What is a good deductible for health insurance centers on three fundamental variables: your yearly earnings capacity, anticipated medical service frequency, and accessible emergency reserve funds based on current federal marketplace analysis data. Determining what is a good deductible for health insurance involves weighing upfront payment capability against recurring monthly premiums obligations.

Recent consumer research indicates 68% of Americans select inappropriate deductible levels, either choosing amounts exceeding their financial cushion capacity or spending unnecessarily on excessive monthly premiums for low-deductible protection they rarely utilize. Healthcare expenses constitute the primary driver of personal financial distress when deductible choices conflict with actual financial resources.

Current regulatory frameworks establish baseline and ceiling deductible parameters across various plan classifications, with bronze plans incorporating elevated deductibles alongside reduced monthly premiums while silver plans present moderate deductible structures. Marketplace options deliver standardized evaluation mechanisms allowing consumers to assess comprehensive yearly expenses encompassing both premiums and potential out-of-pocket maximum exposure limits.

This examination delivers methodical decision-making approaches for choosing optimal deductible levels utilizing empirical evidence from recent enrollment cycles and actuarial expense forecasts for diverse demographic segments and health service consumption patterns.

On This Page

Essential Overview

What is a good deductible for health insurance spans from $750-$4,000 yearly based on your earnings bracket, household composition, emergency fund strength, and projected healthcare service utilization frequency.

How Deductible Amounts Shape Your Healthcare Budget

Deductible choice fundamentally establishes your healthcare financing architecture by creating the equilibrium between fixed monthly premiums and fluctuating medical cost responsibility. Grasping this dynamic enables strategic financial planning that coordinates insurance expenses with your comprehensive fiscal capacity and risk mitigation preferences.

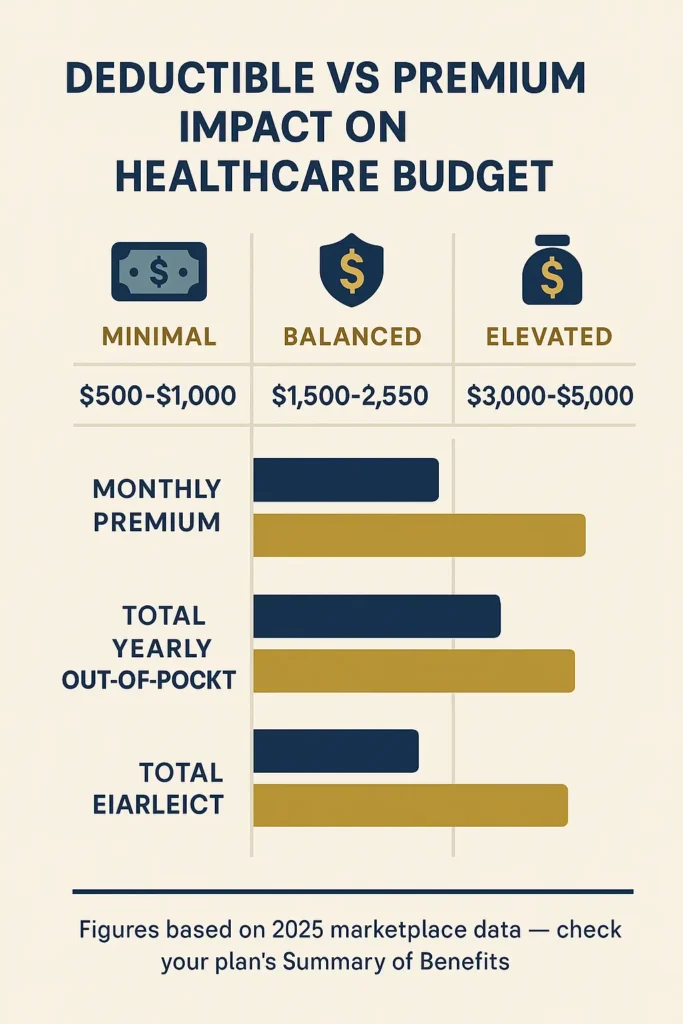

Yearly Expense Impact Evaluation:

| Deductible Category | Monthly Premium Span | Yearly Premium Expense | Maximum Out-of-Pocket | Complete Potential Expense |

|---|---|---|---|---|

| Minimal ($500-$1,000) | $485-$620 | $5,820-$7,440 | $6,320-$8,440 | $6,320-$8,440 |

| Balanced ($1,500-$2,500) | $365-$485 | $4,380-$5,820 | $5,880-$8,320 | $5,880-$8,320 |

| Elevated ($3,000-$5,000) | $245-$365 | $2,940-$4,380 | $5,940-$9,380 | $5,940-$9,380 |

