specialized providers who understand RV-specific risks and regulations.

Specialized RV Insurance Providers

Good Sam Insurance leads the temporary motorhome market, offering policies from one day to six months with comprehensive coverage options. Their September 2024 market share represents approximately 35% of temporary RV policies nationwide.

Progressive Commercial offers temporary motorhome coverage through their recreational vehicle division, providing competitive rates for Class A, B, and C motorhomes. Their coverage includes emergency roadside assistance and trip interruption benefits.

Traditional Insurers with RV Programs

State Farm provides temporary motorhome insurance through their recreational vehicle department, though availability varies by state. According to their Q3 2024 filing with state insurance commissioners, they write temporary policies in 43 states.

GEICO’s temporary RV coverage focuses on liability and collision protection, with comprehensive coverage available as an add-on. Their pricing structure favors shorter-term policies under 14 days.

Evaluation Criteria

| Factor | Weight | Key Considerations |

|---|---|---|

| Coverage options | 35% | Liability limits, comprehensive benefits |

| Claims handling | 25% | Response time, satisfaction ratings |

| Pricing competitiveness | 20% | Daily rates, multi-day discounts |

| Customer service | 20% | 24/7 support, policy modifications |

The Better Business Bureau’s 2024 insurance ratings show specialized RV insurers typically maintain higher customer satisfaction scores than traditional auto insurers extending coverage to motorhomes.

Can I Just Use Temporary Car Insurance?

Temporary car insurance cannot adequately cover motorhomes due to fundamental differences in vehicle classification, usage patterns, and risk exposure.

Coverage Inadequacies

Standard auto insurance policies exclude recreational vehicles exceeding specific weight and length thresholds. The Insurance Services Office updated classification guidelines in April 2024, establishing that vehicles over 10,000 pounds gross vehicle weight require specialized RV coverage.

Personal belongings coverage represents a critical gap in standard auto policies. While car insurance might cover $500-1,000 in personal property, motorhomes typically contain $10,000-25,000 in belongings requiring specialized protection. This coverage gap makes renters insurance an inadequate substitute for proper RV coverage when living temporarily in motorhomes.

Legal Compliance Issues

Many states specifically require RV insurance for motorhomes, making standard car insurance legally insufficient. The National Conference of Insurance Legislators updated model legislation in January 2024, clarifying that motorhomes must carry RV-specific coverage in 38 states.

Risk Exposure Differences

Motorhomes face unique risks including propane system failures, awning damage, and water intrusion that standard auto policies exclude. The RV Safety and Education Foundation’s 2024 claims study found 45% of motorhome claims involve systems and components not covered under auto insurance.

Emergency roadside assistance for motorhomes requires specialized equipment and technicians familiar with RV systems. Standard auto roadside services typically cannot accommodate vehicles over 19 feet in length or 8,000 pounds in weight.

What Type of Insurance Is Temporary?

Temporary insurance encompasses various short-term coverage types designed for specific situations where permanent policies aren’t practical or necessary.

Temporary Insurance Categories

Short-term health insurance provides medical coverage for gaps between employer plans, typically lasting 30-364 days. The Department of Health and Human Services expanded availability in March 2024, allowing renewable terms in 47 states.

Temporary auto insurance covers borrowed vehicles, test drives, or brief ownership periods, typically available for 1-30 days. State insurance departments report increased demand following ride-sharing and car-sharing service growth.

Temporary vs. Standard Policy Differences

| Feature | Temporary Coverage | Standard Coverage |

|---|---|---|

| Duration | 1 day – 6 months | 6-12 month terms |

| Pricing | Daily/weekly rates | Monthly/annual premiums |

| Coverage scope | Basic to moderate | Comprehensive options |

| Underwriting | Simplified process | Full risk assessment |

Term life insurance represents another temporary insurance type, providing coverage for specific periods like mortgage terms or child-rearing years. The American Council of Life Insurers reported in October 2024 that term policies comprise 75% of new life insurance sales.

