An insurance policy is a legally binding contract that defines what risks and damages are covered, when coverage applies, and the specific limits of your protection. Yet most Americans discover the harsh reality of their insurance policy limitations only when it’s too late to make changes.

Take James Holloway, a 38-year-old logistics supervisor from Newark, New Jersey. After a spring fender mishap, he expected his insurance policy to cover “just in case” situations, but ended up paying more than $3,200 out of pocket due to an excluded provision he never noticed.

James isn’t alone. According to a 2023 Insurance Research Council survey, 61% of Americans are confused by their insurance policy coverage details, leaving them vulnerable when they need protection most.

Understanding your insurance policy before you need it can save thousands in unexpected costs. This comprehensive guide reveals seven critical aspects insurers rarely explain clearly, helping you make informed decisions whether you’re reviewing your current insurance policy terms or shopping for new coverage options.

On This Page

1. Why Most Insurance Policies Don’t Cover What You Think

“I thought my plan had me covered. But after my basement flooded, my agent said, ‘That’s not included under your standard policy.’ I was stunned.”

— Gloria M., 52, teacher, Des Moines, Iowa

When Gloria bought her home in Polk County, she assumed her insurance policy protected her from anything nature threw her way. But when an April 2023 rainstorm overwhelmed her sump pump, her insurer declined the $11,000 damage claim—because she didn’t have optional flood coverage.

She’s not alone:

Fewer than one in twenty U.S. homeowners have flood insurance, despite the fact that nearly every county in the country has dealt with at least one flooding event over the past two decades (FEMA data).

1.1 Understanding the “Named Perils” Trap

Most standard home insurance policies only cover specific perils (like fire, theft, or wind) explicitly listed in your contract. Water damage from plumbing failure? Maybe. Overflow from heavy rains? Probably not—unless you buy extra riders.

1.2 Quick Tip

Always check the exclusions in the fine print. If it’s not named, it’s not covered. Ask for a breakdown in plain English from your provider.

For homeowners specifically, understanding these exclusions is crucial when selecting home insurance coverage that truly protects your investment.

2. The Deductible Illusion: Why “Saving Money” Can Cost You More

“When my daughter’s car was sideswiped, I expected help from my insurance. Instead, I had to pay $1,000 before they’d lift a finger. That felt like a second hit.”

— Marcus L., 45, shift foreman, Louisville, Kentucky

Marcus had chosen a high deductible to keep his monthly premiums low. But when the unexpected happened, his so-called savings disappeared. He ended up draining his emergency fund just to file the claim.

