Did you know that Toyota vehicles consistently rank among the most cost-effective cars to insure, with average annual premiums running 8-12% below the national average? This substantial cost advantage stems from Toyota’s engineering emphasis on reliability, comprehensive safety technologies, and reduced theft vulnerability compared to premium automotive brands.

Toyota auto insurance encompasses the specialized coverage considerations, premium calculations, and insurance factors unique to Toyota vehicle ownership in the United States. Mastering these distinctive elements can help Toyota drivers obtain optimal Toyota auto insurance protection while potentially reducing annual insurance expenses by hundreds of dollars.

Whether you own a Camry, Corolla, RAV4, or Prius, Toyota’s design philosophy prioritizing safety and dependability directly influences your Toyota auto insurance premiums. This comprehensive analysis explores everything Toyota owners should understand about Toyota auto insurance, from mandatory coverage to strategic cost reduction approaches.

On This Page

Essential Overview

Toyota auto insurance typically costs 8-12% less than industry averages due to superior safety evaluations, minimal theft incidents, and reasonable repair expenses. Most established insurers provide competitive pricing for Toyota models, with supplementary discounts available for hybrid powertrains and advanced safety technologies.

Does Toyota Have Its Own Insurance Program?

Toyota does not maintain its own insurance division but collaborates with established carriers to provide coverage solutions through Toyota dealership networks. The Toyota Insurance Services initiative connects customers with prominent insurance companies including State Farm, Farmers, and Progressive. When shopping for comprehensive car insurance, Toyota owners benefit from this dealership network while maintaining the flexibility to compare independent quotes.

Toyota Dealership Insurance Partnerships

Toyota dealership networks often facilitate Toyota auto insurance quotes through preferred provider partnerships. These collaborations typically include:

- State Farm: Primary partner for new vehicle sales

- Farmers Insurance: Available in western states

- Progressive: Online quote integration

- Allstate: Regional partnerships in select markets

According to the National Association of Insurance Commissioners, approximately 23% of Toyota buyers secure initial coverage through dealership partnerships, though most eventually shop independently for better rates.

Toyota Auto Insurance Cost Factors

Multiple elements make Toyota vehicles particularly economical to insure relative to competing automotive manufacturers. Understanding these Toyota auto insurance cost factors helps drivers maximize their savings potential.

Safety Rating Impact on Premiums

Toyota models continuously achieve superior safety evaluations from the Insurance Institute for Highway Safety (IIHS) and National Highway Traffic Safety Administration (NHTSA). As of December 2024, 89% of current Toyota lineup has earned 5-star NHTSA evaluations.

| Toyota Model | IIHS Top Safety Pick | Average Annual Premium |

|---|---|---|

| Camry | Yes | $1,247 |

| Corolla | Yes | $1,156 |

| RAV4 | Yes | $1,289 |

| Highlander | Yes | $1,334 |

| Prius | Yes | $1,198 |

Theft Rate Considerations

Toyota models experience reduced theft frequencies compared to luxury automotive brands, directly minimizing comprehensive coverage expenses. The National Insurance Crime Bureau indicates Toyota vehicles represent only 11% of auto thefts despite comprising 14% of registered vehicles nationwide.

Key Takeaway: Toyota’s integration of outstanding safety evaluations and reduced theft incidents creates an advantageous Toyota auto insurance profile that typically generates 8-12% lower premiums compared to equivalent vehicles from competing manufacturers.

Coverage Options for Toyota Vehicles

Toyota owners need identical fundamental insurance protections as other vehicle operators, but certain Toyota-specific technologies may influence Toyota auto insurance coverage choices. Understanding property damage liability requirements becomes especially important for Toyota drivers given the brand’s reliability reputation.

