Veterinary professional liability insurance protects animal healthcare providers from financial losses arising from claims of professional negligence, errors, or omissions in their medical practice. This specialized coverage addresses the unique risks veterinarians face when treating animals, from routine procedures to emergency interventions that could result in unexpected outcomes.

The veterinary profession carries inherent risks that extend beyond standard business operations. Unlike human medicine, veterinary patients cannot communicate symptoms directly, making diagnosis more challenging and potentially increasing the likelihood of misinterpretation. Additionally, pet owners often view their animals as family members, leading to heightened emotional responses when treatment outcomes fall short of expectations.

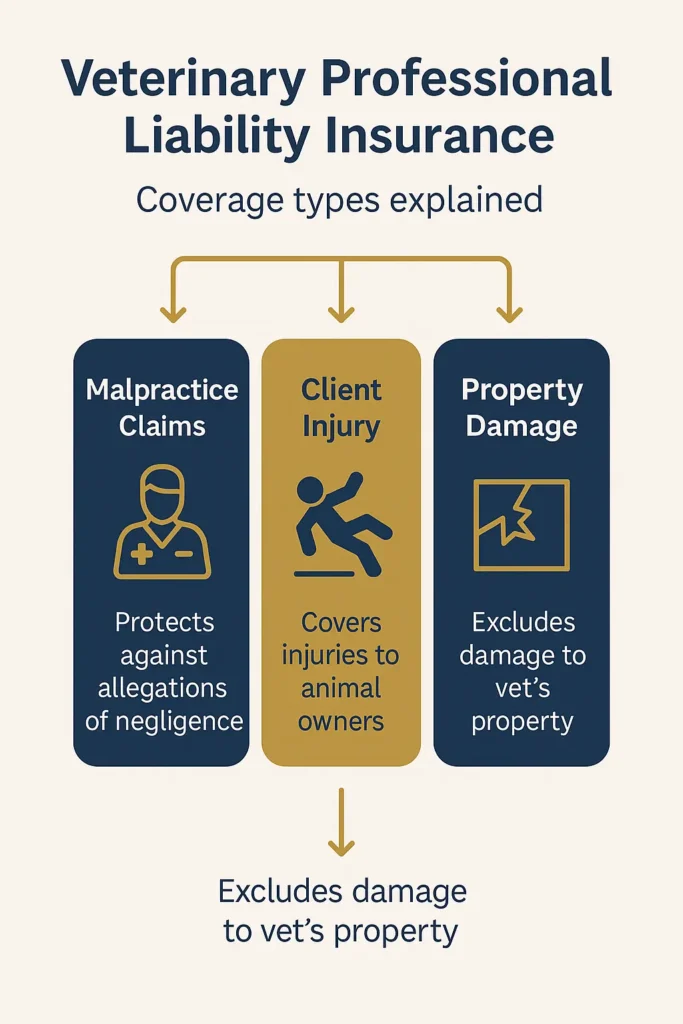

Veterinary professional liability insurance differs significantly from general liability coverage. While general liability protects against accidents occurring on business premises, professional liability specifically addresses claims related to the quality of veterinary care provided. This distinction becomes crucial when determining coverage for various scenarios that veterinary practices encounter daily.

The veterinary insurance landscape has evolved substantially over the past decade, with more comprehensive veterinary professional liability insurance policies now available to address the growing complexity of veterinary medicine. Modern veterinary practices utilize advanced diagnostic equipment, perform sophisticated surgical procedures, and offer specialized treatments that require corresponding insurance protection to safeguard both practitioners and their businesses.

On This Page

Understanding Professional Liability in Veterinary Medicine

Veterinary professional liability insurance in medical practice addresses situations where clients allege that medical care provided fell below accepted professional standards. This specialized coverage protects practitioners against various liability scenarios that can arise in daily veterinary operations.

Essential Protection Scenarios

• Diagnostic errors – Misdiagnosis or delayed diagnosis leading to animal harm • Surgical complications – Unexpected outcomes during routine or complex procedures

• Medication mistakes – Incorrect dosages, drug interactions, or dispensing errors • Communication breakdowns – Inadequate informed consent or follow-up care instructions • Treatment failures – Animals not responding as expected to prescribed therapies

The foundation of veterinary professional liability insurance rests on the duty of care principle that animal healthcare providers owe to their patients. When this duty is allegedly breached, resulting in harm to an animal or financial loss to the owner, professional liability insurance provides both defense and potential compensation.

Key Takeaway: Professional liability coverage extends beyond individual veterinarians to include employed staff members, veterinary students, and interns when working within their authorized scope of practice under proper supervision.

According to the National Association of Insurance Commissioners, professional liability claims often arise from situations where treatment outcomes differ from client expectations, making comprehensive coverage essential for practice protection.

Specialty Practice Risk Assessment

| Practice Type | Risk Level | Common Claims | Premium Multiplier |

|---|---|---|---|

| General Practice | Moderate | Routine complications, diagnostic errors | 1.0x (baseline) |

| Emergency Medicine | High | Critical care decisions, after-hours issues | 2.3x |

| Surgical Specialties | High | Anesthetic reactions, surgical infections | 1.8x |

| Exotic Animal Care | Very High | Limited protocols, specialized knowledge | 2.8x |

| Mobile Veterinary | Variable | Travel risks, equipment limitations | 1.5x |

Modern veterinary practice encompasses diverse specialties, each carrying distinct liability risks that require tailored veterinary professional liability insurance coverage. Emergency veterinarians encounter higher-risk scenarios due to critical care decisions, while exotic animal specialists face unique challenges due to limited treatment protocols and specialized knowledge requirements.

