At 45, Mark from Denver, Colorado, runs a small construction business. When a client suddenly requested a certificate of insurance (COI) to prove his coverage, Mark realized he didn’t fully understand what it entailed. In 2024, over 65% of U.S. small businesses report confusion about COIs, according to the National Association of Insurance Commissioners (NAIC).

Certificates of insurance serve as proof of coverage but are often misunderstood or misused, leading to costly delays and legal risks. Whether you’re a contractor, vendor, or business owner, knowing how to obtain, read, and verify a Certificate of Insurance can protect your business and clients.

This article explains everything about certificates of insurance — from what they include to legal requirements, verification tips, and emerging digital trends. By the end, you’ll have clear, practical knowledge to handle COIs confidently in 2025 and beyond.

On This Page

1. What Is a Certificate of Insurance?

1.1. Definition and Purpose

A certificate of insurance (COI) is an official document issued by an insurance company or broker that summarizes key information about an insurance policy. It provides verification that an individual or business maintains coverage for certain risks, including liability and property damage. The COI does not itself provide insurance but acts as evidence of the policyholder’s insurance status, often requested in business contracts or partnerships.

2024 U.S. Statistic: According to the National Association of Insurance Commissioners (NAIC), 72% of small businesses required to provide COIs reported using them to satisfy contractual insurance verification in 2024.

Local Anecdote: Sarah, a 38-year-old event planner in Austin, Texas, once lost a contract because she failed to promptly provide a COI, causing the client to question her liability coverage.

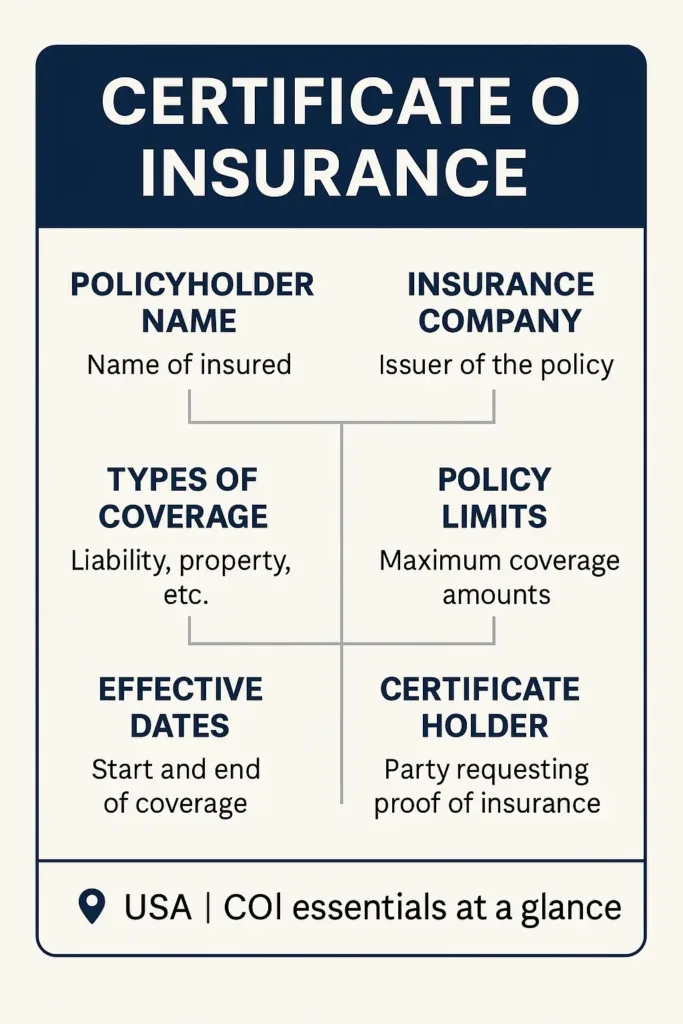

1.2. Key Information Included on a COI

Certificates of insurance generally list critical details including the name of the insured party, the insurer issuing the policy, the kinds of coverage provided, the limits of those coverages, and the dates during which the policy is active. They also name any additional insured individuals or entities and specify who the certificate is issued to as proof of insurance. This information helps third parties quickly verify that the necessary insurance coverage is in place at the time of the certificate’s issue.