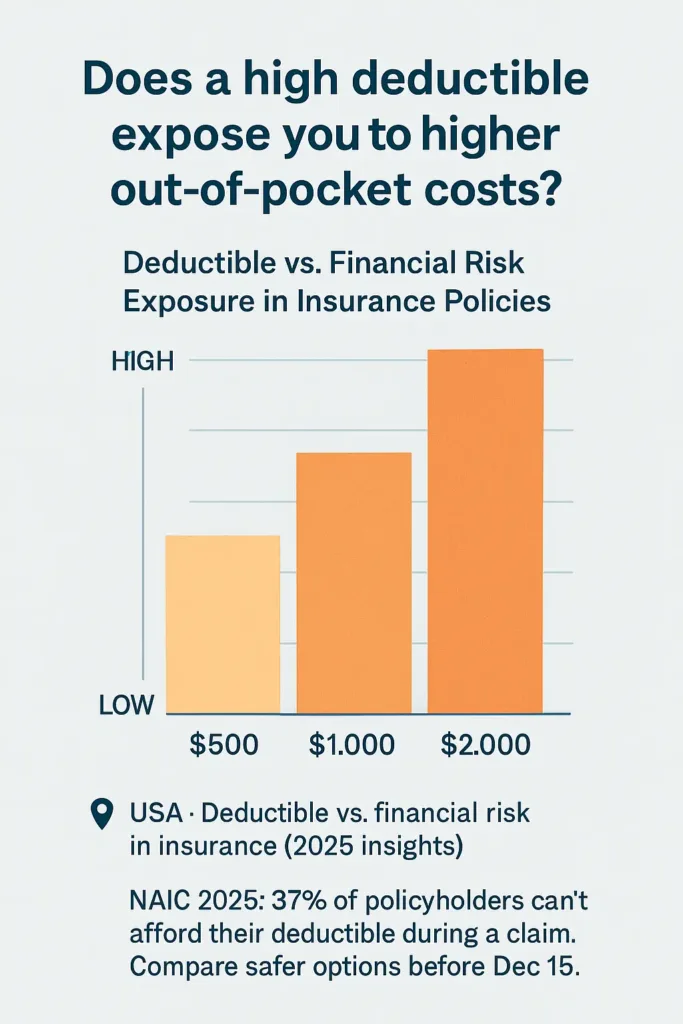

That experience is more common than most realize. The National Association of Insurance Commissioners (NAIC) reported in 2023 that over 37% of policyholders couldn’t afford their own deductible during a covered event.

2.1 High Deductible = High Risk

Opting for a higher deductible might lower your monthly payments, but it shifts a bigger financial burden onto you when something goes wrong. Many people believe their savings will bridge the gap when trouble hits—until reality throws a wrench in that plan.

2.2 Did You Know?

Most insurers offer plans with deductibles ranging from $250 to $2,500, but nearly 60% of Americans have less than $1,000 in liquid savings, according to a 2024 Federal Reserve report. That mismatch can break a household financially during a claim.

This financial gap is particularly concerning for drivers, as car insurance deductibles can leave you stranded when accidents happen.

3. Exclusion Clauses: The Fine Print That Can Break You

“My husband was shocked. The claim for our stolen bikes got denied—because they were taken from our front porch, not the garage.”

— Renee S., 41, nurse practitioner, Flagstaff, Arizona

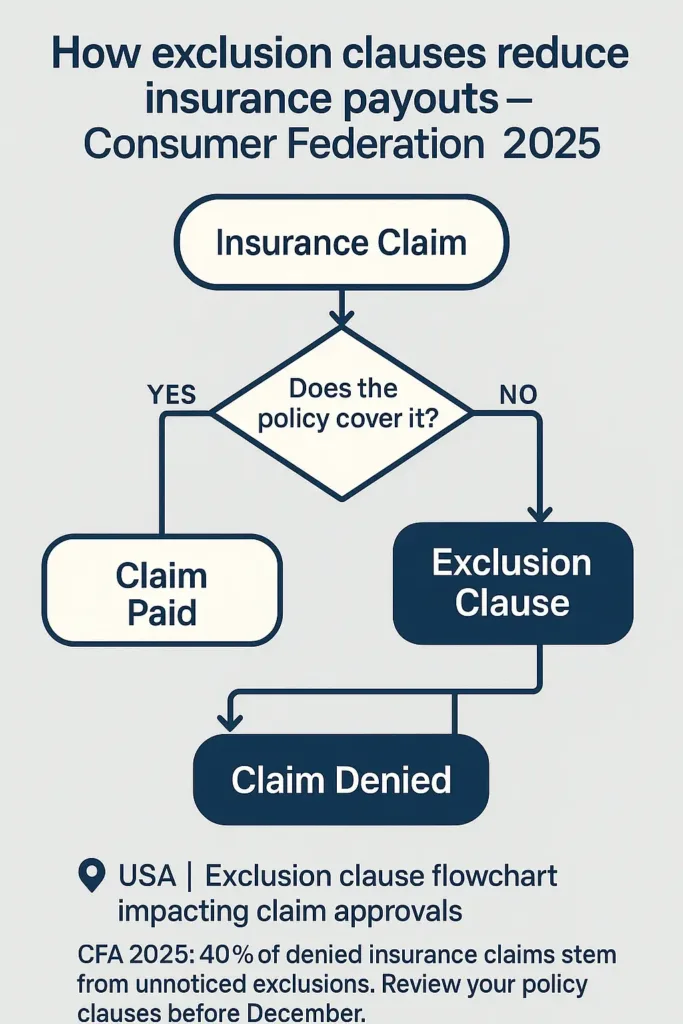

Renee and her partner thought their renters insurance policy protected all their belongings. But tucked deep in the contract was a clause that limited theft coverage to items stored in “secured, enclosed structures.” The difference? A few feet—and thousands of dollars lost.

