The buzzing of lawnmowers echoes through a quiet street in Chandler, Arizona. Maya Torres, 36, just put her son down for a nap and is now scrolling through an insurance renewal notice on her cracked iPad. “Deductible: $1,000,” it reads. She frowns. “Wait—what is a deductible in insurance, exactly?” She’s already paying $219/month in premiums, and now she might owe more if something goes wrong?

Look… this part usually surprises folks: before your insurance pays a dime, you have to cover a chunk yourself—that’s your deductible. Maya didn’t know that. Heck, most people don’t. A neighbor once told me she thought it was a “bonus” you got from the insurer. (Not quite.) A recent national survey even showed that over half of policyholders didn’t grasp how deductibles actually work—until they had to file a claim and saw the bill sitting squarely in their lap.

In this guide, we’ll walk you through what a deductible really means, how it works in real life, and what you can do to make smarter (and cheaper) choices—before it’s too late.

On This Page

1. What Is a Deductible in Insurance – No Boring Definitions Just Real Talk

1.1 It’s Not a Mystery – It’s Just Your Share

Car insurance deductible explained through Tyler’s real case (Montana 2025)

Your insurance doesn’t kick in the second something breaks. Before any money comes your way, there’s a slice you have to pay first. That slice is called your deductible. It’s not hidden—it’s just rarely explained properly.

Think of it like showing up to a potluck: you bring a dish before you eat. Same deal here. The insurer won’t step in until you’ve put something on the table.

Tyler, a 39-year-old diesel mechanic in Bozeman, Montana, learned this the hard way when his 2015 Chevy Malibu slid into a pole after a night snowstorm. Repairs were estimated at $3,200. His deductible? $1,000. Until that amount came out of his pocket, the insurer wasn’t paying anything.

“You mean I pay for years and still owe more when I need help?” Tyler exhaled through clenched teeth, gaze fixed on the cracked metal. “Didn’t see that coming.”

Understanding how car insurance works can help you avoid Tyler’s surprise. Whether you’re dealing with collision coverage or comprehensive protection, knowing your deductible amount beforehand prevents financial shock when accidents happen.

1.2 What You Actually Get After a Claim

Deductibles aren’t just numbers—they’re choices that hit you when life turns upside down. You don’t feel them when signing the policy—you feel them when mopping up the aftermath.

In Akron, Ohio, Carl and Denise run a small sandwich shop off Main Street. One winter morning, Denise opened the backroom to find standing water creeping toward the bread racks. A burst pipe had soaked half the store. Between cleanup, replacement equipment, and repairs, the total came to $9,300. Their deductible was $1,500. Meaning they had to eat that first part themselves, literally.

If they’d gone for a $500 deductible instead, they would’ve paid less that day—but their annual premium would’ve been higher. That’s the hidden trade: either you bleed slowly over months, or you hemorrhage all at once.

“That’s basically the price of our oven repair last summer,” Carl muttered, wiping his hands on a receipt roll. Denise didn’t respond. She grabbed a towel, dropped to her knees, and began scooping water into a plastic bin.

