Patricia Williams, a graphic designer from Austin, assumed her basic home insurance policy provided comprehensive coverage until Hurricane Harvey’s floodwaters destroyed her home office and art studio. The $45,000 in damage from water, ruined equipment, and lost artwork received no coverage because standard home insurance excludes flood damage, forcing her to rebuild entirely from personal savings while continuing mortgage payments on the damaged property.

Home insurance provides financial protection for residential properties through coverage that addresses structural damage, personal property losses, liability claims, and additional living expenses during repairs. Property owners pay annual or monthly premiums in exchange for protection against covered perils including fire, theft, windstorms, and various other risks specified in policy terms.

The American residential insurance market protects over 85 million homeowner policies according to the Insurance Information Institute, generating $109.3 billion in direct written premiums during 2022. This represents the second-largest property-casualty insurance line after auto insurance, reflecting the significant financial investment Americans maintain in residential real estate.

Coverage Options Explained

Home Insurance Market Analysis

Property insurance costs have increased substantially due to climate change impacts, construction cost inflation, and severe weather frequency. The National Association of Insurance Commissioners reports that catastrophe losses from natural disasters reached $99 billion in 2022, with residential properties bearing the majority of weather-related damage costs nationwide.

Geographic location significantly influences home insurance pricing through varying natural disaster risks, local building costs, and state regulatory environments. Coastal states prone to hurricanes typically maintain higher average premiums, while areas with frequent wildfires, tornadoes, or severe storms face elevated comprehensive coverage costs reflecting regional risk exposures.

Current residential insurance market conditions reveal several concerning trends:

- Home insurance premiums increased an average of 12.1% annually between 2017-2022 according to National Association of Insurance Commissioners data

- Catastrophic weather events caused $165 billion in insured losses during 2022, the fourth-highest year on record

- Insurance availability has decreased in high-risk areas, with some carriers withdrawing from California and Florida markets

- Replacement cost coverage gaps affect 64% of homes, with average underinsurance of 22% according to industry estimates

- Construction material costs increased 35% between 2020-2022, outpacing policy limit adjustments

Consumer behavior patterns show growing interest in higher coverage limits and additional endorsements as homeowners recognize inflation impacts on replacement costs and personal property values.

Home Insurance Coverage Analysis

Affordable Home Insurance Options

Home insurance affordability varies based on coverage selections, deductible amounts, dwelling age, and location-specific risk factors. Property owners can reduce premiums through higher deductibles, security system installations, and various discount programs while maintaining adequate protection levels. State insurance departments often provide consumer guides comparing average costs and coverage options available in local markets.

Home Insurance Cost Factors

Home insurance premiums reflect property-specific risk assessments including dwelling age, construction materials, square footage, and local replacement costs. Insurance companies evaluate factors such as proximity to fire departments, prior claims history, credit scores in applicable states, and coverage limit selections when determining individual policy pricing through actuarial analysis and underwriting guidelines.

Home Insurance Coverage Components

Home insurance policies typically include four main coverage sections addressing different protection needs. Dwelling coverage pays for structural repairs, while personal property coverage addresses belongings damage. Liability protection covers legal claims from injuries occurring on the property, and additional living expenses help with temporary housing costs during covered repairs or rebuilding periods.

Home Insurance Claims Processing

Home insurance claims follow standardized procedures established by state regulations and industry practices. Policyholders must report losses promptly, document damages thoroughly, and cooperate with insurance company investigations. Claim settlement involves damage assessment by adjusters, coverage determination, and payment processing according to policy terms and applicable deductibles.

