Jackson had been living in Fort Myers for six years without ever thinking twice about flood insurance. Last September, after just three hours of heavy rain, two feet of water surged into his garage. The repairs? Nearly $9,000—none of it covered. “If only I’d known,” he muttered, staring at the soaked drywall. That night, he typed into his phone: how much is flood insurance in Florida?

Here’s the quick answer: most Floridians pay between $500 and $1,300 per year, depending on their flood zone, home type, and insurer. According to FEMA data from 2024, coastal zones like AE or VE can see premiums above $2,000 annually, while Zone X properties may pay less than $400.

Confused? You’re not alone. This guide unpacks real prices, risk factors, and what you can do to lower your premium—before the next storm hits.

On This Page

1. Understanding Flood Insurance in Florida

1.1 What Flood Insurance Covers (and What It Doesn’t)

When Paula moved to Jacksonville in 2023, her real estate agent mentioned flood insurance as an “optional extra.” Six months later, her backyard turned into a swamp and seeped into the crawlspace. The damage? Over $12,000—and not a cent covered by her standard homeowners insurance. That’s when she learned the hard truth: flood insurance is a separate policy.

Flood insurance typically covers structural damage caused by rising water, including walls, floors, electrical systems, and built-in appliances. It also includes essential contents like washers, dryers, and freezers if you have contents coverage. However, it doesn’t pay for landscaping, temporary housing, or cars—those fall outside the scope. It also excludes damage from burst pipes or sewer backups, unless directly caused by flooding.

Pro Tip

FEMA flood insurance covers up to $250,000 for your home and $100,000 for contents. But that’s the cap—anything beyond that requires excess coverage or private add-ons.

Understanding exactly what flood insurance does and doesn’t include is critical. Many Florida residents assume their homeowners policy has them covered. It doesn’t. In a flood-prone state, that assumption can cost you thousands.

1.2 Is Flood Insurance Mandatory in Florida?

The short answer? It depends—mostly on where you live and how your home is financed. If your property is located in a high-risk FEMA flood zone (Zone A, AE, or VE) and you have a federally backed mortgage, flood insurance isn’t optional. It’s legally required.

But even if you live in a low- or moderate-risk area (like Zone X), you’re not off the hook. According to FEMA’s 2024 data, over 25% of flood insurance claims in Florida come from these lower-risk zones. That’s why many private insurers and local agents strongly recommend getting coverage regardless of mandate.

Here’s a simplified table showing when flood insurance is required:

| Flood Zone | Mandatory if Mortgage? | Typical Premium Range |

|---|---|---|

| Zone AE / VE | Yes | $900 – $2,500/year |

| Zone A | Yes | $600 – $1,800/year |

| Zone X | No | $300 – $700/year |

Client–Agent Dialogue

Client: “I’m in Zone X—do I really need flood insurance?”

Agent: “Legally, no. But FEMA shows your ZIP has had 3 flood claims in the past 5 years. One policy could save you tens of thousands.”

Even if not required, knowing how much is flood insurance in Florida for your specific zone helps you make an informed choice. Some homeowners choose to skip it—until the first storm hits. By then, it’s too late.

2. How Much Is Flood Insurance in Florida?

2.1 Florida Flood Insurance Rates by Zone (A, X, AE)

Carlos lives in a modest home just outside Fort Lauderdale, in FEMA’s Zone AE. When he received his flood insurance quote, he couldn’t believe it: $2,100 per year. Just a few streets away, his friend in Zone X pays less than $500. Same ZIP, different realities. Your rate hinges entirely on how FEMA classifies your location on its flood zone map—sometimes just a street apart makes a dramatic difference.

