What’s the real cost of protecting your home? The average home insurance cost hits $2,401 annually nationwide, but here’s what most homeowners don’t realize — your neighbor might pay three times more for identical coverage. This pricing puzzle affects 85 million American homeowners, and understanding it could save you thousands.

Recent market shifts have fundamentally changed home insurance pricing. Climate disasters caused $165 billion in losses during 2024, pushing insurers to completely recalculate risk assessments. Meanwhile, construction costs jumped 23% since 2020, forcing coverage adjustments that many homeowners haven’t recognized yet.

Critical Cost Facts for 2025:

- National median: $2,401 yearly ($200 monthly)

- Price range: $631 (Hawaii) to $6,210 (Oklahoma)

- Rate increases: 42% cumulative since 2019

- Claim frequency: Up 18% from pre-2020 levels

Smart homeowners who understand these seven cost factors typically save 15-30% annually while maintaining superior protection. Here’s how geography, home characteristics, and personal decisions create your unique premium — plus proven strategies that actually work for reducing costs without sacrificing coverage quality.

On This Page

1. Breaking Down Home Insurance Cost Components

Your premium isn’t arbitrary — it reflects sophisticated risk calculations that most homeowners never see. The average cost of homeowners insurance in the U.S. is about $2,110 a year for $300,000 worth of dwelling coverage, but this baseline shifts dramatically based on specific risk factors.

Understanding these components helps you identify where potential savings exist. Think of your premium as having four main building blocks, each contributing different amounts to your total cost.

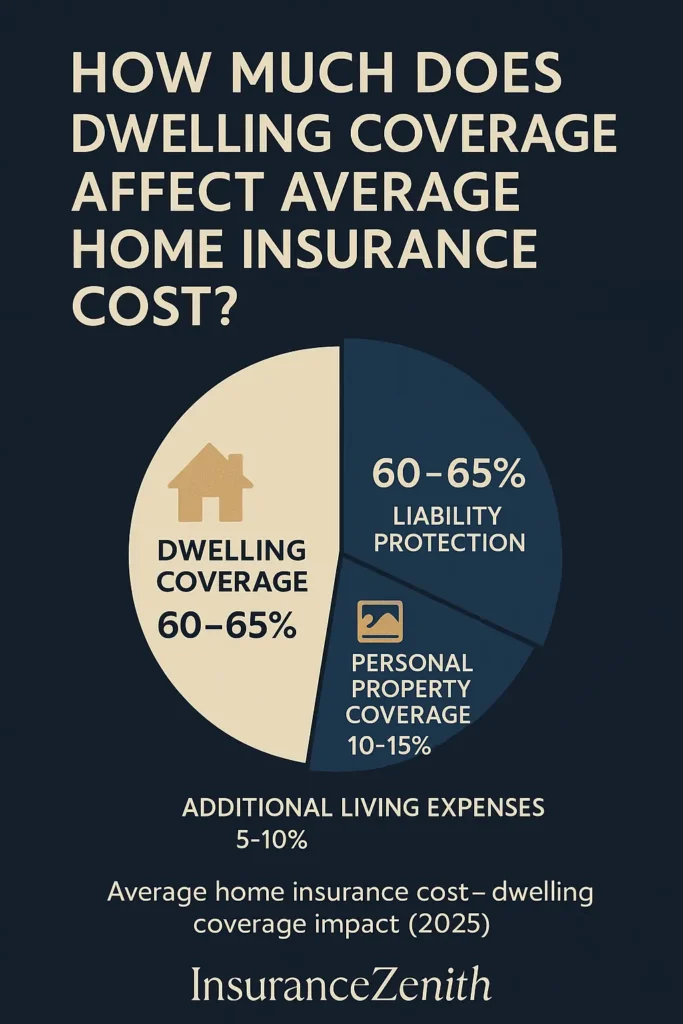

Primary Cost Components:

- Dwelling coverage: 60-65% of total premium

- Liability protection: 15-20% of total premium

- Personal property coverage: 10-15% of total premium

- Additional living expenses: 5-10% of total premium

1.1 Dwelling Coverage Impact on Average Home Insurance Cost

Dwelling coverage dominates your premium because it represents the largest potential payout for insurers. Replacement cost refers to the amount it would cost to rebuild your home with construction materials of similar type and quality. This differs significantly from your home’s market value.