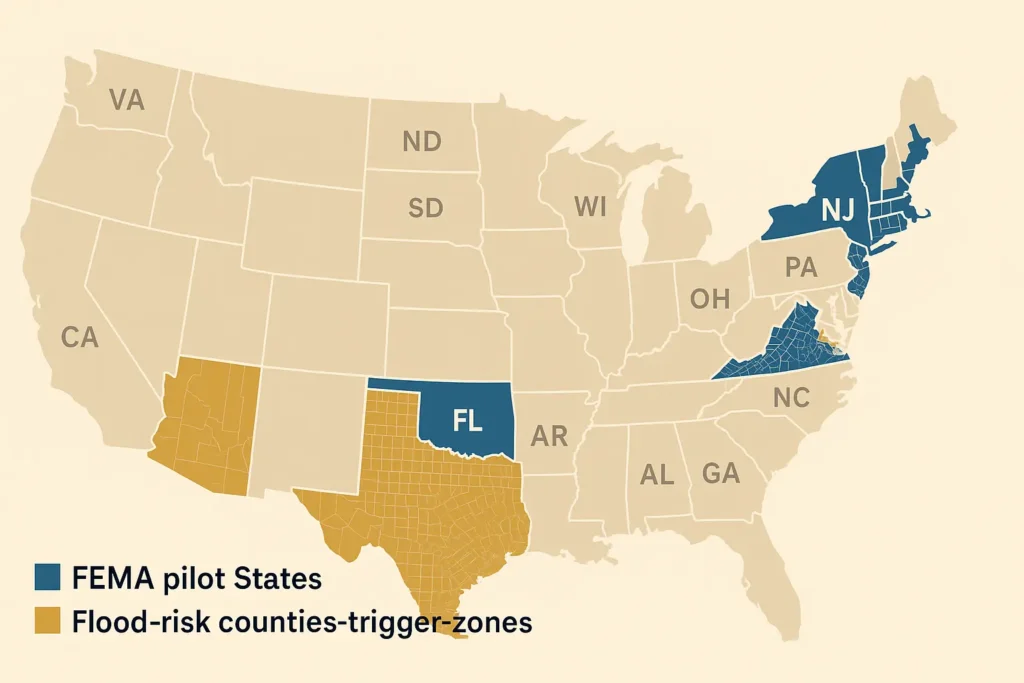

Flood Insurance Requirements

Standard home insurance policies exclude flood damage, requiring separate coverage through the National Flood Insurance Program or private insurers. Flood insurance becomes mandatory for properties in Special Flood Hazard Areas with federally-backed mortgages, though coverage provides valuable protection regardless of location since flooding can occur anywhere from various causes including burst pipes and storm drainage issues.

Home Insurance for New Homeowners

First-time homebuyers often face confusion about coverage needs, policy options, and adequate protection levels for their specific situations. New homeowners should consider replacement cost coverage rather than actual cash value, understand policy exclusions and limitations, and evaluate additional endorsements for valuable items, home-based businesses, or specific risks not covered under standard policies.

Home Insurance Policy Structures

Home insurance markets offer various policy forms designed to address different property types, coverage needs, and risk tolerance levels. HO-3 policies represent the most common homeowners coverage, providing open-perils protection for dwellings while specifying covered perils for personal property through detailed policy language.

HO-1 and HO-2 policies offer more limited coverage at reduced costs, protecting against specifically named perils only. These basic forms provide essential fire and theft protection but exclude many risks covered under comprehensive policies, making them suitable primarily for older homes or budget-conscious property owners.

HO-4 policies serve renters by covering personal property and liability without dwelling protection, since landlords typically maintain structural coverage. HO-6 policies address condominium owners’ specific needs, covering interior improvements and personal property while coordinating with association master policies covering common areas and building exteriors.

Vacant property insurance addresses homes temporarily unoccupied due to renovations, estate settlements, or marketing for sale. Standard homeowners policies often exclude coverage for properties vacant longer than 30-60 days, requiring specialized coverage to maintain protection during unoccupied periods that present increased risks.

Luxury home insurance serves high-value properties exceeding standard coverage limits through specialized underwriting and enhanced services. These policies often include agreed-value coverage, broader perils protection, and concierge claim services designed to address unique needs of expensive homes and valuable personal property collections.

Landlord insurance covers rental properties through dwelling protection, loss of rental income coverage, and enhanced liability limits addressing tenant-related risks. Personal homeowners policies typically exclude rental activities, requiring separate landlord coverage for properties used to generate rental income through tenant occupancy.

This information describes general home insurance concepts based on industry data and regulatory information. Property insurance coverage requirements and options vary by location, property type, and individual circumstances. Readers should consult current policy documents and qualified professionals for specific coverage decisions.

Recent Insurance Guides

FEMA Flood Map Changes 2025 – 5 Critical Facts Homeowners Must Act On

Unresponsive Insurance Agent: What to Do When Your Agent Won’t Respond in 2025

Rising Reinsurance Costs Hurricane States 2025: Complete Guide

Climate Resilience Discounts Homeowners Insurance 2025: 8 Money-Saving Facts

Essential Guide to Parametric Flood Insurance USA 2025 — Key Rules & Benefits

Understanding Electric Insurance Coverage in 2025

Roof Replacement Insurance Cost – Complete Guide 2025

Home Insurance Payout for Roof Damage – Complete Guide 2025

How Much Is Flood Insurance in Florida

Flood Insurance Guide 2025

Cheapest Homeowners Insurance

Insurance for Mobile Homes

How to Reduce Home Insurance Costs?

Flood Insurance for Homeowners