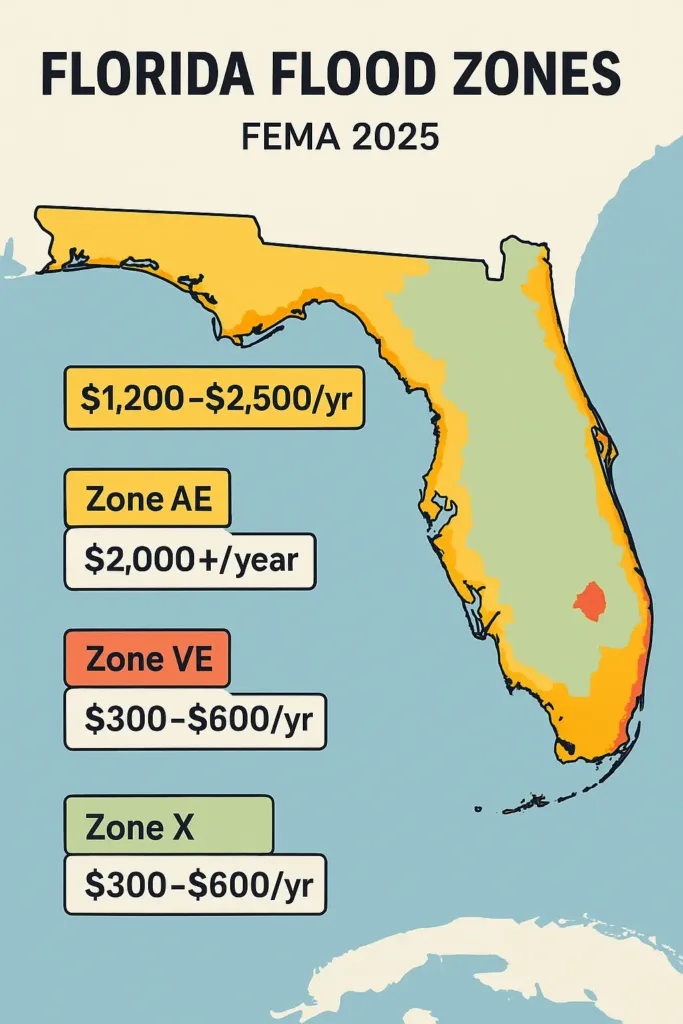

In Florida, flood insurance rates fluctuate sharply by zone:

| FEMA Zone | Risk Level | Premium Range (2025) |

|---|---|---|

| Zone AE | High | $1,200 – $2,500/year |

| Zone A | Moderate | $800 – $1,800/year |

| Zone X | Low/Minimal | $300 – $700/year |

Pro Tip

Homes in Zone A or AE can often reduce premiums by presenting an Elevation Certificate, which verifies the home’s construction is above base flood level.

Many homeowners are surprised by how much is flood insurance in Florida when they first compare FEMA zones. It’s not uncommon for identical homes, a block apart, to have rates that differ by more than $1,000.

2.2 Cost Breakdown by City and Property Type

The price of flood insurance in Florida doesn’t just depend on your zone—it also depends on your address and the structure itself. A ground-level condo in Naples won’t be priced like an elevated home in Gainesville.

Here’s a realistic 2024 snapshot (FEMA + NAIC):

| City | Home Type | Flood Zone | Est. Premium |

|---|---|---|---|

| Miami Beach | Ground-floor condo | AE | $2,300 |

| Orlando | Townhouse | X | $460 |

| Tampa | Elevated bungalow | A | $990 |

| Fort Lauderdale | Single-family coastal | VE | $2,800 |

Client–Agent Dialogue

Client: “Why is my neighbor’s premium half of mine?”

Agent: “He’s on slightly higher ground, and his home hasn’t had any past flood damage. Those two things alone can drop a premium by hundreds.”

When homeowners search how much is flood insurance in Florida, they often overlook the impact of property type and micro-location. Personalized quotes matter more than averages.

2.3 FEMA vs Private Flood Insurance Prices

Many homeowners assume FEMA’s NFIP is the only route for flood insurance—but that’s no longer the case. In Florida, private insurers have stepped in with flexible plans, expanded coverages, and in some cases, better pricing than the federal standard.

| Provider | Typical Premium (FL) | Max Coverage | Notable Limits |

|---|---|---|---|

| NFIP (FEMA) | $800 – $1,600 | $250K structure | No replacement cost, no basements |

| Private Insurer A | $600 – $1,400 | Up to $1M+ | May require inspection |

| Private Insurer B | $950 – $1,800 | $500K+ + contents | Limited availability in Zone VE |

2024 Update – NAIC:

Over 20% of all new flood insurance policies in Florida in 2024 were issued by private carriers, not FEMA.

While FEMA is more standardized, private policies may offer better value, especially for newer homes or those outside coastal surge zones.

2.4 What Is the Average Flood Insurance Premium in Florida?

Data from FEMA and the NAIC (2024) shows that most Florida homeowners pay around $958 annually for flood insurance, though the real figure depends heavily on location and flood risk.

- Low-risk ZIPs: $350–$600/year

- Moderate-risk: $800–$1,200/year

- High-risk coastal zones: $2,000+

| ZIP Code | City | Average Premium |

|---|---|---|

| 33139 | Miami Beach | $2,420 |

| 32801 | Orlando | $530 |

| 33606 | Tampa | $880 |

| 33301 | Fort Lauderdale | $1,960 |

Asking “how much is flood insurance in Florida” only makes sense when you know your flood zone, property elevation, and claims history. Without that context, averages can be misleading.

