Jake had just finished his coffee in downtown Worcester when he found a bright orange envelope on his windshield—an expired insurance fine. His last policy had auto-renewed at a higher premium without notice. Frustrated, he Googled: “How to get the best car insurance quotes Massachusetts.” It wasn’t just about saving money—it was about not being caught off guard again.

If you’re wondering the same, here’s what you need to know: In Massachusetts, car insurance rates vary up to $1,600/year depending on your ZIP code, age, and driving history (source: NAIC, 2024). Getting multiple quotes is the fastest way to avoid overpaying—especially in a state with one of the highest average premiums in New England.

→ Let’s break down how quotes actually work, how to compare them smartly, and what to watch out for in 2025.

On This Page

1. How Jake in Worcester Discovered the Real Cost of Car Insurance

1.1 A Late Renewal, a Fine, and a Wake-Up Call

Jake had just finished his coffee on a snowy morning in downtown Worcester when he spotted an orange slip tucked under his windshield wiper. A $525 fine. That’s what it cost him for unknowingly driving uninsured—just 12 days after his car insurance policy lapsed. He had assumed it would auto-renew like usual. But this time, the insurer had quietly changed its renewal policy, and the email notice was buried in a sea of spam.

That lapse triggered more than just a fine. It automatically flagged Jake as a high-risk driver in the state database and suspended his license until he could prove continuous coverage. Overnight, his car insurance quotes in Massachusetts spiked by 30 to 40%, based on 2025 data from the Massachusetts Division of Insurance.

Jake’s record was spotless—no speeding tickets, no claims. But in Massachusetts, even a minor disruption in coverage can push your risk rating into expensive territory.

Pro Tip

Always activate both SMS and email alerts from your insurer. Missing a renewal by a few days can cost you hundreds—plus a trip to the RMV.

1.2 What He Learned About Insurance Pricing

Determined not to get caught off guard again, Jake spent the weekend comparing car insurance quotes in Massachusetts across both national and local providers. The numbers shocked him: for the same liability coverage, quotes ranged from $108 to $267 per month. Same car, same ZIP code, same coverage level. The only variable? The insurer.

Why such a huge range? Because in Massachusetts, quotes aren’t standardized. They’re shaped by a blend of ZIP code data, driving history, prior coverage, vehicle type, and even financial reliability.

Jake lives in ZIP code 01610, which carries one of the highest insurance risk ratings in Worcester. When he tested the quote using a nearby ZIP (01605), it dropped by $312 per year. Just three miles made the difference.

Dialogue – Jake and a local agent

— “Why is my new quote so much higher than last year?”

— “Two reasons: the lapse in coverage and your ZIP code. You were reclassified as higher risk.”

— “But I’ve never had an accident.”

— “The algorithm doesn’t care—it flags data, not intentions.”

Eventually, Jake chose a mid-tier insurer offering decent customer support and added roadside assistance. His final premium? $142/month. Still higher than before, but much lower than the original offers.

📊 UX ENRICHMENT – Sample Quote Range (Worcester, MA, 2025)

| Driver Profile | Monthly Quote Range | Example Provider |

|---|---|---|

| Clean record, age 40 | $118 – $168 | Liberty Mutual |

| Minor accident, age 27 | $139 – $229 | GEICO |

| No prior insurance, age 33 | $154 – $267 | MAPFRE, Progressive |

(Source: Sample quote simulations in ZIPs 01604–01610, January 2025)

Jake’s experience reveals what many drivers overlook: car insurance quotes in Massachusetts aren’t locked. They shift constantly with factors you might never consider. If you don’t re-shop, you could be overpaying by hundreds every year.

2. How Car Insurance Quotes Work in Massachusetts

2.1 What Factors Affect Your Quote?

Let’s not sugarcoat it—car insurance quotes in Massachusetts aren’t built on logic alone. They’re shaped by complex algorithms that weigh everything from your ZIP code to the type of car you drive. It’s like being scored by a system that knows more about your life than your best friend.