Real-life Example: A subcontractor providing services to a general contractor must show a COI naming the contractor as an additional insured to comply with contract terms and manage liability risks.

1.3. Common Misconceptions About COIs

There is often confusion that a certificate of insurance functions as an insurance contract or offers direct coverage. In truth, the certificate is a summarized record that does not modify the terms or scope of the underlying insurance policy. While it details certain coverages, it does not represent every possible risk the policyholder may face. To fully understand coverage, reviewing the actual insurance policy documents is essential.

Fictional Dialogue:

Tom (Seattle, WA, 42): “I thought once I handed over the COI, I was fully covered for any claim.”

Insurance Agent: “The COI shows coverage exists but always read the full policy for detailed protections and exclusions.”

Pro Tip (Texas Insurance Code § 4101.056): In Texas, insurers must issue COIs accurately reflecting policy terms and may be held liable for misrepresentations in certificates.

| Element | Description |

|---|---|

| Policyholder Name | Name of insured individual or business |

| Insurance Company | Issuer of the policy |

| Types of Coverage | Liability, property, workers’ compensation, etc. |

| Policy Limits | Maximum coverage amounts |

| Effective Dates | Start and end dates of coverage |

| Certificate Holder | Party requesting proof of insurance |

| Additional Insured | Parties added to the policy for coverage |

2. Why Businesses Need a Certificate of Insurance

2.1. Risk Management and Liability Protection

Businesses use a Certificate of Insurance as a key risk management tool to confirm that partners, contractors, or vendors carry adequate insurance coverage. This helps mitigate exposure to financial losses from accidents, property damage, or legal claims. A COI acts as documented proof that the involved party has insurance protecting against specific liabilities, reducing the risk of costly lawsuits.

2024 U.S. Statistic: The National Association of Insurance Commissioners (NAIC) reports that 68% of businesses require COIs before beginning work with third parties in 2024.

If you’re a solo contractor or entrepreneur, understanding your small business insurance cost is essential before issuing or requesting COIs.

Local Anecdote: Jason, a 50-year-old property manager in Charlotte, North Carolina, always insists on receiving a COI from every contractor to avoid liability issues after a costly slip-and-fall incident.

2.2. Legal and Contractual Requirements

Many contracts and state regulations mandate that businesses provide a certificate of insurance to demonstrate compliance with insurance obligations. Not providing or confirming a valid Certificate of Insurance may lead to contract violations or penalties imposed by regulatory authorities. Thus, COIs serve not only as evidence of insurance but also as a compliance checkpoint.

Pro Tip (California Insurance Code § 11580.1): California requires specific insurance disclosures and COI provisions in construction contracts to protect project owners and general contractors.

2.3. Industry-Specific COI Needs

Different industries have unique COI requirements based on typical risks and regulatory frameworks. For example, construction, healthcare, and event planning sectors often demand specialized certificates reflecting coverage for workers’ compensation, professional liability, or general liability. Understanding these nuances helps businesses obtain appropriate COIs that satisfy both legal and operational demands.

Real-life Example: A healthcare provider in Florida must submit a COI showing malpractice insurance to maintain compliance with state health regulations.

3. How to Obtain a Certificate of Insurance

3.1. Requesting from Your Insurer

To obtain a certificate of insurance, policyholders typically request it directly from their insurance company or broker. Most insurers provide COIs upon request without additional charge, especially if the policy is active and in good standing. It is important to specify the certificate holder’s name and any special endorsements or additional insureds to ensure the COI meets the requesting party’s requirements.

2024 U.S. Statistic: A recent survey by the National Association of Insurance Commissioners (NAIC) found that 85% of policyholders receive their COI within five business days of the request.

