Deciding between term vs whole life insurance feels like standing at a crossroads with your family’s financial security hanging in the balance. I’ve watched countless families wrestle with this choice, and here’s what I’ve learned—the path you take today shapes your financial landscape for decades.

The insurance world loves throwing around technical jargon that leaves most folks scratching their heads. You’ve probably heard agents pitch “permanent coverage with cash accumulation” or “affordable temporary protection,” but what does that actually mean for your wallet and your family’s future? The truth is, these two insurance types serve completely different purposes, and picking the wrong one can cost you thousands.

Recent industry analysis reveals that 47% of American households own some form of life insurance, yet a staggering 60% admit they don’t fully understand their policy’s features. This knowledge gap often leads to either paying excessive premiums for unnecessary features or buying inadequate coverage that leaves families vulnerable.

Quick Decision Guide:

- Tight budget + specific timeframe → Term coverage wins

- Long-term wealth strategy + tax planning → Whole life fits better

- Growing family with mortgage debt → Term provides maximum bang for your buck

- Estate preservation + inheritance goals → Whole life offers structured benefits

Take Maria, a 29-year-old teacher from Denver. She’s got twin toddlers, a $280,000 mortgage, and needs $600,000 in coverage. Term insurance runs her $35 monthly while whole life would cost $350. That $315 monthly difference? She’s pumping it into her 403(b) and emergency fund instead.

This detailed breakdown examines seven crucial distinctions between term vs whole life insurance, giving you the insights needed to choose based on your actual circumstances, not sales pressure. You’ll understand the real costs behind each option, discover how coverage duration affects your strategy, and learn to sidestep the expensive mistakes that trap many families.

When we’re done here, you’ll have a crystal-clear framework for making this decision and understand exactly how it fits into your broader financial picture. No more second-guessing—just solid reasoning you can stand behind.

On This Page

1. Coverage Duration and Permanence

The biggest difference between term vs whole life insurance policies boils down to a simple question: how long does your protection last?

How Term Coverage Works

Term life insurance operates like a rental agreement for protection. You pay premiums for a set period—usually 10, 20, or 30 years—and if you pass away during that window, your beneficiaries collect the death benefit. When your term ends, so does your coverage, unless you’re willing to pay significantly higher renewal rates.

This temporary structure makes term insurance perfect for covering debts and obligations that have clear endpoints. Most families rely on term life coverage options to replace income during their peak earning years, ensure mortgage payments continue, or fund children’s college expenses.

Duration Snapshot:

- Term Policies: 10-30 year periods (renewal possible but expensive)

- Whole Life Policies: Coverage until age 100-121

- Premium Changes: Term skyrockets at renewal; whole life stays constant

- Renewal Rights: Term allows renewal without new medical exams (at higher cost)

1.1 The Term Expiration Reality

Here’s something most people don’t grasp until it’s too late: when your term expires, you’re essentially starting from scratch. Any health changes during the covered years can make new coverage prohibitively expensive or completely unavailable.

Picture this scenario: you secure a 20-year term policy at 35. When it expires at 55, you might face premiums that have jumped 1,000-1,500% for identical coverage. This dramatic increase explains why understanding these renewal challenges matters before you sign on the dotted line.

Real Premium Shock (55-year-old male, $500K coverage):

- Expiring 20-year term: $720/year

- New 20-year term: $2,880/year

- Identical coverage, 4x the cost

The numbers tell a sobering story: actuarial data shows only 1-3% of term policies ever pay death benefits because most people either outlive their coverage or drop it due to cost increases.

1.2 Whole Life’s Permanent Promise

Whole life insurance eliminates the expiration anxiety completely. Your protection continues as long as you make premium payments, regardless of health deterioration, age advancement, or any other factors. This permanence offers reassurance that your beneficiaries will receive benefits whenever you pass away.

This lasting protection proves valuable for estate planning, final expense coverage, or guaranteeing an inheritance. Many people find comfort knowing their coverage won’t vanish when they might need it most—during later years when securing new protection becomes challenging or impossible.