This kind of technicality isn’t rare. In 2024, the Consumer Federation of America found that over 40% of denied claims stem from policy exclusions most policyholders didn’t know existed.

3.1 The Language Problem

Exclusion clauses are often written in complex legal terms. They may include wording like “subject to limitations” or “except as otherwise provided,” which many interpret too broadly—or miss entirely.

3.2 Myth vs. Fact

Myth: All your belongings are covered under any circumstance.

Fact: Coverage often depends on how, where, and why damage or loss occurred—and whether those conditions are spelled out in your policy.

Understanding these coverage limitations is essential whether you’re reviewing renters insurance terms or evaluating comprehensive property protection.

4. Auto-Renewals: The Silent Cost Increase You Never See Coming

“I didn’t touch my coverage, but my premium went up $432 this year. No accident, no claim—just silence.”

— Carla N., 34, administrative assistant, Fresno, California

Every December, Carla’s insurance policy renews automatically. But this year, she was stunned to see her premium spike by nearly 20%. When she called to ask why, the representative said, “Rates adjust with market conditions.” No warning. No explanation. Just a higher bill.

She’s not alone. A 2023 report from the Consumer Financial Protection Bureau revealed that more than 1 in 4 Americans don’t review their insurance renewals—many because they assume the terms haven’t changed.

4.1 Loyalty Penalties Are Real

Insurers often raise rates gradually on long-term customers, betting they won’t notice—or won’t bother to shop around. This practice, sometimes called “price optimization,” is legal in many states but rarely explained to the consumer.

4.2 What You Can Do

Mark your renewal date on a calendar. Request a full breakdown of changes 30 days prior. If the numbers don’t make sense, get quotes elsewhere. Insurers often offer better deals to new customers than loyal ones. Consider bundling options like auto and renters insurance packages to maximize your savings potential.

5. Claim Denials: When “Covered” Doesn’t Mean Paid

“They told me the shingles were already deteriorating—that it wasn’t the storm’s fault. But I watched the wind tear through our roof in real time.”

— Tom W., 63, retired firefighter, Macon, Georgia

Tom believed his insurance policy had him covered for wind damage. But after a powerful storm swept across Bibb County in March 2024, his claim hit a wall. The adjuster concluded that his roof’s “age and condition” disqualified it from coverage, despite visible damage from the storm itself. Left with a $7,600 repair bill, Tom paid out of pocket.

That kind of reasoning is more common than most realize. According to a 2024 Insurance Information Institute report, 1 in 10 property claims is denied, often due to vague policy wording or adjuster interpretation.

5.1 The “Wear and Tear” Loophole

Insurers frequently cite “pre-existing damage” or “poor maintenance” to avoid payouts, especially when documentation is limited. Without before-and-after photos or inspection reports, your case can be easily dismissed.

5.2 Quick Tip

After any home upgrade or repair, take clear photos and store receipts digitally. That documentation can be a lifeline if your claim ever goes to dispute or arbitration.

6. Cancellation Rules: One Missed Payment Can Void Everything

“I was recovering in the hospital and completely lost track of bills. By the time I got home, they’d canceled my policy without warning.”

— Danielle H., 29, freelance designer, Spokane, Washington

Danielle’s insurance policy had been active for over three years. But during a brief hospital stay in March 2024, she fell behind on a single premium. When she called to reinstate coverage, the company informed her that the cancellation was final—and she’d have to reapply from scratch, at a higher rate.