Local Anecdote: Emily, a 29-year-old freelance graphic designer from Portland, Oregon, needed a COI to work with a new client. She found that requesting the COI early in the contract negotiation helped avoid project delays.

3.2. Typical Processing Time and Fees

In most cases, insurers process COI requests quickly, often within a few business days. While many providers issue certificates at no extra cost, some brokers or third-party services may charge a fee for expedited requests or for managing multiple certificates. Understanding your insurer’s process and timing for issuing a Certificate of Insurance is essential to avoid unexpected delays.

Pro Tip (New York Insurance Law § 2111): New York mandates that insurers respond to COI requests promptly to prevent disruptions in contractual relationships.

3.3. Using Brokers or Online Platforms

Policyholders can also obtain certificates through insurance brokers or digital platforms designed for COI management. These tools often streamline the process by allowing users to request, track, and store certificates electronically, reducing paperwork and improving compliance monitoring. However, it is crucial to ensure these platforms are reputable and compliant with state insurance regulations.

Real-life Example: A mid-sized marketing agency in Atlanta uses an online COI platform to manage certificates for its contractors, reducing administrative burden and ensuring up-to-date documentation.

4. Understanding the Details on a Certificate of Insurance

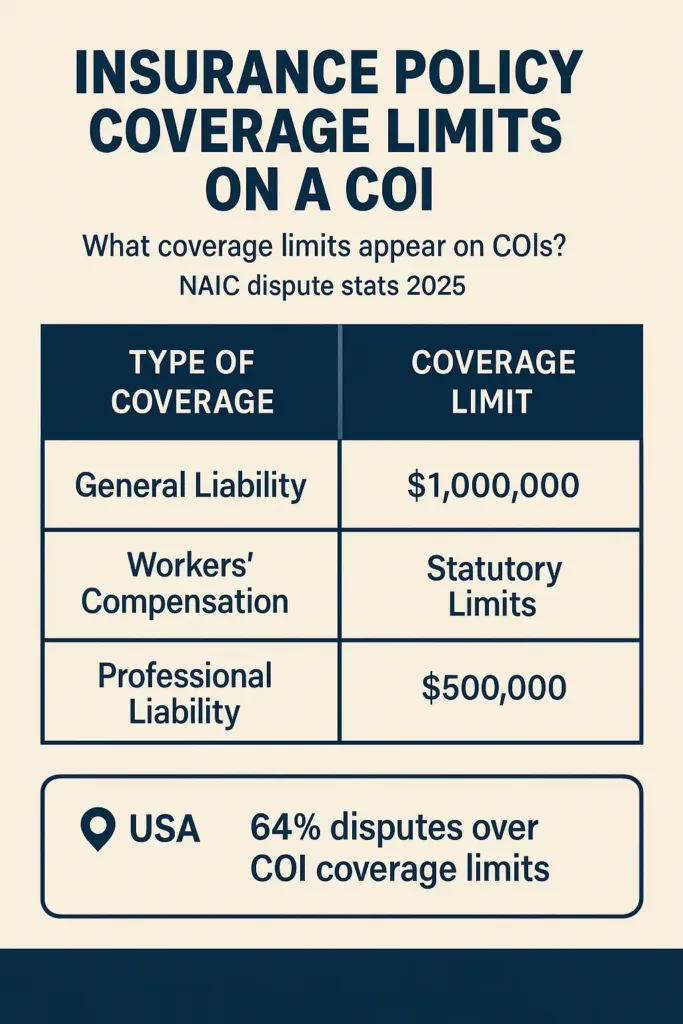

4.1. Policy Types and Coverage Limits

A Certificate of Insurance details the types of insurance policies in effect, such as general liability, workers’ compensation, or professional liability. They also specify coverage limits, which indicate the maximum amount the insurer will pay for a claim. These limits help third parties assess the adequacy of coverage for potential risks involved in a contract or business relationship.

2024 U.S. Statistic: In 2024, 64% of contract disputes related to insurance involved disagreements about coverage limits, according to the National Association of Insurance Commissioners (NAIC).

