The heat of a Texas summer fills Sarah’s kitchen as she arrives home, a 36-year-old nurse. After a long 12-hour shift, she’s both exhausted and relieved.

Her phone buzzes on the countertop, displaying a message: “Your auto insurance claim has been approved.” A sigh of relief escapes her. But soon, a thought crosses her mind: “Did I understand everything before accepting this?”

Navigating the claims process can often feel complicated, and errors are more common than many realize. In fact, the National Association of Insurance Commissioners (NAIC) reports that nearly 15% of claims are either partially or completely denied each year.

This article will guide you through the entire claims process, shedding light on what’s covered, what isn’t, and offering practical tips to avoid costly mistakes.

On This Page

1. Understanding the Basics of an Insurance Claim

Handling insurance claims can sometimes feel like you’re lost in a maze. At first glance, it may seem straightforward, but as you go deeper, the complexities become evident. So, what does an insurance claim really mean? Simply put, it’s a formal request made to your insurer asking for financial reimbursement or coverage based on the terms of your policy, after a covered incident occurs. Whether it’s an auto accident, property damage, or a medical issue, the general process tends to follow the same basic structure, though the specifics can vary depending on the type of insurance.

1.1. How to File a Claim

Although filing a claim may seem easy, providing the correct and detailed information from the very start is essential to avoid delays. The first step is notifying your insurance company and providing a full description of the incident or loss. Once that’s done, an adjuster is assigned to assess the situation. This could involve examining physical damage, interviewing witnesses, or reviewing medical documentation, depending on the nature of your claim.

1.2. Pitfalls to Avoid

Many people assume their claim will be automatically accepted, but the reality is often different. If, for example, an adjuster believes that the damage falls below the deductible or if the cause of the loss is disputed, your claim may be denied or reduced. A common error? Failing to follow up or keep track of essential documents, which can lead to unnecessary complications down the line.

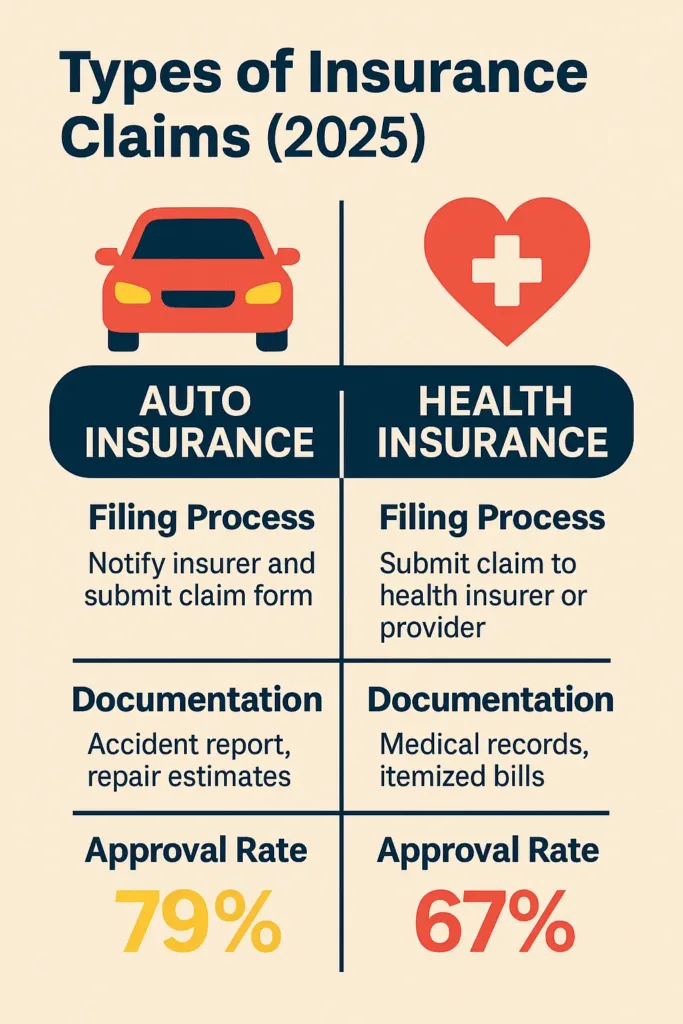

2. Types of Insurance Claims

2.1. Auto Insurance Claims

When it comes to car insurance, the most common types of claims are for accidents, theft, or damage caused by natural events. Understanding your coverage options is crucial before filing any claim. Let’s say you’re involved in a car accident—after exchanging information with the other party, the next step is to file a claim with your insurer. You’ll be asked to provide details about the incident, including police reports, witness statements, and any evidence like photos of the damage. An insurance adjuster will then review your claim, assess the damage, and decide how much compensation you’re entitled to.