Permanent Protection Features:

- Zero medical re-qualification requirements

- Premiums locked in regardless of age or health changes

- Lifetime coverage guarantee (with continued premium payments)

- Estate planning predictability

This guaranteed aspect particularly appeals to business owners requiring key person coverage or families with special needs members who’ll need lifelong financial support.

1.3 Flexibility Factors

Term insurance offers superior flexibility in coverage amounts since you can easily modify protection levels when renewing or buying new policies. You might begin with $1 million coverage in your 30s, then scale back to $500,000 in your 50s as your mortgage shrinks and kids achieve financial independence.

Whole life insurance delivers less flexibility in coverage amounts but more predictability in costs and benefits. While many policies allow riders or policy loans, changing the base coverage typically requires purchasing additional policies.

Flexibility Breakdown:

- Term Options: Simple coverage adjustments between terms

- Whole Life Limits: Fixed coverage with minimal adjustment options

- Cost Effects: Term adjustments impact future premiums; whole life changes need new policies

Smart financial planning often combines both approaches—substantial term coverage for immediate needs plus smaller whole life policies for permanent requirements as circumstances improve.

2. Premium Structure and Cost Differences

The price gap between term vs whole life insurance often becomes the deciding factor for most families.

Term’s Cost Advantage

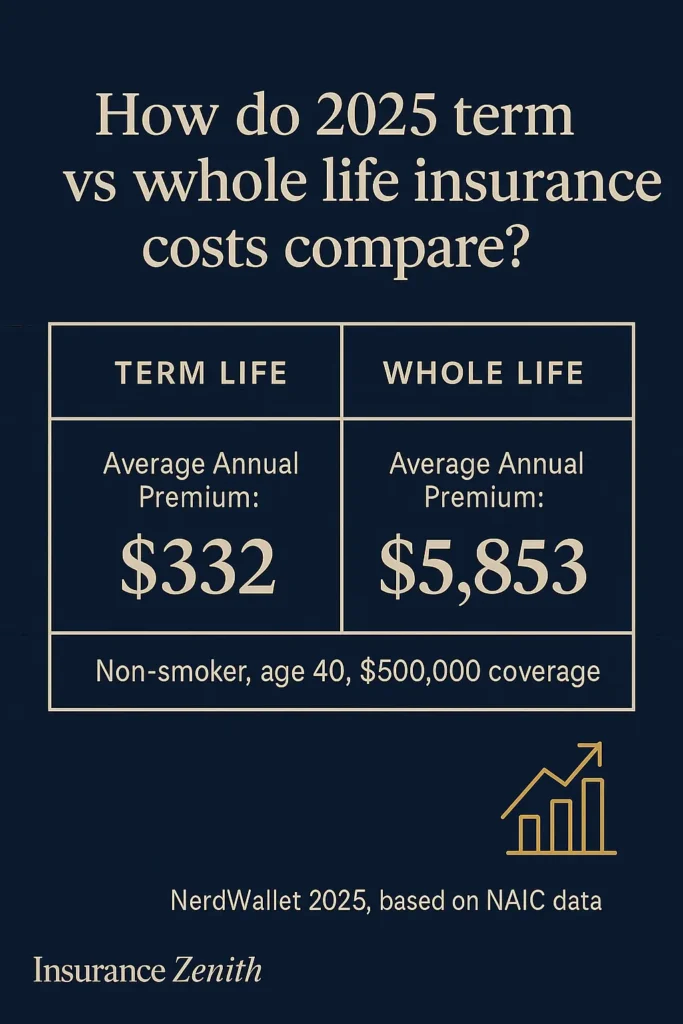

When evaluating term vs whole life insurance costs, term life insurance costs dramatically less than whole life insurance—typically 10-20 times less for identical death benefit amounts. This massive cost difference exists because term insurance delivers pure protection without investment or cash accumulation features.

Consider a healthy 35-year-old non-smoker needing $500,000 coverage. A 20-year term policy might cost $350-450 annually, while comparable whole life coverage could run $3,500-4,500 yearly. This efficiency allows young families to secure substantial protection during their most vulnerable financial period, despite tight budgets.