Core Coverage Components and Protection Scope

Veterinary professional liability insurance typically includes several essential components that work together to provide comprehensive protection. Understanding these elements helps practitioners make informed coverage decisions and ensures adequate protection against various liability exposures.

Primary Coverage Elements

1. Professional Negligence Protection

- Claims alleging errors in medical judgment

- Omissions in care resulting in animal injury

- Legal defense costs (often unlimited)

- Settlement and damage payments up to policy limits

2. Regulatory Defense Coverage Many veterinary professional liability insurance policies include coverage for regulatory proceedings and disciplinary actions brought by state veterinary boards.

Critical Protection: According to HHS guidance on professional liability insurance, regulatory defense coverage helps ensure veterinarians can adequately defend themselves against professional board investigations without depleting personal resources.

3. Extended Protection Features • Lost income reimbursement during temporary license suspension • Crisis management services following adverse publicity • Privacy violation protection and breach of confidentiality coverage • Telemedicine consultation coverage for remote veterinary services

Coverage Limits and Financial Structure

| Coverage Type | Typical Limits | Deductible Options | Average Annual Cost |

|---|---|---|---|

| Per Occurrence | $1M – $6M | $2,500 – $25,000 | $1,500 – $8,000 |

| Annual Aggregate | $3M – $12M | $5,000 – $50,000 | Based on occurrence limits |

| Regulatory Defense | $50K – $250K | $0 – $10,000 | Typically included |

| Crisis Management | $25K – $100K | $1,000 – $5,000 | Optional coverage |

The financial structure of veterinary professional liability insurance policies varies significantly based on practice type, geographic location, and coverage selections. Higher coverage limits provide enhanced protection but result in proportionally increased premiums, requiring practitioners to balance adequate protection with budget considerations.

Some veterinary professional liability insurance policies also provide coverage for telemedicine consultations, which have become increasingly common following the expansion of remote veterinary services and digital health platforms.

Risk Factors Unique to Veterinary Practice

Veterinary medicine presents distinctive liability risks that differentiate it from other professional services. Understanding these unique risk factors helps practitioners appreciate the importance of comprehensive professional liability protection and implement appropriate risk management strategies.

Communication and Diagnostic Challenges

Primary Risk Factors: • Non-verbal patients – Animals cannot directly communicate symptoms or pain levels • Owner-reported histories – Often incomplete, inaccurate, or emotionally influenced • Clinical observation limitations – Stress from veterinary visits can mask symptoms • Time pressure constraints – Busy practices may rush diagnostic processes • Species-specific knowledge – Exotic animals require specialized understanding

The emotional bond between pet owners and their animals significantly impacts liability exposure in veterinary practice. Pet owners often view their animals as family members and may have unrealistic expectations about treatment outcomes or recovery timelines.

Risk Amplifier: This emotional component can escalate routine complications into formal complaints or legal actions, even when veterinary care provided meets accepted professional standards and industry best practices.

Regulatory and Controlled Substance Risks

Veterinary practices face additional risks related to controlled substance handling, as many veterinary medications require special licensing and strict inventory controls. Understanding professional liability insurance protection requirements helps practices implement proper protocols.

High-Risk Areas:

- DEA registration compliance and renewal requirements

- Inventory tracking and documentation procedures

- Prescription monitoring program participation

- Staff training on controlled substance protocols

Emergency Care Risk Profile

| Risk Factor | Impact Level | Common Scenarios | Mitigation Strategies |

|---|---|---|---|

| Incomplete histories | High | Critical care decisions with limited data | Standardized intake protocols |

| Time-pressured decisions | Very High | Life-threatening emergencies | Clear emergency procedures |

| After-hours staffing | High | Reduced supervision, fatigue factors | Adequate supervision requirements |

| Equipment limitations | Medium | Diagnostic constraints | Regular maintenance, backup systems |

| Client emotional stress | High | Heightened expectations, blame | Enhanced communication training |

Emergency and after-hours care present heightened liability risks due to the urgent nature of these situations and the potential for incomplete medical histories. These time-pressured scenarios require careful documentation and clear communication with pet owners to minimize liability exposure, making veterinary professional liability insurance particularly crucial for emergency practice settings.

Policy Types and Structure Overview

Veterinary professional liability insurance is available through several policy structures, each offering different levels of protection and premium arrangements. Selecting the appropriate policy type requires understanding these fundamental differences and their long-term implications for practice protection.