Healthcare spending demonstrates consistent trends tied to age demographics and persistent health condition frequency. Adults between 25-35 years typically spend $2,100 yearly on medical services, while individuals aged 45-55 average $4,200 annually based on current actuarial information from leading insurance providers.

EXPERT INSIGHT: Determine your healthcare equilibrium threshold by identifying when yearly premium reductions from elevated deductibles surpass your standard medical spending. This computation reveals your ideal deductible balance point.

Emergency reserve necessities connect directly with selected deductible levels. Financial advisors suggest maintaining accessible savings matching your chosen deductible plus three extra months of living costs to manage unexpected medical situations without jeopardizing other fiscal responsibilities.

Employer plans frequently present different deductible frameworks compared to individual marketplace options, with numerous organizations providing Health Savings Account contributions that substantially decrease net deductible exposure for workers choosing high-deductible health plans combined with HSA advantages.

Income-Based Deductible Selection Strategies

Earnings level functions as the fundamental factor for suitable deductible determination, with federal poverty thresholds creating logical breakpoints for optimal healthcare expense management. Understanding what is a good deductible for health insurance according to income guarantees your insurance selection strengthens rather than weakens your overall financial stability.

Strategic Deductible Choice by Earnings:

| Yearly Household Earnings | Ideal Deductible Span | Monthly Premium Budget | Logic |

|---|---|---|---|

| $25,000-$40,000 | $500-$1,200 | $200-$300 | Subsidy reductions accessible |

| $40,000-$65,000 | $1,000-$2,000 | $300-$450 | Equilibrium protection approach |

| $65,000-$100,000 | $1,500-$3,500 | $250-$400 | Enhanced risk tolerance |

| $100,000+ | $2,500-$6,000+ | $200-$350 | HSA taxation benefits |

Marketplace options incorporate expense-sharing reductions delivering substantial deductible support for households earning 100-250% of federal poverty thresholds. These subsidies can decrease silver plans deductibles by 60-90%, creating lower deductible choices financially reachable for moderate-income households while preserving comprehensive coverage advantages.

CRITICAL CONSIDERATION: Tax credit qualification diminishes at particular earnings thresholds, influencing total healthcare expenses. Calculate your modified adjusted gross earnings to establish subsidy eligibility before choosing deductible levels through marketplace options.

High-earnings households gain considerably from combining high-deductible health plans with maximum Health Savings Account deposits. HSA funds deliver triple taxation benefits while building long-term healthcare reserves that substantially reduce lifetime medical expenses through tax-free growth and withdrawal.

Regional earnings differences significantly influence optimal deductible determination, with high living-cost regions requiring alternative approaches than lower-cost areas. Consider local healthcare pricing when evaluating what is a good deductible for health insurance, as identical deductible amounts represent varying relative financial burdens across geographic markets.

For comprehensive information regarding qualifying earnings thresholds and subsidy programs, reference our detailed health insurance guide which contains current enrollment standards and eligibility criteria.