Real Cost Analysis (35-year-old, $500K coverage):

| Coverage Type | Annual Premium | 20-Year Total |

|---|---|---|

| 20-Year Term | $375 | $7,500 |

| Whole Life | $4,100 | $82,000 |

| Savings | $3,725 | $74,500 |

That $74,500 difference, invested in a balanced portfolio earning 7% annually, could grow to over $280,000 in 20 years—substantially exceeding typical whole life cash value growth.

2.1 Level Premium Mechanics

Both term and whole life can offer level premium guarantees, but they function differently. Term policies lock in premiums for the specific term duration (10, 20, or 30 years), while whole life policies guarantee level premiums throughout your entire lifetime.

This distinction becomes crucial when evaluating long-term expenses. Term premiums remain stable during the initial period but spike dramatically upon renewal. Our comprehensive life insurance guide details how these premium structures influence your long-term financial planning and coverage strategies.

Whole life’s level premium feature provides budgeting certainty—you’ll pay identical amounts at 75 as you did at 35, regardless of inflation or health deterioration.

Premium Guarantee Comparison:

- Term Guarantees: Level only during initial term period

- Whole Life Guarantees: Level throughout lifetime

- Inflation Impact: Whole life premiums become relatively cheaper over time

- Budget Planning: Both allow predictable premium planning during guarantee periods

2.2 Fee Structure Analysis

Whole life insurance incorporates numerous fees and charges absent in term insurance. These include administrative fees, insurance cost charges, mortality and expense charges, plus surrender penalties if you cancel early.

Term insurance maintains minimal fees since it provides straightforward protection without investment components. Your premium payments go directly toward insurance protection and basic administrative expenses.

Fee Structure Comparison:

- Term Fees: Basic administrative costs only (typically 2-5% of premium)

- Whole Life Fees: Multiple fee layers totaling 15-25% of annual premiums

- Transparency: Term fees remain simple; whole life fees can be complex

- Growth Impact: Fees significantly reduce whole life cash value growth in early years

Understanding these fees explains why whole life policies often don’t break even on cash value versus premiums paid until year 10-15.

2.3 Lifetime Cost Evaluation

While term insurance costs less initially, total lifetime expense comparisons depend on coverage duration needs. If you require insurance beyond the initial term period, whole life might become more economical despite higher initial premiums.

Consider this situation: purchasing term insurance repeatedly throughout your life due to renewals or new policies might accumulate costs exceeding a whole life policy bought during younger years. However, this calculation assumes permanent coverage needs, which many people lack.

Break-Even Factors:

- Coverage duration requirements (permanent vs. temporary)

- Health changes affecting renewability over time

- Investment returns on premium differences

- Actual versus projected cash value growth rates

The critical insight: term insurance excels for temporary needs, while whole life makes sense only for permanent coverage requirements or specific estate planning objectives.

3. Cash Value and Investment Components – Term vs Whole Life Insurance

Whether your policy builds cash value represents one of the most significant distinctions when comparing term vs whole life insurance types.

Whole Life’s Cash Building

Whole life insurance incorporates a cash value element that accumulates over time, functioning like a built-in savings account within your policy. Part of each premium payment feeds this cash value, which grows with interest and potential dividends.

This cash accumulation offers several advantages: you can borrow against it, use it for future premium payments, or withdraw portions for emergencies. The cash value grows tax-deferred, meaning you avoid taxes on growth until withdrawing more than you’ve contributed in premiums.

Cash Value Timeline:

- Years 1-5: Minimal cash value (high fees limit growth)

- Years 6-15: Steady accumulation begins

- Years 16+: Significant cash value develops

- Policy Maturity: Cash value equals death benefit

Reality check: most policies don’t accumulate meaningful cash value until year 7-10 due to substantial upfront costs and fees.

3.1 Term Plus Investment Strategy

When comparing term vs whole life insurance options, term life insurance provides zero cash value or investment features—and that’s actually advantageous for many people. The “buy term and invest the difference” approach involves purchasing less expensive term coverage while investing premium savings in separate investment accounts.

This strategy potentially generates superior returns compared to whole life cash value growth, since you can select investments with better performance potential. However, it demands discipline to actually invest the difference rather than spending it on lifestyle expenses.