Take Anna, 29, a marketing analyst who moved from East Somerville to Medford. Same job, same 2019 Honda Civic, still no tickets. But when she changed her garaging address, her premium jumped $34/month. Why? Because her new street had a slightly higher history of claims and rear-end collisions.

Massachusetts operates under a managed competition model. That means the state approves base rates, but each insurer tweaks them using their own formulas. These factors typically carry the most weight:

- ZIP code and garaging address

- Driving record (past 5 years)

- Years licensed and age

- Vehicle type and safety rating

- Annual mileage

- Insurance history and any gaps

- Credit score (still considered, especially by national carriers)

Pro Tip

If your quote seems suspiciously high, ask the insurer for a “rating explanation.” They’re required to provide it—and it may expose outdated info or errors that you can dispute.

One thing’s certain: there’s no such thing as a “standard rate” in the Bay State.

Understanding these factors becomes crucial when comparing different policy options. Our comprehensive car insurance guide explains how these variables interact across different states and coverage types.

2.2 The Role of ZIP Code, Driving History, and Vehicle Type

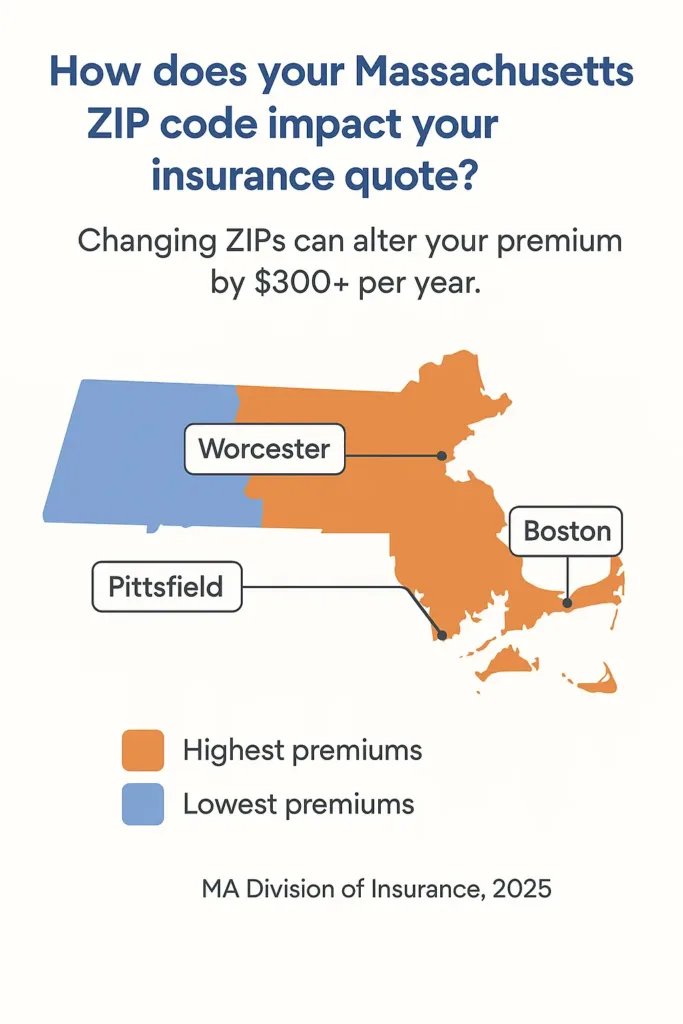

Think your driving record is squeaky clean? That’s great—but it’s only part of the story. In Massachusetts, your ZIP code acts like a digital fingerprint for insurers. It determines your baseline risk before they even ask your name.

Here’s what ZIP data includes:

- Frequency of collisions

- Rate of stolen vehicles

- Average repair costs

- Lawsuit rates

- Density of uninsured drivers

Let’s compare three cities:

| ZIP Code | Location | Avg. Monthly Quote | Relative Risk |

|---|---|---|---|

| 02118 | Boston (South End) | $174 | High |

| 01605 | Worcester North | $159 | Moderate |

| 01201 | Pittsfield | $112 | Low |

(Data source: 2025 average quote simulations by ZIP)

Now add your personal record. A single speeding ticket in the last 36 months? That could boost your rate by 15–20%. If you’ve had no accidents and carry continuous coverage, many insurers apply “good driver” discounts—unless you moved ZIP codes and reset your history with a new carrier.