Claims-Made vs. Occurrence-Based Comparison

| Policy Feature | Claims-Made | Occurrence-Based |

|---|---|---|

| Coverage Trigger | When claim is filed | When incident occurs |

| Premium Structure | Lower initially, increases annually | Higher but stable |

| Tail Coverage | Required for continuous protection | Not needed |

| Career Flexibility | Requires careful planning | More portable |

| Retirement Planning | Must purchase tail coverage | Automatic protection |

Claims-Made Policy Features: • Coverage for claims filed during active policy period • Requires continuous coverage to maintain protection • Retroactive date determines coverage eligibility • Typically lower initial premiums with annual increases

Occurrence-Based Policy Features: • Covers incidents that occur during policy period • Protection continues regardless of when claims are filed • Higher premiums but provides long-term security • Preferred for career transitions and retirement planning

Group Coverage Options and Professional Associations

Advantages of Group Policies:

- Cost-effective coverage through shared risk pools and economies of scale

- Simplified underwriting process with standardized applications

- Professional advocacy and industry-specific expertise

- Educational resources and risk management programs

Potential Limitations:

- Standardized terms may not fit all practice needs or specialties

- Membership requirements for continued coverage eligibility

- Limited customization options compared to individual policies

- Group claim experience can impact individual pricing

Many veterinary professionals prefer occurrence-based veterinary professional liability insurance coverage for the peace of mind it provides, particularly when considering career transitions, practice sales, or retirement planning scenarios.

Extended Reporting Period (Tail) Coverage Options

Critical Decision Point: Tail coverage provides protection for claims filed after a claims-made policy expires. This coverage is essential when changing insurance carriers, selling a practice, or retiring from veterinary medicine.

Tail Coverage Variations: • 12-month reporting period – Basic protection for recent incidents ($2,500-$5,000) • 24-month extended period – Enhanced coverage for delayed claims ($5,000-$10,000) • 60-month comprehensive – Extended protection for complex cases ($10,000-$15,000) • Unlimited tail coverage – Maximum lifetime protection ($15,000-$25,000)

The USDA Animal and Plant Health Inspection Service provides guidance on veterinary liability standards that can impact tail coverage requirements and duration, which vary significantly among insurance providers and practice specialties.

Claims Scenarios and Real-World Applications

Veterinary professional liability insurance becomes essential when examining common claim scenarios that arise in everyday practice. Understanding these real-world applications helps practitioners recognize their coverage needs and implement appropriate risk management strategies to minimize liability exposure.

High-Frequency Claim Categories

1. Diagnostic Error Cases Diagnostic errors represent the most frequent source of professional liability claims, particularly when delayed or incorrect diagnoses lead to animal suffering, death, or increased treatment costs.

Common Diagnostic Scenarios: • Radiographic misinterpretation – Missing fractures, masses, or foreign objects • Laboratory result errors – Misreading values or failing to follow up on abnormal results

• Clinical sign misassessment – Overlooking subtle symptoms of serious conditions • Delayed referral decisions – Not consulting specialists when appropriate

Real-World Example: A veterinarian misdiagnoses gastric dilatation-volvulus (bloat) as simple indigestion, delaying life-saving surgery. The pet dies within hours, leading to a veterinary professional liability insurance claim for emotional distress, economic damages, and punitive damages totaling $75,000.

Surgical and Anesthetic Complications

| Procedure Category | Complication Risk | Claim Frequency | Average Settlement |

|---|---|---|---|

| Routine Spay/Neuter | Moderate | 15% of claims | $8,000 – $25,000 |

| Orthopedic Surgery | High | 25% of claims | $15,000 – $50,000 |

| Dental Procedures | Low-Moderate | 8% of claims | $5,000 – $15,000 |

| Emergency Surgery | Very High | 35% of claims | $25,000 – $100,000+ |

High-Risk Surgical Scenarios:

- Anesthetic complications during routine procedures

- Post-operative infections due to sterile technique failures

- Surgical site dehiscence from inadequate closure techniques

- Wrong-site surgery or procedure errors

Even routine procedures like spaying or neutering can result in unexpected complications that trigger veterinary professional liability insurance claims when pet owners perceive that adequate care standards were not met.

Medication and Treatment Protocol Errors

Critical Error Categories: • Dosage miscalculations based on incorrect weight measurements • Drug dispensing mistakes due to similar packaging or labeling • Contraindication oversights with concurrent medications or conditions • Compounding errors in customized prescription preparations • Administration route mistakes (oral vs. injectable formulations)

Key Takeaway: Communication-related claims often arise from inadequate informed consent discussions, failure to explain treatment risks and alternatives, or poor follow-up communication regarding treatment outcomes and expectations.

Emergency Situation Liability Exposures

Emergency situations present unique liability challenges for veterinary professionals, particularly during after-hours periods when critical decisions must be made rapidly with limited information and resources.

Emergency Risk Factors:

- Incomplete medical histories and limited prior veterinary records

- High-stress decision making under severe time constraints

- Emotional client interactions during life-threatening crises

- Resource limitations outside normal business hours

- Fatigue factors affecting clinical judgment and performance

These high-stress scenarios require robust veterinary professional liability insurance coverage that accounts for the inherent risks of emergency medicine practice and provides adequate protection against the elevated claim frequency in emergency settings.

Coverage Limitations and Exclusions

Understanding veterinary professional liability insurance exclusions helps practitioners identify potential gaps in their protection and make informed decisions about additional coverage needs or risk management strategies.

Standard Policy Exclusions

Intentional Acts and Criminal Behavior Most policies explicitly exclude coverage for: • Deliberate misconduct or intentional harm to animals • Criminal activities related to professional practice • Substance abuse incidents affecting clinical judgment • Sexual misconduct or inappropriate behavior allegations • Fraud or misrepresentation in billing or treatment records

Protection Rationale: These exclusions protect insurance carriers from covering deliberate misconduct while maintaining coverage for honest mistakes, errors in professional judgment, or unintentional omissions in care.

