American homeowners face a harsh reality in 2025: insurance premiums are projected to rise 8% this year to a national average of $3,520, following a brutal 20% increase over the past two years. You’re probably feeling the squeeze in your monthly budget as homeowners insurance costs continue climbing faster than inflation.

But here’s what insurance companies don’t want you to know: there are legitimate ways to slash your premiums without cutting essential protection. Smart homeowners discovered strategies that saved them hundreds—sometimes thousands—annually while maintaining comprehensive coverage.

Immediate Money-Saving Actions:

- Policy bundling: Save 10-25% instantly

- Smart deductible increases: Cut premiums 15-30%

- Security system installations: Reduce costs 5-20%

- Annual rate shopping: Uncover savings up to 40%

The insurance industry profits when customers overpay for coverage they don’t understand. This guide reveals 12 proven methods that work regardless of your current premium level or carrier. You’ll discover overlooked discounts, negotiation tactics that actually work, and timing strategies that maximize savings.

Whether you’re drowning in rising premiums or simply want to optimize your coverage costs, these techniques deliver measurable results that compound over time.

On This Page

1. How to Reduce Home Insurance Costs Through Multi-Policy Bundling

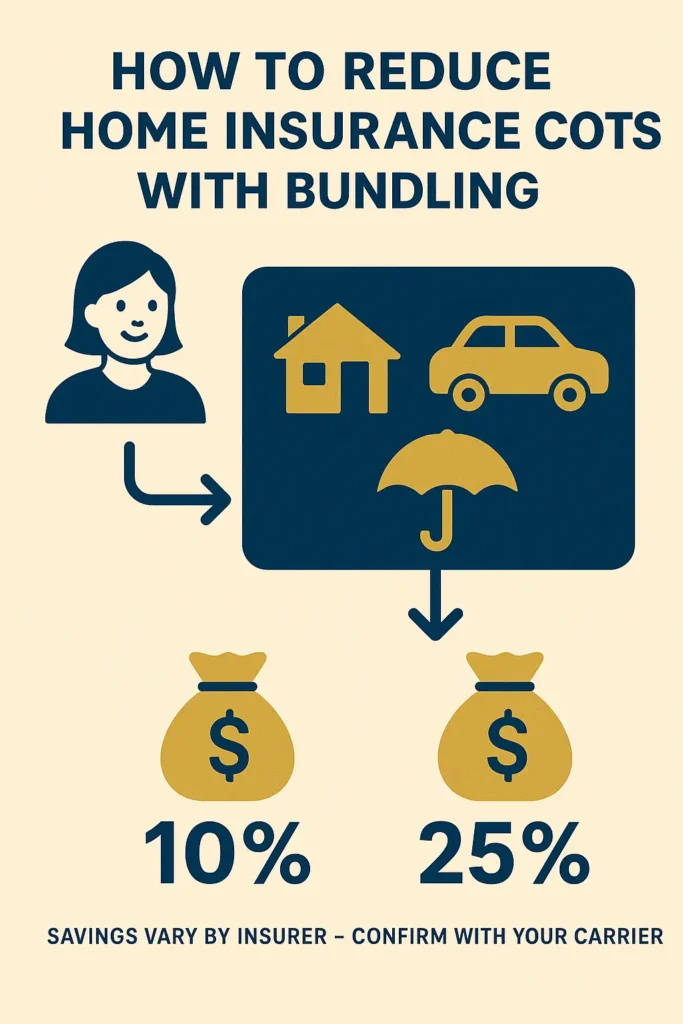

Insurance carriers reward customers who consolidate multiple policies under one roof, and understanding how to leverage this effectively represents your fastest path to substantial savings. The math works in your favor: companies prefer managing comprehensive customer relationships over competing for individual policies.

Bundle Savings Reality Check:

- Home + Auto: 10-25% off both policies

- Triple bundle (Home/Auto/Life): Up to 35% total reduction

- Home + Umbrella: Additional 8-15% savings

- Student coverage add-on: Extra 5-12% discount

1.1 Strategic Auto and Home Insurance Combinations

Pairing your property and vehicle coverage with a single insurer typically delivers your largest immediate cost reduction. Depending on your home insurance company, you could save as much as 25 percent for insuring your home and car with the same company.