Then there’s the car itself. A 2023 Subaru Forester with crash-avoidance tech gets favorable pricing. A 2010 Dodge Charger without anti-theft? Not so much. Some vehicles are simply “rated higher” due to repair costs or theft frequency.

Dialogue – Agent and Client, Dorchester

— “Why did my rate jump even though I’ve never filed a claim?”

— “Your new ZIP has more uninsured drivers and rear-end claims. Plus, your new SUV costs more to fix than your old sedan.”

📊 UX ENRICHMENT – Real Impact of ZIP & Vehicle (2025)

| Driver Profile | Vehicle | ZIP Code | Monthly Quote |

|---|---|---|---|

| Safe driver, 34 | 2021 Toyota Camry | 02118 | $172 |

| Same driver | 2021 Toyota Camry | 01201 | $117 |

| Same ZIP, new car | 2023 Jeep Grand Cherokee | 02118 | $203 |

Bottom line? Even perfect drivers can get hit with steep quotes. In Massachusetts, it’s not just how you drive—it’s where you drive, what you drive, and whether your profile fits the insurer’s algorithm.

3. Massachusetts Auto Insurance Laws in 2025

3.1 Minimum Coverage Requirements

Let’s clear this up: just because a policy is “legal” doesn’t mean it’s safe. Many drivers in Massachusetts carry only the minimum—and later realize it’s barely enough to cover a trip to the ER, let alone a multi-car collision on I-93.

Ray, a 43-year-old Uber driver in Lowell, found that out the hard way. His $36/month policy met the legal minimum. But when he rear-ended an SUV during a rainy Friday commute, the other driver claimed whiplash. Ray’s insurer covered $8,000. The hospital bill was $17,600. Guess who got stuck with the difference?

Here’s what the Commonwealth of Massachusetts requires in 2025:

| Coverage Type | Minimum Required |

|---|---|

| Bodily Injury to Others | $20,000 per person / $40,000 per accident |

| Property Damage | $5,000 |

| Personal Injury Protection (PIP) | $8,000 |

| Bodily Injury by Uninsured Auto | $20,000 / $40,000 |

These limits haven’t changed in years, even as medical costs and repair estimates have climbed dramatically. Just fixing a bumper and repainting a fender on a 2024 vehicle can exceed $6,000—already more than the property damage minimum.

Official Note – MA Insurance Bulletin #04-INS, 2025

“Motorists must maintain active liability insurance to operate any private passenger vehicle legally in the Commonwealth.”

It’s important to understand that Massachusetts is a no-fault state. That means your insurer pays certain injury-related bills regardless of who caused the crash—but there are thresholds. If the accident leads to over $2,000 in medical costs or causes lasting harm, lawsuits become fair game.

For financed or leased vehicles? The lender typically requires collision and comprehensive coverage on top of the state minimum. Why? Because they’re protecting the car as an asset—not just you.

Pro Tip

If your quote feels too good to be true, check what’s not included. Many drivers confuse “minimum coverage” with “full coverage.” They’re not the same—and the difference can be financially devastating.

3.2 Penalties for Driving Uninsured in MA

Some drivers think of insurance as optional—something you “get around to” when life slows down. But in Massachusetts, driving without insurance is a criminal offense, not just a ticket.

Leah, a 24-year-old nursing student in Springfield, missed two premium payments. She didn’t realize her policy had been canceled. When she got pulled over for a broken taillight, she also got her license suspended on the spot.

Within 72 hours, Leah was dealing with:

- A $560 reinstatement fine

- A required SR-22 filing (a certificate of financial responsibility)

- A 60-day license suspension

- A spike in premiums of over 60%

- An automatic “high-risk” label on all future car insurance quotes in Massachusetts

And reinstating coverage? That didn’t erase the violation from her record.

Dialogue – RMV Clerk, Springfield

— “Even if you’re reinstated, the lapse stays on file for six years.”