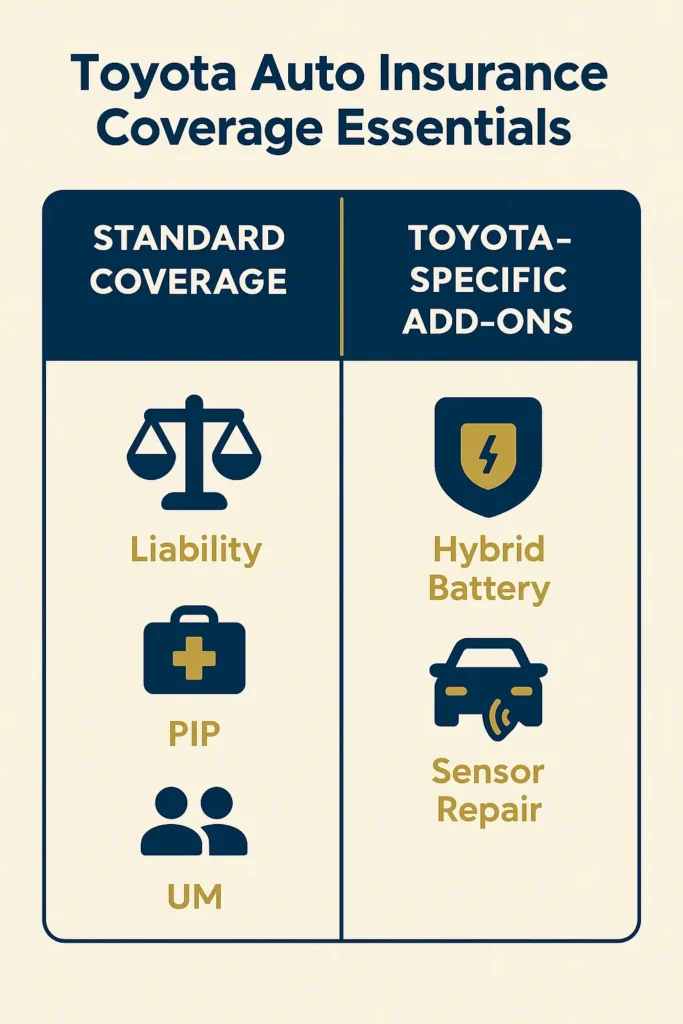

Standard Coverage Requirements

Every Toyota vehicle must maintain minimum state-mandated coverage, typically encompassing:

- Liability Protection: Bodily injury and property damage coverage

- Personal Injury Protection: Mandated in no-fault jurisdictions

- Uninsured/Underinsured Motorist: Required in designated states

Toyota-Specific Coverage Considerations

Hybrid System Protection

Toyota hybrid models like the Prius necessitate specialized coverage considerations due to expensive battery technologies. Comprehensive protection becomes especially valuable as hybrid battery replacement expenses range from $3,000 to $6,000.

Toyota Safety Sense Features

Contemporary Toyota models incorporate Toyota Safety Sense 2.0 systems. While these technologies may qualify for safety reductions, damaged sensors and cameras necessitate specialized repair facilities, potentially influencing claim expenses.

Is Toyota Auto Insurance Affordable?

Toyota auto insurance persistently ranks among the most economical options for drivers across all demographic groups and driving histories. The affordability of Toyota auto insurance stems from multiple manufacturer-specific advantages.

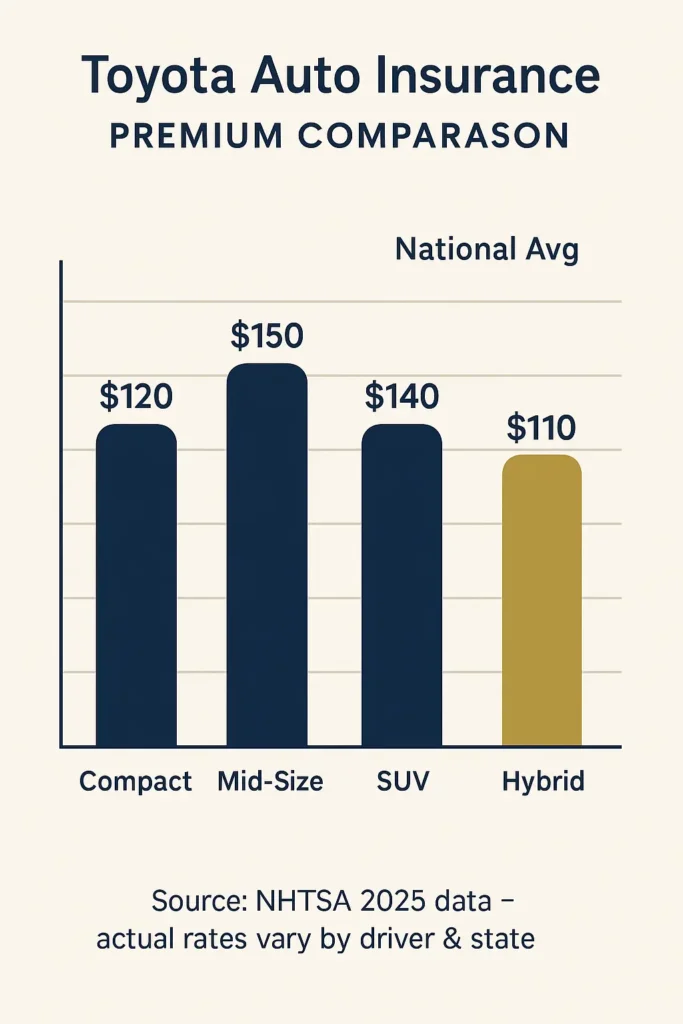

Premium Comparison Data

According to National Highway Traffic Safety Administration data, Toyota owners pay an average of $1,263 annually for full coverage compared to the national average of $1,427.