Business Operations and Employment Exclusions

| Excluded Activity | Required Coverage Type | Typical Premium Range |

|---|---|---|

| Employment disputes | Employment Practices Liability | $800 – $2,500 annually |

| Discrimination claims | General Liability + EPLI | $1,200 – $3,000 annually |

| Wage and hour violations | Employment Practices Liability | $600 – $1,800 annually |

| Premises accidents | Commercial General Liability | $400 – $1,200 annually |

| Product liability | Product Liability Coverage | $300 – $1,000 annually |

Business-related activities often fall outside veterinary professional liability insurance coverage scope. The business insurance coverage for veterinary practices should address these non-medical professional risks that standard malpractice policies exclude.

Prior Knowledge and Retroactive Date Limitations

Critical Exclusion Impacts:

- Known incidents that occurred before policy inception date

- Suspected problems not properly reported to previous insurance carrier

- Continuous coverage gaps that void protection for prior incidents

- Retroactive date restrictions limiting coverage to recent incidents only

Warning: If a veterinarian was aware of a potential claim or incident before purchasing new coverage, that specific incident may be excluded from protection under the new policy, emphasizing the importance of continuous coverage.

Scope of Practice and Licensing Exclusions

Exclusions for Unauthorized Activities: • Practice outside authorized geographic jurisdiction or state licensing • Expired license periods when professional authorization has lapsed • Unauthorized procedures beyond training, certification, or experience level • Experimental treatments not approved by regulatory authorities or professional boards

Veterinary professional liability insurance policies typically require practitioners to maintain current licenses and work within established professional boundaries to maintain coverage eligibility and avoid policy voidance.

Premium Factors and Cost Considerations

Veterinary professional liability insurance premiums reflect numerous risk factors that insurance carriers evaluate when determining coverage costs. Understanding these factors helps practitioners budget appropriately and identify opportunities for premium reduction through risk management.

Practice Type Risk Assessment and Premium Impact

| Practice Category | Annual Premium Range | Risk Multiplier | Key Risk Factors |

|---|---|---|---|

| General Practice | $1,500 – $3,500 | 1.0x (baseline) | Routine procedures, preventive care |

| Emergency/Critical Care | $4,000 – $8,000 | 2.3x | Life-threatening cases, after-hours |

| Surgical Specialties | $3,500 – $6,500 | 1.8x | Anesthesia, complex procedures |

| Exotic Animal Practice | $5,000 – $10,000 | 2.8x | Limited protocols, specialized knowledge |

| Mobile/House Call | $2,000 – $4,500 | 1.4x | Travel risks, equipment limitations |

Practice type significantly influences premium calculations, with emergency clinics and specialty practices typically facing higher rates due to increased liability exposure, higher claim frequency, and larger average settlement amounts compared to general practice settings.

Geographic and Regional Risk Variations

High-Cost Liability Regions: • California – Highest litigation rates, large damage awards • Florida – Large pet populations, active legal environment

• New York – High damage awards, complex legal system • Illinois – Major metropolitan areas, elevated claim costs • Texas – Large market with variable local court conditions

Lower-Cost Geographic Areas: • Rural Midwest states – Lower litigation rates, smaller settlements • Mountain West regions – Limited legal activity, rural practices • States with tort reform – Caps on damages, streamlined legal processes

Geographic location plays a substantial role in veterinary professional liability insurance pricing, as legal environments, jury award patterns, and claim frequencies vary significantly between states, regions, and urban versus rural practice locations.

Claims History Premium Impact Matrix

| Claims History | Premium Adjustment | Additional Requirements | Coverage Restrictions |

|---|---|---|---|

| No Prior Claims | 5-15% discount | Standard underwriting | Full coverage available |

| 1 Claim (settled) | 15-25% increase | Risk management program | Higher deductibles |

| 2+ Claims | 25-60% increase | Enhanced protocols | Procedure restrictions |

| Large Settlement | 50-100+ increase | Specialized underwriting | Limited carrier options |

Risk Management Premium Benefits: • Continuing education participation (5-10% discount) • Practice accreditation programs (10-15% discount)

• Client communication training (5% discount) • Electronic medical records (3-7% discount) • Professional association membership (2-5% discount)

Integration with Other Insurance Policies

Veterinary professional liability insurance works alongside other business insurance coverages to provide comprehensive protection for veterinary practices. Proper coordination prevents coverage gaps, eliminates unnecessary overlaps, and ensures cost-effective risk management.

Essential Insurance Coordination Matrix

| Coverage Type | Primary Protection | Interaction with Professional Liability | Annual Cost Range |

|---|---|---|---|

| General Liability | Premises accidents, property damage | Complementary – no overlap | $400 – $1,200 |

| Workers Compensation | Employee injuries, occupational illness | Independent coverage | $800 – $3,000 |

| Cyber Liability | Data breaches, privacy violations | Some overlap in privacy claims | $600 – $2,500 |

| Property Insurance | Equipment damage, theft, disasters | Independent coverage | $1,000 – $4,000 |

| Business Interruption | Income loss from closures | Complementary protection | $300 – $1,500 |

Workers Compensation Integration Requirements

State-by-State Mandates:

- Mandatory coverage in most states for businesses with employees

- Coverage amounts and requirements vary significantly by jurisdiction

- Premium calculations based on payroll amounts and industry risk classifications

- Independent contractor distinctions impact coverage requirements

Protection Coordination: Workers compensation protects injured employees and shields employers from workplace injury lawsuits, providing complementary protection to veterinary professional liability insurance without overlap or conflict.