— “I didn’t even drive the car!”

— “Intent doesn’t matter. The system only tracks coverage status.”

Under current 2025 law, uninsured drivers face:

- Fines of $500–$5,000

- Mandatory license suspension (60 days minimum)

- Up to one year in jail (for repeat offenses)

- SR-22 requirement for future policies

- Long-term reclassification as a high-risk driver

Here’s the worst part: even one lapse—even if you don’t drive during it—can inflate your car insurance quotes in Massachusetts for years. Most insurers will treat you like you’ve had an at-fault crash.

📊 UX ENRICHISSEMENT – Legal Minimums vs. Real-World Risk

| Coverage Type | Legal Minimum (MA, 2025) | Real-World Concern |

|---|---|---|

| Bodily Injury to Others | $20K/$40K | ER visits and rehab often exceed $40K |

| Property Damage | $5,000 | Most new vehicles exceed $6,500 in repairs |

| PIP (No-Fault) | $8,000 | Doesn’t cover long-term pain treatment |

| Uninsured Motorist Coverage | $20K/$40K | Hit-and-run injuries often exceed $50K |

| Coverage Lapse | Illegal | Triggers SR-22, license suspension, and surcharges |

Pro Tip

Set up multiple payment alerts—text, calendar, email—and consider autopay through your insurer’s app. In Massachusetts, one missed payment can cost more than three years of safe driving discounts.

4. Where to Get Car Insurance Quotes in Massachusetts

4.1 Online Comparison Tools vs. Local Agents

When Mike, a freelance designer in Cambridge, bought a new hybrid, he figured he’d grab a quick quote online and call it a day. Within ten minutes, he had six car insurance quotes in Massachusetts—ranging from $114 to $197/month. Same driver, same car, totally different prices. That’s when he realized: not all quotes are built the same.

Massachusetts is a managed competition state. That means insurers set their own rates—but within a state-approved framework. Online tools like The Zebra, Compare.com, or Gabi make it easy to compare prices, but many don’t account for ZIP-specific risk, prior coverage gaps, or your actual garaging location.

On the flip side, local agents often have access to regional carriers—like MAPFRE or Arbella—that don’t show up in big-name tools. They can also catch coverage mismatches, recommend discounts you didn’t know existed, and factor in real-life details like whether your car is parked on-street or in a private garage.

Dialogue – Mike and his local agent in Cambridge

— “Why is this quote $40 less than the online one?”

— “Because we included your loyalty discount and adjusted for your actual parking situation. The algorithm online guessed.”

Here’s how to make both work for you:

🧠 Pro Tip

Start with online comparison tools to get a baseline. Then bring that data to a licensed MA agent for a personalized second opinion. The hybrid approach almost always saves money—or reveals coverage gaps.

4.2 Top Insurers in MA and Their Quote Platforms

So who should you actually get a quote from? In Massachusetts, it depends on whether you want speed, context, or both.

➤ National Carriers with Online Tools

These offer convenience—but often miss local pricing nuances.

| Company | Instant Quote | MA-Specific Adjustments | Mobile App |

|---|---|---|---|

| GEICO | ✅ Yes | ❌ Limited | ✅ Yes |

| Progressive | ✅ Yes | ✅ Some ZIP + credit factors | ✅ Yes |

| Liberty Mutual | ✅ Yes | ✅ Includes MA minimums | ✅ Yes |

➤ Regional or Hybrid Providers

Often overlooked, but they know Massachusetts like the back of their hand.

| Company | Instant Quote | Agent Required | Strength |

|---|---|---|---|

| MAPFRE | ✅ Yes | Optional | MA-specific coverage options |

| Arbella | ❌ No | ✅ Yes | Local claims and underwriting |

| Safety Insurance | ❌ No | ✅ Yes | Strong regional reputation |

➤ Official Tools

- Mass.gov – Overview of legal requirements, but no quotes

- Division of Insurance Consumer Tool – Allows policy comparison (coverage only)

Official Quote from MA Division of Insurance, 2025

“Consumers are encouraged to compare multiple insurance providers to evaluate both price and protection levels.”