3. Key Factors That Affect Flood Insurance Costs

3.1 Flood Zones and Risk Levels

When Katrina bought her home in Sarasota, she was told it was in Zone X—low-risk. She didn’t think much of it. Two years later, after FEMA’s 2024 remapping, she was reclassified into Zone AE, and her flood premium jumped by over $1,200 a year. One bureaucratic change—and suddenly, flood insurance cost more than her homeowner’s policy.

Flood zones are the foundation of how much is flood insurance in Florida. FEMA categorizes zones by likelihood of flooding, with high-risk areas paying the most:

| Zone | Risk Level | Insurance Requirement |

|---|---|---|

| VE | Very High (coastal) | Mandatory with mortgage |

| AE | High | Mandatory with mortgage |

| A | Moderate | Often required |

| X | Minimal | Optional |

Even in “safe” zones, FEMA data (2024) shows that over 25% of flood claims in Florida come from areas marked Zone X. Translation? Low risk doesn’t mean no risk—and your rate reflects the zone you’re mapped into.

3.2 Property Location, Elevation, and History

Two houses. Same ZIP code. One costs $450/year for flood insurance; the other? Over $2,000. The difference often comes down to where exactly the home sits, how high it’s built, and whether it’s been flooded before.

Here’s what insurers evaluate:

- Proximity to water (coast, river, drainage basin)

- Elevation vs. base flood level (via Elevation Certificate)

- Prior flood damage or claims

- Local topography and drainage

Pro Tip

Homes that sit just one foot above base flood elevation can see premium reductions of up to 40%, according to FEMA modeling.

How much is flood insurance in Florida? You won’t know until your home’s specific position, height, and history are factored in.

3.3 Coverage Amount and Deductibles

Insurance pricing always balances risk and coverage. With flood policies, the amount you insure and the deductible you select will directly shape your rate.

| Coverage | Effect on Premium |

|---|---|

| $250K home only | Baseline FEMA maximum |

| + Contents ($100K) | Increases premium 10–25% |

| Higher deductible | Lowers premium, but raises out-of-pocket |

| Lower deductible | Raises premium, reduces upfront risk |

Some homeowners want peace of mind with full structure + contents protection. Others go minimal, insuring only the loan-required amount.

Client–Agent Dialogue

Client: “Should I add contents coverage?”

Agent: “Do you want FEMA replacing your $2,000 washer and $4,000 couch—or would you cover it yourself?”

How much is flood insurance in Florida isn’t just about location. What you choose to protect, and how much risk you’re willing to shoulder, plays a big role too.

3.4 Other Rate Drivers: Construction, Basement, Claims

Beyond zone and elevation, several lesser-known factors can significantly influence your premium:

- Year built: Homes constructed after 1978 (post-FIRM) often get better rates

- Foundation type: Elevated homes = lower premiums

- Basements or crawlspaces: Higher risk, especially in coastal flood zones

- Claims history: Multiple prior NFIP claims = premium surcharges

- Type of insurer: FEMA is fixed-rate; private carriers rate by risk model

2024 FEMA Bulletin:

Homes with 2+ past NFIP claims may face 25% surcharges or lose eligibility for grandfathered rates under Risk Rating 2.0.

Even your roof style, flood vents, and distance to a fire station can affect quotes. Understanding every rate driver is the best way to avoid surprises—and reduce costs.

4. 2025 Flood Insurance Rules in Florida

4.1 Recent Legislative Changes and FEMA Updates

In January 2025, Greg in Fort Lauderdale received a letter from his insurer. It stated his flood premium would rise by 18% under FEMA’s updated Risk Rating 2.0 model. He hadn’t filed any claims. He hadn’t changed coverage. What had changed? The rules.

Florida homeowners are now facing the full rollout of Risk Rating 2.0, FEMA’s revamped pricing system based on individual property characteristics—not just flood zones. It considers:

- Distance to water

- Foundation type

- First-floor elevation

- Replacement cost of the home

- Historical flood frequency (ZIP-level)

2025 FEMA Advisory:

“Risk Rating 2.0 reflects real flood risk. Premiums may rise or fall based on property-level data.” — FEMA Flood Map Division

This means that how much is flood insurance in Florida now depends less on your zone letter (A, X, VE) and more on your exact GPS coordinates and structural details.

4.2 NFIP Rate Updates for Florida Homeowners

With Risk Rating 2.0 now in effect across Florida, National Flood Insurance Program (NFIP) rates are no longer tied to flat tables. Instead, every property has a customized price based on FEMA’s algorithm.

| Year | NFIP Rate Cap | Notes |

|---|---|---|

| 2023 | Max +18% yearly | Risk Rating 2.0 Phase-In Begins |

| 2024 | +18% cap upheld | Most increases below 12% statewide |

| 2025 | +18% max still active | Full statewide implementation complete |

Pro Tip

NFIP rate hikes are capped at 18% per year under federal law—but that cap compounds over time. A $600 policy today could exceed $1,000 in three years.