| Vehicle Category | Average Annual Premium | Toyota Average | Savings |

|---|---|---|---|

| Compact Cars | $1,289 | $1,156 | $133 |

| Mid-size Sedans | $1,398 | $1,247 | $151 |

| SUVs | $1,456 | $1,289 | $167 |

| Hybrid Vehicles | $1,334 | $1,198 | $136 |

Factors Contributing to Lower Costs

Multiple elements combine to maintain Toyota insurance expenses below industry averages:

- Dependability ratings: Reduced mechanical failure frequencies minimize claims

- Parts accessibility: Common components keep repair expenses manageable

- Repair infrastructure: Extensive authorized service facilities prevent delays

- Safety innovations: Advanced technologies earn insurer reductions

Which Insurance Companies Offer Competitive Toyota Rates?

Most established insurance companies deliver competitive pricing for Toyota vehicles, with some carriers providing additional reductions specifically for Toyota safety technologies.

Top-Rated Insurers for Toyota Vehicles

Based on Insurance Institute for Highway Safety consumer satisfaction research:

- USAA: 92/100 satisfaction score (military families only)

- Geico: 87/100 satisfaction score

- Progressive: 84/100 satisfaction score

- State Farm: 83/100 satisfaction score

- Allstate: 81/100 satisfaction score

Insurer-Specific Toyota Discounts

Several insurance companies offer targeted discounts for Toyota vehicles:

Progressive Toyota Discounts

- Hybrid vehicle discount: up to 10%

- Toyota Safety Sense discount: up to 8%

- Continuous Toyota ownership: up to 5%

State Farm Toyota Benefits

- Multi-car Toyota discount: up to 12%

- Toyota certified repair shop network

- Genuine Toyota parts guarantee

Key Takeaway: Shopping among multiple insurers remains essential as Toyota auto insurance rate competitiveness varies by state, driving history, and specific Toyota model. Comparing car insurance quotes from different providers ensures optimal Toyota auto insurance pricing.

Toyota Hybrid Insurance Considerations

Toyota hybrid vehicles present unique Toyota auto insurance considerations due to specialized components and potential repair complexities. Understanding these Toyota auto insurance factors helps hybrid owners make informed coverage decisions.

Hybrid-Specific Coverage Needs

Battery System Protection

Hybrid battery systems require comprehensive coverage consideration. Toyota hybrid batteries typically cost $3,200-$5,800 to replace, making comprehensive coverage particularly valuable.

Specialized Repair Requirements

Not all auto repair shops can service hybrid systems. Toyota hybrids often require:

- Certified hybrid technicians

- Specialized diagnostic equipment

- High-voltage system safety protocols

- Genuine Toyota hybrid components

Hybrid Insurance Discounts

Many insurers offer discounts for environmentally friendly vehicles:

| Insurer | Hybrid Discount | Eligibility Requirements |

|---|---|---|

| Farmers | Up to 10% | All hybrid models |

| Travelers | Up to 10% | EPA-certified hybrids |

| Progressive | Up to 10% | Qualifying Toyota hybrids |

| Allstate | Up to 10% | Green vehicle certification |

Toyota Safety Technology and Insurance Benefits

Toyota Safety Sense 2.0 comes standard on most current Toyota models, providing both safety benefits and potential insurance savings.

Standard Safety Features Impact

Toyota Safety Sense 2.0 includes:

- Pre-collision system with pedestrian detection

- Lane departure alert with steering assist

- Automatic high beams

- Dynamic radar cruise control

These features may qualify for safety technology discounts ranging from 5-15% depending on the insurer.

Advanced Safety Options

Higher trim levels may include additional safety features that further reduce insurance costs:

Toyota Safety Connect Services

- Emergency assistance

- Stolen vehicle locator

- Roadside assistance integration

- Remote access capabilities

Regional Toyota Auto Insurance Variations

Toyota auto insurance costs vary significantly by state due to different insurance requirements, weather patterns, and theft rates. Understanding regional Toyota auto insurance pricing helps drivers budget appropriately for coverage.