2. Different Types of Deductibles and Which One Can Hurt the Most

2.1 Fixed Dollar Deductibles Versus Percentage-Based Surprises

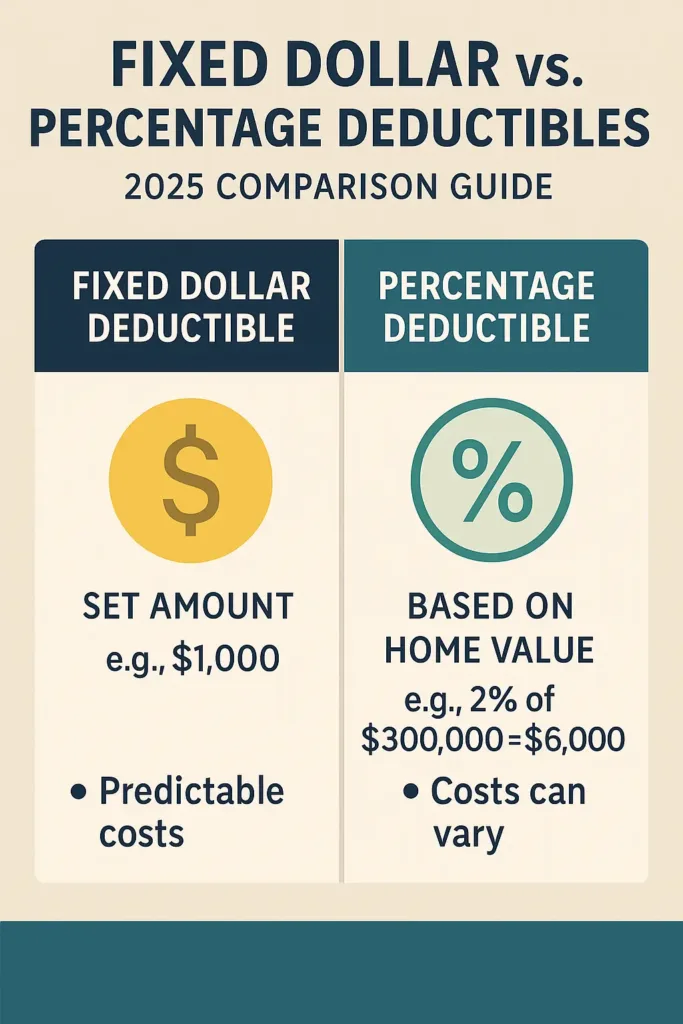

All deductibles aren’t built the same. Some are fixed: you know the number, you expect it. Others? They shift depending on what your policy covers—and that’s where people get blindsided.

Take Amy, 42, who owns a modest home in Galveston, Texas. Her insurer listed a “2 percent hurricane deductible” on the paperwork. She assumed that meant 2 percent of whatever the storm damaged. But after the roof peeled off during a late-season storm, the real math hit: 2 percent of $320,000, her insured home value. That’s $6,400 out of her pocket, upfront.

“I thought it was based on damage cost, not the full house,” she told her neighbor while trying to duct tape her living room ceiling.

Percentage deductibles climb higher the more your coverage is worth. Bigger house, bigger number. And in coastal zones? These policies aren’t rare—they’re standard.

Pro Tip

Why Your State Might Change the Rules

Texas, Florida, the Carolinas—all use percentage deductibles for storm coverage. But even inland states are adopting them for hail, wildfires, or flooding. Don’t assume you’re exempt.

| Deductible Type | How It Works | Where You’ll See It |

|---|---|---|

| Fixed Dollar Amount | Same number every time you file a claim | Most auto, health, renters |

| Percentage-Based | Varies based on your total coverage | Homeowners in disaster zones |

This complexity is why many homeowners benefit from understanding comprehensive home insurance coverage options. Different regions have varying deductible structures, and knowing what applies in your area can save thousands during a claim.

2.2 One Claim, One Deductible? Not Always.

Now here’s another twist: some policies make you pay per claim. Others apply it once a year, no matter how many accidents or bills come up.

Daniel, a middle school teacher from Des Moines, learned this the hard way. In March, a branch cracked his windshield. In November, a fender bender added a second repair. Each time? A fresh $1,000 out of pocket. “It’s like I got double-taxed for bad luck,” he muttered, digging through his glovebox for receipts.

In health plans, it works differently. You might chip away at your deductible across several visits. But once you hit the annual max, your insurer starts covering more—or even everything.

And with auto or home insurance? Every incident resets the meter. Whether it’s hail on Monday or a flooded basement by Friday, expect to pay your share each time.

3. How Deductibles Impact What You Really Pay

3.1 The Premium-Deductible Balancing Act

Insurance pricing plays a tricky game: raise your deductible, and your monthly insurance premiums often shrink. On paper, that seems smart. But in real life? It doesn’t always work out the way you expect.

Take Mitch, a 31-year-old rideshare driver in Phoenix. He chose a $2,000 deductible to save $34 a month on his car insurance. Then a distracted driver sideswiped him during a night shift. Total damage? $2,300. After filing the claim, he realized he’d only get $300 covered.

“I saved a few bucks each month, but now I’m draining my emergency fund,” he said, watching his rear bumper hang loose in the repair shop parking lot.