When calculating dwelling coverage needs, consider these replacement cost factors:

- Current construction materials pricing (up 23% since 2020)

- Local labor costs and availability

- Architectural complexity and custom features

- Building code upgrade requirements

Real-World Cost Example: A 2,000-square-foot home in Denver requiring $200 per square foot to rebuild needs $400,000 dwelling coverage. With current market rates, this generates approximately $2,800-$3,200 in annual premiums, depending on additional risk factors.

For homeowners concerned about adequate coverage levels, understanding replacement cost vs actual cash value provides essential guidance for making informed decisions about coverage amounts.

1.2 How Location Drives Premium Calculations

Geographic location influences average home insurance cost more than any other single factor. Consumers living in the 20 percent of ZIP Codes with the highest expected annual losses to buildings from climate-related perils paid $2,321 in premiums on average, 82 percent more than those in the 20 percent lowest climate-risk ZIP Codes.

High-Risk Geographic Factors:

- Hurricane exposure zones (Atlantic and Gulf coasts)

- Wildfire interface areas (California, Colorado, Texas)

- Tornado corridors (Texas, Oklahoma, Kansas)

- Earthquake fault proximity (California, Alaska)

- Flood plain designations

ZIP code risk assessment goes beyond natural disasters. Insurers analyze crime statistics, fire department response times, building costs, and historical claim patterns. A home 50 miles away might face completely different risk calculations.

Distance-Based Risk Factors:

- Fire station proximity (under 5 miles preferred)

- Hydrant accessibility (within 1,000 feet optimal)

- Emergency services response times

- Hospital and trauma center locations

1.3 Personal Property and Liability Considerations

Personal property coverage typically equals 50-70% of your dwelling amount, while liability protection starts at $100,000 but often needs increasing. These components affect your average home insurance cost differently than dwelling coverage.

Most homeowners underestimate personal property values. Quick household inventories reveal $75,000-$150,000 in belongings for typical families. High-value items like jewelry, art, or collectibles require additional coverage through riders or endorsements.

Liability Exposure Assessment:

- Net worth protection needs

- Professional liability risks

- Recreational vehicle ownership

- Pool or trampoline liability

- Pet ownership considerations

Modern liability claims average $43,000, with settlements reaching hundreds of thousands. Adequate liability coverage protects your assets and future earnings from unexpected lawsuits.

For comprehensive protection strategies, our detailed homeowners insurance guide explores coverage optimization techniques that balance cost with protection needs.

2. State-by-State Average Home Insurance Cost Analysis

Regional variations in average home insurance cost create dramatic pricing differences across America. Oklahoma is the most expensive state for home insurance at $5,858 a year, while Hawaii has the lowest home insurance rates, averaging $613 a year. This represents nearly a 10-fold difference for identical coverage.

Most Expensive States (2025 Annual Premiums):

- Oklahoma: $6,210 average

- Nebraska: $5,912 average

- Kansas: $5,412 average

- Louisiana: $4,890 average

- Texas: $4,585 average

Least Expensive States (2025 Annual Premiums):

- Hawaii: $631 average

- Vermont: $950 average

- Delaware: $1,025 average

- Alaska: $1,035 average

- Maine: $1,180 average

2.1 Weather-Related Cost Drivers

Natural disaster frequency directly correlates with average home insurance cost across regions. There were at least 20 billion-dollar natural disasters in the nation last year. The average number of billion-dollar disasters in the last few years has risen to 20.4, while this average was just 8.5 annual events from 1980 to 2023.

2024 Major Disaster Impacts:

- Hurricane damages: $89 billion in insured losses

- Wildfire destruction: $12.8 billion in claims

- Severe convective storms: $34.2 billion total

- Winter storm events: $8.9 billion in damages

Climate change accelerates these trends. Traditional “safe” regions now face unprecedented weather risks, forcing insurers to recalculate long-term risk models. States previously considered low-risk are experiencing significant premium increases.

Emerging Risk Regions:

- Pacific Northwest (wildfire expansion)

- Upper Midwest (severe storm increases)

- Northeast (flooding pattern changes)

- Mountain West (wildfire interface growth)

For homeowners in flood-prone areas, specialized flood insurance coverage provides essential protection that standard policies exclude.

2.2 Construction Cost Regional Variations

Local building costs significantly impact average home insurance cost calculations. Metropolitan areas with high construction costs generate higher premiums because rebuilding expenses increase proportionally.

