Meet Jake, a 32-year-old marketing professional living in Denver, Colorado. Like many Coloradans, he’s looking for cheap car insurance in Colorado to fit his busy lifestyle and his tight budget. When his current policy saw a steep rise in premiums, Jake started researching options that wouldn’t break the bank. The good news? In 2024, Coloradans can still find affordable auto insurance that meets state requirements and provides the necessary coverage.

In Colorado, car insurance costs vary significantly depending on factors like your location, driving history, and even the type of vehicle you own. With average premiums being around $1,400 annually in Colorado (NAIC, 2024), it’s crucial to understand how to secure the best deal. This guide will help you compare insurance providers, find discounts, and ensure that you meet the state’s minimum coverage laws—all while saving money. You can also estimate your car insurance rates using our free tool.

If you’re a Colorado driver looking to lower your premiums without sacrificing coverage, keep reading to discover practical tips and the best options available in 2024.

On This Page

1. Why Car Insurance is Essential in Colorado

1.1. Colorado’s Minimum Car Insurance Requirements

In Colorado, the law mandates that all drivers carry a minimum level of car insurance to legally operate a vehicle. The state requires that drivers maintain at least $25,000 in bodily injury liability coverage per person, $50,000 per accident, and $15,000 for property damage. This minimum coverage ensures that drivers have a financial safety net in case of an accident, protecting both the individual and others involved in the incident.

“Pro Tip: Always review your insurance policy to ensure it meets Colorado’s minimum requirements, but keep in mind that these limits may not be sufficient to cover serious accidents. Understanding liability vs full coverage car insurance can help you make informed decisions about upgrading your protection, which may save you from out-of-pocket expenses that could otherwise arise from higher medical bills or extensive property damage.”

1.2. Penalties for Driving Without Insurance in Colorado

Driving without the required car insurance in Colorado is a serious offense with significant consequences. First-time offenders can be fined up to $500, and repeat violators may face even harsher penalties. In addition to the fines, a driver’s license and registration may be suspended. Those caught without insurance may also be required to file an SR-22 form, which certifies that they have obtained the necessary insurance coverage.

In Boulder, Colorado, Laura, 42, found herself in a minor accident after a long day at work. Without insurance at the time, she was fined $500 and had her license suspended for 90 days. Now, she stresses the importance of keeping insurance active, even for those who drive infrequently, to avoid unnecessary fines and complications.

1.3. Unique Risks for Drivers in Colorado (Weather, Road Conditions)

Driving in Colorado comes with unique challenges due to the state’s diverse weather conditions and mountainous terrain. Winter months bring snow, ice, and slippery roads, which can increase the risk of accidents. Drivers should be especially cautious when navigating mountain passes or rural roads, which may be poorly lit or not as frequently plowed.

2024 U.S. Statistic: According to the Colorado Department of Transportation, winter weather is responsible for nearly 40% of car accidents in the state. Drivers who live in high-altitude areas or frequently travel through mountain regions should consider adding comprehensive coverage or roadside assistance to their policies to protect against weather-related incidents.

To better prepare for Colorado’s unique driving conditions, consider using our car insurance calculator to estimate premiums that include comprehensive coverage for weather-related incidents.

2. Factors Affecting Car Insurance Costs in Colorado

2.1. Demographics and Driving History

The cost of car insurance in Colorado is influenced by several factors, including demographics and your driving history. Insurance companies assess your age, gender, and marital status to determine risk levels. For example, younger drivers (especially those under 25) often face higher premiums due to their higher likelihood of being involved in accidents. Similarly, drivers with a history of accidents or violations may see their rates increase significantly.

“Pro Tip: Colorado insurers often offer discounts for drivers with a clean driving record. If you’ve been accident-free for several years, explore our guide on safe driver discounts explained to learn about potential rate reductions or loyalty discounts you may qualify for.”