Imagine Mike, a 28-year-old software developer in Chicago, who recently had a minor accident. After submitting his photos and police report, the adjuster deemed his vehicle repairable, and he received the funds to cover most of the costs. However, if his car had been declared a total loss, the process would have been slightly more complex, including a detailed evaluation of the car’s value and the terms of his policy.

Bundling can also make a difference. If Mike had been bundling auto and renters insurance, he might have received a better rate or simplified claims handling under one provider.

For more detailed information about auto coverage options and how they affect your claims, explore our comprehensive car insurance analysis to understand what protection works best for your situation.

2.2. Health Insurance Claims

Health insurance claims typically arise from medical treatments, prescriptions, or hospital visits. When you visit a healthcare provider, you usually pay upfront, and then your insurer reimburses you. However, it’s not always so straightforward. Sometimes, the insurer will deny the claim or only cover part of the costs. This can happen due to errors in coding, mismatched policy terms, or pre-existing conditions.

Take the case of Ashley, a 33-year-old teacher from Austin, who needed surgery after a car accident. While her doctor filed the claim directly, Ashley received a partial denial because the hospital didn’t verify her pre-authorization for a certain procedure. Understanding health insurance requirements beforehand can prevent such complications.

3. How to Avoid Common Insurance Claim Mistakes

3.1. Be Thorough with Documentation

One of the most crucial aspects of filing a claim is making sure that all the documentation is accurate and complete. Missing or incorrect information can lead to delays, reduced payouts, or even denials. Whether it’s an auto accident, home damage, or medical treatment, always gather as much supporting evidence as possible. This might include photos, police reports, medical records, or receipts.

Take the example of Jordan, a 40-year-old real estate agent in Miami. After his home was damaged in a storm, he made the mistake of submitting only a few photos of the damage. His insurance company initially denied the claim because the evidence wasn’t thorough enough. It wasn’t until Jordan sent more detailed photos and an estimate from a contractor that his claim was approved.

3.2. Keep Track of Deadlines

Many policyholders overlook the importance of adhering to deadlines when it comes to filing insurance claims. Insurance companies usually have specific time frames in which a claim must be filed, and missing this deadline could result in losing your coverage. Make sure to note the filing deadline and submit all required documents promptly.

Think about Emma, a 50-year-old nurse from Boston. After a minor fender-bender, she delayed filing her auto insurance claim because she was caught up with work. By the time she submitted her claim, she was informed that the filing window had closed, and her claim was no longer eligible. Emma learned the hard way that timely filing is essential to securing the compensation you’re entitled to.

4. What Happens After You File an Insurance Claim?

4.1. The Role of the Claims Adjuster

Once you’ve filed your claim, the insurance company will assign a claims adjuster to assess your situation. The adjuster’s role is to evaluate the damage, determine liability, and decide how much compensation you’re entitled to based on your policy. This process can take anywhere from a few days to several weeks, depending on the complexity of your claim.

For instance, when Kyle, a 29-year-old photographer in Seattle, filed a claim after his equipment was stolen, his insurance company sent an adjuster to inspect the incident. The adjuster reviewed his inventory records and photos of the stolen items, and within two weeks, Kyle received reimbursement for the full value of his equipment.

4.2. The Approval or Denial Process

After the adjuster completes their assessment, they will recommend either approval or denial of the claim. If your claim is approved, you will receive a payout according to the terms of your policy. However, if the claim is denied, you will be informed about the reasons behind the decision. It’s important to carefully review these reasons and understand your options for appealing the decision.

Consider Hannah, a 38-year-old marketing manager in Los Angeles. After her home was damaged in a fire, her insurance claim was denied because the insurer argued that the fire started due to negligence. However, after hiring an independent adjuster and gathering additional evidence, she successfully appealed the decision and was ultimately compensated for her losses.

5. Common Reasons for Insurance Claim Denials

5.1. Lack of Coverage or Exclusions in the Policy

A frequent reason for a claim denial is that the event you’re claiming for isn’t covered by your insurance policy. Every policy has a set of exclusions—specific events or circumstances that won’t be covered. It’s crucial to carefully review your policy to know what’s included and what’s not. If you’re unsure about any coverage details, it’s always a good idea to reach out to your insurer for clarification.

