Car insurance by state requirements create America’s most confusing regulatory puzzle. You could drive legally in Maine with $50,000 coverage but face jail time in North Carolina with the same policy. That’s not hyperbole—it’s the reality of our fragmented insurance system.

Here’s what caught millions off guard in 2025: four states completely rewrote their rules. California doubled requirements after 56 years of zero changes. Virginia killed its “pay $500 instead of buying insurance” loophole. Meanwhile, drivers in Louisiana pay $2,883 yearly while Maine residents spend just $1,175 for similar protection.

The financial stakes couldn’t be higher. Get your car insurance by state requirements wrong and you’re looking at fines, license suspension, or worse—personal bankruptcy if you cause a serious accident. Miss the new 2025 changes and you might be driving illegally without knowing it.

2025’s Biggest Car Insurance by State Shakeups

- California: Minimums jumped from 15/30/5 to 30/60/15 (first change since 1969)

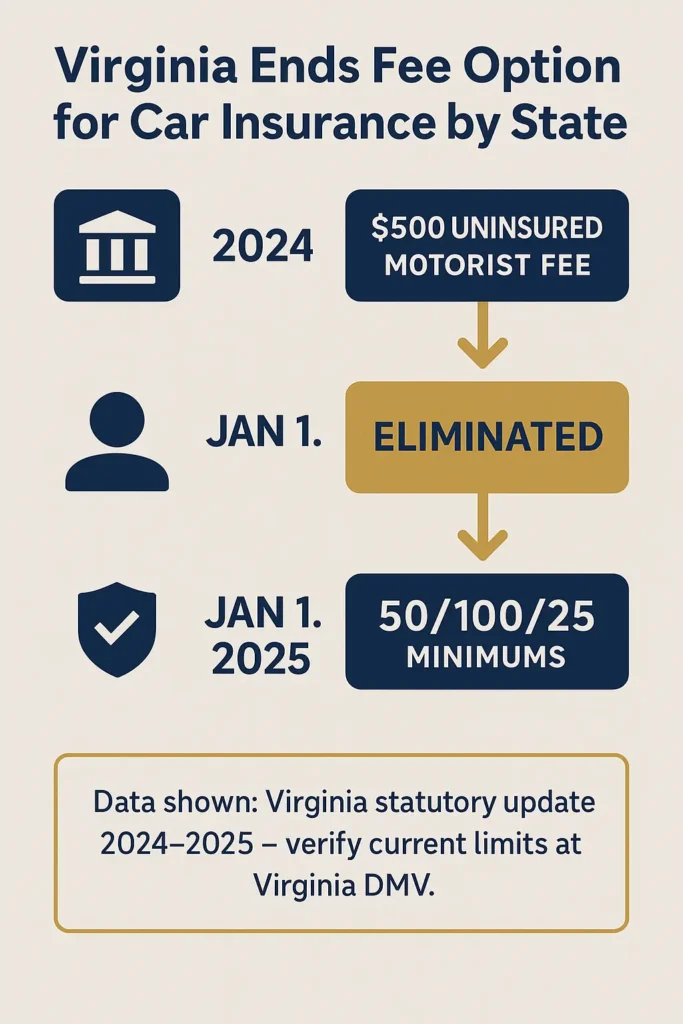

- Virginia: Fee-instead-of-insurance option eliminated entirely

- North Carolina: Property damage soaring to $50,000 (highest in America)

- Utah: Across-the-board increases in all categories

Smart drivers know that minimum coverage often equals maximum financial risk. We’ll show you exactly what each state demands, where costs hurt most, and how to protect yourself without overpaying.

On This Page

1. How Car Insurance by State Requirements Actually Work

Car insurance by state laws operate like a giant jigsaw puzzle where no two pieces match. Each state wrote its own rules based on local politics, accident patterns, and insurance industry lobbying. The result? A system so complex that even insurance agents get confused.

Think about it this way: speed limits change from state to state, but car insurance by state differences are far more dramatic. Drive from New Hampshire (no insurance required) to Massachusetts (strict minimums plus PIP) and your legal obligations flip completely.

Most states demand liability coverage, but the amounts swing wildly. Some add personal injury protection, others require uninsured motorist coverage, and a few throw in medical payments mandates. Missing any piece can void your coverage entirely.

Understanding the Three-Number Code Every car insurance by state requirement uses a standard format: 25/50/25 means:

- $25,000 maximum for one person’s injuries

- $50,000 maximum for all injuries in one accident

- $25,000 maximum for property damage

Don’t let these numbers fool you—they’re floors, not ceilings.