Highest Construction Cost Markets (per sq ft):

- San Francisco Bay Area: $350-$450

- New York Metro: $300-$400

- Los Angeles Basin: $275-$375

- Seattle Region: $250-$325

- Boston Area: $225-$300

Construction Cost Factors:

- Local labor rates and availability

- Material transportation expenses

- Building code requirements

- Permit and inspection fees

- Environmental regulations

Rural areas often face higher per-square-foot costs despite lower labor rates because of material transportation and limited contractor availability. This paradox affects average home insurance cost calculations in unexpected ways.

2.3 Regulatory Environment Impact

State insurance regulations influence pricing structures and available options. Some states limit rate increases or require specific coverage elements, affecting overall market dynamics.

Regulatory Variations by State:

- Credit score usage: Prohibited in California, Hawaii, Maryland, Massachusetts

- Rate filing requirements: Prior approval vs. file-and-use systems

- Coverage mandates: Specific perils or coverage amounts

- Deductible limitations: Minimum and maximum allowable amounts

For residents of high-cost states seeking savings opportunities, strategies for reducing home insurance costs offer practical approaches that work within regulatory frameworks.

3. Critical Factors That Determine Your Average Home Insurance Cost

Multiple interconnected factors create your unique premium calculation. While location provides the foundation, specific home characteristics and personal factors fine-tune your final cost.

3.1 Home Age and Construction Materials

Home age significantly influences average home insurance cost because older properties face higher risk profiles. A house built in 2023 with $250,000 in dwelling coverage averages $1,319 per year, while the same policy for a home built in 2000 costs about $2,614.

Age-Based Risk Factors:

- Electrical system outdating (pre-1980s wiring)

- Plumbing deterioration (galvanized pipes)

- Roofing material degradation

- Foundation settling issues

- HVAC system efficiency loss

Construction materials create substantial premium differences. Fire-resistant materials reduce risk exposure, while certain materials increase vulnerability to specific perils.

Material Risk Assessment:

- Roof type: Asphalt shingle vs. wood shake vs. metal

- Siding materials: Vinyl vs. wood vs. brick vs. stucco

- Foundation type: Slab vs. basement vs. crawl space

- Window quality: Single-pane vs. impact-resistant

Construction Quality Indicators: Modern building techniques often reduce insurance costs through improved safety standards. Homes built after 2000 typically incorporate better electrical systems, plumbing, and structural engineering that insurers recognize with lower premiums.

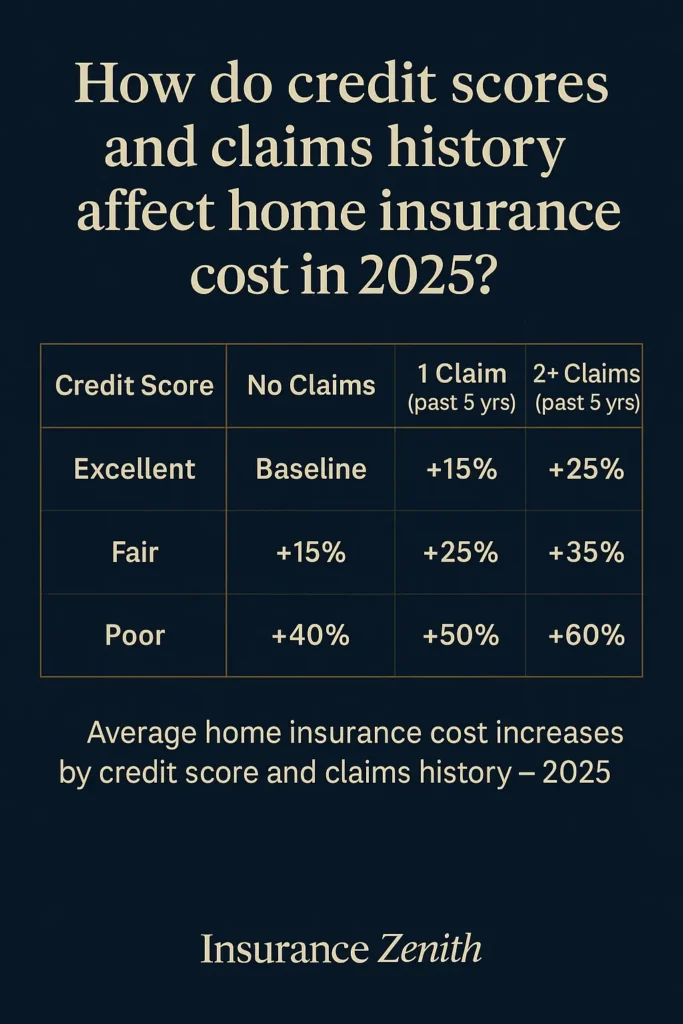

3.2 Credit Score and Claims History Impact

Credit scores dramatically affect average home insurance cost in most states. Homeowners with excellent credit may pay around $5,000 less per year than those with poor credit. This correlation reflects statistical relationships between credit management and claim frequency.