Cyber Liability and Privacy Protection Coordination

Overlapping Coverage Scenarios: • Client privacy violations – Both cyber and professional liability may respond • Medical record breaches – Primary cyber coverage, secondary professional liability • HIPAA violations – Cyber liability typically provides primary coverage • Telemedicine incidents – Professional liability primary, cyber secondary

Modern Cyber-Specific Risks:

- Ransomware attacks on practice management systems and patient databases

- Credit card payment data breaches during transaction processing

- Email security compromises exposing confidential client communications

- Cloud storage vulnerabilities affecting backup and archival systems

While veterinary professional liability insurance covers medical care quality issues, cyber liability coverage addresses the growing digital risks that modern veterinary practices face through electronic records, online payments, and digital communication platforms.

Property and Business Interruption Coordination

Property Insurance Coverage Scope:

- Building and premises protection for owned or leased facilities

- Medical equipment replacement costs for diagnostic and surgical equipment

- Supply inventory protection for medications, supplies, and materials

- Business personal property including computers, furniture, and fixtures

Comprehensive Protection: Property insurance protects veterinary practice physical assets from damage or theft, while business interruption coverage provides income replacement during covered closures, working together with professional liability to ensure complete practice protection.

Business Continuity Planning Elements: • Natural disaster response protocols and backup facilities • Equipment failure contingencies and replacement procedures • Infectious disease closure preparations and remote work capabilities • Civil authority shutdown response and client communication plans

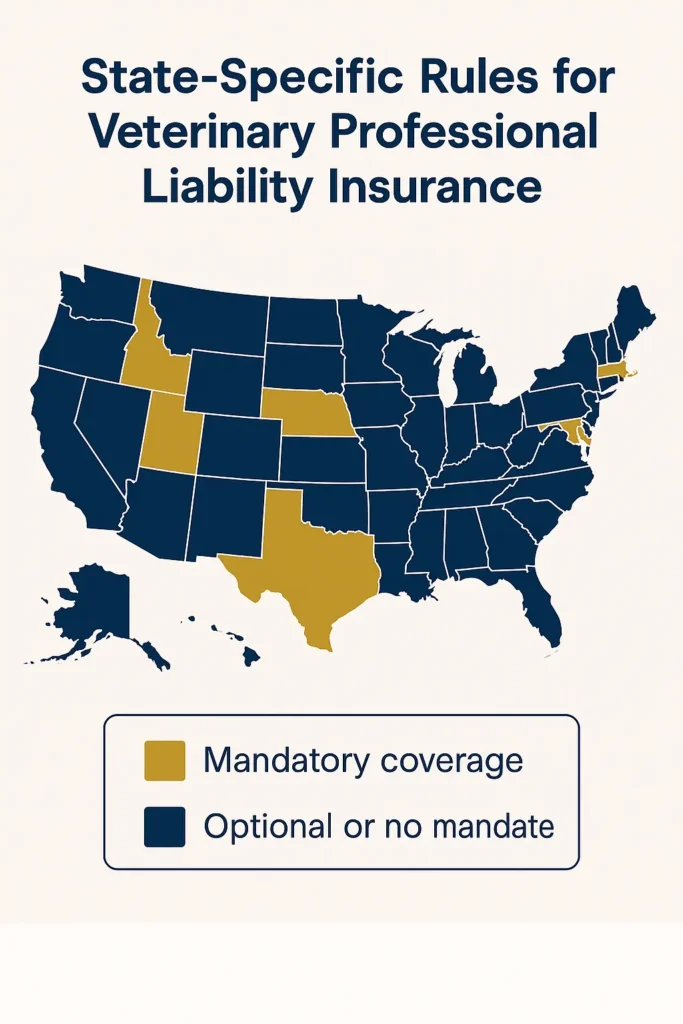

State Regulatory Requirements

Veterinary professional liability insurance requirements vary significantly across different states, creating a complex regulatory landscape that practitioners must navigate carefully. Understanding these variations helps ensure compliance and adequate protection while avoiding regulatory penalties.

State Requirement Classification System

Mandatory Coverage States:

- California – Specific minimum coverage for research facilities and specialty procedures

- New York – Required disclosure to clients with standardized language

- Florida – Enhanced requirements for emergency clinics and after-hours facilities

- Texas – Alternative risk retention group options with state oversight

Strongly Recommended States: Most states fall into this category, where veterinary boards: • Encourage coverage through licensing guidelines and professional standards • Require proof for controlled substance registrations and specialty procedures • Mandate reporting of coverage status during license renewal processes • Include coverage discussions in continuing education requirements

Detailed State-by-State Requirements Matrix

| State | Mandatory Status | Minimum Limits | Special Requirements | Penalties for Non-Compliance |

|---|---|---|---|---|

| California | Yes* | $1M/$3M | Research facilities, disclosure | License suspension possible |

| Florida | Partial | $2M/$6M | Emergency clinics only | Practice restrictions |

| New York | No | Recommended | Client disclosure required | Regulatory review |

| Texas | No | Varies | RRG options available | None specified |

| Ohio | No | $1M/$3M | Board recommendation only | None |

| Pennsylvania | No | Recommended | Continuing education topics | None |

*Mandatory for specific practice types and activities

Emerging Regulatory Trends and Future Requirements

2025 Regulatory Developments: • Telemedicine coverage mandates for practices offering remote consultations • Cyber liability integration requirements linking data protection to professional liability • Client communication training linked to coverage verification and premium discounts • Risk management program participation incentives through regulatory recognition

Key Insight: Florida has implemented unique veterinary professional liability insurance requirements for emergency clinics and specialty practices, recognizing the increased risk exposure these facilities face due to critical care situations and after-hours operations.