1.1 Liability Coverage Forms the Foundation

Liability insurance represents the core car insurance by state requirement in 49 states. This coverage protects others when you cause accidents, but here’s the brutal truth: it does absolutely nothing for you. Your medical bills? Your car repairs? That’s on you.

The scary math: these state minimums often prove laughably inadequate. A basic emergency room visit runs $3,000-$10,000. Serious surgery hits $50,000-$200,000. Luxury car damage easily reaches $50,000-$100,000. Multi-vehicle accidents can top $1,000,000.

Real-World Disaster Scenario Picture this: you rear-end a BMW in Texas (30/60/25 minimums). The car damage hits $45,000, driver hospitalization costs $75,000, and the passenger needs $30,000 in treatment. Your state minimums cover $60,000 for injuries and $25,000 for property damage. You’re personally liable for $85,000 beyond your coverage.

That’s why experienced drivers carry far more than car insurance by state minimums—they understand that minimums equal maximum financial exposure.

1.2 No-Fault States Flip Everything Upside Down

Twelve states turned traditional insurance logic backwards with no-fault systems. In these car insurance by state frameworks, your insurance pays your medical bills regardless of who caused the accident. Sounds protective, right? There’s a catch.

No-Fault States Requiring PIP

- Florida, Hawaii, Kansas, Kentucky

- Massachusetts, Michigan, Minnesota, New Jersey

- New York, North Dakota, Pennsylvania, Utah

No-fault systems limit your right to sue other drivers except in severe cases. You get faster medical payments but lose legal recourse for pain and suffering. The trade-off typically means higher premiums due to mandatory Personal Injury Protection coverage.

Michigan takes no-fault to extremes with unlimited PIP coverage, creating some of America’s highest car insurance by state costs. Florida requires PIP but no bodily injury liability—a unique combination that confuses many drivers.

1.3 Uninsured Motorist Protection: The Hidden Essential

About 20 states mandate uninsured motorist coverage because they recognize a harsh reality: roughly 13% of American drivers lack insurance entirely. In some states, that number climbs above 25%. Your chances of getting hit by an uninsured driver are disturbingly high.

Uninsured motorist coverage protects you when at-fault drivers can’t pay damages. Without it, you’re essentially gambling that every other driver carries adequate insurance. Given that many states allow ridiculously low minimums, even “insured” drivers might not have enough coverage to handle serious accidents.

Some states require only uninsured motorist bodily injury coverage. Others mandate property damage protection too. A few states let you reject this coverage in writing, which amounts to financial suicide in today’s lawsuit-happy environment.

2. Major 2025 Car Insurance by State Requirement Changes

This year delivered earthquake-level changes to car insurance by state requirements. California’s transformation marked the most significant single-state update in American insurance history. Virginia’s elimination of its fee-based alternative forced thousands into traditional coverage. Together, these changes affect over 50 million drivers.

Why now? Inflation destroyed the buying power of decades-old minimums. A $5,000 property damage limit that seemed reasonable in 1970 can’t handle today’s $40,000 average vehicle values. Medical costs exploded even faster, making old bodily injury limits worthless.

State legislators finally acknowledged reality: their “protection” wasn’t protecting anyone.

2.1 California’s Historic Earthquake

California’s car insurance by state overhaul represents the Golden State’s first requirement change since the Nixon administration. Think about that—these limits survived Watergate, the Vietnam War, multiple recessions, and the tech revolution without adjustment.

California’s Transformation Details

- Previous minimums: 15/30/5 (laughably inadequate since 1990)

- New minimums: 30/60/15 (still modest but more realistic)

- Premium impact: 17% average increase for minimum coverage drivers

- Effective date: January 1, 2025

The change particularly stings budget-conscious drivers who previously scraped by with rock-bottom coverage. However, the new limits provide actual protection instead of legal fiction. A $15,000 property damage limit couldn’t replace a decent SUV’s bumper in 2024.

California’s insurance companies estimated that 40% of minimum coverage drivers faced premium increases exceeding 20%. Many discovered that slightly higher coverage levels cost less with different insurers, making shopping essential.

2.2 Virginia Kills Its Unique Loophole

Virginia operated America’s strangest car insurance by state system until 2024. Drivers could pay the state $500 annually instead of buying insurance—a massive gamble that thousands took. This “uninsured motorist fee” disappeared completely in July 2024.