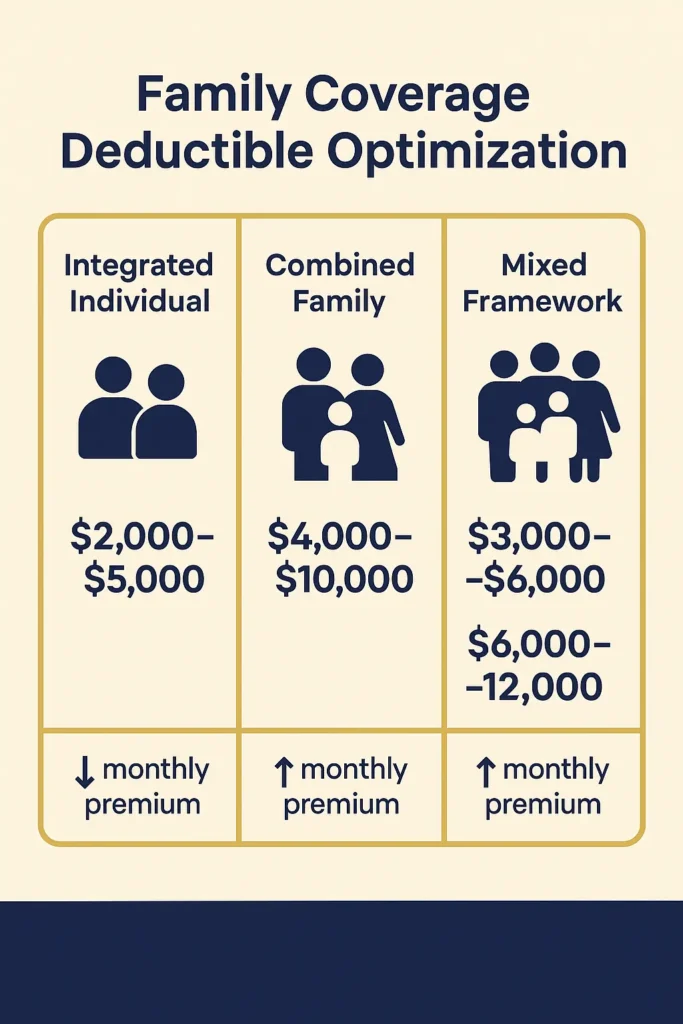

Family Coverage Deductible Optimization

Household coverage presents complex deductible frameworks requiring thorough evaluation of individual versus combined limits, integrated deductible characteristics, and family healthcare consumption patterns. Understanding what is a good deductible for health insurance becomes increasingly complex with family coverage due to multiple variables influencing cost-effectiveness.

Household Deductible Framework Types:

- Integrated Individual Deductibles: Each household member maintains separate deductible thresholds within overall family coverage

- Combined Family Deductibles: Single unified deductible amount must be fulfilled before any household member receives benefits

- Mixed Frameworks: Combination systems incorporating both individual and family thresholds

Household size directly influences healthcare consumption probability and cost-effectiveness of various deductible thresholds. Statistical evaluation demonstrates larger families gain from reduced per-person deductible amounts due to elevated likelihood of medical service usage across multiple household members throughout the policy cycle.

Household Size Optimization Framework:

| Household Composition | Individual Deductible | Family Deductible | Monthly Premium Influence |

|---|---|---|---|

| Partnership (2 adults) | $1,200-$2,500 | $2,400-$5,000 | Moderate elevation |

| Small household (3-4 members) | $900-$2,000 | $2,700-$4,000 | Higher premiums justified |

| Large household (5+ members) | $600-$1,500 | $1,800-$4,500 | Lower deductibles recommended |

ALERT: Non-integrated family deductibles generate potential financial difficulty when one household member requires expensive medical treatment. Verify your plan’s particular deductible mechanisms before enrollment to prevent unexpected expense exposure.

Pediatric healthcare requirements frequently involve routine preventive services, immunizations, and developmental evaluations that gain from immediate coverage without deductible application. Children’s medical costs can be unpredictable, with common conditions requiring prompt intervention throughout the year.

Pregnancy and childbirth costs represent considerable healthcare expenses that gain from lower deductible planning. Maternity care typically involves multiple appointments, diagnostic evaluations, and delivery costs that can easily surpass $10,000-$15,000 total expenses depending on complications and delivery approach.

Additional resources for family planning include our analysis of health insurance cost factors which details specific considerations for different family compositions and life phases.

Traditional vs High-Deductible Plan Comparison

Traditional and high-deductible health plans represent fundamentally different healthcare cost management philosophies. Understanding what is a good deductible for health insurance requires comparing these alternatives based on individual health status, earnings level, and long-term financial planning objectives.