This kind of abrupt termination isn’t rare. According to the National Association of Insurance Commissioners, policy lapses due to nonpayment increased by 17% in 2023, largely tied to economic hardship and medical emergencies.

6.1 Grace Periods Vary Widely

Some insurers offer a 10-day window. Others give 30. And some—especially for auto coverage—can cancel after just one missed payment. The terms are often buried in page four of your policy documents.

6.2 Actionable Advice

Set up auto-pay with alerts and monitor your renewal notices closely. If you’re facing a crisis, call your insurer before a due date passes. Consider switching providers or looking to bundle auto and renters coverage to reduce your monthly costs.

7. Coverage Limits: The Cap That Could Leave You Exposed

“When our kitchen caught fire, I thought our insurance would handle it. But they capped the payout at $15,000—repairs cost almost double.”

— Kevin J., 47, HVAC technician, Omaha, Nebraska

Kevin assumed his homeowners insurance policy would fully cover the fire damage. But buried in the paperwork was a coverage limit for kitchen-related losses—set far below actual replacement costs. Left with over $12,000 in unexpected expenses, Kevin had to dip into retirement savings to rebuild.

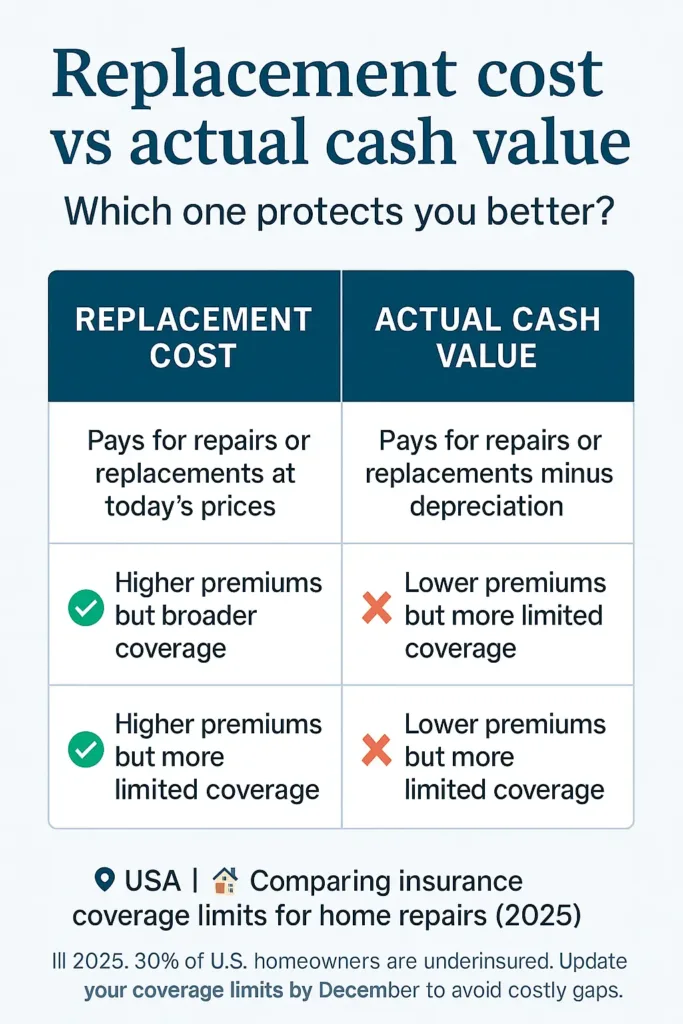

He’s not alone. A 2024 study by the Insurance Information Institute found that more than 30% of U.S. homeowners are underinsured, meaning their policy limits are too low to fully restore their home after a disaster.

7.1 Replacement Cost vs. Actual Cash Value

Many policies offer “actual cash value,” which subtracts depreciation from your payout. That means your 10-year-old cabinets are worth a fraction of what they’ll cost to replace. “Replacement cost” coverage is more protective—but not always standard.