Virginia’s Complete Makeover

- Fee option: Eliminated July 1, 2024

- Previous minimums: 30/60/20

- New 2025 minimums: 50/100/25 (effective January 1, 2025)

- Impact: Huge sticker shock for previously fee-paying drivers

The double whammy hit former fee-payers especially hard. They went from paying $500 annually to needing full coverage costing $1,500-$3,000 depending on their driving records. Many discovered their credit scores, violation histories, and lack of prior insurance created expensive complications.

Virginia’s change also required proof of continuous coverage, penalizing drivers who used the fee option with higher rates when they finally bought insurance.

2.3 North Carolina and Utah Join the Revolution

North Carolina made the boldest property damage move in American insurance history, jumping to $50,000—higher than any other state. This reflects the Tar Heel State’s recognition that modern vehicle values demand modern protection levels.

Utah’s Measured Approach

- Previous requirements: 25/65/15

- New 2025 requirements: 30/60/25

- PIP requirement: Continues at $3,000 minimum

- Rate impact: Minimal due to modest increases

Utah’s conservative adjustment shows how states can modernize gradually rather than shocking drivers with dramatic changes. The state’s no-fault PIP requirement remains unchanged, maintaining system stability while improving baseline protection.

North Carolina’s property damage leap to $50,000 acknowledges pickup truck and SUV values that routinely exceed $40,000. Even mid-range sedans now cost $25,000-$35,000, making old $25,000 limits inadequate for total losses.

3. Complete Car Insurance by State Cost Breakdown

Car insurance by state costs create America’s wildest pricing disparities. Maine drivers pay less than half what Louisiana residents spend for comparable coverage. These differences reflect complex interactions between weather patterns, legal systems, crime rates, and regulatory approaches.

Understanding these variations helps explain why moving can dramatically impact your insurance budget. Geographic arbitrage works both ways—relocating from expensive to cheap states saves thousands annually, while the reverse creates budget shock.

3.1 America’s Most Expensive Car Insurance by State Markets

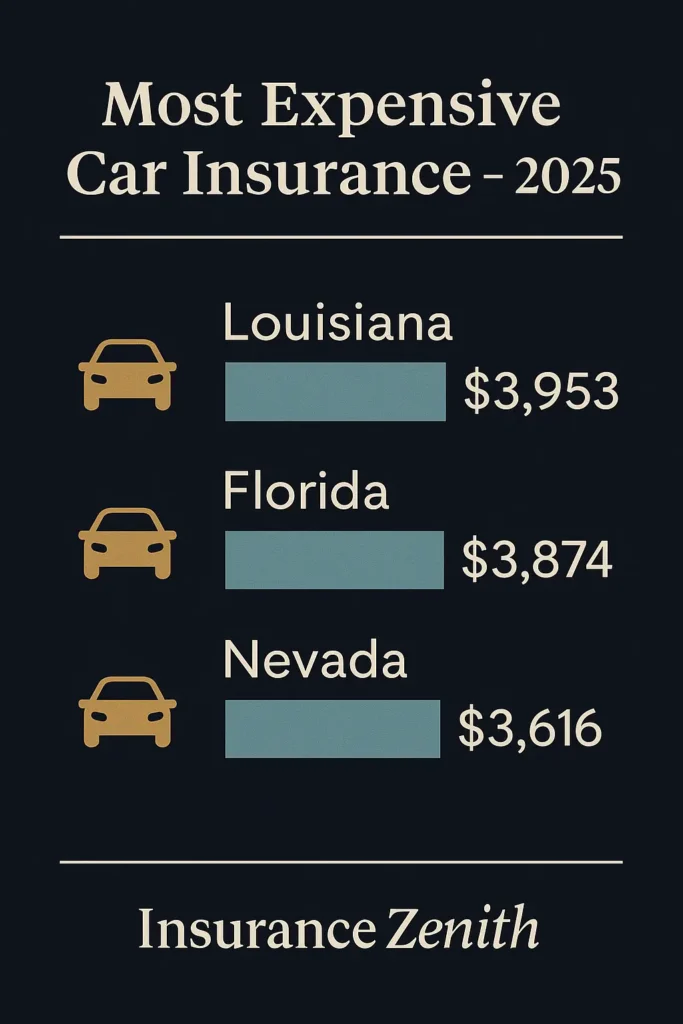

Louisiana: The Undisputed Champion of High Costs ($2,883 annually) Louisiana’s perfect storm of expensive factors creates America’s priciest car insurance by state environment. Frequent severe weather generates massive claim spikes. The state’s legal system encourages lawsuits with generous damage awards. Hurricane Ida alone generated over $15 billion in vehicle damage claims.

