Life insurance by age groups varies dramatically in what you actually need and what you’ll pay. Here’s something most people don’t realize—your 25-year-old self needs completely different coverage than your 45-year-old self, and the strategy that works at 30 can be totally wrong at 60.

I’ve seen too many folks make expensive mistakes because they treat life insurance like a one-size-fits-all product. A friend of mine bought a massive whole life policy at 28, thinking he was being responsible. Fast forward 15 years, and he’s struggling to afford the premiums while his actual coverage needs have tripled.

Life insurance by age groups planning isn’t just about getting covered—it’s about getting the right coverage at the right time for the right price. The 30-something parent with a new mortgage has vastly different priorities than the 55-year-old whose kids just graduated college.

Here’s the reality by age:

- 20s-30s: Lock in cheap rates while you’re healthy, focus on term coverage

- 40s-50s: Peak responsibility years—you need the most coverage now

- 60s+: Shift toward legacy planning and final expenses

Let me walk you through exactly what life insurance by age groups looks like in practice, including some insider strategies that can save you serious money while ensuring your family stays protected no matter what happens.

On This Page

1. Understanding Life Insurance by Age Groups

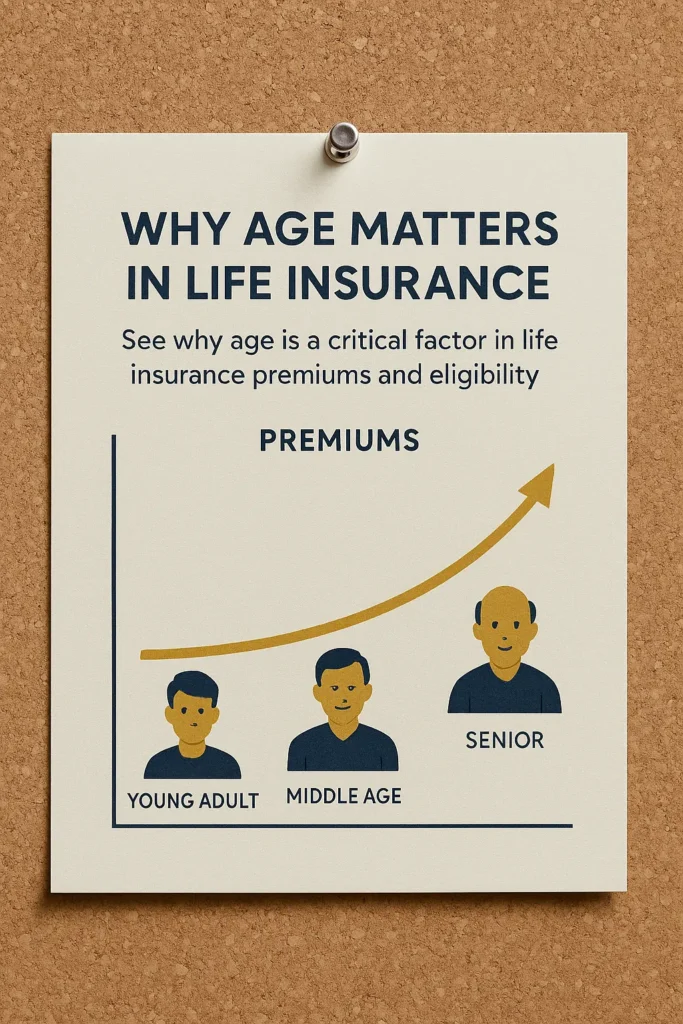

Your age isn’t just a number on your application—it’s the biggest factor determining what coverage you can get and what you’ll pay for it. Life insurance by age groups strategy changes because insurance companies use mortality tables that basically predict how likely you are to die in the next few years.

Sounds morbid? Maybe. But it’s how the business works, and understanding this helps you game the system legally.