Traditional Plan Characteristics:

- Reduced deductible amounts ($500-$1,500 standard range)

- Elevated monthly premiums with immediate coverage advantages

- Predictable copayments for routine medical services

- Limited additional tax-advantaged savings opportunities

High-Deductible Plan Features:

- Minimum deductibles meeting IRS standards ($1,600 individual/$3,200 family for 2025)

- Substantially reduced monthly premiums

- Health Savings Account eligibility with triple tax advantages

- Greater financial responsibility for initial medical costs

Comprehensive Expense Evaluation:

| Plan Category | Monthly Premium | Yearly Deductible | HSA Contribution Threshold | Complete Tax Savings | Net Yearly Expense |

|---|---|---|---|---|---|

| Traditional | $520 | $1,000 | $0 | $0 | $7,240 |

| High-Deductible | $285 | $3,500 | $4,300 | $1,290 (30% bracket) | $4,635 |

Health Savings Accounts deliver exceptional tax benefits for healthcare expense management. Deposits decrease taxable earnings, account balances grow tax-free, and withdrawals for qualified medical costs incur zero tax liability. After age 65, HSA funds can be withdrawn for any purpose with only ordinary income tax owed.

STRATEGIC INSIGHT: HSA funds never expire and transform into powerful retirement savings instruments. Many individuals utilize high-deductible health plans specifically to maximize HSA deposits for long-term wealth accumulation rather than immediate healthcare requirements.

Employer plans often incorporate HSA matching deposits that substantially decrease your net deductible exposure while providing additional tax advantages. Many organizations contribute $500-$1,500 yearly toward employee HSA accounts, generating immediate value that offsets higher deductible amounts for eligible workers.

Risk tolerance evaluation becomes essential when comparing plan categories. Traditional plans attract individuals preferring predictable healthcare expenses, while high-deductible alternatives suit those comfortable with short-term financial exposure in exchange for long-term savings potential and tax benefits.

Learn more about HSA qualification standards and contribution thresholds in our detailed guide to health savings account requirements.

Specific Deductible Amount Recommendations

Different deductible amounts serve particular financial situations and healthcare requirements. Understanding what is a good deductible for health insurance requires matching specific deductible ranges with individual circumstances, emergency fund strength, health status, earnings stability, and long-term financial objectives.

$500-$1,000 Deductible Situations:

- Persistent health conditions requiring regular specialist care and prescription medications

- Limited emergency savings strength (less than $2,500 accessible)

- Frequent healthcare consumption with predictable ongoing medical costs

- Conservative financial approach preferring immediate coverage access

$1,000-$2,500 Deductible Situations:

- Moderate emergency fund accessibility ($2,500-$6,000 liquid savings)

- Occasional healthcare requirements beyond routine preventive services

- Balance between premium affordability and reasonable out-of-pocket protection

- Young professionals establishing financial independence

$2,500-$4,000 Deductible Situations:

- Strong emergency fund strength (over $6,000 readily accessible)

- Generally healthy individuals with minimal chronic condition management

- Desire for reduced monthly premiums while maintaining comprehensive coverage

- HSA eligibility consideration for tax-advantaged healthcare savings

$4,000+ Deductible Situations:

- Substantial financial reserves with excellent emergency fund strength

- Exceptional health status with rare medical service requirements

- Priority on maximizing premium savings and HSA tax advantages

- High-earnings individuals optimizing total healthcare expense management

Deductible Selection Framework:

| Health Profile | Emergency Fund Status | Optimal Range | Primary Advantage |

|---|---|---|---|

| Persistent conditions | Any amount | $500-$1,200 | Immediate care access |

| Generally healthy | Limited savings | $800-$1,800 | Balanced protection |

| Very healthy | Moderate savings | $1,500-$3,500 | Premium expense reduction |

| Excellent health | Strong reserves | $3,000+ | Maximum tax advantages |

Age demographics substantially influence optimal deductible selection patterns. Younger adults typically benefit from higher deductibles due to lower baseline healthcare consumption, while individuals over 50 may prefer moderate deductible amounts as medical service requirements gradually increase with age-related health changes.

VITAL CONSIDERATION: Regional healthcare expense variations influence deductible effectiveness. The same deductible amount provides different relative protection depending on local medical service pricing, with high-cost metropolitan areas requiring adjusted selection strategies.

Geographic considerations also affect provider network access and healthcare delivery expenses. Rural areas may have limited in-network alternatives, potentially increasing out-of-pocket costs even with lower deductible amounts, while urban markets typically offer broader provider networks and competitive pricing structures.