Take Rachel, a 34-year-old teacher in Atlanta, who filed a claim after a hit-and-run accident. Unfortunately, her policy didn’t cover such incidents because she had opted for a basic liability plan instead of a more comprehensive one. As a result, her claim was denied, and she had to pay for the car repairs out of pocket.

This highlights why reviewing different car insurance coverage types is essential when choosing your policy to avoid coverage gaps.

5.2. Failure to Meet the Deductible

Another common reason for claim denials is not meeting the deductible. The deductible is the amount you must pay out of pocket before the insurer starts covering the rest of the costs. If the damage is less than your deductible, the insurance company won’t pay anything.

For example, David, a 40-year-old lawyer in Dallas, filed a claim after his house suffered minor water damage. However, his deductible was higher than the total damage, so his claim was denied. David didn’t realize how insurance deductibles work and ended up covering the repairs himself.

5.3. Misrepresentation or Fraudulent Claims

In some cases, claims are denied due to misrepresentation or fraudulent activity. If the insurance company suspects that you’ve provided false information or exaggerated the extent of your damages, they may reject your claim. This is why it’s important to be honest and transparent when filing your claim.

For example, Anna, a 29-year-old business owner in Phoenix, tried to exaggerate the damage to her car in order to get a larger payout after a minor fender-bender. The insurance company noticed discrepancies in her claim and denied it outright. Misrepresentation can have serious consequences, so always ensure your claim is truthful and accurate.

6. How to Appeal a Denied Insurance Claim

6.1. Understanding the Denial Letter

If your insurance claim is denied, the first step is to carefully read the denial letter. The letter should outline why your claim was denied and which specific parts of your policy were referenced. Understanding these reasons is crucial because it will inform you whether you have a valid case for an appeal. Sometimes, the denial may be due to missing information or incorrect documentation, which can be easily corrected.

Consider the case of Brian, a 48-year-old IT consultant in Denver. His health insurance claim for a medical procedure was denied, with the insurer citing a policy exclusion. After reading the letter, Brian realized that the insurer had overlooked a provision in his policy that covered the procedure. Armed with this information, he was able to successfully appeal the decision.

6.2. The Appeal Process

Once you understand the reason for the denial, the next step is to follow the appeal process. Most insurers have a formal process in place that you must follow to challenge the denial. This typically involves submitting additional documentation, such as new evidence or corrected information, and writing a formal letter explaining why you believe the denial was in error.

Sarah, a 36-year-old entrepreneur in Los Angeles, faced a similar situation after her auto insurance claim was denied for minor damage. She submitted further evidence, including detailed repair estimates and photographs of the damage, along with a formal appeal. Her insurer reviewed the appeal, and within a few weeks, Sarah’s claim was approved.