Investment Performance Comparison (20-year outlook):

- Whole Life Cash Value: 3-4% annual growth (guaranteed)

- Term + Separate Investments: 6-8% potential annual growth (market-dependent)

- Risk Profile: Whole life guaranteed; separate investments variable

- Control Level: Whole life managed by insurer; separate investments self-directed

Research from investment analysis firms shows that disciplined investors using the “buy term and invest the difference” strategy typically accumulate 2-3 times more wealth than whole life policyholders over 20-30 year periods.

3.2 Access and Liquidity Options

Whole life insurance provides multiple cash value access methods: policy loans, partial withdrawals, and complete surrender options. Policy loans let you borrow against cash value without triggering taxes, though unpaid loans reduce your death benefit dollar-for-dollar.

Term insurance offers zero liquidity options since there’s no cash value to access. Emergency money or investment opportunities require separate savings or investment accounts.

Access Method Comparison:

- Whole Life: Policy loans (typically 5-8% interest rates), partial withdrawals, full surrender

- Term: No cash access available

- Tax Effects: Whole life offers tax-advantaged access; term requires separate taxable accounts

- Flexibility: Whole life provides built-in liquidity; term requires external planning

The loan feature attracts many whole life buyers, but borrowed amounts reduce death benefits unless repaid with interest.

3.3 Cash Value Growth Reality

While whole life cash value growth comes guaranteed, returns typically lag other investment alternatives. Insurance companies invest conservatively to guarantee returns, limiting growth potential compared to stock market investments or other options.

Additionally, hefty fees in early policy years dramatically reduce cash value accumulation. Many whole life policies don’t break even on cash value versus premiums paid until year 10-15, making them poor short-term investments.

Growth Reality Elements:

- Conservative investment approach caps returns at 3-4% annually

- Heavy early fees dramatically reduce initial accumulation

- Guaranteed growth provides security but limited upside potential

- Long-term commitment required for meaningful cash value development

For life insurance policy basics and investment planning, understanding these trade-offs helps you make informed decisions about coverage versus separate investment strategies.

4. Death Benefit Variations and Guarantees

How and when beneficiaries collect death benefits differs significantly between term vs whole life insurance policies.

Term Life Benefit Structure

Term life insurance delivers a straightforward death benefit—if you pass away during the covered term, your beneficiaries collect the full policy amount, typically tax-free. The death benefit stays consistent throughout the term period, though some policies offer decreasing or increasing benefit variations.

The simplicity of term death benefits makes them easy to understand and plan around. Your family knows exactly what they’ll receive if something happens during the coverage period, making financial planning more predictable.

Benefit Structure Options:

- Level Term: Consistent death benefit throughout the term (most popular)

- Decreasing Term: Death benefit shrinks over time (often used for mortgage protection)

- Increasing Term: Death benefit expands with inflation (higher premiums required)

- Return of Premium: Refunds premiums if you outlive the term (dramatically higher cost)

4.1 Whole Life Benefit Enhancement

Whole life insurance death benefits can expand over time through dividends and paid-up additions. If your insurer performs well, they may distribute dividends that boost your death benefit beyond the original face amount.

This growth potential delivers inflation protection and enhanced legacy planning, though dividend distributions aren’t guaranteed. The base death benefit remains guaranteed, but additional growth depends on company performance and dividend declarations.

Benefit Enhancement Strategies:

- Dividends: Company profits shared with policyholders (not guaranteed)

- Paid-Up Additions: Purchase extra coverage using dividends

- Automatic Increases: Built-in growth riders (additional premium required)

- Cash Value Conversion: Cash value becomes part of death benefit at maturity

Historical records show participating whole life policies from major insurers have distributed dividends for 100+ consecutive years, though future payments remain uncertain.

4.2 Tax Effects and Implications

Both term and whole life insurance death benefits generally remain income tax-free to beneficiaries, but estate tax implications can differ. Large whole life policies might trigger estate taxes if your total estate exceeds federal exemption limits ($13.61 million in 2024).

The tax-free nature of life insurance death benefits makes them valuable for estate planning strategies. However, understanding your coverage options and tax implications helps optimize your overall financial approach.