7.2 Know Your Numbers

Review your policy’s itemized limits. Compare them to real-world costs in your ZIP code. If your coverage hasn’t been updated in over two years, you’re likely behind.

8. Policy Language: Why Words Like “May” and “Typically” Matter

“I thought it was guaranteed coverage. But the agent said, ‘It may apply—depending on interpretation.’ That one word cost us $9,000.”

— Sarah T., 51, librarian, Rochester, New York

Sarah’s insurance policy included coverage for temporary relocation during home repairs. When a plumbing disaster forced her family into a hotel for three weeks, she expected reimbursement. But the company denied the claim, pointing to a vague sentence: “Coverage may be provided for temporary housing in certain cases.”

It wasn’t just bad luck—it was bad wording. In 2023, a linguistic audit from Consumer Reports flagged over 45% of personal insurance policies as containing “ambiguous or misleading terminology” that can be interpreted differently depending on the adjuster.

8.1 Words That Weaken Your Rights

Terms like “may,” “typically,” or “in some cases” aren’t commitments—they’re loopholes. They give insurers legal leeway to deny or delay benefits, even when the event seems clearly covered.

8.2 What to Watch For

If your policy uses conditional language, ask for clarification in writing. Keep email records of agent responses. Better yet, request a plain-English breakdown of your core coverages—before you need them.

This careful review approach benefits all insurance types, from health insurance enrollment to specialized coverage decisions.

Final Thoughts: Don’t Let Your Insurance Policy Surprise You

James in Newark. Gloria in Des Moines. Danielle in Spokane. These aren’t rare exceptions—they’re the norm for too many Americans who trust their insurance policy without reading between the lines.

Each clause, deadline, and coverage cap can mean the difference between getting help—or footing the bill alone.

If you haven’t reviewed your policy in over a year, do it this week. Not later. Not “someday.” Print it, highlight what confuses you, and call for clarification. For comprehensive coverage comparisons and expert analysis, Insurance Zenith’s detailed guides on life insurance options and property protection strategies can help you make informed decisions. Because with insurance, what you don’t know absolutely can hurt you.

FAQ

What is the insurance policy?

The parties to an insurance policy enter into a legally binding agreement that specifies the risks and losses that are covered, the circumstances in which coverage is applicable, and the limits of coverage. It details your protection terms and conditions as well as your premiums, deductibles, coverage limits, and exclusions. When and how your insurance will compensate you for losses or damages is defined in the policy.

How much does a $1,000,000 life insurance policy cost per month?

The post doesn’t disclose exact life insurance premiums, but you should know that they might vary greatly according on your age, health, way of life, and policy type (term vs. whole life). In most cases, premiums are lower for younger and healthier people. Depending on certain conditions, the monthly premium for a term life insurance policy with a $1 million face value might vary from $30 to several hundred dollars. To find out your precise premium, it’s advisable to seek estimates from insurance companies.

What is an example of an insurance policy?

Homeowners insurance policies sometimes include coverage for certain “named perils” like wind, fire, and theft. There are some things it won’t cover, though, like flooding, unless you add riders. If a homeowner thinks their policy covers all kinds of water damage, they might be surprised to learn that flood damage isn’t covered unless they purchase additional flood insurance.

How do I get my own insurance policy?

Evaluate your requirements: Make a decision on the kind and amount of insurance that best suits your needs (car, health, house, life, etc.).

Research your options: For the best deals, compare coverage options and acquire quotes from multiple insurance companies. You can also utilize internet tools for this purpose.

Have a thorough look at the policy details: Read the tiny print to be aware of potential protection-affecting information, like as coverage limitations, exclusions, deductibles, and more.

Make a policy purchase: You can purchase health insurance through your workplace, an agent, or even online if you select a plan that meets your needs and price.

Updating your policy is essential: To prevent gaps or unanticipated denials, it is important to evaluate and adjust your coverage on a regular basis as your living circumstances change.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.