Age-Based Risk Reality Check:

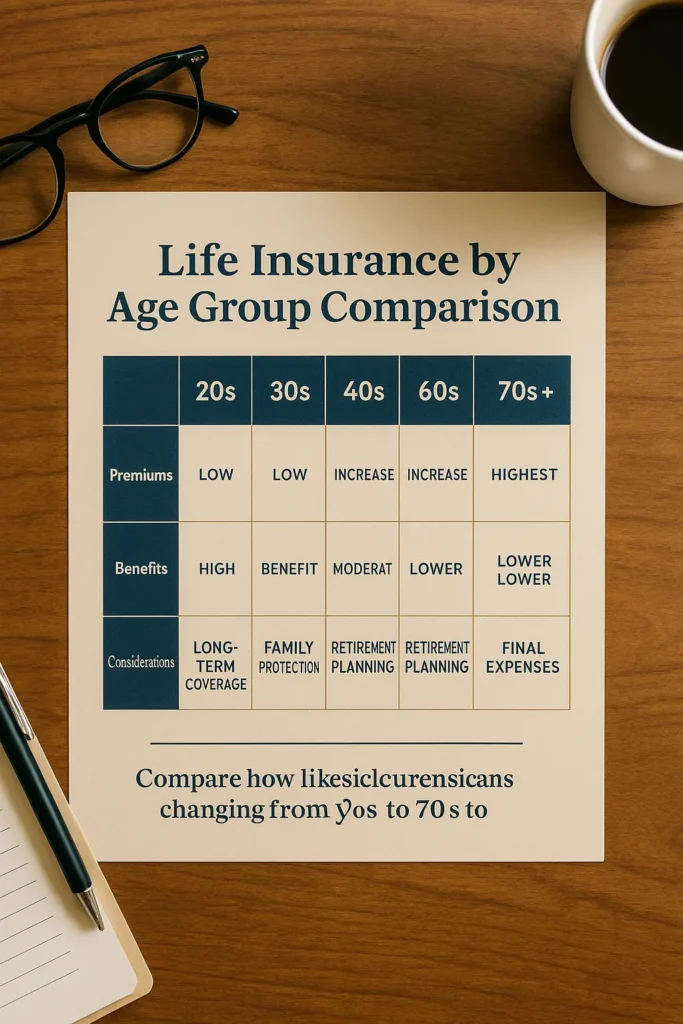

| Age Bracket | Health Hurdles | Premium Reality | Smart Policy Moves |

|---|---|---|---|

| 20s-30s | Basic health questions | Rock-bottom rates | Term life, lock in convertibility |

| 40s-50s | Blood work, maybe EKG | Climbing fast | Mix term + permanent |

| 60s+ | Full medical workup | Expensive but doable | Guaranteed issue options |

The thing most people miss? Life insurance by age groups isn’t just about dying—it’s about matching your coverage to what your family actually needs if you’re not around to provide for them.

1.1 How Age Drives Your Premium Costs

Life insurance by age groups premiums jump because death becomes more statistically likely as you get older. Every year you wait typically bumps your premium 4-9% for term coverage. That’s compounding, folks.

Real example: My neighbor paid $25 monthly for $500,000 in term coverage at age 30. His brother waited until 40 and pays $65 monthly for the same policy. That’s $480 extra per year, every year, for waiting a decade.

The Premium Cliff Effect: Most people don’t realize premiums don’t increase smoothly. There are age “cliffs” where rates jump significantly—usually at 35, 40, 45, 50, and every 5 years after. If you’re approaching one of these ages, buying before your next birthday can save you hundreds annually.

Understanding comprehensive life insurance coverage options helps you time your purchase to avoid these premium jumps while securing the protection your family needs.

1.2 Age-Related Health Reality

Here’s what nobody tells you about life insurance by age groups health requirements: they get tougher fast. In your twenties, you might just answer some health questions online. Hit your forties, and suddenly you’re peeing in cups and getting blood drawn.