And don’t forget: there’s no state-run quote exchange like there is for health insurance. All quotes come from private carriers, even if you start on an official directory. For broader context on how insurance markets operate, explore our detailed analysis of insurance regulation and consumer protection.

📋 UX ENRICHISSEMENT – Checklist: Getting a Reliable MA Quote

| ✅ To-Do | 📌 Why It Matters |

|---|---|

| Know your current coverage | Helps match or improve your existing plan |

| Gather your VIN and driver’s license | Ensures exact vehicle and history rating |

| Confirm garaging ZIP | Rates vary dramatically by address |

| Use both online and local sources | Balances convenience with context |

| Ask about MA-specific discounts | Some carriers reward local safety upgrades |

Pro Tip

If a quote feels “too cheap,” ask: “Is this estimate or final pricing?” Many tools display teaser rates—especially if you haven’t entered your VIN or full history yet.

In short, finding the best car insurance quotes in Massachusetts isn’t just about who offers the fastest form. It’s about understanding the layers behind each price—and making sure the fine print fits your real-life needs.

5. What a “Good” Car Insurance Quote Looks Like in MA

5.1 Average Rates by Age, Location, and Vehicle

Not all car insurance quotes Massachusetts drivers receive are actually “good.” A quote might look low at first glance, but unless it matches your profile and covers your risks, it’s just a number.

Take Rachel, a 26-year-old barista from Salem. She switched from a Toyota Camry to a used Mustang—same job, same ZIP code—and her quote jumped $92/month. Why? Because that Mustang ranked higher in accident risk and theft rate, which insurers flag immediately.

Let’s zoom out. According to 2025 projections from the Massachusetts Insurance Rating Bureau, here’s how rates stack up based on real driver data:

📊 UX ENRICHISSEMENT – Average Premiums by Driver Profile (MA, 2025)

| Driver Profile | Avg. Annual Premium |

|---|---|

| 22-year-old male, Boston, Civic | $2,690 |

| 35-year-old female, Worcester, SUV | $1,540 |

| 50-year-old married, Quincy, sedan | $1,210 |

| 67-year-old retired, Pittsfield, van | $980 |

That’s a $1,700+ swing—purely based on ZIP code, age, and car type.

Here’s what quietly drives up or down your quote:

- Annual mileage (daily commute vs. leisure)

- Credit-based insurance scores

- Vehicle’s crash rating and theft index

- Recent claims or gaps in prior coverage

- Garaging conditions (street vs. driveway vs. garage)

✅ Pro Tip

Always enter your actual VIN and license number when requesting car insurance quotes in Massachusetts. Many tools show low “preview” prices that jump once verified details kick in.

5.2 When Cheap Isn’t Smart: Understanding Value vs. Price

Jake—remember him from Worcester?—learned this lesson the hard way. After getting excited by a $110/month policy, he later found out it lacked uninsured motorist protection and had a $2,000 deductible. A minor fender-bender left him paying out-of-pocket for a rental car and damages.

Mini Dialogue – Jake and his new agent

— “Why was that quote so cheap?”

— “It excluded collision, UIM, and had high out-of-pocket costs. That’s how they trimmed the price.”

This is where most drivers get tripped up. They chase the lowest quote without digging into what’s actually included—or missing.

Here’s how to spot a strong quote from a risky one:

✅ Must-Haves in a Solid MA Car Insurance Quote

- Bodily injury coverage above the MA minimum ($20K/$40K is rarely enough)

- Collision and comprehensive coverage (especially for cars under 10 years old)

- Moderate deductibles ($500–$1,000 max)

- Rental car reimbursement and roadside assistance

- Transparent list of applied discounts (bundles, safe driver, anti-theft…)

📋 UX ENRICHISSEMENT – MA Quote Quality Checklist

| Question to Ask | Why It Matters |

|---|---|

| What’s the bodily injury limit? | MA minimums are outdated—upgrade for safety |

| Is collision/comprehensive included? | Crucial for newer or financed vehicles |

| Any optional protections like UIM or rental? | Avoid costly surprises during claims |

| Are discounts detailed? | Helps verify that you’re not leaving money behind |

| Is this quote final or just an estimate? | Impacts budgeting and coverage decisions |

✅ Pro Tip

Before accepting any car insurance quotes in Massachusetts, ask:

“What’s excluded from this policy?”