Add geographic challenges—much of Louisiana sits below sea level—and you get flood risks that standard policies don’t cover. The state also suffers from high uninsured driver rates, pushing costs onto law-abiding drivers through uninsured motorist claims.

Florida: Hurricane Alley Meets Insurance Fraud ($2,694 annually) Florida’s car insurance by state costs reflect unique challenges that would bankrupt insurers in smaller states. Hurricane exposure creates catastrophic loss potential. The state’s no-fault system requires expensive PIP coverage. Personal injury protection fraud runs rampant, particularly in Miami-Dade and Broward counties.

Florida’s population density, tourist traffic, and retirement community demographics create additional complications. Elderly drivers have higher accident rates, while tourist drivers unfamiliar with local roads generate claim spikes.

Nevada: Urban Concentration Effects ($3,216 annually) Nevada illustrates how population concentration drives car insurance by state costs skyward. Most residents cluster in Las Vegas and Reno, creating traffic density that breeds accidents. The state’s 24/7 entertainment economy means heavy traffic at all hours.

Nevada’s rapid population growth strained infrastructure, creating construction zones and traffic pattern changes that increase accident risks. The state’s “what happens in Vegas” culture also correlates with higher drunk driving rates and associated claims.

3.2 America’s Most Affordable Car Insurance by State Havens

Maine: Rural Roads Equal Lower Risks ($1,175 annually) Maine demonstrates how geography and culture combine to create bargain car insurance by state costs. The state’s low population density means fewer vehicles per mile of road. Rural driving patterns involve less stop-and-go traffic where most accidents occur.

Maine’s stable population, low crime rates, and conservative driving culture reduce claim frequencies. The state experiences minimal severe weather compared to tornado and hurricane zones. Fewer luxury vehicles mean lower theft and repair costs.

New Hampshire: Competitive Market Magic ($1,265 annually) New Hampshire’s unique car insurance by state approach—allowing but not requiring coverage—creates competitive pressure that benefits all drivers. Insurance companies must attract voluntary customers rather than relying on legal mandates.

The Granite State’s “Live Free or Die” philosophy extends to insurance regulation, creating market-friendly policies that keep costs reasonable. Low population density, minimal severe weather, and below-average crime rates contribute to bargain pricing.

Vermont: Small State, Big Savings ($1,319 annually) Vermont’s car insurance by state costs reflect the Green Mountain State’s rural character and stable demographics. Limited urban areas mean less traffic congestion and fewer accident opportunities. The state’s culture emphasizes safe, practical driving over aggressive behavior.

Vermont’s small size allows insurers to understand local risks precisely, enabling accurate pricing that benefits good drivers. The state’s harsh winters actually reduce summer driving, lowering annual mileage and claim exposure.

3.3 Urban vs. Rural: The Great Car Insurance by State Divide

Even within individual states, location creates dramatic car insurance by state cost variations. Urban ZIP codes consistently cost more due to higher theft rates, more accidents, and expensive repair facilities. Rural areas offer savings but sometimes face longer emergency response times that increase injury severity.

City vs. Country Examples

- Texas: Houston averages $42 more monthly than Corpus Christi

- New York: Manhattan ZIP codes vary by $280 monthly within the city

- California: Los Angeles exceeds Central Valley rates by 40%+

These variations mean that moving within your state can impact premiums as much as changing coverage levels. Smart drivers factor insurance costs into housing decisions, especially when choosing between urban and suburban locations.

Urban ZIP codes also face unique risks like vandalism, break-ins, and hit-and-run accidents that rural areas rarely experience. Higher repair costs in cities reflect expensive real estate, union labor, and premium parts availability.

