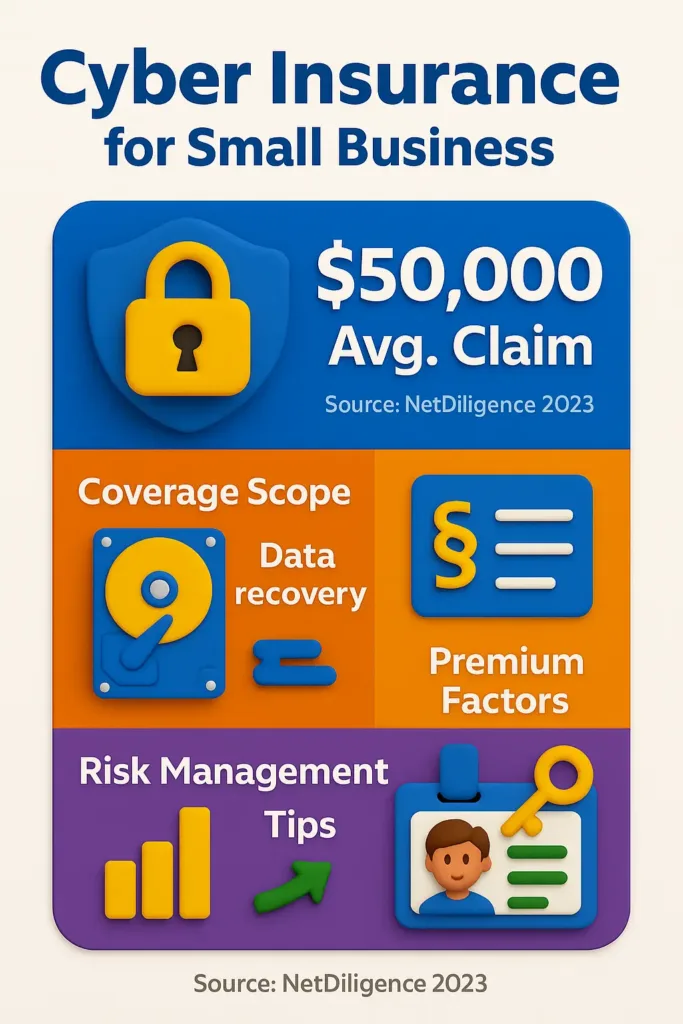

Cyber insurance

Protect your company from cyber threats such as ransomware, phishing attacks, and data breaches. Learn how tailored coverage can safeguard your digital assets, reputation, and financial stability.

Coverage Scope

Covers costs related to data recovery, legal fees, notification to affected parties, and public relations after a cyber incident.

Premium Factors

Premiums depend on business size, industry risk level, data sensitivity, and existing cybersecurity measures in place.

Risk Management Tips

Includes advice on implementing strong passwords, employee training, regular software updates, and multi-factor authentication to reduce cyber risks.