Credit Score Premium Impact:

- Excellent (750+): 25-35% below average rates

- Good (700-749): 10-20% below average rates

- Fair (650-699): Average market rates

- Poor (below 650): 15-40% above average rates

Claims history creates long-lasting premium effects. Filing multiple claims within five years can increase rates by 25-50%, while maintaining claim-free status often qualifies for substantial discounts.

Claims Impact Timeline:

- Years 1-2 after claim: Maximum rate increase

- Years 3-4 after claim: Gradual rate reduction

- Year 5+ after claim: Return to standard rates

- 10+ years claim-free: Maximum discount eligibility

Strategic claims management involves weighing repair costs against potential premium increases. Small claims under $3,000-$5,000 often cost more in increased premiums than paying out-of-pocket.

3.3 Safety Features and Risk Mitigation

Home safety improvements directly reduce average home insurance cost through demonstrated risk reduction. Insurers offer measurable discounts for specific safety installations and security systems.

Discount-Eligible Safety Features:

- Monitored security systems: 5-20% discount

- Fire sprinkler systems: 5-15% discount

- Impact-resistant roofing: 10-30% discount

- Central monitoring systems: 5-10% discount

- Deadbolt locks and window locks: 2-5% discount

Advanced Safety Technology: Smart home technology increasingly influences insurance pricing. Water leak detectors, smoke alarm monitoring, and security cameras provide real-time risk mitigation that insurers value.

Recent innovations like whole-home generators and backup power systems reduce claim severity during weather events, earning additional premium reductions in many markets.

For homeowners interested in comprehensive cost reduction strategies, our practical guide to reducing home insurance costs details specific improvements that generate measurable savings.

4. Calculating and Managing Your Home Insurance Costs

Accurate cost estimation requires understanding how insurers assess your specific situation. While online calculators provide rough estimates, knowing the underlying methodology helps you make informed decisions about coverage levels and cost management.

4.1 Replacement Cost Calculation Methods

Determining accurate replacement costs forms the foundation of appropriate coverage amounts. Multiplying the home’s square footage by the cost to rebuild is a quick way to determine replacement cost, which is the dwelling coverage for your home. For example, let’s assume your home is 2,000 square feet and the average cost to build per square foot is $150. So, 2,000 X $150 = $300,000 dwelling coverage.

Detailed Replacement Cost Factors:

- Base construction cost per square foot

- Architectural complexity multipliers

- Custom feature additions

- Site preparation requirements

- Building code upgrade allowances

Professional Assessment Methods: Many insurers now use sophisticated modeling software that analyzes satellite imagery, local permit data, and construction cost databases. These tools provide more accurate estimates than simple square footage calculations.

Market Cost Variations by Region:

- Urban centers: $180-$350 per square foot

- Suburban areas: $120-$220 per square foot

- Rural locations: $100-$180 per square foot

- Remote areas: $150-$250 per square foot (transportation costs)

4.2 Coverage Level Optimization Strategies

Balancing adequate protection with manageable costs requires strategic coverage selection. Having a small buffer prevents overinsuring while giving you peace of mind that your home’s repair costs will be covered.

Coverage Optimization Framework:

- Calculate minimum replacement cost

- Add 10-20% buffer for cost fluctuations

- Evaluate personal property coverage needs

- Assess liability exposure requirements

- Consider additional coverage riders

Deductible Strategy Impact: Higher deductibles significantly reduce premiums while maintaining full catastrophic protection. The optimal deductible balances savings with affordable out-of-pocket exposure.

Deductible Options and Savings:

- $500 deductible: Baseline premium

- $1,000 deductible: 5-10% premium reduction

- $2,500 deductible: 15-25% premium reduction

- $5,000 deductible: 25-40% premium reduction

Consider your emergency fund capacity when selecting deductibles. Higher deductibles only make financial sense if you can comfortably afford the out-of-pocket expense during a claim.