Regional Compliance Considerations:

- Multi-state practice licensing requires coordination of coverage across jurisdictions

- Mobile veterinary services must meet requirements in all service areas

- Telemedicine consultations across state lines create complex compliance obligations

- Referral relationships may trigger additional coverage or disclosure requirements

Professional Board Considerations

State veterinary medical boards play crucial regulatory roles in overseeing professional liability issues and insurance requirements for licensed practitioners. Understanding these relationships helps practitioners maintain good standing and avoid complications that could impact coverage or licensing status.

Board Functions and Insurance Interaction Framework

Disciplinary Proceedings Coverage: Disciplinary proceedings often trigger professional liability insurance coverage for defense costs, even when allegations ultimately lack merit or are dismissed without findings.

Typical Coverage Includes: • Legal representation costs for board hearings and administrative proceedings • Investigation expense reimbursement for expert witnesses and case preparation • Administrative hearing fees and procedural costs • Appeal process costs for adverse decisions or license restrictions

Important Consideration: Practitioners should understand that board actions may result in policy exclusions, coverage restrictions, or premium increases for future coverage periods, making early intervention and proper defense critical.

Professional Competency Impact on Coverage

| Board Requirement | Coverage Impact | Implementation Timeline | Cost Implications |

|---|---|---|---|

| Continuing Education | Premium discounts available | Annual compliance | 5-10% discount potential |

| Specialty Certifications | Expanded coverage options | Certification-dependent | Variable premium adjustments |

| Clinical Assessments | Coverage reviews triggered | As required | Potential restrictions |

| Scope Limitations | Coverage boundary definitions | Immediate upon restriction | Exclusions may apply |

Professional Competency Requirements established by veterinary boards directly impact veterinary professional liability insurance availability, terms, and costs through risk assessment modifications and underwriting considerations.

Reporting Requirements and Compliance Matrix

Mandatory Reporting Categories: • Adverse event reporting – Significant patient complications or unexpected deaths • License renewal applications – Coverage verification and policy information • Continuing education compliance – Professional development and risk management training • Practice inspection results – Facility assessments and regulatory compliance reviews

Scope of Practice Implications:

- Authorized procedures define the boundaries of coverage eligibility

- Geographic practice limitations affect policy terms and territorial coverage

- Supervision requirements influence coverage for support staff and students

- Emergency care protocols impact liability exposure and coverage conditions

Scope of practice limitations defined by state boards directly affect veterinary professional liability insurance coverage boundaries, with practitioners working outside authorized scope potentially facing coverage exclusions or complete policy voidance.

Current Market Trends and Updates

The veterinary professional liability insurance market has experienced significant evolution throughout 2025, with new developments reshaping coverage options, pricing structures, and risk management approaches that benefit veterinary professionals.

Market Competition and Carrier Expansion

New Market Participants: The veterinary professional liability insurance market has experienced significant growth with new carriers entering the market and existing providers expanding their coverage options and geographic reach.

Market Benefits for Practitioners: • Increased competition leading to more competitive pricing structures • Enhanced coverage options tailored to specific practice types and specialties • Improved customer service standards and claims handling processes • Specialized products developed for niche practices and emerging veterinary fields

Technology Integration and Digital Risk Management

| Technology Category | Coverage Development | Implementation Status | Market Adoption Rate |

|---|---|---|---|

| Telemedicine Platforms | Dedicated liability coverage | Fully implemented | 75% of carriers |

| AI Diagnostic Tools | Algorithm error protection | Pilot programs | 25% of carriers |

| Electronic Records | Enhanced security coverage | Standard offering | 90% of carriers |

| Mobile Applications | App-specific liability | Development phase | 40% of carriers |

Digital Coverage Expansions:

- Telemedicine liability protection for remote consultations and digital health platforms

- Electronic medical records security coverage for data breaches and system failures

- Digital communication risk management for client interactions and consultation platforms

- Mobile application consultation protection for smartphone-based veterinary services

Market Focus: Technology integration has become a major focus for veterinary professional liability insurance providers, with policies now addressing telemedicine risks, electronic medical records security, and digital communication challenges that modern practices face daily.

Specialty Practice Market Growth and Innovation

Emerging Specialty Coverage Areas: • Veterinary oncology – Chemotherapy protocols and specialized treatment coverage • Rehabilitation medicine – Physical therapy and alternative treatment modalities

• Integrative medicine – Holistic and complementary therapy approaches • Veterinary dentistry – Specialized oral surgery and advanced dental procedures

Risk Management Program Evolution:

- AI-powered risk assessment tools for practice evaluation and improvement recommendations

- Real-time practice monitoring systems integrated with electronic health records

- Predictive analytics platforms for claim prevention and early intervention strategies

- Mobile training applications providing accessible continuing education and updates

Risk management programs have become standard offerings from most veterinary professional liability insurance carriers, providing educational resources, practice assessment tools, and client communication training that benefit both practitioners and insurance companies through reduced claim frequency.