Beyond financial benefits, bundling simplifies your life with unified billing, coordinated coverage limits, and streamlined claims when disasters affect multiple policies. When exploring car insurance options, always calculate bundle scenarios versus separate policies.

Smart bundling requires mathematical analysis. Some carriers excel at auto coverage but charge premium rates for home protection, making separate policies more economical despite missing bundle discounts.

1.2 Life Insurance and Umbrella Policy Additions for Compound Savings

Expanding beyond basic home and auto creates additional discount tiers that stack for maximum impact. Many insurers offer progressive discounts that increase with each policy addition, rewarding comprehensive customer relationships.

Umbrella policies provide exceptional bundle value, typically costing $200-400 annually for $1 million liability protection while triggering substantial discounts on underlying policies. This coverage becomes particularly valuable for homeowners with significant assets.

When investigating flood insurance for homeowners, consider how specialized coverage integrates with existing bundles to maximize overall savings.

1.3 Mathematical Bundle Analysis vs Individual Policy Shopping

Effective bundling demands careful comparison of total bundled costs against best-available individual rates. Surface-level comparisons often disguise minimal actual savings when examined closely.

Research standalone policy rates from multiple carriers before committing to bundle arrangements. Convenience might justify small premiums, but ensure you’re not overpaying hundreds annually for that simplicity.

Consider seasonal shopping strategies that capitalize on new customer promotions and competitive rate cycles when evaluating cheapest home insurance options.

2. Reduce Home Insurance Costs with Strategic Deductible Optimization

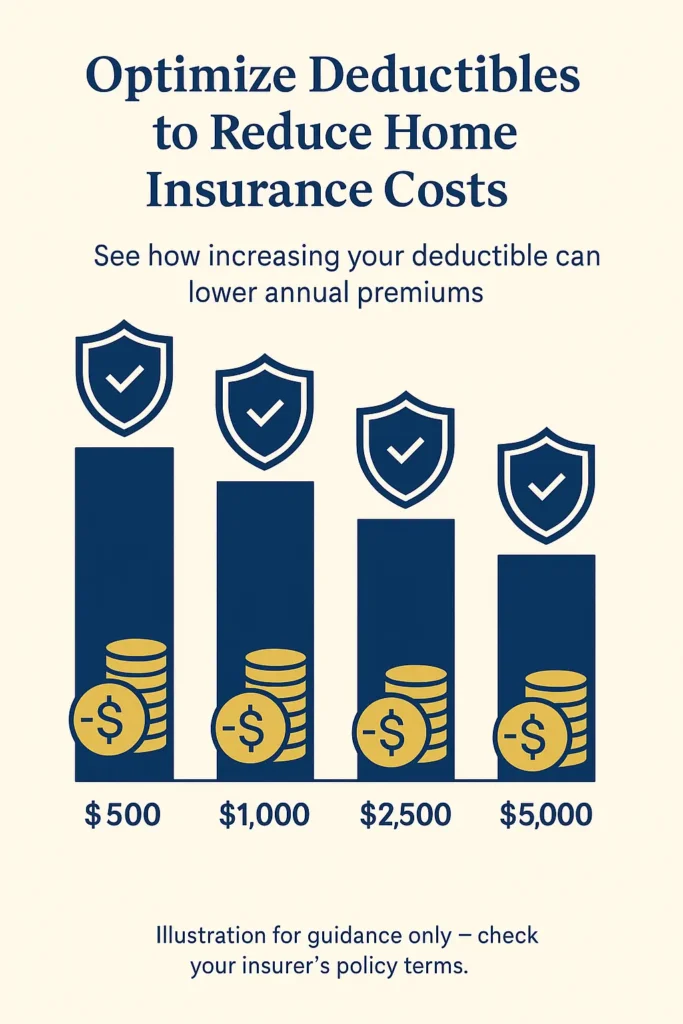

Understanding the mathematical relationship between deductibles and premiums allows homeowners to optimize their risk-reward balance effectively. This strategy requires careful planning but delivers consistent long-term savings for financially prepared households.

2.1 How Deductible Changes Impact Home Insurance Costs

Generally speaking, as your deductible amount increases, your premiums decrease. Moving from $500 to $1,000 typically reduces annual premiums by 12-18%, while jumping to $2,500 can slash costs by 20-30%.