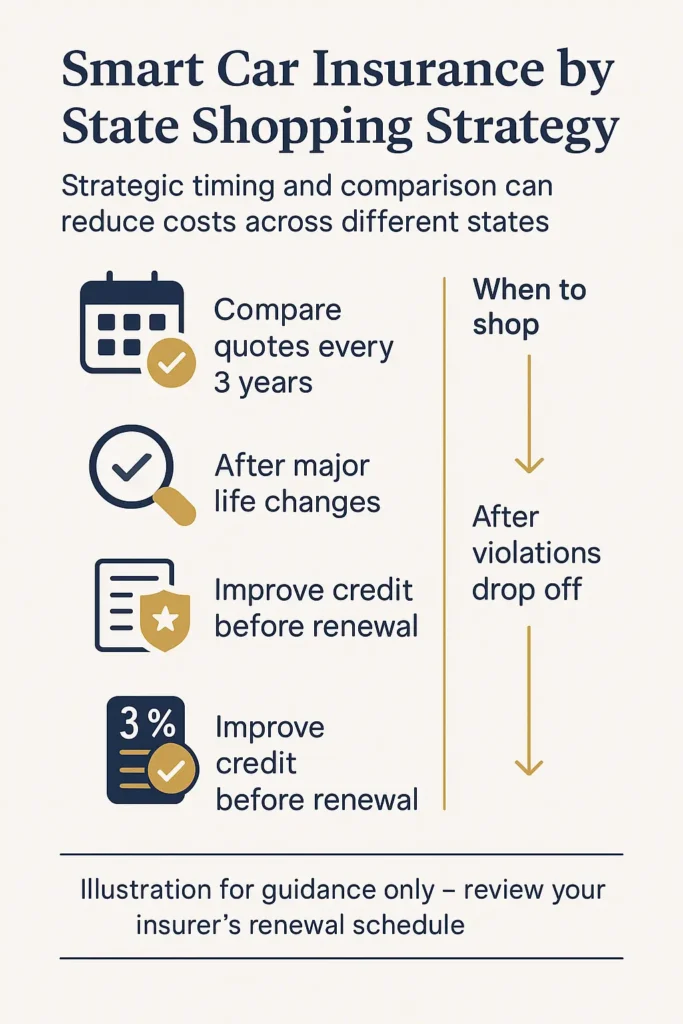

4. Smart Car Insurance by State Shopping Strategies

Mastering car insurance by state shopping requires understanding both universal principles and local market dynamics. National strategies work everywhere, but regional tactics can unlock additional savings specific to your state’s competitive landscape.

The golden rule: shop every three years minimum, but trigger immediate comparisons after major life changes. Different insurers excel in different car insurance by state markets, making loyal customers potentially overpaying customers.

4.1 The Geographic Shopping Advantage

Car insurance by state rate variations create opportunities for savvy shoppers who understand local market dynamics. Some insurers dominate expensive states through risk management expertise. Others excel in cheap states by operating efficiently in low-risk environments.

Regional vs. National Insurer Strategy

- High-cost states: National insurers often provide better value through diversified risk pools

- Low-cost states: Regional insurers frequently offer competitive pricing through local expertise

- Transition states: Mixed markets reward extensive comparison shopping

Learn more about car insurance options and how coverage levels affect your protection and costs across different state requirements.

Research your state’s competitive landscape before shopping. States with many insurers create price competition. States with few options limit shopping benefits but may offer more stable pricing over time.

4.2 Credit Score Optimization: The Hidden Car Insurance by State Factor

Most states allow credit-based insurance scoring, making credit improvement a powerful cost-reduction strategy. The impact varies dramatically by state regulation, with some seeing 80% rate differences between excellent and poor credit scores.

States Restricting Credit Use

- California: Completely prohibits credit scoring for auto insurance

- Hawaii: Severely limits credit factors in pricing decisions

- Massachusetts: Restricts credit-based pricing methodologies

- Michigan: Allows limited consideration in specific circumstances

In unrestricted states, focus on paying bills promptly, reducing credit utilization below 30%, and maintaining long-term accounts to improve your insurance credit score. The investment in credit improvement often pays massive dividends in insurance savings.

For detailed information on how various factors affect your premiums, explore our car insurance calculator to understand rate calculation methods.

4.3 Timing Your Car Insurance by State Shopping

Strategic timing maximizes car insurance by state shopping effectiveness. Certain periods offer better rates due to industry cycles, regulatory changes, and competitive pressures. Understanding these patterns helps secure optimal pricing.

Prime Shopping Seasons

- January-March: New year rate filings take effect

- After major claims events: Competitors adjust pricing aggressively

- Following credit score improvements: Immediate impact on rate calculations

- When violations drop off: Three to five-year improvement cycles

Avoid shopping immediately after accidents or violations when your risk profile appears worst. Wait for rate impacts to stabilize unless your current insurer raises rates dramatically.

4.4 State-Specific Discount Optimization

Different states offer varying discount opportunities based on local priorities and regulations. Understanding which discounts your car insurance by state market emphasizes helps maximize savings potential.