If the answer is unclear, walk away.

A good quote isn’t just low—it’s fair, complete, and responsive to your needs as a Massachusetts driver. If your plan can’t handle a hit-and-run or a rental car scenario, it’s not cheap. It’s dangerous.

For drivers seeking maximum savings without sacrificing protection, consider exploring our guide to cheap car insurance strategies that maintain essential coverage levels.

6. Common Misconceptions About Car Insurance Quotes in Massachusetts

6.1 “Quotes are the same everywhere”

When Mia moved from Cambridge to Holyoke, she expected her insurance premium to stay flat. Same vehicle, same employer, same daily mileage. But her new car insurance quote in Massachusetts came back $56/month higher.

Why? Because quotes aren’t just about you. They’re about where you live. In Massachusetts, ZIP codes function like miniature risk zones. Insurers plug in granular data from your area to adjust your premium—often dramatically.

Factors that shift with your ZIP code include:

- Local claim frequency

- Car theft rates

- Repair shop density and cost

- Weather risks (flood-prone vs. inland)

- Presence of uninsured drivers

Mini Dialogue – Customer and Agent, Holyoke

— “But I haven’t changed how I drive.”

— “True. But your neighborhood has a higher rate of rear-end collisions and garage repairs.”

— “Seriously? That affects my quote?”

— “Every ZIP is a data profile. The algorithm sees risk before it sees you.”

So no, car insurance quotes Massachusetts providers give aren’t universal. Even moving across town—from ZIP 02118 to 02128—can trigger a shift of $20–$80/month. That’s not bias—it’s math.

6.2 “Massachusetts has fixed rates”

This one persists like a myth whispered at RMVs. Yes, Massachusetts uses a “managed competition” model—but that does not mean insurers offer the same rates.

Here’s the reality: the Massachusetts Division of Insurance approves rate frameworks, but every insurer applies them differently. That’s why one driver gets four very different quotes for the same car and coverage.

📄 Official Note – MA Division of Insurance, 2025

“While rates are regulated, insurers may apply proprietary risk models and discounts to approved base structures.”

Let’s make it real:

| Insurer | Annual Quote (Same Driver Profile) |

|---|---|

| Liberty Mutual | $1,760 |

| GEICO | $1,540 |

| MAPFRE | $1,420 |

| Independent Local Broker | $1,315 |

That’s a $445 swing—on the same profile. Why? Because each company values risk differently: some weight credit scores more heavily; others reward bundling or longer tenure.

✅ Pro Tip

Always compare at least three car insurance quotes Massachusetts drivers trust—from a mix of national, regional, and local providers. One-size pricing doesn’t exist.

Discounts vary too. Some carriers reward usage-based tracking. Others penalize short policy durations. If you freelance or work from home? That could cut your quote—but only with companies that ask.

📊 UX ENRICHISSEMENT – Top 5 Myths vs. Reality (MA, 2025)

| Myth | Reality |

|---|---|

| “All quotes are the same” | Every insurer uses different scoring and discount logic |

| “MA has flat rates” | Rates are regulated, not standardized |

| “Good drivers always pay the least” | ZIP code, coverage type, and history often weigh more |

| “Online quotes are final” | Many are soft estimates—real rates follow VIN and license verification |

| “Minimum coverage = full protection” | Legal compliance ≠ real-world financial safety |

The bottom line? Getting car insurance quotes in Massachusetts isn’t just a shopping task—it’s a navigation game. Knowing the myths keeps you from falling into costly traps.

7. Pro Tips to Lower Your Massachusetts Car Insurance Quote

7.1 Small Tweaks That Save Big: What Really Impacts Your Premium

Smart financial moves combined with proper coverage selection could save you hundreds annually. Learn more about optimizing your premiums with our car insurance calculator to model different scenarios.