2.2. Vehicle Type and Age Impacting Premiums

Your car’s make, model, and age play a significant role in determining your insurance premium. Newer vehicles, especially those with high repair costs or advanced safety features, tend to be more expensive to insure. On the other hand, older vehicles may have lower premiums, as they are less costly to repair or replace. However, if your car is older and its value has depreciated significantly, your insurance company may recommend opting for liability-only coverage to save money.

Real-life: Ethan, 58, from Colorado Springs, drives a 2015 Toyota Corolla. When he switched from a full coverage plan to liability-only coverage, his premium dropped by over 30%. This adjustment helped him save on his monthly payments while still meeting state minimum requirements.

2.3. Location and Zip Code Variations in Colorado

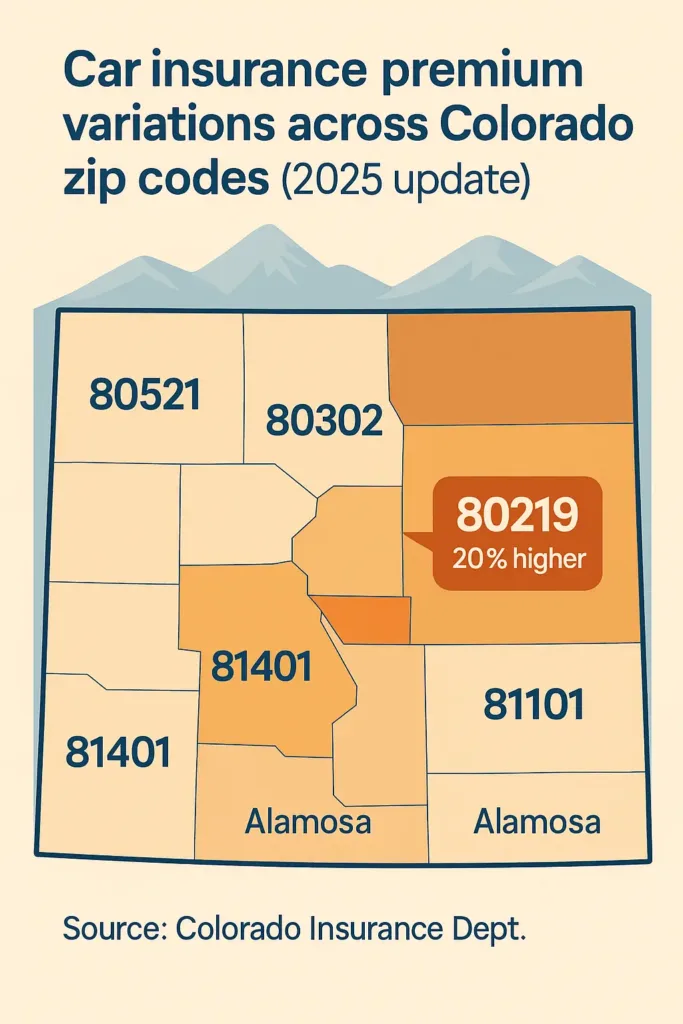

In Colorado, the location where you live can greatly affect your insurance costs. Urban areas with higher traffic density and more accident-prone roads typically result in higher premiums. For example, drivers in Denver or Boulder may pay more for insurance than those in rural areas like Durango or Sterling. Insurance providers also consider crime rates and the frequency of accidents in specific zip codes when calculating premiums.

2024 U.S. Statistic: According to the Colorado Department of Insurance, drivers in metropolitan areas like Denver see premiums that are 15–20% higher than those in rural regions, due to the higher number of accidents and vehicle thefts.

3. Comparing Cheap Car Insurance Providers in Colorado

3.1. Top Insurance Companies for Affordable Coverage in Colorado

When looking for cheap car insurance in Colorado, it’s important to compare the offerings of different insurance companies. Some of the most competitive insurers in Colorado include State Farm, Geico, Progressive, and Allstate. These companies offer a range of policies that cater to different budgets and coverage needs. While some insurers may offer lower premiums, it’s crucial to check what is included in the policy, such as coverage limits, deductibles, and customer service quality.