Florida homeowners should request their “Full Risk Premium” estimate from FEMA to understand long-term impact.

So when people ask how much is flood insurance in Florida, the answer may vary each year—unless you lock in a better alternative.

4.3 Local Requirements and Mortgage Obligations

Even beyond FEMA and NFIP, Florida’s flood insurance landscape is shaped by local ordinances and mortgage mandates. Here’s what residents should know in 2025:

- If your home is in a Special Flood Hazard Area (SFHA) and you have a federally backed mortgage, flood insurance is mandatory

- Many local governments—especially in Miami-Dade, Broward, and Collier counties—now require proof of elevation at renewal

- Several Florida lenders in coastal ZIP codes have begun requiring flood coverage even in Zone X, especially post-hurricane

| Zone | Mortgage Requirement | Typical Add-ons |

|---|---|---|

| AE/VE | Mandatory (federal) | Elevation cert, foundation info |

| A | Strongly encouraged | Lender may still require policy |

| X | Optional (but rising) | Often bundled with homeowners |

Client–Agent Dialogue

Client: “I’m in Zone X, and my lender just asked for flood insurance. Can they do that?”

Agent: “Yes—they have the right. Lenders can impose stricter requirements than FEMA.”

In 2025, understanding your local legal and financial obligations is as important as comparing premiums. Even if not federally required, your city or mortgage lender may say otherwise.

5. How to Lower Your Flood Insurance Premium in Florida

5.1 Mitigation Discounts and Elevation Certificates

Jasmine lives in Tampa, just a few blocks from a flood-prone canal. In 2024, she paid $1,860/year in flood insurance. But after elevating her HVAC system and submitting a certified elevation certificate, her premium dropped to $1,150. That’s over $700 in savings for one proactive move.

FEMA’s National Flood Insurance Program (NFIP) and many private carriers offer premium discounts for mitigation efforts, including:

- Installing flood vents or backflow valves

- Raising mechanical systems (HVAC, water heater) above base flood elevation

- Retrofitting crawlspaces or using flood-resistant materials

- Obtaining an Elevation Certificate from a licensed surveyor

Official Source – FEMA Floodplain Management (2024):

“An elevation certificate can reduce your flood premium by hundreds of dollars annually—especially in Zones AE or VE.”

In fact, how to lower your flood insurance premium in Florida often starts with showing insurers that your home is less vulnerable than the map assumes.

5.2 Switching from NFIP to Private Policies

Many Florida homeowners are still unaware they can switch from NFIP to private flood insurance—even if their mortgage requires flood coverage.

Let’s compare:

| Scenario | NFIP (FEMA) | Private Insurer |

|---|---|---|

| Premium in Fort Lauderdale | $1,600/year (flat) | $980/year (Zone X) |

| Claims payout speed | 30–60 days | Often under 2 weeks |

| Basement or pool coverage | Often excluded | Sometimes included |

| Annual rate cap | 18% | Varies (no federal cap) |

Pro Tip

Private insurers often underwrite homes differently. If your elevation is above base flood level or you’re outside a high-risk zone, your quote could be 30–50% cheaper.

Still, how to lower your flood insurance premium in Florida requires comparing multiple quotes—don’t just auto-renew with NFIP.

5.3 Raising Your Deductible and Smart Bundling

One of the fastest ways to reduce your flood premium? Raise your deductible.

Under NFIP rules:

- $1,000 deductible → higher premium

- $5,000–$10,000 deductible → significant savings (up to 40%)

But make sure you can afford the out-of-pocket cost if a claim occurs. Pairing this with smart bundling—like combining flood and homeowners insurance under the same carrier—can also unlock discounts.

Example:

Mark in Naples raised his flood deductible from $1,500 to $5,000 and bundled with his State Farm homeowners policy. His total annual flood premium dropped from $1,200 to $790.

So if you’re wondering how to lower your flood insurance premium in Florida, think risk sharing + bundling for leverage.

5.4 What to Ask Your Insurance Agent

When shopping for flood insurance in Florida, asking the right questions can reveal big savings:

- “Can you run quotes from both FEMA and private markets?”

- “Am I eligible for elevation-based discounts?”

- “What deductible gives me the best value?”

- “Do you offer bundling discounts with other policies?”

- “If I add flood vents or elevate my water heater, how much would I save?”

Client–Agent Mini-Dialogue

Client: “Why is my neighbor’s policy $600 cheaper?”