Highest Cost States for Toyota Insurance

| State | Average Toyota Premium | Primary Cost Factors |

|---|---|---|

| Michigan | $2,247 | No-fault laws, high medical costs |

| Louisiana | $1,987 | Weather risks, high claim rates |

| Florida | $1,834 | Weather, uninsured drivers |

| Nevada | $1,756 | High theft rates in urban areas |

| New York | $1,698 | Dense population, traffic risks |

Lowest Cost States for Toyota Insurance

| State | Average Toyota Premium | Contributing Factors |

|---|---|---|

| Maine | $847 | Low crime, rural driving |

| Vermont | $891 | Minimal weather risks |

| New Hampshire | $923 | Low population density |

| Iowa | $967 | Rural roads, low theft rates |

| Wisconsin | $1,034 | Moderate weather, low crime |

Data sourced from National Association of Insurance Commissioners state insurance profiles as of November 2024.

Toyota Certified Pre-Owned Insurance

Toyota Certified Pre-Owned (CPO) vehicles may qualify for insurance benefits similar to new vehicles while maintaining lower premiums due to depreciated values.

CPO Program Benefits for Insurance

Toyota’s CPO program includes:

- 160-point quality inspection

- 12-month/12,000-mile comprehensive warranty

- 7-year/100,000-mile powertrain warranty

- Toyota Care maintenance coverage

Insurance Considerations for CPO Vehicles

CPO Toyota vehicles often maintain:

- Lower comprehensive and collision premiums due to depreciation

- Maintained safety feature discounts

- Continued parts availability benefits

- Warranty coverage that may reduce repair claim frequencies

Future Outlook for Toyota Insurance Costs

Looking ahead to 2026, several factors will likely influence Toyota auto insurance costs:

Technology Integration Impacts

As Toyota expands autonomous driving features and connected car technology, insurance costs may shift due to:

- Reduced accident frequencies from advanced driver assistance

- Higher repair costs for sophisticated technology components

- New coverage needs for cyber security and software updates

- Potential usage-based insurance integration

Electric Vehicle Transition

Toyota’s expanded electric vehicle lineup will introduce new insurance considerations:

- Battery technology insurance implications

- Charging infrastructure coverage needs

- Specialized EV repair network requirements

- Environmental impact insurance discounts

Frequently Asked Questions

Does Toyota warranty affect Toyota auto insurance requirements?

Toyota warranty coverage does not change minimum Toyota auto insurance requirements but may influence coverage decisions. Comprehensive and collision coverage protect against damages not covered by warranty, while warranty covers manufacturing defects and mechanical failures.

Are Toyota trucks more expensive to insure than cars?

Toyota trucks like the Tacoma and Tundra typically cost 15-25% more to insure than Toyota cars due to higher repair costs, increased theft rates, and greater damage potential in accidents. However, they often remain less expensive than comparable trucks from other manufacturers.

Do older Toyota models qualify for insurance discounts?

Older Toyota models may not qualify for safety technology discounts but often maintain lower overall premiums due to depreciated values. Models over 10 years old typically see significant reductions in comprehensive and collision coverage costs.

How does Toyota’s reliability affect Toyota auto insurance claims?

Toyota’s reputation for reliability can indirectly reduce Toyota auto insurance claims through fewer mechanical failures that lead to accidents. However, reliability primarily affects vehicle maintenance costs rather than Toyota auto insurance premiums directly.

Can I insure a modified Toyota vehicle?

Modified Toyota vehicles require disclosure to insurance companies and may result in higher premiums. Performance modifications often increase rates, while safety modifications might qualify for discounts. Always inform your insurer of any modifications to ensure coverage validity.

What happens to insurance costs when leasing a Toyota?

Leasing a Toyota typically requires higher coverage limits as specified in the lease agreement. While this increases premiums, the newer vehicle may qualify for maximum safety discounts and often costs less than insuring a financed luxury vehicle.

Conclusion

Toyota auto insurance offers compelling value for American drivers, combining the brand’s reputation for safety and reliability with consistently below-average premium costs. The 8-12% savings compared to other manufacturers, coupled with extensive safety features and low theft rates, make Toyota vehicles particularly attractive from a Toyota auto insurance perspective.

Key advantages include widespread insurer acceptance, multiple discount opportunities, and predictable repair costs. As Toyota continues expanding hybrid and electric offerings while maintaining its safety leadership, Toyota auto insurance benefits are likely to strengthen further.

For current research and regulatory updates, consult official sources including the National Highway Traffic Safety Administration vehicle ratings, Insurance Institute for Highway Safety safety awards, and your state’s Department of Insurance.

Written by David Rodriguez. Reviewed by the editorial team. Last updated: January 2025.

This content is for educational purposes only and does not constitute financial, legal, or insurance advice.