That’s the trade-off: lower monthly cost means higher risk if something actually happens. If you barely file claims, great. But if life gets messy? That cheap rate can punch you in the wallet.

For rideshare drivers like Mitch, commercial vehicle insurance often provides better protection than personal policies, especially when your car is your livelihood. The premium difference might seem steep, but it prevents situations where you’re stuck paying massive deductibles on business-related accidents.

3.2 The Unexpected Math Behind “Saving”

People often think, “I’ll take the higher deductible—it’s cheaper over time.” Sometimes that’s true. But sometimes? You end up losing more long-term.

Let’s say you save $20/month by picking a $1,500 deductible instead of a $500 one. That’s $240/year in savings. But if you have even one accident in three years, that $1,000 difference wipes out everything you saved—and more.

Shannon, a graphic designer in Colorado Springs, picked a high-deductible auto plan to keep her budget tight. “One hailstorm later, I was out $1,500. It erased two years of ‘savings’ in a day,” she said, holding a contractor’s invoice.

Insurance companies bank on this psychology. They know most people won’t file frequent claims, so offering low premiums with big deductibles seems like a win-win. But for the policyholder, it’s often a gamble.

4. Real-Life Claim Scenarios Where Deductibles Make or Break You

4.1 Minor Damage, Major Cost

Sometimes, it’s not the big disasters that hit the hardest—it’s the small ones that don’t even reach your deductible.

Take Victor, a retired army vet from Fayetteville, North Carolina. A fallen tree branch shattered his car’s rear windshield during a windstorm. The repair? $680. His deductible? $1,000. Which meant the entire bill came out of his pocket.

“I thought I had full coverage,” he said, staring at the receipt. “Turns out, I had full responsibility.”

In low-cost claims, a high deductible can mean you’re technically insured but functionally on your own. The insurer doesn’t pay a dime, even though you’ve been paying premiums for years.

Pro Tip

Full Coverage Doesn’t Mean Full Payout

A policy labeled “full coverage” still comes with exclusions, thresholds, and deductibles. Read the fine print—or better yet, ask your agent to explain it like you’re 12.

4.2 When the Claim Is Just Over the Deductible

Marissa, 28, a freelance photographer in Albuquerque, had her camera gear stolen from her parked SUV. The total value? About $2,200. Her deductible? $2,000.

She filed the claim, got a check for $200, and watched her premiums increase by $18 a month for the next two years.

“I ended up paying more in the long run just to replace a lens,” she told her friend, laughing bitterly. “I should’ve just financed it myself.”

That’s the hidden cost of borderline claims. When your deductible almost matches your loss, filing can backfire—especially if it triggers a rate hike.

4.3 Big Claims Where Deductibles Feel Small

On the flip side, deductibles barely register during catastrophic losses.

Jamari and Elise, homeowners in New Orleans, saw their entire first floor ruined after Hurricane Ida pushed six inches of water into their home. The damage totaled over $85,000. Their deductible was $2,500. At that scale, paying it felt minor—a tragic fee, but worth it for the $82,500 they got back.

In large claims, the deductible fades into the background. It becomes the price of survival, not a budget line.

Major disasters highlight why comprehensive homeowners insurance becomes essential. While the deductible feels manageable during large claims, having adequate coverage limits and understanding what’s excluded can make the difference between financial recovery and ruin.