Local Anecdote: Luis, a 42-year-old contractor in Phoenix, Arizona, learned the hard way that insufficient coverage limits on a COI can expose a business to unexpected financial liabilities.

4.2. Additional Insured and Certificate Holder

The certificate holder is the party requesting the COI, often a client or project owner, while additional insureds are entities added to the policy to receive coverage benefits. Being named as an additional insured provides these parties with protection under the policyholder’s insurance, which is particularly important in construction and service contracts to transfer risk appropriately.

Real-life Example: A general contractor requires all subcontractors to add the contractor as an additional insured on their COI to ensure shared liability coverage on the job site.

4.3. Expiration Dates and Renewals

Certificates include policy effective and expiration dates, which indicate the period during which the insurance is valid. Since policies may change or expire, it is critical to monitor COI expiration dates and request updated certificates to maintain continuous proof of insurance. Failure to do so can result in gaps in coverage and contractual non-compliance.

Pro Tip (Florida Statute § 627.409): Florida requires timely notification of policy cancellations to certificate holders to avoid unexpected coverage lapses.

5. How to Verify and Interpret a Certificate of Insurance

5.1. Confirming Validity and Authenticity

Before relying on a Certificate of Insurance as valid proof, it is crucial to verify its authenticity with care. This includes ensuring that the insurance provider is properly licensed and maintains a trustworthy reputation, confirming that the policy is currently in effect, and verifying that the coverage limits meet the contractual obligations. Verification can be done by directly contacting the insurer or by using official state insurance platforms designed to detect fraudulent certificates.

2024 U.S. Statistic: The Insurance Information Institute (III) reports that insurance fraud involving fake COIs increased by 12% in 2024, emphasizing the need for thorough verification.

Local Anecdote: Karen, a 45-year-old procurement manager in Boston, Massachusetts, uncovered a fraudulent COI during vendor onboarding, avoiding potential liability exposure for her company.

5.2. Common Red Flags and Errors

Common issues to watch for include missing signatures, incorrect or outdated policy numbers, coverage expiration dates that have passed, and absent endorsements such as additional insureds or waiver of subrogation when required. These errors can invalidate a COI or leave gaps in coverage, so careful review is essential.

5.3. Legal Implications of Faulty COIs

Accepting a faulty or invalid certificate of insurance can expose businesses to significant legal and financial risks. If a claim arises and the COI does not accurately reflect coverage, the business may be held liable for damages not covered by insurance. Understanding these risks reinforces the importance of diligent COI verification.

Pro Tip (Illinois Insurance Code 215 ILCS 5/155): Illinois law holds parties accountable if they fail to properly verify insurance certificates in certain contracts.

6. Common Issues and How to Avoid Them

6.1. Missing or Incorrect Information

A common issue encountered with a Certificate of Insurance involves incomplete or incorrect details. These mistakes often consist of wrong policy numbers, name misspellings, outdated dates, or absent required endorsements. These inaccuracies may cause a certificate of insurance to be considered invalid, resulting in potential delays or conflicts throughout the contractual process.

2024 U.S. Statistic: According to the National Association of Insurance Commissioners (NAIC), nearly 30% of COIs reviewed in 2024 had some form of inaccurate or missing information.

Local Anecdote: Emily, a 38-year-old project manager in Denver, Colorado, faced project setbacks when a subcontractor’s COI lacked essential policy endorsements, requiring last-minute corrections.

6.2. Expired or Lapsed Policies

Another frequent challenge is dealing with expired or lapsed insurance policies. Certificates may show coverage that has already ended, exposing involved parties to uncovered risks. It is critical for businesses to verify policy start and end dates and to obtain updated certificates as policies renew or change.

Real-life Example: A contractor in Austin, Texas, unknowingly worked under an expired COI, leading to significant liability after an on-site accident.

Homeowners face similar documentation issues when trying to find the cheapest homeowners insurance that still meets liability or lender requirements.