When it comes to car insurance quotes in Massachusetts, most drivers assume switching providers is the only way to save. But the truth? Small, strategic moves can often slash your rate faster than a full policy overhaul.

Let’s take James, a 42-year-old graphic designer in Lowell. He hadn’t changed cars or moved in years, yet his renewal jumped by $34/month. After a quick call to his agent, he realized two things had changed: his annual mileage dropped post-pandemic, and his credit score had quietly improved by 58 points. By updating just those two details—and switching his billing to autopay—he brought his quote back down below last year’s rate.

It’s not just about driving habits. It’s about timing, accuracy, and how well you understand the moving parts behind Massachusetts auto insurance pricing.

7.2 UX ENRICHISSEMENT – Checklist: Smart Adjustments That Actually Reduce Your Quote

| Tip | Why It Helps | Example |

|---|---|---|

| ✅ Update your mileage | Less time on the road = lower risk | Dropping from 12,000 to 7,000 miles/year saved James $218/year |

| ✅ Improve your credit score | MA allows credit-based scoring with limits | A 50+ point jump can reduce premiums by up to 20% |

| ✅ Bundle with renters/home insurance | Loyalty and cross-policy discounts | Arbella offered 15% off for bundling car + home |

| ✅ Avoid gaps in coverage | Gaps flag you as high-risk | Even a 3-day lapse raised a quote by $41/month in Worcester |

| ✅ Shop early | Early quoting triggers “prepared buyer” incentives | Many carriers offer 3–8% off if you quote 35+ days in advance |

7.3 Dialogue – Agent Call in Quincy

Driver: “I barely drive now that I work from home. Do I need to update that?”

Agent: “Absolutely. You’re listed as a commuter with 15,000 miles/year. Drop it to 6,000 and your quote could shrink immediately.”

7.4 Three Little-Known Hacks to Try Before Renewal

1. Request a re-score

If your credit has improved or you’ve paid off a loan, ask your insurer to rerun your profile. Even small changes may push you into a lower pricing tier.

2. Use “advance quote” timing

Get quotes 30–45 days before renewal. According to 2025 data from MAPFRE and Liberty Mutual, drivers who quote early save an average of $96/year more than last-minute shoppers.

3. Check your vehicle’s safety classification

Added lane assist? Rear cameras? Updated VIN data helps insurers reclassify your car’s risk, unlocking tech-based discounts.

7.5 UX ENRICHISSEMENT – Sample Premium Impact from Pro Tweaks (MA, 2025)

| Adjustment | Estimated Savings | Notes |

|---|---|---|

| Dropping mileage from 15k to 7k | $180/year | Common with remote workers |

| Credit score from 640 → 700+ | $280/year | Score tiers matter |

| Policy bundling (home + auto) | $190/year | Not all online quotes include it |

| Quoting 40 days in advance | $85/year | “Advance shopper” discounts apply |

Pro Tip

Set a recurring reminder on your phone 45 days before your renewal. That’s the sweet spot when Massachusetts insurers finalize their next-cycle rates—and when you can still pivot.

8. What You’ll Need to Get an Accurate Car Insurance Quote in Massachusetts

8.1 The Data That Makes a Difference

Ready to compare car insurance quotes in Massachusetts? Great. But if you’re just typing in your ZIP code and car make, don’t expect anything more than a ballpark figure. For a real quote you can actually rely on, precision is everything.

Take Elise, a 46-year-old school administrator in Framingham. She was frustrated after getting wildly inconsistent quotes online. One tool said $138/month, another estimated $222—with the same coverage levels. What changed? Elise finally entered her VIN, exact mileage, and policy history instead of clicking “skip.” Suddenly, the quotes aligned—within $7 of each other.

Why? Because insurance algorithms only work with what you give them. More data in = better pricing out.