Pro Tip: Don’t just go for the cheapest option. Always review the coverage details and check if the insurer offers any additional benefits such as roadside assistance or rental car coverage, which could be valuable in the event of an accident.

3.2. Factors to Compare (Premiums, Coverage, Customer Service)

When comparing car insurance providers, focus on the following key factors:

- Premiums: The price you pay for coverage. Ensure you’re getting value for the amount you’re paying.

- Coverage Limits: Make sure the coverage meets your needs. While minimum coverage is required by law, higher limits may provide better protection in case of a serious accident.

- Customer Service: Read reviews and ask for recommendations to gauge how responsive the insurer is when you need help.

It’s important to find the right balance between affordability and adequate coverage, as well as an insurer that provides reliable customer service in times of need.

3.3. Interactive Estimator: Finding Your Ideal Provider

One of the best ways to compare different car insurance providers is by using online tools such as interactive estimators. These tools allow you to input personal details like your driving history, vehicle type, and coverage preferences to get personalized quotes. By using an estimator, you can quickly compare rates from multiple insurers and identify the most affordable option for your needs.

Real-life: Sarah, 37, from Aurora, used an online insurance estimator to compare quotes from five major companies. She was able to save 15% on her premium by switching to a new provider that offered a discount for safe driving and low mileage.

4. Discounts and Ways to Lower Your Car Insurance Premiums

4.1. Discounts for Good Drivers, Low Mileage, and Bundling

One of the easiest ways to lower your car insurance premiums in Colorado is to take advantage of available discounts. Many insurers offer discounts for good drivers who maintain a clean driving record. If you drive fewer miles each year, you may also qualify for a low-mileage discount. “Additionally, bundling your auto insurance with other policies, such as home or renters insurance, can lead to significant savings. According to the Colorado Division of Insurance, bundling can reduce premiums by 10-25%. Many Colorado drivers also explore our comprehensive guide on best car insurance discounts 2025 to maximize their savings potential.”

Pro Tip: Check with your insurer to see if they offer a “safe driver” discount. If you have not had any accidents or traffic violations for a number of years, you might qualify for a lower rate.

4.2. How Credit Score Affects Your Insurance Costs in Colorado

In Colorado, insurance companies often use your credit score as one of the factors in determining your car insurance premiums. Drivers with higher credit scores tend to pay less for insurance, as they are considered lower-risk customers. Maintaining a good credit score not only helps you secure lower car insurance premiums but also improves your overall financial situation.

Real-life: After improving his credit score, Mark, 45, from Colorado Springs, saw a 10% reduction in his car insurance premiums. By paying off a few outstanding debts and staying on top of his bills, he was able to qualify for a better rate.

4.3. Using Usage-Based Insurance (UBI) Programs for Savings

Usage-Based Insurance (UBI) programs are another great option for drivers in Colorado looking to save on premiums. These programs track how, when, and how much you drive through a device installed in your car or via an app on your phone. If you are a low-mileage driver or drive safely, you may be eligible for lower rates through a UBI program, as it rewards good driving habits and responsible behavior.

2024 U.S. Statistic: According to the Insurance Information Institute (III), nearly 30% of insurance companies in Colorado now offer UBI programs, which have led to a 10–15% reduction in premiums for qualifying drivers.

5. State-Specific Factors Influencing Car Insurance in Colorado

5.1. Colorado’s Auto Insurance Fraud and Consumer Protection Laws

In Colorado, auto insurance fraud is a serious crime, and the state has strict laws in place to protect consumers from fraudulent activities. The Colorado Division of Insurance (DOI) enforces regulations that require insurers to be transparent about policy terms and to handle claims in a fair and timely manner. If you suspect fraud, such as inflated claims or misrepresentation, you can report it to the DOI for investigation.