Regional Discount Patterns

- High-theft states: Enhanced security discounts (alarms, tracking, garaging)

- Weather-prone states: Defensive driving course credits

- Urban states: Low-mileage and usage-based programs

- Rural states: Multi-vehicle and bundling discounts

The National Association of Insurance Commissioners provides comprehensive information about consumer rights and available protections in different state markets.

5. Avoiding Common Car Insurance by State Mistakes

Car insurance by state pitfalls catch even experienced drivers off guard. Each state presents unique traps that can void coverage, create legal problems, or cost thousands in unnecessary premiums. Understanding these dangers helps you navigate successfully.

The biggest mistake? Assuming car insurance by state requirements provide adequate protection. State minimums represent legal floors, not financial ceilings. This misunderstanding leaves millions of Americans financially exposed.

5.1 The Minimum Coverage Financial Trap

State minimums create dangerous illusions of protection. These limits were set decades ago when medical costs were lower, vehicles were cheaper, and lawsuit awards were smaller. Today’s accident costs regularly exceed state minimums by enormous margins.

Real Accident Cost Reality Check

- Emergency room visit: $3,000-$10,000 average

- Major surgery: $50,000-$200,000 range

- Luxury vehicle total loss: $50,000-$100,000+

- Multi-vehicle pile-up: $200,000-$1,000,000+

Many car insurance by state minimums would leave you personally liable for catastrophic amounts in serious accidents. The “savings” from minimum coverage can become the most expensive financial decision of your life.

Consider this: would you rather pay an extra $300 annually for higher limits or risk $100,000+ personal liability in a serious accident? The math speaks for itself.

5.2 Interstate Travel Coverage Complications

Your car insurance by state policy automatically adjusts to provide higher minimums when traveling to states with greater requirements. However, this doesn’t guarantee optimal protection, and international travel creates additional complications requiring advance planning.

Cross-Border Coverage Rules

- Canada: Most U.S. policies extend coverage, but verify before traveling

- Mexico: Standard U.S. policies typically provide zero coverage

- Rental cars: Different states impose varying rental coverage requirements

Plan international travel carefully to ensure continuous protection. Mexican border states offer short-term policies for visitors, but advance planning prevents coverage gaps that could prove catastrophic.

For drivers in border states like California, understanding car insurance in California requirements becomes crucial for both local driving and cross-border travel situations.

5.3 Credit Score Neglect in Sensitive States

In states allowing credit-based pricing, poor credit can increase car insurance by state premiums by 50-80%. Many drivers remain unaware that credit affects insurance costs, missing opportunities for substantial savings through credit improvement efforts.

Credit Improvement Impact Timeline

- Immediate improvements: Paying down high-balance credit cards

- Short-term gains: Disputing and correcting credit report errors

- Medium-term strategy: Establishing payment history consistency

- Long-term building: Maintaining older accounts for credit history length

The Consumer Financial Protection Bureau offers resources for understanding how credit affects various financial products, including insurance premiums.

5.4 Moving Without Policy Updates: A Costly Oversight

Failing to update your car insurance by state policy when moving—even within your state—can void coverage or create gaps. Different ZIP codes have different rates and risk factors, making updates essential for maintaining valid protection.

Moving Day Insurance Checklist

- Notify your insurer before moving day

- Confirm coverage availability in your new location

- Update your address officially with the state DMV

- Verify new area requirements and adjust coverage accordingly

- Research local market competition for potential savings

The Insurance Information Institute provides extensive research on geographic factors affecting auto insurance costs and requirements across different markets.

For comprehensive information about finding affordable coverage options, our cheap car insurance guide explains strategies for reducing costs while maintaining adequate protection levels.

Key Takeaways

Bottom Line: Car insurance by state requirements and costs vary dramatically across America, with the cheapest states offering rates less than half of the most expensive markets. The 2025 car insurance by state requirement changes in four states represent the most significant regulatory shifts in decades, affecting millions of drivers nationwide.

Essential Action Steps for Every Driver:

- Research your car insurance by state specific requirements and any recent changes thoroughly

- Compare quotes from multiple insurers every 2-3 years for optimal pricing

- Consider coverage beyond car insurance by state minimums for adequate financial protection

- Maintain good credit in states that allow credit-based pricing methodologies

- Update your policy immediately when moving, even within your current state

Smart Financial Strategies: The key to smart car insurance by state decisions lies in understanding your state’s unique regulatory environment while recognizing that minimums rarely provide adequate protection. Focus on finding the right balance between legal compliance and financial security, factoring in your state’s cost patterns and regulatory approaches.