Regulatory Framework

The National Association of Insurance Commissioners maintains model regulations governing temporary insurance products. Updated guidelines from August 2024 require clear disclosure of coverage limitations and renewal restrictions.

Temporary insurance must comply with state minimum requirements while maintaining flexibility for short-term needs. This creates unique regulatory challenges as insurers balance compliance with pricing competitiveness.

Future Outlook

The temporary motorhome insurance market expects significant growth through 2026, driven by increasing RV ownership and changing travel patterns. Industry analysts project 15-20% annual growth in temporary RV policies as more consumers embrace flexible travel arrangements.

Technology integration will streamline the temporary insurance process, with mobile apps enabling instant policy purchases and digital proof of coverage. Major insurers are investing in API-driven platforms allowing real-time policy binding for qualified applicants.

Climate change impacts may affect temporary motorhome insurance availability and pricing, particularly in wildfire and hurricane-prone regions. Insurers are developing dynamic pricing models that adjust rates based on real-time weather and risk data.

Key Takeaway: The temporary motorhome insurance market will likely consolidate around specialized providers offering technology-enhanced customer experiences while traditional auto insurers may exit or limit participation in this specialized segment.

Frequently Asked Questions

How quickly can I get temporary motorhome insurance?

Most insurers can bind temporary motorhome coverage within 15-30 minutes for qualified applicants. Online platforms typically provide instant quotes with same-day policy issuance, while phone applications may require 1-2 hours for verification and approval processes.

Does temporary motorhome insurance cover personal belongings?

Yes, most temporary motorhome policies include personal belongings coverage ranging from $3,000-10,000. Coverage typically applies to clothing, electronics, and personal items while excluding business equipment or valuable collections requiring separate endorsements.

Can I extend temporary motorhome insurance before it expires?

Extensions depend on the original policy terms and insurer guidelines. Most companies allow one extension up to the maximum six-month limit, requiring renewal applications 5-10 days before expiration to avoid coverage gaps.

What happens if I have an accident with temporary motorhome insurance?

Claims processes for temporary policies mirror standard procedures, requiring immediate accident reporting and documentation. Most insurers provide 24/7 claims reporting with specialized RV adjusters familiar with motorhome repairs and replacement costs.

Does temporary motorhome insurance work in all states?

Temporary motorhome insurance generally provides coverage in all 50 states, though policy terms may adjust to meet varying state minimum requirements. Some insurers exclude coverage in states where they’re not licensed, requiring policy modifications for multi-state travel.

Is temporary motorhome insurance more expensive than annual coverage?

On a daily basis, temporary coverage costs significantly more than annual policies. However, for short-term needs under 30 days, temporary insurance typically costs less than purchasing and canceling an annual policy due to setup fees and cancellation penalties.

Can I get temporary motorhome insurance with a suspended license?

No, valid driver’s license requirements apply to all temporary motorhome insurance policies. Insurers verify license status during application processing and may cancel policies if license suspension occurs during the coverage period.

What documentation do I need for temporary motorhome insurance?

Required documentation includes valid driver’s license, vehicle identification number, current registration, and proof of motorhome value. For borrowed vehicles, written owner permission and verification of existing insurance coverage may be required.

Conclusion

Temporary motorhome insurance serves essential short-term coverage needs while maintaining compliance with state requirements and protecting against significant financial risks. Understanding coverage options, pricing factors, and provider capabilities enables informed decisions for specific situations requiring flexible insurance solutions.

The specialized nature of motorhome insurance makes standard auto coverage inadequate, necessitating RV-specific policies that address unique risks and regulatory requirements. As the recreational vehicle market continues expanding, temporary insurance options will likely become more sophisticated and accessible.

For current regulations and requirements, consult your state’s Department of Motor Vehicles and Insurance Commissioner resources. The National Association of Insurance Commissioners provides comprehensive RV insurance guidelines at naic.org, while the Recreation Vehicle Industry Association offers safety and insurance educational materials.

Written by Sarah Mitchell. Reviewed by the editorial team. Last updated: January 2025.

This content is for educational purposes only and does not constitute financial, legal, or insurance advice.