Deductible Savings Breakdown:

- $500 → $1,000: Save $180-350 annually

- $1,000 → $2,500: Save $250-450 annually

- $2,500 → $5,000: Save $350-650 annually

Calculate your break-even point by dividing additional deductible cost by annual premium savings. Most homeowners reach break-even within 18-36 months, making higher deductibles mathematically advantageous.

When comparing average home insurance cost across providers, factor deductible impacts into your analysis for accurate comparisons.

2.2 Financial Preparedness Requirements for Deductible Increases

Before raising deductibles, establish adequate emergency reserves to handle potential out-of-pocket expenses without creating financial hardship. Financial planners recommend maintaining deductible amounts plus 25% buffer in easily accessible accounts.

High-yield savings accounts or money market funds provide ideal storage for deductible reserves, earning interest while remaining immediately available. Some families maintain dedicated “insurance deductible” funds separate from general emergency savings.

Consider your household’s financial stability and income predictability when selecting deductible levels. Conservative approaches work best for families with variable income or limited savings.

2.3 Claims Frequency Analysis and Deductible Strategy

Analyze your personal claims history over 5-10 years to determine optimal deductible levels. Property owners who rarely file claims (average frequency is once every 8-10 years) benefit most from higher deductibles.

Homeowners with frequent small claims should focus on prevention strategies rather than deductible optimization. Consider investing in maintenance upgrades that address root causes of recurring issues.

Regional risk factors influence deductible effectiveness. Areas prone to frequent severe weather might justify moderate deductibles despite higher premiums, while stable climates allow aggressive optimization.

3. How Security Systems Help Reduce Home Insurance Costs

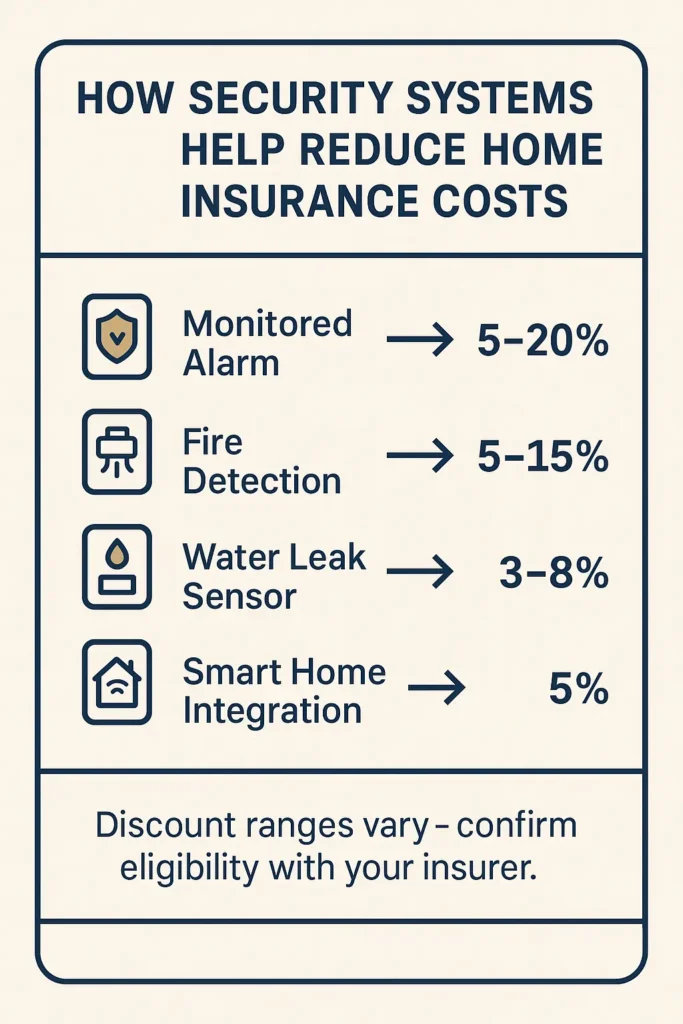

Modern security technology offers dual benefits: enhanced protection and significant insurance savings. Many insurance companies now offer homeowners and renters discounts on their monthly premiums when they use smart home devices. Understanding which features deliver highest premium discounts helps prioritize investments.

Security Discount Schedule:

- Basic monitored alarm: 8-15% premium reduction

- Smart security ecosystem: 10-20% savings potential

- Professional fire monitoring: 5-12% additional discount

- Water leak detection: 3-8% emerging savings

3.1 Professional Monitoring Systems and Maximum Discount Qualification

Insurance companies offer highest discounts for professionally monitored systems because they ensure rapid emergency response and reduce loss severity. If you’ve got a smart home device or home security system, you can qualify for savings on your policy.