Health Screening Evolution:

- Under 35: Usually just a phone interview and health questionnaire

- 35-50: Lab work, possibly an EKG, definitely height/weight measurements

- Over 50: Full medical exam, comprehensive health history, sometimes stress tests

I watched a client go from “preferred plus” rates at 38 to “standard” rates at 42 because he developed high blood pressure. Same guy, four years later, paying 40% more for the same coverage.

The lesson? If you’re relatively healthy now, lock in your rates before life happens to your body.

1.3 Financial Responsibility Shifts

Your life insurance by age groups needs change because your financial responsibilities evolve. Twenty-somethings worry about student loans. Forty-somethings are juggling mortgages, kids, and retirement planning. Sixty-somethings are thinking about leaving something behind.

The Financial Responsibility Timeline:

- 20s: Protect against debt burden on family, establish insurability

- 30s: Cover mortgage, replace lost income for young family

- 40s-50s: Peak earning years, maximum family financial exposure

- 60s+: Estate planning, final expenses, inheritance equalization

This isn’t theoretical. I’ve seen families struggle financially because they had the wrong coverage for their life stage. Too little during peak responsibility years, too much when the kids moved out and the mortgage was paid off.

2. Life Insurance by Age Groups in Your 20s and 30s

Your twenties and thirties are the golden years for life insurance by age groups purchases. You’re young, probably healthy, and premiums are dirt cheap. Even if you’re single with no kids, this is when you want to establish your coverage foundation.

Here’s why this matters: insurability. You might be healthy today, but what if you develop diabetes at 35? Or have a heart episode at 42? Once you have health issues, life insurance becomes expensive or unavailable.

The Early Purchase Advantage: Smart twenty-somethings buy term life coverage not just for today’s needs, but to lock in their right to buy more coverage later. It’s like reserving your spot in line while you’re still at the front.

2.1 Building Your Financial Safety Net

In your twenties and thirties, life insurance by age groups serves as a financial backstop while you’re building wealth. Even without kids, you probably have obligations that would crush your family financially if something happened to you.

Coverage Essentials for Young Adults:

- Student loans with co-signers (your parents are on the hook)

- Credit cards and personal debt

- Funeral and burial costs ($10,000-$20,000 in most areas)

- Lost future earnings your family was counting on

Real numbers: A $300,000 term policy typically costs $20-35 monthly for healthy people in this age group. That’s less than most people spend on streaming services, but it protects against financial disaster.

Don’t overthink it—start with something. You can always adjust as your situation changes.

2.2 Term Life Insurance Sweet Spot

Term life insurance hits the sweet spot for most people in their twenties and thirties. You get maximum death benefit for minimum premium cost, which lets you protect your family while building wealth through other investments.

Why Term Dominates for Young Adults: Term policies are pure insurance—death benefit, period. No investment component, no cash value, no complexity. For young adults, this means more protection for less money, with flexibility to adjust as circumstances change.

The key feature to demand? Convertibility. This lets you transform your term policy into permanent coverage later without medical underwriting. For details on convertible term life insurance benefits, our comparison breaks down when conversion makes sense.

2.3 Coverage Amount Strategy for Young Professionals

Determining coverage amounts in your twenties and thirties requires balancing current obligations with future financial goals. The old “10 times income” rule is outdated—you need a more nuanced approach.

Modern Coverage Calculation:

- Current annual income × 8-12 years of replacement needed

- Plus total debt obligations (minus liquid assets)

- Plus future major expenses (kids’ education, home purchase)

- Minus existing coverage (employer benefits, other policies)

Real scenario: Sarah, 32, earns $75,000 with $40,000 in student loans and no kids yet. Her calculation: $600,000 (8 × income) + $40,000 (debt) + $200,000 (future family planning) = $840,000 total need. She bought a $1 million term policy for $42 monthly.

The beauty of term coverage? You can adjust down later as your debts decrease and assets grow.