Expert Tip: Always read your policy carefully and ask your insurer for clarification if any terms are unclear. By understanding your policy, you can avoid being taken advantage of in the event of a claim.

5.2. Rural vs Urban Car Insurance Costs in Colorado

Car insurance costs in Colorado can vary greatly depending on whether you live in a rural or urban area. Urban areas like Denver and Boulder generally have higher premiums due to the increased risk of accidents, theft, and vandalism. In contrast, rural areas tend to have lower premiums as there is less traffic and fewer claims, though certain factors like weather-related incidents still apply.

Real-life: Emily, 30, who lives in rural Colorado, enjoys significantly lower insurance premiums compared to her friends in Denver. Despite the distance she travels for work, her premiums are 25% lower, largely due to the safer, less congested roads in her area.

5.3. Legal Requirements for Minimum Coverage in Colorado

Colorado law requires all drivers to carry a minimum amount of car insurance to legally operate a vehicle. As mentioned earlier, the minimum required coverage includes $25,000 for bodily injury per person, $50,000 per accident, and $15,000 for property damage. While this is the legal requirement, many drivers opt for additional coverage to better protect themselves in case of an accident. If you’re moving or comparing policies across states, understanding the state insurance requirements in Illinois can offer useful context.

“2024 U.S. Statistic: According to the Colorado Department of Insurance, approximately 90% of Colorado drivers meet the state’s minimum coverage requirements. However, around 40% of these drivers opt for additional coverage to ensure better protection. If you’re moving or comparing policies across states, understanding car insurance in Illinois can offer useful context for different state requirements.”

6. Common Myths About Cheap Car Insurance in Colorado

6.1. Myths About the Cheapest Insurance Being the Best Option

One common myth is that the cheapest car insurance is always the best choice. While low premiums may seem appealing, they often come with limited coverage or higher deductibles that may not offer sufficient protection in the event of an accident. It’s important to balance affordability with adequate coverage to ensure you’re fully protected.

“Pro Tip: Don’t automatically choose the lowest quote. Make sure the policy provides essential coverage like bodily injury liability and comprehensive insurance, especially if you have an expensive vehicle or if you’re driving in higher-risk areas. Learn more about understanding collision vs comprehensive coverage to make informed decisions.”

6.2. The Impact of Age, Gender, and Marital Status on Rates

Many drivers believe that their age, gender, or marital status automatically determines their insurance rates. While these factors can influence premiums, they are not the only considerations. Insurance companies use a variety of data, including driving history, location, and the type of car you drive, to calculate premiums. For example, young drivers under 25 tend to face higher rates, but married drivers or those with a clean driving history may benefit from lower premiums.

Real-life: Mark, 28, from Fort Collins, experienced a drop in his premiums when he switched his policy to one that accounted for his good driving record. Despite being a younger driver, his insurance rate decreased by 20% after he completed a defensive driving course.

6.3. Myth Busting: Low Premiums and Low Coverage Aren’t Always Safe

Another myth is that low premiums always lead to savings in the long run. In reality, opting for a minimal coverage policy to save money on premiums could leave you underinsured if you’re involved in a serious accident. Medical expenses, vehicle repairs, and legal costs can quickly exceed the limits of basic coverage, putting you at risk of having to pay out-of-pocket expenses.

2024 U.S. Statistic: According to the National Association of Insurance Commissioners (NAIC), nearly 30% of drivers in Colorado only carry the state’s minimum coverage, which often leads to financial strain in the case of serious accidents.