Agent: “Her crawlspace is elevated, and she submitted an elevation cert. You’re still rated at slab-on-grade without one.”

Having a proactive conversation with your agent is often the most overlooked way to lower your flood insurance premium in Florida—but one of the most effective.

6. Common Misconceptions About Flood Insurance in Florida

6.1 “I’m Not in a Flood Zone, So I Don’t Need It”

When Trevor moved into his new home in Winter Haven, his lender didn’t mention anything about flood insurance. “Must mean I’m safe,” he assumed. Three months later, a summer downpour left six inches of standing water in his garage—and a $12,000 repair bill he had to cover himself.

This is one of the most common and costly myths in Florida. Every property is in a flood zone—the difference lies in the level of risk, not in the presence or absence of it. Zones like X or C are considered “minimal risk,” but they’re not risk-free. In fact, many claims in Florida come from these areas simply because people don’t think they need protection.

📌 Pro Tip

If you’re in a low-risk area, ask your insurer about a Preferred Risk Policy (PRP). These policies are designed for zones like X and B and can cost as little as $350/year while still offering robust protection.

6.2 “Homeowners Insurance Covers Floods”

This one’s dangerously misleading—and surprisingly widespread. Flood damage is almost never covered under a standard homeowners policy. That includes rainwater seeping into your home after a storm or water rising from the street into your living room.

Here’s the reality:

- If the water comes from above (like a burst pipe or roof leak), you may be covered.

- If it comes from the ground, you need separate flood insurance—through the NFIP or a private provider.

💬 Client–Agent Conversation

Client: “So if a hurricane floods my yard and it gets into my house, I’m covered, right?”

Agent: “Only if you have flood insurance. Otherwise, you’re paying out of pocket.”

The distinction isn’t just legal—it’s financial. Misunderstanding it can mean the difference between a quick repair and tens of thousands in unexpected costs.

6.3 “It’s Too Expensive for What It Covers”

Let’s unpack this myth with some real-life numbers.

Some people hear “flood insurance” and picture a four-figure annual bill. But most Florida homeowners—especially those outside high-risk zones—pay much less.

📊 Flood Insurance Cost Breakdown by Zone (2025)

| FEMA Zone | Average Annual Premium | Typical Range |

|---|---|---|

| VE | $2,800 | $2,500 – $4,000 |

| AE | $1,200 | $900 – $1,600 |

| X/B/C | $450 | $350 – $600 |

According to NAIC and FEMA (2024), the statewide average hovers around $950/year, but that figure includes high-risk coastal areas. Most inland or elevated homes qualify for low-cost policies well under $500.

📣 Testimonial – Miami Shores

“My neighbor warned me it’d be pricey. But I got a private policy for $412 a year—cheaper than my cell phone plan.” – Sharon M., homeowner

Now weigh that against the risk: just 6 inches of water in a single-story Florida home can cause over $20,000 in damage—flooring, drywall, electrical, furniture… all gone in hours.

✅ Key Takeaway

Flood insurance in Florida isn’t a luxury. For many, it’s a budget-friendly safety net that could save your financial future.

7. Real-Life Cases: How Much People Actually Pay

Florida homeowners often assume flood insurance is too complex or costly—until they see what their neighbors are really paying. Here’s a closer look at three real-life examples across different FEMA zones.

7.1 Lisa from Tampa: Townhouse in Zone X

Lisa owns a two-bedroom townhouse in the New Tampa area, a growing suburb that sits in FEMA Zone X—a zone officially designated as “moderate-to-low risk.”

Her lender didn’t require flood insurance, but after Hurricane Idalia in 2023 flooded a friend’s property just 10 miles away, she decided to get coverage anyway.

💡 Lisa’s Premium Breakdown

- Provider: NFIP (Preferred Risk Policy)

- Annual Premium: $386

- Coverage: $250,000 for building, $50,000 for contents

- Deductible: $1,000

🗣️ “It’s less than my monthly coffee habit. And it gives me peace of mind every storm season.”

Despite not being “required,” flood insurance in Zone X gave her affordable protection—and, according to FEMA’s 2024 Risk Map, properties in Zone X still account for over 20% of flood claims in Florida.

7.2 John in Fort Lauderdale: Condo Near Water

John lives in a second-floor condo just four blocks from the Intracoastal in Fort Lauderdale—an area categorized under Zone AE, where the risk is elevated due to water proximity.

Because his condo association covers the building, he only needed contents coverage. He looked into both NFIP and private insurers and found a competitive quote through the private market.

💬 Client–Agent Snippet

Agent: “Your HOA covers the building. You just need contents.”

John: “So if water floods my unit from the balcony door, my stuff’s covered?”