4.3 Shopping and Comparison Best Practices

Effective comparison shopping for average home insurance cost requires systematic evaluation of multiple factors beyond premium prices. Perhaps the best way to estimate your homeowners insurance cost is to compare home insurance quotes from multiple carriers (making sure to request the same or similar coverage levels across the board to get a true price comparison).

Comparison Shopping Checklist:

- Identical dwelling coverage amounts

- Same deductible levels across quotes

- Comparable liability limits

- Similar additional coverage options

- Consistent discount applications

Timing Considerations: Insurance rates fluctuate throughout the year based on market conditions and company performance. Shopping 30-45 days before renewal provides optimal timing for securing competitive rates.

Red Flags During Shopping:

- Quotes significantly below market averages

- Pressure for immediate decisions

- Reluctance to provide written estimates

- Unclear coverage explanations

- Limited financial strength ratings

For comprehensive market analysis and carrier comparisons, finding the cheapest home insurance options provides detailed evaluation criteria and selection strategies.

5. Cost-Saving Strategies That Actually Work

Reducing average home insurance cost without compromising protection requires strategic approaches that insurers genuinely value. These proven methods generate substantial savings while maintaining comprehensive coverage.

5.1 Bundling and Multi-Policy Discounts

Insurance bundling remains one of the most reliable cost reduction strategies. Many insurers, including major providers, offer discounts for customers who combine their policies, leading to significant savings. Typical bundling discounts range from 5-25% on home insurance premiums.

Effective Bundling Combinations:

- Home + Auto: 10-20% average discount

- Home + Auto + Umbrella: 15-25% average discount

- Home + Life Insurance: 5-15% average discount

- Multi-property coverage: 10-20% average discount

Bundling Evaluation Framework: Calculate total insurance costs across all policies, not just individual discounts. Sometimes separate policies from different carriers cost less than bundled coverage, despite discounts.

When Bundling Makes Sense:

- Similar service quality across policy types

- Competitive base rates before discounts

- Simplified claims management preferences

- Loyalty program value additions

5.2 Home Improvement ROI for Insurance Savings

Strategic home improvements generate both property value increases and insurance premium reductions. Installing fire alarms, burglar alarms, and other protective measures makes your home safer and makes you eligible for discounts.

High-ROI Insurance Improvements:

- Impact-resistant roofing: 10-30% premium reduction

- Central security monitoring: 5-20% premium reduction

- Whole-house generators: 5-15% premium reduction

- Updated electrical systems: 10-25% premium reduction

- Plumbing system upgrades: 5-15% premium reduction

Improvement Cost-Benefit Analysis: Calculate annual premium savings against improvement costs to determine payback periods. Improvements with 5-7 year payback periods often provide excellent long-term value.

Documentation Requirements: Maintain detailed records of improvements, including permits, inspections, and contractor certifications. Insurers require proof of upgrades before applying discounts.

5.3 Claims Management and Prevention

Smart claims management significantly impacts long-term average home insurance cost. One of the biggest factors that can impact your home insurance premiums is your claims history. Once you file a claim, your insurance company deems you as more of a risk and more expensive to continue insuring.

Strategic Claims Decision Framework:

- Calculate total repair costs

- Compare against deductible amount

- Estimate premium increase duration (3-5 years)

- Consider claim-free discount loss

- Evaluate financial capacity for self-funding

Claim-Free Incentive Programs: Many insurers offer substantial discounts for extended claim-free periods. These programs reward risk management with progressively larger discounts over time.

Prevention Investment Priorities:

- Regular roof and gutter maintenance

- HVAC system professional servicing

- Plumbing system inspections

- Electrical system updates

- Landscaping for fire/wind protection

Professional maintenance costs far less than claim-related premium increases. Preventive approaches protect both your property and your insurance costs.

For homeowners dealing with claim denials, understanding home insurance claim processes provides essential guidance for protecting your interests during disputes.

6. Future Trends Affecting Home Insurance Costs

Understanding emerging trends in average home insurance cost helps homeowners prepare for future market changes and make informed long-term decisions about coverage and risk management.

6.1 Climate Change and Catastrophic Risk Evolution

Climate-related perils increasingly drive insurance market changes. Average homeowners insurance premiums per policy increased 8.7 percent faster than the rate of inflation in 2018-2022, according to the data analyzed. This trend accelerates as extreme weather events become more frequent and severe.