Personal Deductible Calculator Method

Calculating what is a good deductible for health insurance requires systematic evaluation of healthcare history, financial capacity, and risk tolerance to identify the most cost-effective balance between monthly premiums and potential medical costs. This methodical approach ensures your insurance selection aligns with both health requirements and budgetary constraints.

Step-by-Step Calculation Framework:

- Healthcare History Evaluation

- Review 24 months of medical costs including all services, prescriptions, and procedures

- Identify seasonal patterns and recurring healthcare requirements throughout typical years

- Calculate monthly and yearly average spending across different cost categories

- Financial Capacity Assessment

- Evaluate current emergency fund balance accessible for immediate medical costs

- Determine comfortable deductible amount without compromising other financial obligations

- Consider earnings stability and ability to replenish emergency reserves after major medical events

- Total Expense Comparison Modeling

- Compare yearly premium expenses across different deductible alternatives available in your area

- Add projected medical costs to premium expenses for comprehensive yearly projections

- Include potential HSA tax advantages for high-deductible plan considerations

Personal Optimization Worksheet:

| Evaluation Factor | Low Deductible ($1,200) | Medium Deductible ($2,800) | High Deductible ($4,500) |

|---|---|---|---|

| Yearly Premium Expense | $6,840 | $4,560 | $3,180 |

| Projected Medical Costs | $3,200 | $3,200 | $3,200 |

| Out-of-Pocket Medical Expense | $1,200 | $2,800 | $3,200 |

| HSA Tax Advantage | $0 | $0 | -$1,350 |

| Total Yearly Expense | $11,240 | $10,560 | $9,030 |

STRATEGIC INSIGHT: Apply the 70/30 healthcare expense principle – if you expect to incur medical costs exceeding 30% of the premium difference between plan alternatives, select the lower deductible option for optimal financial protection.

Scenario planning helps identify optimal deductible selection across different potential healthcare consumption patterns. Model three distinct scenarios: minimal healthcare usage (routine preventive care only), moderate medical requirements (occasional urgent care or specialist visits), and high healthcare consumption (chronic condition management or surgical procedures).

Risk tolerance evaluation involves assessing your comfort level with potential financial exposure during unexpected medical emergencies. Conservative individuals typically prefer lower deductibles for predictable expenses, while those comfortable with short-term financial uncertainty may choose higher deductibles for long-term savings optimization.

Healthcare consumption prediction becomes more accurate with age and established health patterns. Younger adults with limited medical history may need broader deductible safety margins, while individuals with documented chronic conditions can more precisely calculate optimal protection levels based on established treatment patterns and expenses.

Understanding what is a good deductible for health insurance ultimately depends on balancing all these factors while considering your unique circumstances and financial objectives. The calculation method provides a systematic approach to making this important healthcare financial decision.

For comparison with other insurance products and comprehensive coverage planning, consider reviewing our complete insurance protection strategies to understand how health deductibles fit within your overall risk management approach.

FAQ

Is it better to have a $500 or $1,000 deductible?

A $500 deductible works better for individuals with chronic health conditions, frequent medical appointments, or limited emergency savings who need immediate healthcare access without significant upfront expenses. A $1,000 deductible suits generally healthy people who can afford higher initial costs and want to reduce monthly premiums by approximately $40-60. The decision depends on your yearly medical costs and accessible emergency funds.

Is it better to have a low or high deductible for health insurance?

Low deductibles benefit people with ongoing medical requirements, chronic conditions, or limited financial reserves who require predictable healthcare expenses and immediate coverage access. High deductibles work better for healthy individuals with substantial emergency savings who want lower monthly premiums and Health Savings Account tax benefits. Consider your health status, emergency fund strength, and risk tolerance when determining what is a good deductible for health insurance.

Is it better to have a $250 deductible or $1,000?

A $250 deductible provides nearly immediate healthcare coverage with minimal upfront expenses, ideal for individuals with frequent medical requirements or chronic conditions requiring regular treatment. A $1,000 deductible offers significant monthly premium savings and works well for healthy individuals who rarely need medical services beyond yearly checkups. Calculate total yearly expenses including both premiums and expected medical costs to determine optimal value.

Is a $3,000 deductible considered high?