Agent: “Only if you have flood insurance. Without it, you’re out thousands.”

💡 John’s Premium Breakdown

- Provider: Private insurer

- Annual Premium: $312

- Coverage: $60,000 contents

- Deductible: $1,250

His total cost was less than one night at a beachfront hotel, and it protected irreplaceable belongings like his guitar, desktop computer, and vintage books.

7.3 Maria in Orlando: FEMA Zone A Home

Maria’s single-story home sits in Zone A—a higher-risk area near a small retention pond in East Orlando. FEMA flood maps designate this as a Special Flood Hazard Area (SFHA), which means her mortgage lender required flood coverage.

📊 Maria’s Premium (2025)

Type Amount Provider NFIP Annual Premium $1,142 Coverage $250,000 (structure) + $100,000 (contents) Deductible $2,000 Elevation Certificate Yes (discount applied)

📣 Testimonial

“I thought I’d pay over $2,000 a year. Turns out, the elevation certificate saved me almost $400.” – Maria G., Orlando homeowner

With mitigation efforts and a recent elevation certificate, Maria’s premium dropped below the neighborhood average—and she’s now protected against rising water from hurricanes and seasonal storms.

📎 Infobox: Average Premiums by ZIP (2025 – Sample)

- 33647 (Tampa, Zone X): $360 – $410

- 33308 (Fort Lauderdale, Zone AE): $290 – $340

- 32825 (Orlando, Zone A): $1,050 – $1,250

✅ Want to Pay Less?

Here’s how Florida homeowners lower their premiums:

- Request an Elevation Certificate

- Opt for higher deductibles

- Compare NFIP vs private carriers

- Bundle with home or wind insurance

- Ask about Preferred Risk Policies (PRP) if you’re in Zone X

Each of these Floridians faced different circumstances, yet all managed to find affordable, customized flood insurance based on their FEMA zone and property type.

Flood insurance in Florida isn’t one-size-fits-all—but it’s rarely as expensive as people think.

8. Florida Flood Insurance: Pros, Cons, and Alternatives

Choosing the right flood insurance in Florida is not just about price—it’s about protection, peace of mind, and understanding what you’re really buying. Let’s break it down clearly.

8.1 Pros of Having Flood Coverage in Florida

When Rachel bought her home in Cape Coral, her realtor casually mentioned “it’s not required” because the area was in Zone X. But three months later, her neighbor’s home flooded after just two days of heavy rain.

She got lucky—he didn’t. That moment convinced her to buy flood insurance in Florida, and it turned out to be one of the smartest financial decisions she’s ever made.

✅ Why Florida Homeowners Choose Flood Insurance

- Storms, not zones, cause damage. Rainfall and drainage failures can flood homes even in “low-risk” areas.

- Most policies cost under $1,000/year—less than many homeowners expect.

- Coverage includes both structure and personal belongings.

- FEMA reports that just one inch of water can lead to over $25,000 in damage.

📣 Official Quote (FEMA 2024)

“Anywhere it can rain, it can flood. Flood risk isn’t just about zones—it’s about exposure.” — FEMA Risk Rating 2.0 Summary

In a hurricane-prone state like Florida, flood insurance isn’t optional—it’s part of a smart, resilient financial plan.

8.2 Limits and Gaps in FEMA Policies

While the NFIP provides a valuable safety net, its coverage has strict ceilings and notable exclusions that many first-time buyers overlook.

⚠️ NFIP Coverage Limits

Coverage Type Maximum Payout Building (residential) $250,000 Contents $100,000 Basement Contents Not Covered Additional Living Exp. Not Covered

💬 Client–Agent Dialogue

Client: “So if my HVAC unit in the basement is damaged, it’s not covered?”

Agent: “Correct. Unless it’s an essential component, basement contents are typically excluded under FEMA rules.”

📎 Common NFIP Gaps

- No coverage for temporary housing or relocation

- Limited protection for luxury finishes or upgraded flooring

- Outdated elevation data in some Florida counties

Even more confusing: premiums don’t always align with true risk, which is why homeowners in Zone X sometimes pay more than those in Zone AE.

8.3 Alternatives: Private Insurers, Excess Coverage

Frustrated with FEMA’s caps, many Floridians are exploring the growing market of private flood insurance. The options are broader, often cheaper, and better tailored to modern homes.

💡 Pro Tip

If your home’s value exceeds $250,000 or you want coverage for living expenses, ask about excess flood insurance or private plans with ALE (Additional Living Expenses) built in.