5. How to Select the Best Deductible for Your Needs

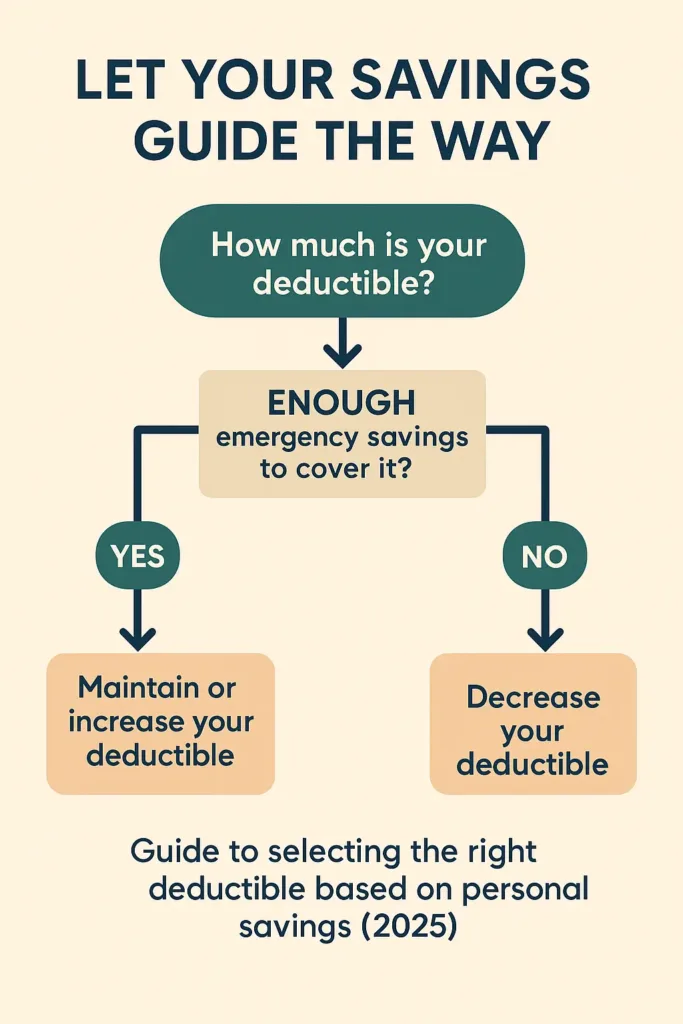

5.1 Let Your Savings Guide the Way

Forget the fancy quote tool for a moment. What really matters is whether you could cover the deductible right now if something happened. If your savings aren’t enough to handle a $1,000 or $2,000 cost, then opting for a higher deductible could leave you at greater financial risk than you expect.

In simpler terms: your deductible should always be less than what you have saved for emergencies. If it’s not, you could be relying too much on insurance and not enough on your own financial cushion—something that could create stress when you need to move fast.

If you’re managing a fixed income or planning for retirement, you may need coverage tailored for older adults.

5.2 Think About Claim Frequency

Do you live in a flood zone? Have three kids under ten? Commute through a deer-crossing forest every night? If your lifestyle or location makes claims more likely, a lower deductible might be smarter—even if it costs more each month.

But if you drive once a week, live in a brick house on a hill, and haven’t filed a claim in a decade? You might lean higher. Just be ready to pay it if something finally goes wrong.

Business owners face similar decisions when selecting commercial insurance deductibles. A landscaping company operating multiple trucks might benefit from lower deductibles given higher accident frequency, while a consulting firm with minimal physical assets might choose higher deductibles for cost savings.

5.3 Do the Math Before You Commit

The premium difference between a $500 and $1,500 deductible might be $30/month. That’s $360/year. Now ask yourself: would you rather save that amount and risk paying $1,000 more during a claim?

Break it down over time:

- One claim every 5 years: A lower premium wins.

- One claim every 1–2 years: Lower deductible wins.

Math won’t catch everything, but it’s better than guessing.

And if you’re a small business owner, it’s worth checking how much business insurance might cost as part of your overall risk planning.

6. The Bottom Line: Finding the Right Balance

6.1 It’s Not Just About Premiums

When choosing a deductible, many people focus on the immediate savings—the lower premium. But that approach ignores the bigger picture. It’s easy to look at the cost of your monthly payment and assume it’s the best option, but what really matters is how much you’re willing to pay out of pocket when the time comes.

A lower premium can look appealing, but if you can’t cover the deductible when you need to, that savings won’t matter much. You may end up stuck between a rock and a hard place, choosing between paying your deductible or going without repairs or medical treatment.

6.2 When in Doubt, Ask

Still unsure about what deductible fits your life best? Don’t hesitate to reach out to your insurer. Ask them to walk you through real-life scenarios and explain what would happen in different situations. This can give you a clearer picture of how much you’ll need to pay out of pocket and whether the savings are worth the risk.