Tax Impact Summary:

- Income Tax: Death benefits generally tax-free for both types

- Estate Tax: Whole life policies included in estate value if you own them

- Generation-Skipping: Both can trigger GST taxes on large amounts

- State Taxes: Varies by state; most don’t tax death benefits

Strategic estate planning might involve irrevocable life insurance trusts (ILITs) to remove policies from taxable estates.

4.3 Payout Alternatives

Life insurance companies provide various death benefit payment alternatives to beneficiaries. While both term and whole life offer these options, whole life policies sometimes include enhanced settlement choices due to their cash value elements.

Standard alternatives include lump sum payments, installment payments over time, or interest-only payments where beneficiaries collect interest while preserving principal. Some insurers offer immediate annuity conversions for guaranteed lifetime income.

Available Payout Methods:

- Lump Sum: Immediate full payment (chosen by 85% of beneficiaries)

- Installments: Fixed payments over specified years

- Interest Only: Beneficiary collects interest, preserves principal

- Life Income: Convert to annuity for lifetime payments

Most beneficiaries select lump sum payments for maximum flexibility, but installment alternatives can provide budgeting assistance for those who might struggle with large amounts.

5. Age and Health Considerations in Term vs Whole Life Insurance

Your age and health status significantly influence which insurance type makes more sense for your circumstances when choosing between term vs whole life insurance.

Young Adult Considerations (20s-30s)

Young adults typically benefit most from term life insurance due to lower costs and temporary coverage requirements. During these years, you’re likely building your career, starting a family, and managing debt obligations like student loans or a first mortgage.

Term insurance allows you to secure substantial coverage affordably, protecting your family during your most vulnerable financial years. The money saved on premiums can go toward building emergency funds, eliminating debt, or investing for retirement.

Young Adult Priorities:

- Maximum coverage at minimum cost (often need $500K-$1M+ protection)

- Debt protection (student loans, early mortgage payments)

- Income replacement during prime earning years

- Flexibility to adjust coverage as circumstances evolve

Consider Alex, age 27, recently married with $92,000 in student loans and a new mortgage. He needs $750,000 coverage but earns $48,000 annually. Term insurance costs $325/year versus $3,200 for whole life—that difference funds his Roth IRA contributions instead.

5.1 Middle Age Decision Points (40s-50s)

Middle-aged individuals face more complex insurance decisions as their financial situations stabilize and long-term planning becomes more important. This period often involves considering converting term policies to permanent coverage or purchasing whole life insurance.

If you’re in your 40s or 50s with significant assets, established careers, and reduced debt obligations, whole life insurance might make sense for estate planning and wealth transfer purposes. However, if your insurance requirements remain temporary, renewing term coverage or purchasing new term policies might remain the better choice.

Middle Age Considerations:

- Career Peak: Higher income allows for larger premium payments

- Asset Accumulation: More complex estate planning requirements emerge

- Health Changes: May affect future insurability and premium rates

- Children’s Independence: Reduced temporary coverage requirements

This life stage often involves exploring coverage alternatives as financial priorities shift from protection to wealth transfer and tax planning strategies.

5.2 Senior Considerations (60s+)

Seniors face limited and expensive term life insurance alternatives, making whole life insurance more attractive if coverage remains needed. However, many seniors discover their life insurance requirements have diminished as debts get paid off and children achieve financial independence.

For seniors who still require coverage, whole life insurance provides guaranteed acceptance alternatives (with some policies) and stable premiums. The cash value component can also serve as an emergency fund or long-term care funding source.

Senior Insurance Requirements:

- Final Expense Coverage: Funeral and burial costs ($7,000-$15,000 average)

- Estate Planning: Wealth transfer to heirs

- Debt Elimination: Remaining mortgage or credit obligations

- Spouse Protection: Income replacement for surviving spouse

Many seniors discover that their existing assets can self-insure their final expenses, eliminating the need for life insurance entirely.

5.3 Health Status Effects

Your current and future health significantly affects the term versus whole life decision. If you have health issues or a family history of medical problems, securing whole life coverage while healthy might be wise.

Conversely, if you’re in excellent health with no family history of serious conditions, term insurance allows you to reassess your situation periodically and potentially secure better rates or different coverage amounts based on changing requirements.