📊 FEMA vs Private Flood Insurance Comparison

Feature NFIP (FEMA) Private Insurer Max Structure Coverage $250,000 Up to $1M+ Contents Limit $100,000 Up to $500,000 Additional Living Expense ❌ Not included ✅ Often included Claims Process Slower Faster, flexible Premium Range (FL Avg.) $500 – $1,300 $400 – $1,800

Private carriers like Neptune, TypTap, or Wright Flood now cover thousands of Florida properties—and often allow custom deductibles, multiple buildings, and higher-value items.

📋 Checklist: Should You Consider Private Flood Insurance in Florida?

☐ Is your home worth more than $250,000?

☐ Do you have valuables exceeding $100,000 inside?

☐ Do you want relocation or loss-of-use coverage?

☐ Have you had issues with FEMA maps or payouts?

☐ Are you in a coastal city like Naples, Miami, or Sarasota?

If you answered yes to two or more, it’s worth getting a quote from both NFIP and private providers—and comparing line by line.

📘 Quick Facts: 2025 Flood Insurance Landscape in Florida

- Over 1.7 million NFIP policies currently active in Florida (FEMA, 2024)

- Private flood market grew 28% in Florida between 2022 and 2024 (NAIC data)

- Some HO-5 policies now allow flood riders as add-ons for comprehensive coverage

- Bundling discounts available if purchased with homeowners or windstorm policies

Flood insurance in Florida is no longer a niche product—it’s a mainstream necessity. Whether you stick with FEMA or go private, what matters most is choosing a plan that fits your real exposure and your real budget.

10. Final Checklist: Get the Best Flood Insurance Deal in Florida

10.1 Quick Comparison: NFIP vs Private Policies

When shopping for flood insurance in Florida, one of the first decisions you’ll make is whether to stick with FEMA’s National Flood Insurance Program (NFIP) or explore private options. Both paths come with trade-offs—and the difference can be hundreds of dollars a year.

Let’s break it down simply:

| Feature | NFIP (FEMA) | Private Insurers |

|---|---|---|

| Max Dwelling Coverage | $250,000 | $1 million or more |

| Contents Coverage | Up to $100,000 | Often $200K–$500K+ |

| Additional Living Expenses (ALE) | ❌ Not included | ✅ Commonly included |

| Underwriting Flexibility | Rigid / zone-based | Risk-based, more flexible |

| Waiting Period | 30 days | 7–15 days (often) |

| Accepted by Lenders | ✅ Nationwide | ✅ But varies by lender |

| Avg. Premium (FL, 2025) | $850–$1,400/year | $600–$2,000/year (varies widely) |

🧠 Pro Tip: If your home is elevated, located in Zone X, or has updated flood mitigation systems, a private policy may offer you better coverage at a lower cost.

💬 “My bank only required NFIP, but my agent showed me a private quote with triple the coverage—for just $90 more per year.” – Tyler, Jacksonville

10.2 Cost-Saving Tips by ZIP Code

Premiums for flood insurance in Florida don’t just vary by flood zone—they can differ drastically by ZIP code, elevation, and even building type. Here’s how to keep your rate down, no matter where you live.

📍 Average 2025 Premiums by ZIP (Sample)

- 33139 (Miami Beach, Zone AE): ~$1,750/year

- 32207 (Jacksonville, Zone X): ~$590/year

- 32828 (Orlando, Zone A): ~$980/year

- 34236 (Sarasota, Zone AE): ~$1,210/year

- 33411 (West Palm Beach, Zone X): ~$680/year

✅ Actionable Ways to Lower Your Flood Insurance Bill:

- Bundle policies (home + flood = multi-line discount with some carriers)

- Elevate your water heater, HVAC, and electrical panel above base flood elevation

- Install flood vents in crawl spaces or garages

- Request a new Elevation Certificate (can lower your rating under NFIP)

- Opt for a higher deductible ($5,000 vs $1,000 can reduce premiums 15–30%)

- Ask about discounts for gated communities, HOA flood protections, or mitigation upgrades

💬 “I saved $328/year just by raising my deductible and submitting my home’s elevation certificate. Worth the hassle.” — Veronica, Fort Myers

10.3 Questions to Ask Before Buying

Too many Floridians rush into buying flood insurance in Florida without knowing the right questions to ask. Whether you’re dealing with a FEMA-backed policy or a private plan, slow down—and get answers.

📝 Ask These Before You Sign:

- What exactly is covered—and what isn’t?

(Are detached garages, basements, or mold damage included?) - Is the coverage replacement cost or actual cash value?

(FEMA often only covers depreciated value for contents.) - Will this meet my mortgage lender’s minimum requirements?

- How long is the waiting period?

- Are there policy caps I need to supplement with excess insurance?

- Can I cancel or switch to private later without penalty?

- Does the insurer cover Additional Living Expenses (ALE)?