Whether you’re a new driver learning complex requirements or an experienced motorist dealing with car insurance by state requirement changes, staying informed about your state’s insurance landscape empowers better financial decisions and helps ensure proper protection for your specific situation.

For additional guidance on understanding coverage options and finding the best rates in your area, explore our comprehensive cheap car insurance guide and learn about coverage variations across different state markets and regulatory environments.

FAQ

Which state has the highest car insurance rates?

Nevada has the highest car insurance rates in the US at $3,216 annually, followed closely by Louisiana at $2,883 and Florida at $2,694. Nevada’s high costs stem from urban concentration effects, with most residents clustered in Las Vegas and Reno creating traffic density that breeds accidents.

The state’s 24/7 entertainment economy means heavy traffic at all hours, while rapid population growth has strained infrastructure, creating construction zones and traffic pattern changes that increase accident risks. The “what happens in Vegas” culture also correlates with higher drunk driving rates and associated claims.

Other expensive states include:

Louisiana: $2,883 (severe weather, high litigation rates)

Florida: $2,694 (hurricane exposure, no-fault system, fraud)

These costs reflect complex interactions between weather patterns, legal systems, crime rates, and regulatory approaches that create America’s wildest pricing disparities.

External Resource: For current state-by-state rate comparisons and detailed cost breakdowns, visit the Insurance Information Institute’s Auto Insurance Database which provides comprehensive premium data across all states.

What state has the cheapest car insurance?

Maine offers the cheapest car insurance in America at just $1,175 annually for full coverage. The Pine Tree State benefits from several cost-reducing factors that create ideal conditions for low premiums.

Why Maine is cheapest:

Low population density means fewer vehicles per mile of road

Rural driving patterns involve less stop-and-go traffic where most accidents occur

Stable population with low crime rates

Minimal severe weather compared to tornado and hurricane zones

Conservative driving culture reduces claim frequencies

Other affordable states:

New Hampshire: $1,265 (competitive market, low regulations)

Vermont: $1,319 (rural character, stable demographics)

The difference between Maine and the most expensive states represents over $2,000 annually in potential savings, demonstrating how geographic location dramatically impacts insurance costs.

Does it matter if your car insurance is in another state?

Your car insurance automatically adjusts to provide higher minimums when traveling to states with greater requirements, but several complications can arise with out-of-state coverage.

Key considerations:

Automatic adjustment: Your policy provides your home state minimums OR the visited state’s requirements, whichever is higher

Claims processing: Different states have varying legal systems and settlement patterns

Premium calculations: Rates are based on your garaging address, not where accidents occur

International travel complications:

Canada: Most US policies extend coverage, but verify before traveling

Mexico: Standard US policies typically provide zero coverage, requiring separate Mexican insurance

The document emphasizes that failing to update your policy when moving—even within your state—can void coverage or create dangerous gaps due to different ZIP code risk factors.

External Resource: For detailed information about interstate coverage rules and requirements, consult the Federal Highway Administration’s Insurance Guidelines which explains coverage obligations across state lines.

Is there a car insurance that covers all 50 states?

Yes, major national insurance companies provide coverage that works in all 50 states, automatically adjusting to meet each state’s minimum requirements. However, “covers all states” doesn’t mean identical coverage everywhere.

How national coverage works:

Your policy automatically provides the higher of your purchased limits OR the state’s minimum requirements

Claims are handled according to the state where the accident occurs

Premium calculations reflect your home state’s risk factors and regulations

Top national insurers with 50-state coverage:

State Farm, Geico, Progressive, Allstate, Nationwide

Important limitations:

Not all insurers operate in every state (some regional carriers have limited territories)

Coverage gaps can occur during international travel

Different states have varying no-fault laws and legal systems

The document notes that different insurers excel in different state markets, making comparison shopping essential even with national carriers.

In which 3 states is it most expensive to own a car?