Smart security platforms integrating cameras, sensors, and mobile alerts qualify for enhanced discounts as insurers recognize their effectiveness in preventing losses. Document all installed components and monitoring features when requesting rate quotes.

Consider total cost of ownership including equipment, installation, and monthly monitoring fees when evaluating security investments. Premium savings often offset ongoing costs while providing valuable protection.

3.2 How Fire Detection Systems Reduce Home Insurance Costs

Interconnected smoke detection systems with professional monitoring can reduce premiums by 5-12% while providing life-saving early warning capabilities. Advanced systems that differentiate between smoke types earn higher discounts.

Fire sprinkler systems deliver substantial premium reductions (8-15%) but require significant upfront investment. Calculate payback periods carefully, as residential sprinkler installation typically costs $3,000-8,000 for existing homes.

Smart fire detection technology that automatically alerts monitoring services represents cutting-edge protection that increasingly influences insurance pricing decisions.

3.3 Smart Home Technology Integration and Emerging Discounts

American Family Insurance offers up to a 5% discount on homeowners insurance on homes with smart home devices. Qualifying devices include those that detect water, improve your energy efficiency and increase your home’s overall safety like a smart home security system.

Water leak sensors, smart thermostats, and automated lighting systems qualify for insurance discounts as data demonstrates their effectiveness in preventing common claim types. These devices provide early warning systems that minimize damage severity.

Insurance companies develop partnerships with smart home technology providers to offer device discounts and installation incentives. Research these programs when exploring what affects your specific situation.

4. Claims History Management to Reduce Home Insurance Costs

Your claims history profoundly impacts premium calculations, with insurers viewing frequent claimants as elevated risks requiring higher rates. Going claim-free for a set time, such as five years, can result in savings of up to 15%. Strategic claims management builds preferred customer status over time.

4.1 Claims-Free Discount Progression and Accumulation Strategies

Most insurers implement tiered claims-free discounts that increase annually, typically beginning at 5% after one claim-free year and growing to 15-25% after five consecutive years. You might be eligible for a discount if you haven’t filed a claim in a number of years, typically within the past three to five years.

Claims-Free Discount Timeline:

- Year 1: 5-8% discount eligibility

- Year 3: 10-15% discount achievement

- Year 5: 15-25% maximum discount

- Year 10+: Elite customer pricing tiers

Avoid filing claims for amounts less than your deductible plus 30% to preserve claims-free status. For example, with a $1,000 deductible, consider paying privately for damages under $1,300.

4.2 Strategic Claim Filing Decision Framework

Evaluate potential claims by considering immediate repair costs against long-term premium increases. Small incidents like minor water damage, cosmetic issues, or theft under $2,000 often cost less to handle privately.

Major catastrophic losses including fire damage, significant storm damage, or substantial theft should always trigger claims regardless of rate impact concerns. Insurance exists primarily to protect against financial catastrophes.

Consider consulting specialists for water-related incidents, as some damages might be covered under separate flood policies rather than standard homeowners coverage.

4.3 Claim Impact Duration and Rate Recovery

Most claims affect premium rates for 3-5 years, with impact severity diminishing annually until complete removal from rate calculations. Initial rate increases of 15-30% gradually decrease each year before returning to base rates.

Multiple claims within short timeframes create compounding rate penalties and may trigger non-renewal notices. Understanding these timelines helps homeowners make informed decisions about claim filing timing.

Some insurers offer claim forgiveness programs for long-term customers or first-time claimants. Research these options when evaluating insurance companies for your overall cost reduction strategy.

5. How to Reduce Home Insurance Costs Through Annual Rate Shopping

The insurance marketplace continuously evolves with companies adjusting rates, introducing new discounts, and modifying underwriting criteria. Average homeowners insurance premiums per policy increased 8.7 percent faster than the rate of inflation in 2018-2022, making regular shopping essential for cost control.

5.1 How to Reduce Home Insurance Costs Through Effective Rate Comparison

Begin shopping 45-60 days before renewal to allow adequate time for thorough comparison and smooth transition. Request quotes from minimum 4-6 companies including national carriers, regional specialists, and mutual insurance companies.