7. How to File a Claim and Maximize Your Car Insurance Benefits

7.1. Step-by-Step Process for Filing an Insurance Claim in Colorado

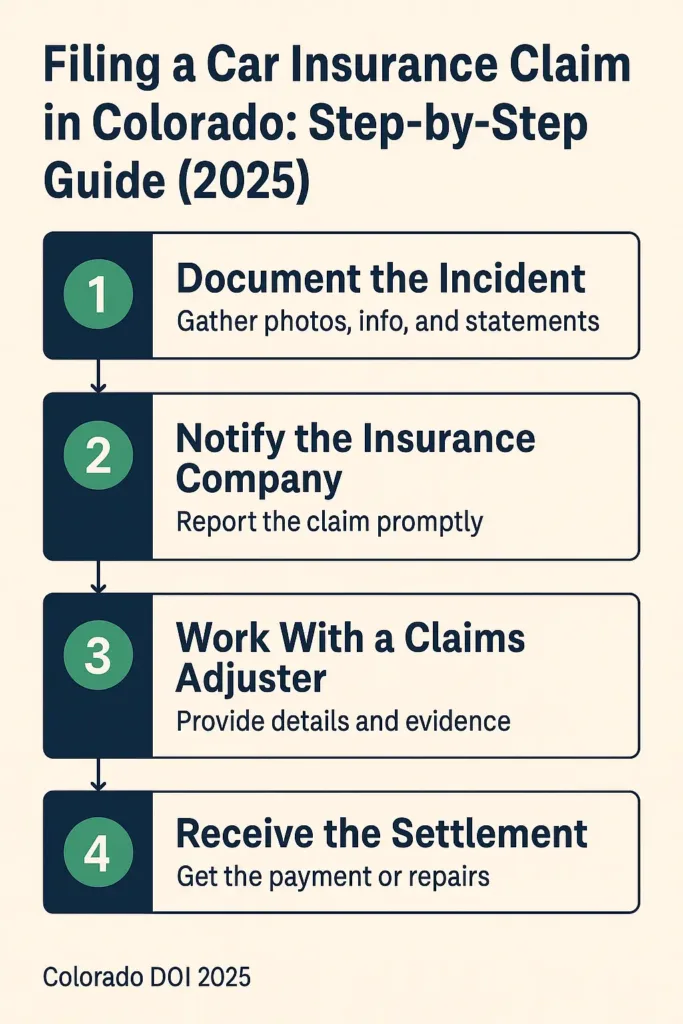

If you’ve been involved in a car accident, filing a claim is an essential step to ensure you’re compensated for damages. In Colorado, after an incident occurs, your first action should be to reach out to your insurance company as quickly as possible. Many companies provide round-the-clock services, allowing you to file a claim at any time, day or night.

To start the claims process, you will need to provide clear and precise information about the accident. This includes where and when it took place, what caused the incident, and the details of everyone involved, including their contact information and insurance policies. It’s also wise to gather photographic evidence of the damage and secure a copy of the police report, if available. These steps will streamline the claims process and help you present a solid case to your insurer.

For additional guidance on accident procedures, consult the Colorado State Patrol official guidelines for reporting accidents and understanding your legal obligations.

7.2. Understanding Your Rights Under Colorado Law During Claims

Colorado law offers protection for individuals involved in claims to ensure they are treated fairly and promptly by their insurance companies. If you believe your claim is being mishandled, delayed, or denied, you have the legal right to file a complaint with the Colorado Division of Insurance (DOI). If the matter is still unresolved, you may consider taking legal action to ensure your rights are upheld.

Pro Tip: Document every step of the process. Keep records of all your conversations with your insurance company, any correspondence, photos of the damage, and receipts for repairs or medical expenses. These records will not only help protect your interests but also expedite the process if any issues arise during your claim.

7.3. Real-life Example: How Insurance Can Help After an Accident

When Sarah, 38, from Longmont, was involved in a multi-car accident on I-25, she relied on her comprehensive car insurance to cover the damage. Not only did her insurance pay for her vehicle repairs, but it also assisted with the medical expenses following the accident. The claims process was seamless, allowing Sarah to focus on recovery while her insurer managed the financial aspects.