Based on the insurance cost data provided, the three most expensive states for car insurance ownership are:

Nevada: $3,216 annually

Louisiana: $2,883 annually

Florida: $2,694 annually

Nevada’s unique cost drivers:

Urban concentration in Las Vegas and Reno

24/7 traffic from entertainment economy

Rapid population growth straining infrastructure

Higher drunk driving rates

Louisiana’s perfect storm:

Frequent severe weather generating massive claims

Legal system encouraging lawsuits with generous awards

Hurricane exposure (Hurricane Ida alone generated $15 billion in vehicle damage)

High uninsured driver rates

Florida’s challenging environment:

Hurricane exposure creating catastrophic loss potential

No-fault system requiring expensive PIP coverage

Rampant personal injury protection fraud

High population density and tourist traffic

External Resource: For comprehensive vehicle ownership cost analysis including insurance, registration, and taxes, visit AAA’s Driving Costs Calculator which breaks down all expenses by state.

What 3 states are car insurance rates going up in?

The document identifies four states that significantly changed their requirements in 2025, leading to rate increases:

California: Historic overhaul doubling minimums from 15/30/5 to 30/60/15 (first change since 1969) 17% average increase for minimum coverage drivers

40% of minimum coverage drivers faced increases exceeding 20%

Virginia: Eliminated fee-instead-of-insurance option and increased minimums to 50/100/25 Former fee-payers went from $500 annually to $1,500-$3,000 for full coverage

Double impact from elimination of fee option plus higher requirements

North Carolina: Set America’s highest property damage minimum at $50,000 Reflects recognition that modern vehicle values demand modern protection

Acknowledges pickup truck and SUV values routinely exceeding $40,000

Utah: Increased requirements from 25/65/15 to 30/60/25 More measured approach with minimal rate impact

Conservative adjustment showing gradual modernization

Which US state does not require car insurance?

New Hampshire is the only state that doesn’t require car insurance, but this doesn’t mean drivers can ignore financial responsibility. The “Live Free or Die” state still requires drivers to prove they can pay for damages they cause.

New Hampshire’s unique system:

No mandatory insurance requirement

Must demonstrate financial responsibility if involved in accidents

Can face license suspension and significant penalties if unable to pay damages

Creates competitive pressure that actually benefits drivers with lower rates ($1,265 annually)

Financial responsibility alternatives in New Hampshire:

Self-insurance with sufficient assets

Surety bonds

Cash deposits with the state

The document notes that New Hampshire’s approach creates competitive pressure since insurance companies must attract voluntary customers rather than relying on legal mandates, resulting in more competitive pricing.

External Resource: The New Hampshire Department of Safety provides detailed information about the state’s financial responsibility requirements and alternatives to traditional insurance.

Who has the most expensive car insurance?

Based on state averages, drivers in Nevada face the most expensive car insurance at $3,216 annually. However, individual driver characteristics can create even higher costs regardless of location.

Factors creating the highest individual premiums:

Poor credit scores (can increase rates 50-80% in states allowing credit scoring)

Multiple violations and accidents

DUI convictions

Teenage drivers or drivers under 25

High-risk vehicles (luxury cars, sports cars)

Most expensive demographic combinations:

Young male drivers with sports cars in expensive states

Drivers with multiple violations in urban high-crime areas

High-risk drivers needing SR-22 filings

The document emphasizes that even within expensive states, rates vary dramatically by ZIP code, with urban areas consistently costing more due to higher theft rates, more accidents, and expensive repair facilities.

External Resource: For personalized rate comparisons and understanding how various factors affect your specific situation, use Progressive’s Rate Comparison Tool which provides quotes based on individual risk profiles.

Why is Maine car insurance so cheap?

Maine’s car insurance costs just $1,175 annually due to a perfect combination of geographic, demographic, and cultural factors that minimize insurance risks.

Geographic advantages:

Low population density: Fewer vehicles per mile of road reduces accident frequency

Rural driving patterns: Less stop-and-go traffic where most accidents occur

Minimal severe weather: Limited exposure to tornadoes, hurricanes, and catastrophic storms

Lower crime rates: Reduced theft and vandalism claims

Cultural and economic factors:

Conservative driving culture: Emphasis on safe, practical driving over aggressive behavior

Stable demographics: Limited population growth and established communities

Lower vehicle values: Fewer luxury vehicles mean reduced theft and repair costs

Competitive insurance market: Multiple carriers competing for business

Seasonal advantages:

Harsh winters actually help: Reduced summer driving lowers annual mileage and claim exposure

Limited urban congestion: Few major metropolitan areas mean less traffic density

The document notes that Maine’s small size allows insurers to understand local risks precisely, enabling accurate pricing that benefits good drivers through lower premiums.

External Resource: For detailed information about factors affecting auto insurance rates and state-specific considerations, visit the Maine Bureau of Insurance which provides consumer resources and rate information specific to Maine drivers.