Provide identical coverage specifications to all insurers for accurate comparisons. Minor coverage differences create misleading rate variations that don’t reflect true value propositions between competing options.

Utilize independent insurance agents who represent multiple companies to streamline comparison processes. These professionals often identify discounts and coverage combinations missed in direct-to-consumer shopping.

5.2 Market Cycle Understanding and Rate Fluctuation Patterns

Insurance rates fluctuate based on catastrophic loss experience, regulatory changes, investment performance, and competitive dynamics. Some states are looking at a 27% spike this year, with Louisiana expecting the largest increases.

Regional insurers sometimes provide significantly lower rates than national companies, particularly in areas with lower disaster frequency. Don’t overlook smaller carriers with strong financial ratings when conducting comprehensive comparisons.

New customer acquisition campaigns provide substantial first-year savings for policy switchers. Time your shopping to coincide with promotional periods while ensuring long-term rate competitiveness.

5.3 Optimization Timing for Maximum Savings Opportunities

Schedule major home improvements, security installations, or protective upgrades before beginning rate shopping. These enhancements qualify for additional discounts that influence carrier selection decisions.

Consider renewal timing in relation to seasonal weather patterns and regional risk cycles. Some companies adjust pricing based on recent catastrophic events that temporarily elevate rates.

Maintain continuous coverage throughout shopping processes to avoid coverage gaps that impact future rates or eligibility. Coordinate timing carefully when switching carriers to ensure seamless protection.

6. Home Improvements That Reduce Insurance Costs Long-Term

Strategic home improvements can significantly reduce insurance premiums while enhancing property value and safety. Understanding which upgrades deliver highest insurance savings helps prioritize renovation investments for maximum financial return.

6.1 How Roof Upgrades Reduce Home Insurance Costs

Modern roofing materials like impact-resistant shingles, metal roofing, or tile installations can reduce premiums by 5-35% depending on location and storm risk. These upgrades demonstrate proactive risk management that insurers reward through lower rates.

Roof Upgrade Discount Potential:

- Impact-resistant shingles: 10-20% discount

- Metal or tile roofing: 15-35% reduction

- Storm shutters: 5-15% savings

- Reinforced garage doors: 3-8% discount

Foundation improvements, structural reinforcements, and seismic retrofitting qualify for substantial discounts in appropriate geographic areas. Document all improvements with professional certifications to ensure maximum insurance credit.

When planning major renovations, consult with insurance professionals about potential premium impacts before beginning work. Some improvements trigger rate reductions that justify higher renovation budgets.

6.2 Plumbing and Electrical System Modernization Benefits

Updating plumbing systems with modern materials and leak detection technology reduces water damage risks and qualifies for insurance discounts. Copper or PEX piping replacements often eliminate surcharges applied to homes with older galvanized or polybutylene systems.

Electrical system upgrades including circuit breaker replacements, GFCI installations, and whole-house surge protection demonstrate reduced fire risks that insurers value. Some companies require electrical updates for coverage eligibility in older homes.

Smart home integration during renovation projects qualifies for emerging technology discounts. Water shut-off systems, electrical monitoring, and automated climate controls increasingly influence insurance pricing.

6.3 Energy Efficiency and Risk Reduction Combinations

Energy-efficient improvements like new windows, insulation upgrades, and HVAC modernization often qualify for insurance discounts while reducing utility costs. These improvements demonstrate overall property maintenance and risk reduction.

Consider cumulative impact of multiple simultaneous improvements when planning renovation projects. Comprehensive upgrades often qualify for enhanced discount programs that exceed individual improvement savings.

Research state and local incentive programs that might subsidize improvements while generating insurance savings. Some areas offer tax credits or rebates that improve financial return on risk-reduction investments.

7. Credit Score Optimization for Lower Premiums

Your credit score significantly impacts homeowners insurance premiums because it’s an indication of risk. A poor credit history may lead an insurance company to believe that you’re more likely to file a claim. An excellent credit score can save you hundreds of dollars per year on premiums.

7.1 How Credit Scores Affect Home Insurance Costs

Insurance companies use credit-based insurance scores, which differ from traditional credit scores but rely on similar data. Studies show people with poor credit are more likely to file claims, so most states allow insurers to factor credit into pricing.