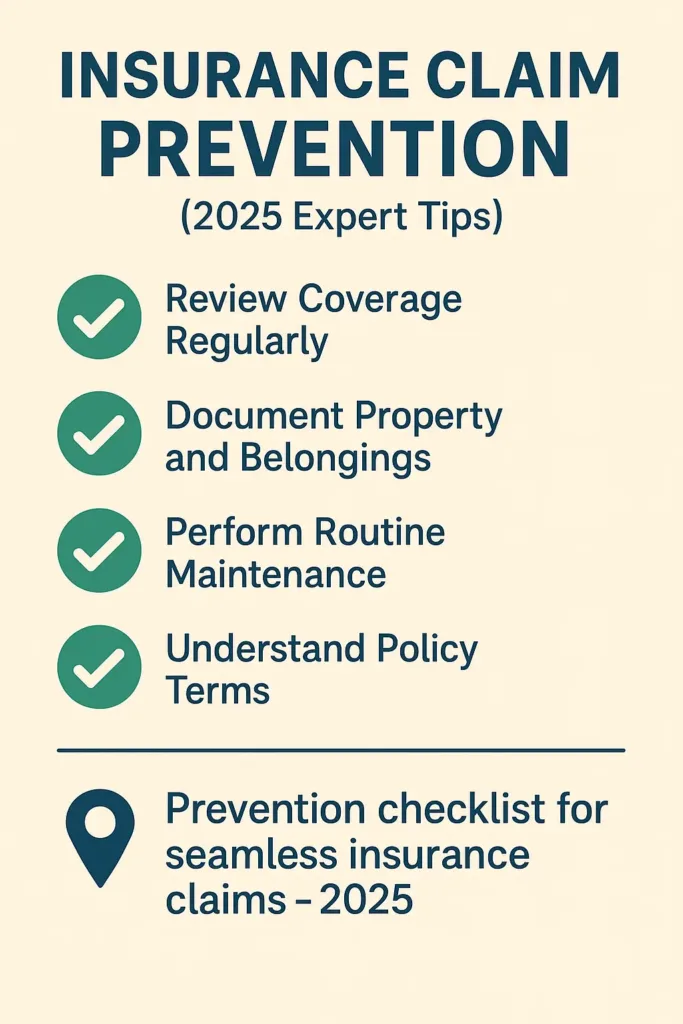

7. Tips for Preventing Future Insurance Claim Issues

7.1. Regularly Review Your Insurance Policy

A great way to minimize issues with insurance claims is by regularly reviewing your policy to ensure it meets your current needs. As your circumstances change, so should your coverage. Whether it’s a new addition to your home, a new car, or any significant lifestyle changes, make sure your insurance reflects these updates.

For instance, Tom, a 41-year-old contractor in Nashville, recently renovated his kitchen. However, he forgot to update his homeowner’s insurance to cover the new appliances and upgrades. When a small kitchen fire caused some damage, his insurance didn’t cover the costs because the policy hadn’t been updated. Regularly reviewing your insurance policy helps ensure it reflects your current needs and covers new risks like home upgrades or added drivers.

Whether you need life insurance, home coverage, or vehicle protection, keeping your policies current prevents coverage surprises during claims.

7.2. Keep Records of Important Documents

Always keep detailed records of important documents related to your insurance policy and any claims. This includes receipts, photos, medical records, or any communication with your insurer. A well-organized record-keeping system can help you quickly respond to any requests from your insurer and speed up the claims process.

Take the case of Linda, a 29-year-old freelancer in New York, who filed a claim for water damage to her apartment. She had saved all her receipts for repairs and photos of the damage, which helped expedite her claim. Having everything documented made it much easier for the insurance company to process her request.

Conclusion

Understanding Your Coverage

The key takeaway from this guide is that understanding your insurance coverage and the claims process is vital. The more informed you are, the more confident you’ll be when handling a claim. Review your policy regularly, keep track of important documents, and don’t hesitate to contact your insurer with questions. These proactive steps will save you time and stress in the long run.

Imagine Mark, a 50-year-old firefighter from San Diego. After a break-in at his home, he felt confident in his ability to handle the insurance claim because he had carefully reviewed his policy and kept all documentation organized. With the right preparation, Mark quickly navigated the process and received a fair payout.

Be Prepared for the Unexpected

Insurance claims may seem overwhelming, but they don’t need to be. By staying organized, fully understanding your coverage, and avoiding common mistakes, you can streamline the process and ensure you get the compensation you deserve. If your claim happens to be denied, don’t hesitate to appeal—remember, you have the right to have the decision reconsidered.

By following these steps, you’ll protect yourself in the event of an incident and avoid being caught off guard by a denied claim. Stay proactive, stay informed, and always keep in mind that your insurance is there to offer you peace of mind when it matters most.

FAQ

How does the insurance claim work?

An insurance claim is a formal request you make to your insurer asking for compensation or coverage after a covered incident (like an accident, theft, or medical treatment). You notify your insurer, provide details and documentation of the loss, and then an adjuster evaluates your claim. Based on your policy, the insurer decides whether to approve or deny the claim and issues a payout if approved.

What are the 4 stages of insurance claims?

Filing the Claim: Notify your insurer promptly with full details and supporting evidence (photos, police reports, medical records).

Claim Assessment: An insurance adjuster reviews the claim, inspects damage, and determines liability and payout.

Approval or Denial: The insurer either approves and processes payment or denies the claim with reasons explained.

Appeal (if needed): If denied, you can review the denial letter, submit additional evidence, and formally appeal the decision.

What is the process of insurance claim?

Step 1: Report the incident to your insurance company immediately.

Step 2: Submit all required documents—photos, reports, receipts, medical records.

Step 3: The claims adjuster investigates and assesses your claim.

Step 4: Receive a decision from the insurer to approve or deny your claim.

Step 5: If approved, get compensated according to your policy. If denied, review the reasons and consider appealing.

What not to say in an insurance claim?

Avoid exaggerating or misrepresenting facts—this can lead to denial or accusations of fraud.

Don’t admit fault or liability prematurely.

Avoid vague or inconsistent descriptions of the incident; be clear and factual.

Don’t withhold information that the insurer requests, as delays or non-disclosure can harm your claim.

Never lie or alter documents; honesty is critical for claim approval.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.