6.3 Final Thoughts

Choosing the right deductible isn’t just about saving a few bucks each month—it’s about knowing what you can afford when the unexpected happens. By carefully evaluating your financial situation, understanding your risk, and planning for the future, you can make the best decision for you and your family.

7. What to Do If You’re Unable to Pay Your Deductible

7.1 Exploring Payment Options

If you find yourself facing a deductible that feels out of reach, don’t panic. Many insurers provide options like payment plans or financing for larger claims, especially when the situation is urgent.

These flexible options allow you to break down the cost into manageable payments over a few months, which can make a big difference when you’re dealing with an unexpected event.

Some insurers might let you pay part of the deductible upfront while deferring the rest, so be sure to check if these options are available to you based on your specific case. If this isn’t possible, another solution could be to consider personal loans or credit cards with low interest to manage the cost, though this requires careful planning to avoid accumulating debt.

7.2 Using Your Credit Wisely

Another option is to use a credit card for your deductible payment—if you’re confident you can pay it off quickly. Keep in mind that not all insurers will accept credit card payments for the deductible, but some do, and it could give you the breathing room you need.

However, be cautious about this approach. It’s easy to get stuck in a cycle of high-interest payments if you’re not careful. Always make sure you can pay off the balance within a reasonable timeframe to avoid accumulating significant interest charges.

7.3 Consider Lowering Your Deductible

If you consistently have difficulty meeting your deductible, it might be a good idea to review your policy. Many insurance companies give you the flexibility to adjust your deductible, although this change may result in higher monthly premiums.

Consider whether the trade-off is worth it: if lowering your deductible means you’ll have a more manageable cost when an accident or emergency occurs, it may provide peace of mind. On the other hand, increasing your premiums might be financially harder in the short term, but it could save you in the long run if you ever need to file a claim.

For health insurance specifically, understanding HSA and FSA options can help manage high deductibles more effectively. These accounts let you save pre-tax dollars for medical expenses, essentially reducing the real cost of your deductible.

CONCLUSION

So, what is a deductible in insurance? This common term is often misunderstood, yet it’s one of the most critical factors in determining your out-of-pocket expenses. Understanding what is a deductible in insurance can help you better navigate your insurance policy and make more informed decisions when claims arise. What is the deductible in insurance? It’s the portion of the financial burden you must shoulder before the insurance company steps in. Simply put, the deductible in insurance is the upfront cost you bear before your insurer starts to cover the remaining expenses.

Whether you’re shopping for auto coverage, evaluating health insurance plans, or protecting your business assets, the deductible decision impacts your financial security. Take time to compare different coverage types and deductible combinations before committing to any policy.

FAQ

What does it mean if you have a $1,000 deductible?

Having a $1,000 deductible means you must pay the first $1,000 of any covered claim out of your own pocket before your insurance company starts paying. For example, if your car repair costs $3,200, you pay $1,000, and the insurer covers the remaining $2,200. The deductible is your “share” of the loss and is a fixed amount you agree to when buying the policy.

Is it better to have a $500 deductible or $1,000?

It depends on your financial situation and risk tolerance. A $500 deductible usually means higher monthly premiums but lower out-of-pocket costs when you file a claim. A $1,000 deductible lowers your monthly premium but means you pay more upfront if you have a claim.

If you have enough savings to cover a $1,000 expense comfortably, the higher deductible can save you money over time through lower premiums. If not, a lower deductible might be safer, even though your monthly payments are higher.

Is it better to have a high or low deductible?

High deductible: Lower monthly premiums but higher out-of-pocket costs when you claim. Best if you rarely file claims and have savings to cover the deductible.

Low deductible: Higher monthly premiums but less out-of-pocket expense if you need to file a claim. Best if you expect to file claims often or don’t have much savings.

Choosing the right deductible is about balancing premium savings with your ability to pay upfront costs in an emergency.

Do you actually pay a deductible?

Yes, you pay your deductible out of pocket whenever you file a claim, before your insurer pays the rest. The deductible is not an extra fee — it’s part of your financial responsibility during a claim. For example, if your deductible is $1,000 and your repair bill is $900, you pay the entire $900 yourself because it’s less than your deductible. If your bill is $2,000, you pay $1,000 and insurance covers the remaining $1,000.