California, Hawaii, Maryland, and Massachusetts prohibit companies from using credit history in customer premiums. Other states limit how credit can be used, making geographic location crucial for credit impact analysis.

Monitor your credit report regularly and dispute inaccuracies that could affect insurance scoring. Small improvements in credit can translate to meaningful premium savings over time.

7.2 Credit Improvement Strategies for Insurance Savings

Pay bills on time consistently, as payment history represents the largest factor in credit scoring. Set up automatic payments for insurance premiums and other recurring bills to maintain perfect payment records.

Reduce credit utilization below 30% across all accounts, with optimal utilization under 10%. This demonstrates financial responsibility that translates to lower insurance risk assessment.

Avoid closing old credit accounts unnecessarily, as length of credit history contributes to scoring. Keep older accounts active with small, regular purchases to maintain positive credit history.

7.3 Timeline for Credit Score Impact on Insurance Rates

Credit improvements typically take 30-90 days to reflect in credit reports and insurance scoring models. Plan credit optimization strategies well before insurance renewal periods to capture maximum savings.

Significant credit improvements might justify early policy changes or carrier shopping to capitalize on better rates immediately rather than waiting for renewal periods.

Document credit improvements when communicating with insurance agents, as some companies offer mid-term adjustments for customers who demonstrate improved creditworthiness.

8. Loyalty Programs and Long-Term Customer Benefits

Home insurance companies regularly reward long-term customers with loyalty discounts. As policyholders remain in good standing and claims-free, most insurers reduce premium costs annually. Understanding how to maximize these benefits while avoiding loyalty traps becomes crucial.

8.1 Loyalty Discount Progression and Optimization

Staying with the same insurer for years can earn discounts around 5% after three to five years and 10% if you remain a customer for six or more years. State Farm offers discounts up to 24% to customers who are claim-free and have been with the company for at least nine years.

Loyalty Discount Structure:

- Years 1-2: No loyalty discount typically

- Years 3-5: 5-8% discount eligibility

- Years 6-9: 8-12% discount progression

- Years 10+: Maximum loyalty benefits up to 24%

Track your loyalty discount progression and ensure it’s properly applied to your policy. If you’re not sure whether the discount is being applied, ask your insurance agent for clarification.

8.2 How to Reduce Home Insurance Costs While Maximizing Loyalty Benefits

Loyalty discounts provide excellent reasons to stay with your insurance company, but that doesn’t mean you shouldn’t shop around. Getting quotes from other insurers every few years remains essential for cost optimization.

Your insurer’s loyalty discount might pale compared to another insurer’s new customer discount and competitive rates. Calculate total costs including loyalty benefits versus new customer offers when evaluating switches.

Some carriers offer “win-back” pricing for former customers who return after brief departures, effectively resetting loyalty timelines while providing competitive rates.

8.3 Strategic Loyalty Management for Maximum Savings

Consider timing major claims in relation to loyalty discount progression. Filing claims just before qualifying for higher loyalty tiers can impact long-term savings calculations.

Negotiate with existing carriers using competitive quotes while highlighting your loyalty status and claims-free history. Many companies offer retention pricing to prevent customer defection.

Research whether your current carrier offers loyalty benefits beyond premium discounts, such as enhanced coverage options, reduced deductibles, or priority claims handling.

9. Geographic and Location-Based Strategies

Your location significantly impacts insurance costs, but understanding geographic factors helps optimize coverage and costs within your area. Homeowners in communities affected by substantial weather events are paying far more than those elsewhere, with high-risk ZIP codes paying 82% more than low-risk areas.

9.1 Understanding Regional Risk Factors and Pricing

Geographic location typically impacts insurance rates because every area has different risk levels for damage. Oklahoma City has the highest average annual premium at $5,431, while Portland, Oregon’s average is lowest at $1,032 among major cities.

Research your area’s specific risk profile including wildfire zones, flood plains, hurricane corridors, and earthquake fault lines. Understanding these factors helps you make informed decisions about coverage levels and deductibles.

Consider how climate change affects your region’s long-term risk profile when making housing and insurance decisions. Areas experiencing increasing disaster frequency may see continued rate increases.

9.2 Microlocation Factors Within Your Area

Distance to fire stations, hydrants, and emergency services affects insurance pricing. Homes within 500-1,000 feet of fire hydrants often qualify for discounts, while rural properties face surcharges for extended response times.