A $3,000 deductible qualifies as moderate-to-high and meets IRS standards for Health Savings Account eligibility, providing significant tax benefits for qualified individuals. This amount requires substantial emergency fund strength and works best for healthy people with minimal healthcare requirements who prioritize lower monthly premiums and long-term tax savings. It may create financial difficulty for those with chronic conditions or limited savings.

What is a disadvantage of having a high deductible?

High deductibles create substantial upfront healthcare expenses that may discourage necessary medical care due to financial concerns, potentially leading to delayed treatment and worsened health outcomes. They require significant emergency fund reserves and can cause financial strain during unexpected medical emergencies, chronic condition management, or family healthcare requirements. Monthly premium savings may not offset these risks for individuals with regular medical costs.

Does my deductible reset every year?

Annual deductible cycles restart each January 1st for standard calendar-year policies or on your specific plan anniversary date for alternative policy periods. You must satisfy your complete deductible amount each new policy year before insurance benefits begin for covered services. Routine preventive services maintain full insurance coverage without deductible application regardless of whether you’ve met your yearly amount, as mandated by federal healthcare regulations.

Conclusion

Determining what is a good deductible for health insurance requires comprehensive evaluation of your earnings level, healthcare consumption patterns, emergency fund strength, and long-term financial objectives rather than focusing solely on monthly premium expenses. Optimal deductible selection balances immediate affordability with adequate protection against unexpected medical costs while considering potential tax benefits and coverage accessibility.

Research demonstrates that strategic deductible selection can reduce total yearly healthcare expenses by 15-25% when properly aligned with individual circumstances and health requirements. The evaluation framework includes calculating break-even points between premium savings and deductible exposure, assessing emergency fund necessities, and evaluating personal risk tolerance for medical cost variability.

Lower deductibles ranging $500-$1,500 provide superior protection for individuals with chronic conditions, frequent healthcare requirements, or limited emergency savings despite higher monthly premiums expenses. Higher deductibles from $2,500-$5,000+ offer substantial premium reductions and valuable HSA tax advantages for healthy individuals with strong financial reserves and minimal medical service requirements.

Understanding what is a good deductible for health insurance ultimately depends on balancing immediate financial constraints with long-term healthcare expense management strategies. The systematic approach outlined in this guide provides the framework necessary to make informed decisions that protect both your health and financial well-being.

Key Takeaways

Optimal deductible selection depends primarily on your yearly earnings level, expected healthcare consumption frequency, emergency fund strength, and personal risk tolerance for unexpected medical costs.

Lower deductibles ($500-$1,500) benefit individuals with chronic health conditions, frequent medical appointments, or limited emergency savings despite higher monthly premiums expenses and immediate coverage access.

Higher deductibles ($2,500+) provide significant monthly premiums savings and Health Savings Account eligibility for healthy individuals with substantial emergency reserves and minimal healthcare service requirements.

Calculate total yearly healthcare expenses including monthly premiums, projected medical costs, and potential HSA tax advantages rather than comparing deductible amounts alone for optimal financial decision-making.

Family coverage requires careful evaluation of integrated versus combined deductible frameworks and household healthcare consumption patterns across all family members throughout the policy cycle.

Emergency fund strength should equal or exceed your selected deductible amount plus three months additional living costs to ensure financial protection during unexpected medical emergencies.

External References

- Centers for Medicare & Medicaid Services 2025 Marketplace Data

- National Association of Insurance Commissioners Health Insurance Guide

- Department of Labor HSA Guidelines 2025

- Internal Revenue Service HSA Contribution Limits 2025

- Kaiser Family Foundation Health Insurance Survey 2024

Disclaimer

Data freshness: Health insurance rates and deductible frameworks change yearly during open enrollment periods based on federal regulations and state insurance department approvals. Information accuracy depends on timing of official policy releases and marketplace options updates.

Geographic variations: Deductible alternatives and healthcare expenses vary significantly by state jurisdiction, local market conditions, and regional provider network frameworks. Always consult your state insurance department and local marketplace options for location-specific guidance and current plan accessibility.

Professional advice: This educational content does not constitute personal financial, medical, or insurance advice tailored to individual circumstances. Healthcare and insurance decisions should be made in consultation with licensed insurance professionals, financial advisors, and healthcare providers familiar with your specific situation and requirements.