Health Impact Factors:

- Current Health: Affects initial premium rates for both types

- Family History: Genetic predispositions influence long-term planning

- Lifestyle Elements: Smoking, drinking, dangerous hobbies affect rates significantly

- Future Insurability: Health changes make new coverage difficult or expensive

Recent medical advances have improved life expectancy, but they’ve also made underwriting more sophisticated and health-focused.

6. Which Option Is Right for You

Choosing between term vs whole life insurance depends on your specific financial situation, objectives, and personal preferences.

Term Life Insurance Works Best For:

Most financial experts recommend term life insurance for people with temporary coverage requirements and limited budgets. Understanding the term vs whole life insurance debate helps clarify that if you’re young, have dependents, carry debt, or need maximum coverage at minimum cost, term insurance typically delivers the best value.

Term insurance works particularly well if you’re disciplined about investing the premium difference in separate accounts. This proven strategy potentially generates superior returns compared to whole life cash value while providing more investment control and flexibility.

Term Insurance Best Suits:

- Young families with mortgages and dependent children

- High debt levels requiring temporary income protection

- Limited budgets needing maximum coverage amounts

- Temporary requirements with specific end dates (mortgage payoff, children’s education completion)

The “buy term and invest the difference” strategy works best for people who actually invest the premium savings rather than spending them on lifestyle inflation.

6.1 Whole Life Insurance Makes Sense For

Whole life insurance suits people with permanent coverage requirements, substantial assets requiring estate planning, or those who prefer guaranteed returns over market risk. If you’re in a high tax bracket, have maximized other retirement accounts, or want to leave a guaranteed inheritance, whole life might be appropriate.

The forced savings aspect appeals to people who struggle with investment discipline, though this comes at the cost of potentially higher returns from separate investments.

Whole Life Insurance Best Suits:

- High net worth individuals with estate planning requirements (estates exceeding $10M)

- Business owners requiring key person coverage or buy-sell agreements

- Conservative investors preferring guaranteed returns over market volatility

- Permanent requirements like final expenses or spousal protection lasting beyond typical term periods

Business applications include funding buy-sell agreements where guaranteed death benefits ensure smooth ownership transfers regardless of market conditions.

6.2 Hybrid Strategies and Combinations

Many people benefit from combining both coverage types when navigating the term vs whole life insurance decision. You might purchase a smaller whole life policy for permanent requirements while using term insurance for temporary obligations like mortgage protection or income replacement.

This hybrid approach provides the benefits of both coverage types while managing costs. The whole life component ensures some permanent coverage while term insurance handles larger temporary requirements affordably.

Combination Strategy Examples:

- $100K whole life + $400K term for mixed permanent and temporary requirements

- Whole life for final expenses + term for income replacement

- Convert portion of term to whole life as financial situation improves

- Business whole life + personal term for different coverage purposes

This strategy particularly suits high earners who want permanent coverage but need substantial temporary protection during peak earning years.

6.3 Decision Framework and Next Steps

Use this framework to evaluate your situation: Calculate your total insurance requirements, determine what portion is temporary versus permanent, assess your budget constraints, and consider your investment discipline and risk tolerance.

Decision Framework Questions:

- How long do you need coverage? (Temporary requirements favor term)

- What’s your budget for premiums? (Limited budgets favor term)

- Do you have investment discipline? (Yes favors term plus invest difference)

- Are you in a high tax bracket? (Yes might favor whole life tax benefits)

- Do you need estate planning tools? (Yes favors whole life)

Most financial advisors recommend starting with term insurance in your 20s-30s, then reassessing as your financial situation evolves and permanent requirements become clearer.

7. Common Mistakes to Avoid with Term vs Whole Life Insurance

Understanding these common pitfalls helps you make a more informed decision and avoid costly mistakes when selecting between term vs whole life insurance.

7.1 Purchasing Whole Life Too Young

Many insurance agents recommend whole life insurance to young adults, emphasizing the benefit of “locking in” low rates while healthy. While this sounds logical, it often represents poor financial advice for most young people.

Young adults typically have limited budgets and temporary coverage requirements. Purchasing expensive whole life insurance often means buying less coverage than needed, leaving families underprotected. The premium difference invested separately usually generates better long-term returns than whole life cash value.