3. Life Insurance by Age Groups for Middle-Aged Adults (40s-50s)

Your forties and fifties represent peak life insurance by age groups complexity. You’re earning the most you’ll probably ever earn, but you’re also supporting the most people with the biggest financial obligations. This is when families need the most coverage, but it’s also when premiums start climbing significantly.

Life insurance by age groups planning becomes critical during these years because you’re balancing multiple competing priorities: current family needs, college funding, retirement savings, and aging parent care. Get this wrong, and your family faces financial catastrophe.

Peak Responsibility Reality: These are the years when losing a primary earner devastates families financially. I’ve worked with widows who went from comfortable middle-class living to struggling to keep the house because they underestimated their coverage needs during peak earning years.

3.1 Family Protection Maximum

Parents in their forties and fifties need life insurance by age groups coverage that handles both immediate replacement needs and long-term financial objectives. We’re talking about maintaining lifestyle, paying off major debts, and funding future goals like college.

Comprehensive Family Coverage Strategy:

- Income replacement for 15-20 years until kids become self-sufficient

- Complete mortgage payoff to secure family housing

- College funding for all dependent children (current costs: $30,000-$70,000 annually)

- Ongoing childcare and household management expenses

- Surviving spouse’s retirement security

Real numbers get big fast. A family with $150,000 household income, $300,000 mortgage, and two kids heading to college might need $2-3 million in total coverage. Sounds scary, but term life insurance keeps this affordable.

The mistake I see constantly? Underestimating the true cost of replacing a stay-at-home parent. Childcare, housekeeping, meal preparation, transportation—these services cost $40,000-$60,000 annually in most markets.

3.2 Term vs Permanent Coverage Strategy

Middle-aged adults often benefit from life insurance by age groups strategies that combine term and permanent coverage. Term handles the big temporary needs like mortgage protection and income replacement, while permanent policies build cash value and provide lifelong protection.

Strategic Coverage Combination:

- Term coverage: Large amounts (1-2 million) for 15-20 year periods covering major debts and child-rearing years

- Permanent coverage: Smaller amounts (250,000-500,000) that build cash value and provide lifetime protection

This approach maximizes protection during peak need years while building a financial asset. The permanent coverage can supplement retirement income through policy loans or provide inheritance for grandchildren.

For comprehensive analysis of whole life vs term life insurance options, our detailed breakdown helps you decide which combination works for your situation.

3.3 Managing Premium Increases

Life insurance by age groups costs rise significantly in your forties and fifties as health risks increase and mortality tables show higher claim probabilities. Smart planning minimizes these increases while maintaining adequate protection.

Cost Management Tactics:

- Level premium term: Lock in rates for 20-30 year periods

- Laddering strategy: Buy multiple smaller policies with different term lengths

- Health optimization: Maintain good health to qualify for preferred rates

- Annual review: Adjust coverage as debts decrease and assets grow

Pro tip: If you’re healthy, consider buying slightly more coverage than you currently need. It’s easier to drop excess coverage later than to add more if your health deteriorates.

4. Senior Life Insurance by Age Groups (60s and Beyond)

Life insurance by age groups for seniors serves completely different purposes than coverage for younger adults. Income replacement becomes less critical as you approach retirement, but life insurance can provide estate planning benefits, final expense coverage, and wealth transfer opportunities.

The focus shifts from “How do we replace lost income?” to “How do we handle final expenses and pass wealth efficiently to our heirs?”

Senior Insurance Priorities: Seniors typically focus on covering end-of-life costs, paying off remaining debts, equalizing inheritances among children, or creating tax-free wealth transfer. The emphasis moves from protection to legacy planning.

4.1 Final Expense and Estate Planning

Final expense coverage handles the immediate costs that hit families when someone dies. These aren’t small amounts—funeral homes are expensive, and medical bills can linger for months after death.