6.3. Failure to Update Certificates

Neglecting to update certificates regularly can cause coverage gaps and contractual violations. Insurance requirements and policy details may evolve, so routinely reviewing and promptly updating COIs is necessary to maintain compliance and protection.

Pro Tip (Texas Insurance Code § 1952.057): Texas law mandates timely updates to insurance certificates in construction contracts to avoid coverage lapses.

7. How to Choose the Right Certificate of Insurance for Your Needs

7.1. Assessing Your Risk Exposure

Before requesting or accepting a certificate of insurance, it’s crucial to understand the specific risks associated with your business or project. Identifying potential liabilities helps determine the types and amounts of coverage needed to ensure adequate protection.

2024 U.S. Statistic: The Insurance Information Institute (III) notes that 65% of small businesses underestimate their liability risks, leading to insufficient insurance coverage.

Local Anecdote: Mark, a 50-year-old contractor in Seattle, Washington, faced a costly lawsuit after assuming minimal insurance coverage was sufficient for his projects.

7.2. Understanding Coverage Types and Limits

Certificates of insurance vary in the types of coverage they summarize—general liability, workers’ compensation, professional liability, and more. It is essential to review the coverage limits and exclusions detailed in the Certificate of Insurance to ensure they align with your contractual and risk management needs.

7.3. Verifying Additional Insured and Endorsements

Often, contracts require certain parties to be listed as additional insureds on the certificate. Confirm that these endorsements are properly included and clearly stated to avoid coverage gaps and disputes.

Pro Tip (California Insurance Code § 11580): California law requires clear disclosure of additional insured parties and endorsements in insurance documentation.

8. Alternatives to Traditional Certificates of Insurance

8.1. Using Surety Bonds

Surety bonds can sometimes serve as an alternative or complement to traditional certificates of insurance. They provide a financial guarantee that contractual obligations will be met, offering protection against default or failure to perform.

2024 U.S. Statistic: According to the Surety & Fidelity Association of America, surety bond usage in construction projects increased by 8% in 2024.

8.2. Leveraging Risk Management Programs

Certain companies implement integrated risk management strategies that blend insurance coverage with active safety protocols and regulatory compliance efforts. These approaches may lessen the dependence on standard COIs by reducing overall risk exposure.

8.3. Captive Insurance Companies

Large corporations sometimes use captive insurance companies to self-insure risks, issuing certificates internally to demonstrate coverage. This approach requires specialized knowledge and regulatory compliance.

Pro Tip (NAIC Guidelines): Captive insurance arrangements must adhere to strict regulatory standards to ensure legitimacy and protection.

Conclusion

Certificates of insurance are essential tools for verifying coverage and managing risk in many business relationships. Understanding how to read, verify, and maintain accurate COIs helps prevent costly disputes and legal exposure. By being vigilant about common issues and knowing available alternatives, businesses can protect themselves effectively. When in doubt, consulting with insurance professionals or legal experts can provide valuable guidance to ensure your Certificate of Insurance meets proper coverage and compliance.

FAQ

How much does a COI cost?

Most insurers issue a Certificate of Insurance (COI) free of charge with an active policy. However, some brokers or third-party services may charge fees for expedited processing or managing multiple certificates. Generally, obtaining a COI is quick and often included in your insurance service without extra cost.

How to get the certificate of insurance?

You request a COI directly from your insurance company or broker. Many insurers provide it within a few business days, especially if your policy is current. You must specify the certificate holder’s name and any required endorsements, such as additional insureds, to ensure the certificate meets contractual needs. Some businesses also use online platforms to streamline COI requests and management.

How important is a certificate of insurance?

A COI is crucial for businesses to verify that contractors, vendors, or partners have proper insurance coverage before beginning work. It helps manage liability risks and satisfies legal or contractual insurance requirements. Without a valid COI, companies face potential financial exposure and contract violations.

What does insurance certification mean?

Insurance certification refers to the issuance of a Certificate of Insurance, which is an official summary document verifying that a person or business maintains certain insurance policies with specified coverage limits and effective dates. It does not itself provide coverage but acts as proof that insurance is in place.