Young Adult Mistakes:

- Insufficient coverage due to whole life’s high cost

- Missed investment opportunities from tying up money in low-return cash value

- Premature commitment to permanent coverage before understanding true requirements

- Agent bias toward higher commission whole life products (often 5-10x term commissions)

The opportunity cost is significant: $3,000 annual premium difference invested at 7% for 30 years grows to over $280,000.

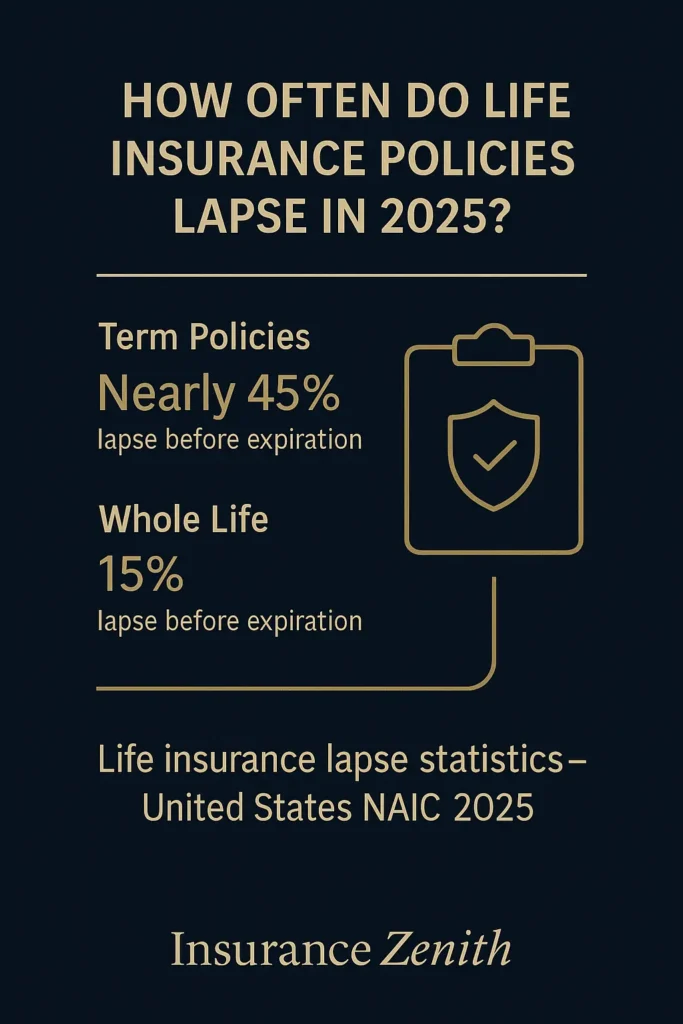

7.2 Allowing Term Coverage to Lapse

One of the biggest term life insurance mistakes involves allowing coverage to lapse when you still have dependents or financial obligations. This often happens when premiums increase at renewal or when people assume they no longer need coverage.

Before letting term coverage expire, carefully evaluate whether you still have insurance requirements. If you do, explore alternatives like converting to whole life (if available), purchasing new term coverage, or understanding age-specific options rather than eliminating protection entirely.

Lapse Prevention Strategies:

- Regular requirements assessment to determine continued coverage needs

- Conversion alternatives available with many term policies (usually first 10-20 years)

- Reduced coverage rather than complete elimination

- Professional consultation before making major coverage changes

Industry statistics show that 85-90% of term policies expire without paying benefits, often due to lapse rather than outliving the requirement.

7.3 Ignoring Inflation and Changing Requirements

Both term and whole life insurance buyers often fail to account for inflation’s impact on coverage adequacy. A $500,000 policy today won’t provide the same purchasing power in 20-30 years.

Additionally, your insurance requirements change over time as you pay off debts, accumulate assets, and your dependents become financially independent. Regularly reviewing and adjusting your coverage ensures it remains appropriate for your situation.

Inflation Protection Strategies:

- Increasing coverage riders that grow death benefits over time (typically 3-5% annually)

- Regular policy reviews to assess current adequacy (every 3-5 years)

- Supplemental coverage to account for inflation and changing requirements

- Professional guidance for long-term planning considerations

A $500,000 policy today has only $300,000 purchasing power in 20 years assuming 3% inflation.