Final Expense Reality Check:

- Average funeral costs: $8,000-$15,000 (more in expensive areas)

- Outstanding medical bills and end-of-life care costs

- Estate administration and probate expenses

- Immediate cash needs for surviving family

Many seniors choose guaranteed issue policies that require no medical exam and accept all applicants within certain age ranges. Yes, they’re more expensive per dollar of coverage, but they ensure insurability regardless of health problems.

For those dealing with health challenges, exploring no medical exam life insurance solutions provides options when traditional coverage isn’t available.

4.2 Legacy and Wealth Transfer

Life insurance by age groups for seniors often focuses on efficient wealth transfer. Death benefits pass to beneficiaries tax-free, making life insurance an attractive estate planning tool for people with substantial assets.

Estate Planning Applications:

- Wealth replacement: Offset charitable giving or pay estate taxes

- Inheritance equalization: Provide equal inheritances when assets aren’t easily divisible (family business, real estate)

- Generation skipping: Create tax-free inheritance for grandchildren

- Tax planning: Convert taxable assets into tax-free death benefits

Permanent life insurance policies can also provide living benefits through policy loans or withdrawals, offering financial flexibility during retirement years. You can essentially use your death benefit while you’re alive if you need access to the cash.

4.3 Health-Related Coverage Challenges

Seniors face higher premiums and more restrictive underwriting due to age-related health concerns. However, several options exist for older adults who need coverage but may not qualify for traditional policies.

Alternative Coverage Options:

- Guaranteed issue: No medical questions, automatic acceptance (expensive but available)

- Simplified issue: Limited health questions, faster approval process

- Graded benefit: Reduced death benefits in first 2-3 years, then full coverage

- Group coverage: Through associations, unions, or employers with less strict requirements

The trade-off is cost. These options typically cost 2-3 times more per dollar of coverage than traditional policies, but they provide valuable protection for seniors who might otherwise be uninsurable.

5. Age-Specific Life Insurance by Age Groups Buying Strategies

Each age group benefits from different life insurance by age groups purchasing approaches. Understanding these strategies helps you maximize coverage value while minimizing unnecessary costs throughout your lifetime.

The key insight? There’s no single “best” strategy that works for everyone. Your optimal approach depends on your age, health, financial situation, and family circumstances.

5.1 Timing Your Purchase Decisions

Timing life insurance by age groups purchases requires balancing current needs against future cost increases. Generally, buying sooner provides long-term financial advantages, but specific situations may warrant different approaches.

Optimal Purchase Timing:

- Buy early: Lock in low premiums while you’re healthy and young

- Life event triggers: Marriage, children, mortgage purchase, income increases

- Health status: Before developing medical conditions that increase costs

- Financial capacity: When you can afford adequate coverage without straining budget

The cost of waiting almost always outweighs potential benefits. Premium increases compound annually, and health issues can develop unexpectedly, making coverage expensive or unavailable.

Real example: Two identical applicants, both 35 and healthy. One buys immediately, the other waits two years. The second applicant pays 18% more for the same coverage, every year, for the life of the policy.

5.2 Convertible Term Features Strategy

Convertible term life insurance provides flexibility to change policy types without medical underwriting. This feature becomes particularly valuable as you age and your insurance needs evolve.

Conversion Strategy Benefits:

- Health protection: Convert to permanent coverage if health declines

- Changing needs: Adjust policy type as financial situation evolves

- Rate advantages: Maintain insurability despite health changes

- Long-term planning: Bridge temporary and permanent coverage needs

Most convertible term policies allow conversion within specific timeframes (typically 10-20 years) and before reaching certain ages (usually 65-70). The key is understanding these deadlines and planning accordingly.

For guidance on when to convert term to permanent coverage, our analysis covers the financial considerations and optimal timing strategies.

5.3 Value Optimization by Life Stage

Getting maximum value from life insurance by age groups requires matching policy features to your specific age-related needs and financial circumstances.