8.2 Checklist – What to Have on Hand Before You Click “Get Quote”

| Information Needed | Why It Matters |

|---|---|

| ✅ Driver’s license (all drivers) | Confirms driving history, infractions, and eligibility |

| ✅ VIN (Vehicle Identification Number) | Tells the insurer about trim, safety ratings, and value |

| ✅ Actual mileage | Triggers low-mileage discounts or risk adjustments |

| ✅ Garaging address | Impacts risk profile—ZIP code matters in MA |

| ✅ Prior insurance info | Shows continuity, lapses, and coverage patterns |

| ✅ Use of vehicle (commute, business, pleasure) | Affects base rate and usage-based discounting |

| ✅ Any incidents in last 5 years | Required for legal quote accuracy |

Pro Tip

If your vehicle has new safety features (blind spot monitors, rear cameras, adaptive cruise), mention them—even if aftermarket. Many Massachusetts insurers offer safety-based discounts, but only if the system logs the info.

8.3 The Common Mistakes That Raise Your Quote—Silently

Even when you mean well, small errors can make your car insurance quotes in Massachusetts spike for no reason. And unlike a typo, the system won’t warn you—it’ll just charge more.

🚫 Example #1: Mileage Guessing

Rounding up to 12,000 when you only drive 6,000 a year could erase your low-mileage discount.

🚫 Example #2: Outdated Address

Quoting from an old ZIP code? A 2024 audit showed that switching from urban 02118 to suburban 01760 could save $300+/year.

🚫 Example #3: Driver Roles

Accidentally listing your 18-year-old son as the primary driver instead of occasional can increase the quote by 40%.

🚫 Example #4: Mislabeling Usage

If you now work remotely but your old profile says “daily commute,” you’re missing out on commuter adjustment credits.

Dialogue – Agent Q&A, Brookline, MA

Driver: “I just put in rough info to get a fast quote. Does that matter?”

Agent: “Absolutely. Fast inputs give you inflated numbers. Precision unlocks discounts—especially in Massachusetts, where ZIP data and usage matter more than people think.”

UX ENRICHISSEMENT – Accuracy Impact on MA Car Insurance Quotes

| Mistake | Cost Estimate (Annual) | Fix |

|---|---|---|

| Using estimate mileage instead of actual | +$180 | Use recent odometer reading |

| Quoting from prior address | +$220 | Use garaging ZIP, not mailing |

| Wrong driver type listed | +$340 | Clarify who drives and how often |

| Skipping prior coverage details | +$150 | Upload declarations page if available |

Pro Tip

Before submitting any online form, take 5 minutes to confirm your address, mileage, driver roles, and vehicle use. That tiny effort could cut your quote by hundreds—and help avoid follow-up “adjustments” when insurers verify.

9. Final Thoughts: Don’t Let Massachusetts Rates Catch You Off Guard

In Massachusetts, getting car insurance quotes isn’t just a task—it’s a strategy. Whether you’re in Worcester, Brookline, or Pittsfield, your rate can swing by over $1,000/year based on details that often seem minor: your ZIP code, mileage, policy timing, even how recently you checked your credit.

Jake, Elise, Rachel, and Mike all discovered the same truth: the first quote isn’t always the right quote—and it rarely reflects the full picture. Too many drivers lock in premiums based on vague estimates or loyalty habits that no longer serve them.

But you? You’re now ahead of the curve.

Armed with the right tools, the right questions, and a clearer understanding of what shapes car insurance quotes in Massachusetts, you can:

- ✅ Avoid overpriced renewals

- ✅ Spot misleading “cheap” quotes with missing coverage

- ✅ Use timing, tech, and personal data to drive down your premium

- ✅ Compare real offers that reflect your situation—not a generic profile

Final Checklist Before You Choose a Policy

🔲 Have your VIN and odometer reading ready

🔲 Confirm your garaging ZIP (not just mailing address)

🔲 Know your driving history for the past 5 years

🔲 Decide on extras like rental, glass, and uninsured motorist

🔲 Check your credit 4–6 weeks in advance

🔲 Compare at least three quotes, including one from a local agent

🔲 Ask: “What’s missing from this policy?”—and get a clear answer

🧭 Next Step

Set a calendar reminder 30 days before your next renewal date. That one habit alone could unlock a better plan—before your current rate locks you in.

Because in Massachusetts, information is leverage—and when you shop smart, your wallet wins.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.