Climate Change and Emergency Preparedness Considerations

New Coverage Developments:

- Emergency preparedness plan requirements for disaster response and business continuity

- Disaster response capability assessments integrated into underwriting processes

- Business continuity planning mandates for practice resilience and client service continuation

- Mobile veterinary service coverage for disaster relief and emergency response situations

Emerging Trend: Climate change impacts have influenced veterinary professional liability insurance considerations, particularly regarding emergency preparedness, disaster response capabilities, and practice resilience planning that ensure continued service during challenging circumstances.

FAQ

What does veterinary professional liability insurance cover?

Veterinary professional liability insurance provides comprehensive protection for animal healthcare providers against claims alleging professional negligence, diagnostic errors, or treatment complications. Core coverage areas include medical malpractice claims for allegations of substandard care resulting in animal injury or death, diagnostic error protection covering misdiagnosis or delayed diagnosis situations, and surgical complication coverage protecting against unexpected procedural outcomes.

Legal defense costs receive unlimited coverage in most policies, while regulatory proceeding defense provides protection during state board investigations. Additional coverage typically includes privacy violation protection for client confidentiality breaches, telemedicine liability for remote consultation services, coverage for veterinary technicians working under supervision, and crisis management services following adverse publicity events.

The policy responds to claims made during the coverage period, provided the alleged incident occurred after the policy’s retroactive date and continuous coverage is maintained. Most policies also include coverage for regulatory defense costs when state veterinary boards investigate professional conduct complaints.

How much does professional liability insurance cost for veterinarians?

Professional liability insurance costs for veterinarians vary significantly based on multiple risk factors, with annual premiums typically ranging from $1,500 to $10,000 depending on specific circumstances. General practice veterinarians usually pay $1,500 to $3,500 annually for standard risk coverage, while emergency medicine practitioners face $4,000 to $8,000 annually due to high-risk exposure.

Surgical specialties typically range from $3,500 to $6,500 annually for elevated risk coverage, and exotic animal practitioners may pay $5,000 to $10,000 annually representing the highest risk category. Geographic location significantly impacts costs, with higher-litigation areas like California and Florida resulting in premiums 25-40% above national averages.

Additional cost factors include claims history with clean records receiving 5-15% discounts, deductible selection with options from $2,500 to $25,000, risk management program participation offering up to 15% discounts, and practice size considerations. Many carriers offer group rates through professional associations, potentially reducing costs by 10-20% compared to individual policies.

Do veterinary technicians need professional liability insurance?

Veterinary technicians generally receive coverage under their employer’s veterinary professional liability insurance policy when performing duties within their scope of practice and under appropriate veterinary supervision. Employer-provided coverage typically includes protection for licensed veterinary technicians performing authorized duties, coverage while working under direct supervision of licensed veterinarians, protection for standard technical procedures within scope of practice, and legal defense costs for covered incidents.

Individual coverage may be necessary for technicians working in multiple locations or practices, independent contractors providing specialized services, those providing mobile veterinary support services, and relief technicians working temporary assignments. Professional associations offer affordable group coverage options, typically ranging from $200 to $800 annually for comprehensive protection.

Key considerations include state-specific scope of practice regulations, employment arrangement specifics comparing employee versus contractor status, types of procedures regularly performed, and potential gaps in employer-provided coverage. Independent technicians or those providing specialized services should strongly consider individual veterinary professional liability insurance coverage to protect against potential gaps in employer-provided protection.

What is the difference between veterinary malpractice and general liability insurance?

Veterinary malpractice insurance, properly called veterinary professional liability insurance, and general liability insurance serve distinctly different purposes. They protect against separate categories of risk exposure.

Veterinary professional liability insurance covers quality of medical care provided to animal patients. This includes diagnostic errors and treatment complications, professional negligence allegations, and medication mistakes and dosing errors. It also covers surgical complications and anesthetic reactions.

General liability insurance covers premises accidents such as slip-and-fall incidents. It protects against property damage caused by business operations and third-party bodily injury on business property. Product liability for items sold is also included.

Professional liability focuses on medical practice quality with claim examples including misdiagnosis and surgical errors. General liability focuses on business operations with examples like client injuries and property damage.

Most veterinary practices require both coverages since they address completely different risk exposures.

Are veterinarians required by law to have professional liability insurance?

Most states do not legally mandate professional liability insurance for veterinarians. However, this varies significantly by jurisdiction and practice type. Practical and regulatory pressures often make coverage effectively essential.

States with mandatory requirements include California for veterinarians working with research animals. Florida requires coverage for certain emergency clinic operations. New York requires disclosure of coverage status to clients.

Common indirect requirements include hospital privileges often requiring proof of coverage. Professional association membership may mandate insurance. Employment contracts typically require adequate protection.

Many state veterinary boards require proof of insurance for license renewal applications and controlled substance registrations. While not universally required by law, the financial risks of practicing without coverage make professional liability insurance practically essential.