🗣️ Dialogue – Agent vs Homeowner

Homeowner: “This looks fine, but it’s cheaper than I expected. What’s the catch?”

Agent: “Great question. The low premium is because it’s ACV-based. You’d only get reimbursed for the current value of your things—not what it costs to replace them.”

Homeowner: “Ah. That changes everything.”

📌 Final Reminder: Don’t shop based on price alone. A $600 policy that leaves you with $30,000 in uncovered losses isn’t really a deal.

✅ You’re almost there. Before clicking “Buy Now” on any policy, revisit:

- Your zone designation (A, AE, X…)

- Home’s elevation and flood mitigation features

- Your financial risk tolerance (deductible, exclusions, max limits)

And always—get multiple quotes.

FAQ

How much is flood insurance in Florida per month?

On average, flood insurance in Florida costs between $40 and $110 per month, depending on where you live, your home’s elevation, and the type of coverage you choose.

For example, a homeowner in Zone X in Orlando might pay around $480/year (or $40/month), while someone in Zone AE in Fort Lauderdale could pay $1,320/year ($110/month) or more if the property is near the water.

💬 A homeowner in Miami told us:

“When I saw my premium hit $98/month, I thought something was wrong—but then I realized my property was one block from a canal and FEMA reclassified the zone last year.”

📍 Infobox – Average Monthly Cost (2025)

Zone X (low risk): $35–$55/month

Zone AE (moderate risk): $65–$95/month

Zone A (high risk): $80–$120/month

(Based on FloridaAllRisk + NAIC 2024 data)

Is it hard to get flood insurance in Florida?

Not really. In fact, getting flood insurance in Florida has become easier than ever, especially since private companies began expanding beyond the NFIP (FEMA).

If you live in a mandatory flood zone (Zone A, AE, or VE), your lender may require it—but you’re automatically eligible.

If you’re in a moderate or low-risk area, like Zone X, you can still buy coverage at lower rates.

🗣️ What surprises most people?

“I thought being inland meant I wasn’t eligible, but the agent said I could get a Preferred Risk Policy for under $500 a year.”

Private carriers like TypTap, Neptune Flood, or Wright Flood now offer streamlined applications online with no elevation certificate required in most cases.

✅ Pro Tip: Even if you’re not required to get flood coverage, many Florida homeowners do—because 30% of flood claims come from low-risk areas.

How much is flood insurance in Florida Zone A?

Zone A is considered high risk, and premiums reflect that. In 2025, most Floridians in Zone A pay between $950 and $1,800 per year for flood insurance.

👩💼 Agent insight:

“If your home is older, lacks flood vents, or is below base flood elevation, you’ll probably be near the top of that range—especially in coastal counties like Sarasota or Charlotte.”

✅ Ways to reduce your Zone A premium:

Install certified flood vents

Elevate major appliances

Submit an updated Elevation Certificate

Bundle flood and windstorm insurance with the same carrier

How much is flood insurance in Florida Zone X?

Zone X is considered low-risk, but that doesn’t mean flood insurance is irrelevant. In fact, over 20% of claims in Florida come from Zone X properties.

Typical premium: $350 to $550 per year, or about $30 to $45 per month.

📍 Example:

Lisa in Gainesville paid $402/year for flood insurance on her townhouse. That’s less than what she pays for streaming services—but gives her peace of mind during hurricane season.

💬 “My neighbor’s house had a pipe burst during a storm. FEMA didn’t help because it wasn’t declared a federal disaster. That made me realize how fragile the system is.”

How much is FEMA flood insurance in Florida?

FEMA-backed flood insurance, also known as NFIP, has standardized pricing based on your zone, elevation, and building characteristics. The average cost in Florida is $958/year, though premiums under FEMA’s new Risk Rating 2.0 model can vary widely.

📣 FEMA (2024):

“Rates are no longer solely based on zone. Risk Rating 2.0 uses more granular data, including distance to water, elevation, and even construction materials.”

Some homeowners in high-risk zones have seen rates rise by 18% annually, while others in lower-risk zones actually saw premiums drop.

How much is flood and hurricane insurance in Florida?

Flood insurance and hurricane (windstorm) insurance are two separate coverages—and you may need both.

⚡ Flood Insurance (NFIP or private):

Covers rising water from storms, overflowing lakes, storm surge

Avg. cost in Florida: $500–$1,300/year

🌪️ Hurricane or Windstorm Insurance:

Often part of your homeowner’s policy (especially in coastal zones)

Avg. cost: $2,000–$4,500/year, depending on your roof, location, and deductible

📊 Combined, many Floridians pay $3,000 to $5,000/year to fully protect their homes from natural disasters.