Emerging Risk Patterns:

- Traditional “safe” zones experiencing new weather risks

- Increased frequency of billion-dollar weather events

- Extended wildfire seasons in western states

- More intense hurricane activity in coastal regions

- Flooding risks expanding beyond traditional flood zones

Market Response Strategies: Insurers are implementing dynamic pricing models that adjust rates based on real-time risk assessments. These models consider satellite weather data, fire danger indices, and seasonal risk variations.

Long-term Cost Projections: Industry analysts project continued above-inflation increases in average home insurance cost, particularly in high-risk regions. Some coastal and wildfire-prone areas may face annual increases of 10-20% for the next 5-10 years.

6.2 Technology Integration and Smart Home Discounts

Advanced technology increasingly influences average home insurance cost through improved risk monitoring and prevention capabilities. Smart home devices provide real-time data that helps prevent claims and reduce loss severity.

Emerging Technology Discounts:

- IoT water leak detection systems: 5-15% potential savings

- Smart smoke and carbon monoxide detectors: 3-10% discounts

- Advanced security systems with AI monitoring: 10-25% reductions

- Weather monitoring and alert systems: 5-12% savings

- Automatic utility shutoffs: 8-20% potential discounts

Data Privacy Considerations: Technology-based discounts often require sharing usage data with insurers. Understanding privacy policies and data usage agreements becomes essential for informed decision-making.

Installation and Maintenance Requirements: Technology discounts typically require professional installation and regular system monitoring. Factor ongoing costs against premium savings when evaluating these options.

6.3 Regulatory Changes and Market Dynamics

State insurance regulations continue evolving in response to market pressures and consumer protection needs. These changes directly affect average home insurance cost and coverage availability.

Current Regulatory Trends:

- Increased oversight of rate increase requests

- Expanded coverage mandates for specific perils

- Consumer protection enhancement requirements

- Climate risk disclosure obligations

- Technology integration standards

Market Availability Concerns: Some insurers are reducing exposure or withdrawing from high-risk markets entirely. For example, in 2023, AAA announced it would no longer be renewing policies with home, auto and umbrella bundles in Florida, claiming the growing risk of natural disasters is proving too costly for insurance companies to operate.

Consumer Impact of Market Changes: Limited carrier competition in high-risk areas often results in higher premiums and reduced coverage options. State-sponsored insurance programs may become necessary alternatives for some homeowners.

Planning for these market changes involves diversifying risk through home improvements, maintaining excellent credit, and building emergency funds to handle potential coverage gaps or significant premium increases.

Conclusion: Mastering Your Home Insurance Costs

Understanding average home insurance cost requires analyzing multiple interconnected factors that create your unique premium calculation. The national average of $2,401 annually provides a baseline, but your actual costs depend on geographic location, home characteristics, personal risk factors, and coverage decisions.

Essential Cost Management Strategies:

- Compare quotes from multiple carriers every 2-3 years using identical coverage specifications

- Invest in safety improvements that generate measurable premium discounts

- Maintain excellent credit scores in states where they affect pricing

- Choose deductibles that balance savings with financial capacity

- Bundle policies when it provides genuine value across all coverage types

Long-term Planning Considerations: Climate change and market evolution will continue driving above-inflation increases in average home insurance cost. Proactive risk management through home improvements, technology adoption, and financial planning helps maintain affordable coverage while protecting your investment.

The most costly mistake isn’t paying slightly more for insurance — it’s inadequate coverage when disaster strikes. Focus on finding optimal protection levels that safeguard your financial security while managing costs through proven strategies rather than simply seeking the lowest premium.

Remember that your home represents your largest investment and your family’s primary shelter. Quality coverage from financially stable insurers provides peace of mind that justifies reasonable costs. Smart homeowners balance comprehensive protection with strategic cost management to achieve both security and affordability.

For additional insights into specialized coverage needs and cost optimization strategies, our comprehensive homeowners insurance guide explores advanced topics that help maximize your coverage value while minimizing unnecessary expenses.

Sources & References:

- U.S. Department of the Treasury Federal Insurance Office – Homeowners Insurance Market Analysis (2025)

- NerdWallet National Home Insurance Cost Analysis (2025)

- Bankrate Home Insurance Rate Survey (August 2025)

- Insurance.com State-by-State Rate Comparison (2025)

- LendingTree State of Home Insurance Report (2025)

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.