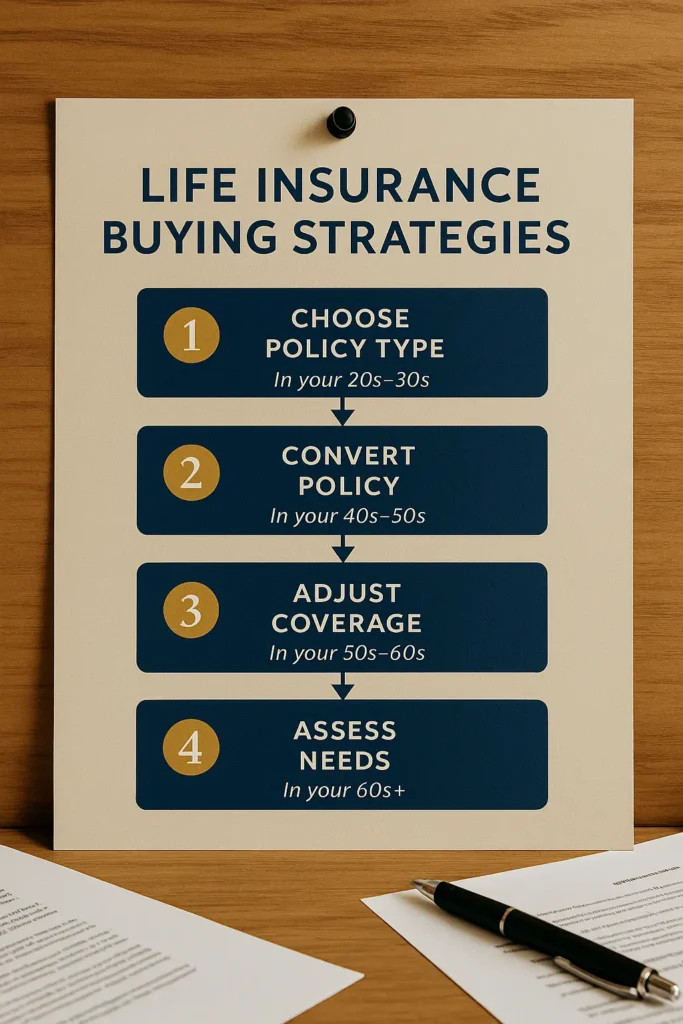

Value Optimization Roadmap:

Ages 20s-30s:

- Prioritize term life for maximum coverage at minimum cost

- Demand convertible features for future flexibility

- Buy coverage early to lock in preferred health rates

- Focus on establishing insurability foundation

Ages 40s-50s:

- Blend term and permanent coverage for comprehensive protection

- Use life insurance for estate planning and wealth accumulation

- Review and adjust coverage as family needs peak then decline

- Consider tax advantages of permanent policy cash value

Ages 60s+:

- Shift focus toward final expense and legacy planning

- Explore guaranteed issue options if health prevents traditional coverage

- Investigate living benefits for retirement income planning

- Coordinate with overall estate and tax planning strategies

The secret sauce? Regular reviews. Life insurance by age groups needs change, and your coverage should evolve with your circumstances.

FAQ: Life Insurance by Age Groups

What’s the best age to buy life insurance by age groups?

The best time to buy life insurance by age groups is in your twenties or early thirties when you’re young, healthy, and premiums are at their lowest. Even if you don’t have dependents yet, purchasing coverage early locks in affordable rates and protects your insurability if health issues develop later. Every year you wait typically increases premiums by 4-9%.

How much does life insurance by age groups cost?

Life insurance by age groups costs vary dramatically. A healthy 25-year-old might pay $25-40 monthly for $500,000 in term coverage, while a 45-year-old pays $75-120 for the same policy. Seniors often pay $300-600 monthly due to higher mortality risk and health considerations. The key is buying while you’re young and healthy.

Do I need coverage if I’m single with no dependents?

Even single individuals benefit from life insurance by age groups planning to cover debts, final expenses, and protect co-signers on loans. Additionally, purchasing coverage while young and healthy provides future insurability protection and allows you to lock in low premiums before life circumstances change dramatically.