A single malpractice claim can result in hundreds of thousands of dollars in legal costs and potential damages.

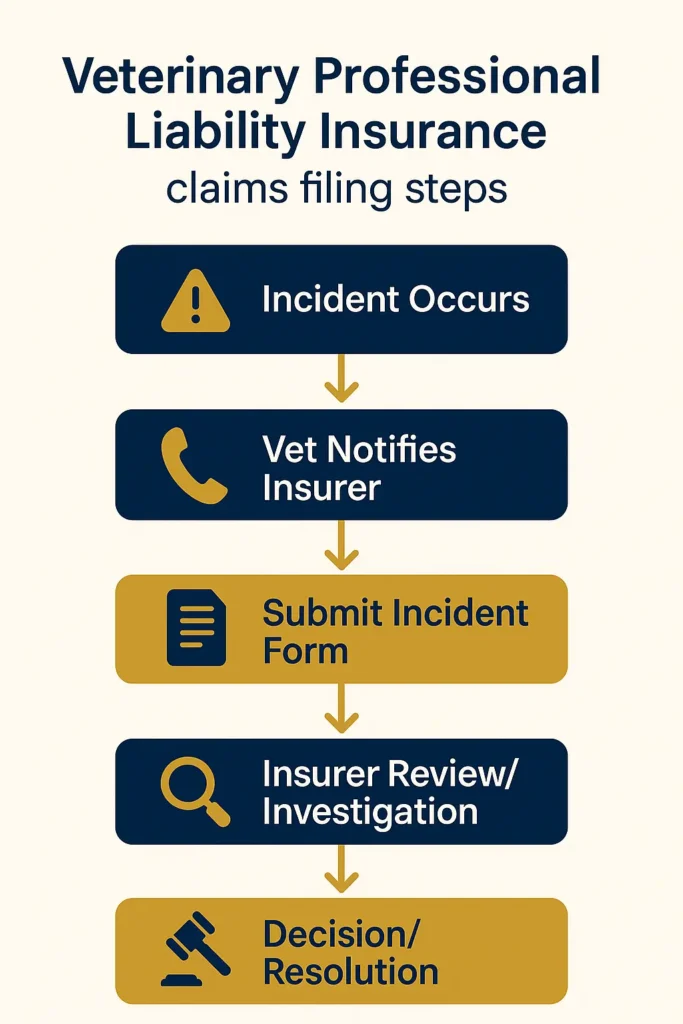

How do I file a claim with my veterinary professional liability insurance?

Filing a veterinary professional liability insurance claim requires immediate action and careful documentation to ensure proper coverage and protection. The claims process follows specific steps that practitioners must understand.

Immediate notification requirements include contacting your insurance carrier immediately upon becoming aware of any incident. Report within 24-48 hours of incident discovery according to policy-specific requirements. Notify even if unsure whether the incident will result in a formal claim.

Essential information to provide includes your policy number and coverage details. Include the incident date, time, and location along with details about animals and clients involved. Provide a detailed description of circumstances and all relevant medical records.

The step-by-step process involves immediate reporting to the insurance carrier within 24-48 hours. A claims adjuster will be assigned within 1-3 business days. Submit required documentation within 10 days.

Critical guidelines include preserving all medical records related to the incident. Avoid discussions with clients or their attorneys without carrier approval. Cooperate fully with the insurance company investigation while maintaining client confidentiality.

Conclusion

Veterinary professional liability insurance represents an essential risk management tool for modern veterinary practice, providing financial protection and peace of mind in an increasingly complex healthcare environment. The insurance landscape continues evolving with technological advances, changing practice patterns, and emerging risks that require comprehensive coverage solutions tailored to specific practice needs and specialties.

Understanding policy options, state requirements, and current market trends empowers practitioners to make informed decisions about their professional liability protection. The integration of technology, expanded specialty services, and evolving client expectations creates new challenges that veterinary professional liability insurance must address through innovative coverage solutions and enhanced risk management programs.

The regulatory environment varies significantly across states, requiring practitioners to stay informed about jurisdiction-specific requirements while maintaining compliance with evolving professional standards. Modern insurance carriers offer increasingly sophisticated products that address traditional risks while adapting to contemporary practice challenges including telemedicine, digital records management, and specialized treatment protocols.

Key Takeaways

• Coverage is essential – Veterinary professional liability insurance provides crucial protection against claims related to professional negligence, diagnostic errors, and treatment complications, with requirements varying significantly by state and practice type.

• Policy selection matters – Understanding policy structures, exclusions, and integration with other business insurance helps practitioners select appropriate coverage levels while managing premium costs through risk management and smart purchasing decisions.

• Market evolution continues – Current trends toward technology integration, specialty coverage options, and enhanced risk management programs provide improved protection and value for veterinary professionals throughout 2025 and beyond.

• Compliance is critical – State regulatory variations and professional board considerations require practitioners to maintain current knowledge of jurisdiction-specific requirements while ensuring continuous coverage to avoid protection gaps.

Disclaimer: The information in this article is for educational purposes only and reflects data and regulations available at the time of publication. Insurance rules and veterinary professional liability provisions may change frequently, and specific coverage can vary by state and carrier. Readers should verify details with licensed insurance professionals and their state veterinary board. For advice tailored to your personal practice situation, always consult a licensed insurance professional familiar with veterinary liability coverage.