Neighborhood characteristics including crime rates, building density, and construction quality influence pricing. Gated communities or neighborhoods with low crime rates typically qualify for reduced premiums.

Elevation and proximity to bodies of water affect flood and storm damage risks. Understanding your property’s specific risk factors helps optimize coverage and identify potential discounts.

9.3 Leveraging Location Benefits for Cost Reduction

Document positive location factors when requesting quotes, including proximity to fire protection, low crime statistics, and disaster-resistant features of your area.

Consider how home improvements interact with location-specific risks. Wind-resistant upgrades provide greater value in hurricane zones, while fire-resistant materials matter more in wildfire areas.

Research local and state insurance requirements and incentive programs that might provide additional savings opportunities based on your geographic location.

10. Professional and Group Affiliation Discounts

Many insurance companies extend savings to specific professional groups, military members, educators, and organization affiliates. These discounts often go unnoticed but can provide meaningful savings for eligible customers.

10.1 Professional and Occupational Discounts

Special savings opportunities are often available for members of the military community. Other professionals can sometimes save too — certain companies offer savings to teachers, government employees and more.

Research your employer’s potential insurance partnerships or group buying programs. Many large employers negotiate group rates with insurers that provide better pricing than individual policies.

Professional associations, alumni organizations, and trade groups sometimes offer insurance programs with preferential rates for members. Explore membership benefits beyond networking and education.

10.2 Military and Veterans Benefits

Military personnel and veterans often qualify for substantial insurance discounts through specialized programs. USAA provides exclusive coverage to military families with competitive rates and excellent service.

Active duty military may qualify for deployment-related discounts when away from home for extended periods. These temporary adjustments reflect reduced occupancy risks during deployment.

Veterans organizations often partner with insurance companies to provide group discounts for their members. Research these opportunities through VFW, American Legion, and other veterans groups.

10.3 Senior and Retirement Discounts

Some insurance companies offer discounts specifically for seniors. Typically, to qualify, the house must be your primary residence, you have to be age 55 or older and you must work outside of your house less than 24 hours a week.

Retirement often qualifies homeowners for additional discounts due to increased home occupancy and maintenance attention. Document your retirement status when requesting quotes or policy reviews.

AARP partnerships with major insurers provide specialized programs for members over 50, often including enhanced coverage options along with competitive rates.

Conclusion: Your Strategic Roadmap to Sustainable Home Insurance Savings

Reducing home insurance costs in 2025 requires a comprehensive approach that balances immediate opportunities with long-term optimization strategies. With national premiums averaging $3,520 and projected to keep rising, these proven methods can potentially save homeowners 20-40% annually while maintaining essential protection.

Priority Implementation Schedule:

- Week 1: Bundle policies for instant 10-25% reductions

- Week 2: Optimize deductibles strategically for 15-30% savings

- Month 1: Install qualifying security systems for 5-20% discounts

- Month 2: Complete annual rate shopping to capture market opportunities

- Ongoing: Maintain claims-free status for long-term 15-25% benefits

Begin with high-impact, low-effort strategies like policy bundling and deductible optimization, then implement longer-term approaches including home improvements and technology upgrades. Remember that sustainable savings come from comprehensive strategies rather than isolated tactics.

Expected Annual Savings by Strategy:

- Multi-policy bundling: $350-875 annually

- Strategic deductible increases: $250-650 annually

- Security system discounts: $175-700 annually

- Claims-free progression: $175-875 annually

- Annual rate shopping: $200-1,400 annually

The insurance landscape continues evolving with new discount programs, technology integrations, and coverage options emerging regularly. Stay informed about industry changes and review your approach annually to maintain optimal cost-effectiveness.

For comprehensive guidance covering all aspects of homeowners protection, including coverage analysis, policy comparisons, and state-specific requirements, explore our complete homeowners insurance guide to ensure you’re making informed decisions about both costs and coverage adequacy.

Smart insurance management requires balancing cost optimization with protection needs. Use these strategies to reduce expenses while maintaining comprehensive coverage that protects your family’s financial security and peace of mind in an increasingly challenging insurance environment.

- National Association of Insurance Commissioners (NAIC)

- Insurance Information Institute

- U.S. Department of the Treasury Federal Insurance Office

- Insurify 2025 American Homeowner Insurance Report

- Consumer Financial Protection Bureau

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.