Can seniors over 70 still get life insurance by age groups coverage?

Yes, seniors over 70 can obtain life insurance by age groups through guaranteed issue policies, simplified issue coverage, or group insurance plans. While more expensive than traditional coverage, these options provide valuable protection for final expenses and legacy planning without requiring medical underwriting or health questions.

Should I choose term or permanent based on my age?

Life insurance by age groups type selection depends on your life stage. Younger adults (20s-30s) typically benefit most from term life insurance due to lower costs and temporary coverage needs. Middle-aged adults (40s-50s) may need a combination approach. Seniors often prefer permanent policies for estate planning and guaranteed lifetime coverage.

How does health affect life insurance by age groups options?

Health impact increases significantly with age. Young adults often qualify for preferred rates with minimal health screening, while middle-aged applicants may need comprehensive medical exams. Seniors with health issues can access guaranteed issue policies that don’t require medical underwriting but cost substantially more per dollar of coverage.

What happens to coverage when I retire?

Your life insurance by age groups needs may change dramatically at retirement as income replacement becomes less critical. Some people reduce coverage amounts, convert term policies to permanent coverage, or focus on final expense protection. Permanent policies can provide retirement income through policy loans or cash withdrawals.

Is employer coverage enough, or do I need additional protection?

Employer life insurance typically provides only 1-2 times your annual salary, which is often insufficient for complete family protection. Most financial advisors recommend 8-12 times annual income in total coverage. Additional personal coverage ensures protection if you change jobs and provides adequate family financial support.

How often should I review my life insurance by age groups strategy?

Review your life insurance by age groups coverage every 3-5 years or after major life changes like marriage, children, home purchase, or significant income changes. Regular reviews ensure your coverage amount and policy type remain appropriate for your current age, family situation, and financial responsibilities.

What’s the difference between guaranteed issue and traditional coverage?

Guaranteed issue life insurance accepts all applicants within certain age ranges without medical questions but typically costs more and may have graded death benefits for the first 2-3 years. Traditional coverage requires health underwriting but offers better rates for healthy applicants and immediate full death benefits upon approval.

Can I increase coverage as I get older?

Increasing life insurance by age groups coverage as you age typically requires new medical underwriting and results in higher premiums based on your current age and health. Some policies offer guaranteed increase options or riders that allow coverage increases without medical exams, but planning for future needs while young and healthy provides the most cost-effective approach.

Should I convert my term policy to permanent coverage?

Converting term to permanent coverage makes sense if you need lifelong protection, want to build cash value, or have developed health issues that would prevent qualifying for new coverage. Consider conversion before your term policy expires and while conversion options remain available, typically before age 65-70.

Key Takeaways for Life Insurance by Age Groups

Life insurance by age groups planning requires different strategies at different life stages, but the fundamental principle remains consistent: purchase coverage when you’re young, healthy, and premiums are most affordable. Your twenties and thirties offer the best opportunity to secure long-term financial protection.

The biggest mistake people make? Treating life insurance like a static purchase instead of an evolving strategy that should adapt to your changing life circumstances.

Essential Action Steps:

- Evaluate your current coverage against age-appropriate guidelines and family needs

- Consider term life insurance for maximum protection during peak earning and responsibility years

- Review and adjust coverage every 3-5 years as circumstances, debts, and assets change

- Explore convertible features that provide flexibility as you age and health potentially declines

The most successful life insurance by age groups strategies align coverage types and amounts with your specific age-related financial responsibilities while maintaining affordability throughout your lifetime. Whether you’re building your first policy or reviewing existing coverage, understanding how age affects your needs empowers you to make informed decisions.

For comprehensive information about policy types, coverage options, and specific product features, our detailed life insurance analysis provides in-depth guidance for every age group and life stage. Understanding life insurance beneficiary rules ensures your coverage protects the right people at every stage of life.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.