8. Alternatives to Traditional Car Insurance in Colorado

8.1. Pay-Per-Mile Car Insurance Programs

For drivers who don’t drive often or only use their vehicle occasionally, pay-per-mile insurance can be an excellent alternative to traditional car insurance. These programs, such as those offered by companies like Metromile, charge you based on the number of miles you drive each month, rather than a flat premium. This can significantly lower your insurance costs if you drive less than the average person.

Pro Tip: Pay-per-mile insurance typically requires the installation of a tracking device in your car to monitor mileage. Make sure the tracking device doesn’t collect excessive personal data or affect your privacy before committing to this type of policy.

8.2. Insuring Older Cars with Liability-Only Policies

For owners of older vehicles, maintaining full coverage insurance may no longer be necessary, especially if the car’s value has depreciated significantly. In these cases, opting for liability-only insurance may be a smart way to save money. Liability coverage protects you in the event you cause damage to another person’s property or cause injury in an accident, but it won’t cover repairs or replacement of your vehicle.

Real-life: Mike, 55, from Grand Junction, decided to switch to a liability-only policy for his 2008 sedan. After assessing the car’s value, he realized that paying for full coverage was no longer cost-effective. He saved nearly 40% on his annual premium by making the switch.

8.3. Exploring the Colorado Low-Cost Automobile Insurance Program (CLCA)

Colorado residents with low incomes or those who may not be able to afford standard auto insurance can take advantage of the Colorado Low-Cost Automobile Insurance Program (CLCA). This state-run program offers affordable liability coverage for eligible drivers, ensuring that even those with financial challenges can meet the state’s minimum insurance requirements.

“2024 U.S. Statistic: According to the Colorado Department of Insurance, around 10% of Coloradans rely on the CLCA to maintain the minimum required auto insurance. For comprehensive guidance on all affordable options, explore Insurance Zenith’s complete car insurance resource center, which covers everything from state programs to traditional policies.”

Conclusion

Finding affordable car insurance in Colorado doesn’t have to be a challenge. By understanding the various factors that impact your premiums, such as driving history, vehicle type, and location, you can make informed decisions that help you save money while maintaining adequate coverage. From traditional policies to alternative options like pay-per-mile insurance and liability-only coverage for older cars, there are plenty of ways to keep your insurance costs low while still meeting Colorado’s legal requirements.

If you’re unsure about the best insurance option for your needs, don’t hesitate to reach out to a licensed insurance advisor. With the right information and resources, you can find the perfect policy that offers both affordability and protection.

For more comprehensive guidance on vehicle protection, consider reviewing our detailed analysis on factors that affect car insurance rates to ensure you’re getting the best possible coverage for your specific situation.

FAQ

How much is car insurance monthly in Colorado?

The average annual car insurance premium in Colorado is about $1,400, which breaks down to roughly $115–$120 per month. However, actual rates vary widely by location, driving history, and coverage level. For example, urban areas like Denver or Boulder tend to have higher premiums, while rural areas often enjoy lower rates.

What is the #1 cheapest car insurance?

There isn’t a single “#1 cheapest” insurer since rates depend on your personal factors, but major companies like State Farm, Geico, Progressive, and Allstate consistently offer some of the most affordable and competitive car insurance options in Colorado. Using online quote comparison tools can help you find the cheapest option tailored to your situation.

Is $200 a month a lot for car insurance?

$200 per month is generally considered above average but not uncommon for Colorado drivers, especially those living in urban areas or with factors like younger age or poor driving history. Many drivers pay less, but in cities with higher accident or theft rates, premiums around $200/month can happen.

Can car insurance be $500 a month?

Yes, car insurance can reach $500 a month or more, though this is typically for high-risk drivers, expensive vehicles, or residents in dense urban areas with high claims and theft rates. While rare, it’s possible and usually signals the need to shop around, improve driving records, or adjust coverage to find better rates.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.