Key Takeaways

The choice between term vs whole life insurance ultimately depends on your specific financial situation, coverage requirements, and long-term objectives. Term life insurance offers maximum coverage at minimum cost, making it ideal for young families, temporary requirements, and budget-conscious consumers. Whole life insurance provides permanent protection with cash value growth, suited for estate planning, high net worth individuals, and those preferring guaranteed returns.

Bottom Line Decision Framework:

- Choose Term If: You have temporary coverage requirements, limited budget, young family, or prefer investing separately

- Choose Whole Life If: You need permanent coverage, have estate planning requirements, prefer guaranteed returns, or want forced savings

Most financial experts recommend term life insurance for the majority of consumers, especially during peak earning years with dependents. The premium savings can be invested separately for potentially higher returns while providing adequate family protection.

Before making your final decision about term vs whole life insurance, consider consulting with a fee-only financial advisor who can provide objective guidance based on your complete financial picture. Remember, the best life insurance is the coverage you can afford to maintain throughout the period you need protection.

Next Steps:

- Calculate your total insurance requirements using online calculators

- Determine temporary versus permanent coverage needs

- Get quotes for both term and whole life alternatives from multiple insurers

- Consider your investment discipline and risk tolerance honestly

- Consult with an independent insurance professional for personalized guidance

For comprehensive information about life insurance policies and coverage alternatives, including detailed comparisons of policy types, underwriting requirements, and application processes, review our complete life insurance resource center.

FAQ

Which is better, term life or whole life insurance?

For most people, term life insurance works better because it provides way more coverage for your money. Think about it – if you’re 35 with kids and a mortgage, you can get $500,000 in term coverage for around $400 per year, while whole life would cost you $4,000 annually for the same death benefit. That extra $3,600 can go toward paying off debt, building an emergency fund, or investing for retirement. Whole life only makes sense if you have permanent coverage needs and substantial wealth to manage.

Why does Dave Ramsey not like whole life insurance?

Dave Ramsey dislikes whole life insurance because it’s expensive and delivers poor investment returns. He advocates for “buy term and invest the difference” – getting cheaper term coverage and putting the savings into mutual funds or other investments that typically earn better returns than whole life’s cash value growth of 3-4%. His argument is that whole life combines two things that work better separately: insurance and investing. The fees and complexity make it a subpar choice for building wealth.

What is the downside of whole life insurance?

The biggest downside is cost – whole life runs 10-20 times more expensive than term insurance for the same death benefit. Plus, the cash value growth is terrible in the early years due to heavy fees and charges. Most policies don’t even break even until year 10-15. You’re also locked into conservative investment returns around 3-4% annually when you could potentially earn 7-8% in the stock market. The complexity and lack of flexibility make it unsuitable for most families’ needs.

Why is term life insurance not worth it?

Term life insurance gets criticized because only 1-3% of policies ever pay out death benefits – most people either outlive the term or let coverage lapse when premiums spike at renewal. Critics argue you’re essentially “renting” protection with nothing to show for it afterward. However, this misses the point entirely. Term insurance isn’t supposed to be an investment – it’s pure protection during your most vulnerable financial years when your family needs income replacement and debt coverage.

Can you cash out whole life insurance?

Yes, you can cash out whole life insurance through several methods. You can take policy loans against the cash value (usually at 5-8% interest rates), make partial withdrawals, or surrender the entire policy for its cash value. However, loans reduce your death benefit dollar-for-dollar unless repaid, and surrendering early often means getting back less than you paid in premiums due to surrender charges and fees. The cash value also grows tax-deferred, but withdrawals above your premium payments get taxed as income.

Does Dave Ramsey recommend term life insurance?

Absolutely. Dave Ramsey strongly recommends term life insurance as part of his “buy term and invest the difference” philosophy. He suggests getting 10-12 times your annual income in term coverage during your working years, then investing the money you save on premiums into retirement accounts and other investments. His reasoning is that term provides maximum protection at minimum cost while you build wealth separately through better-performing investments than whole life’s cash value.

How much is whole life insurance for a 55 year old?

A 55-year-old can expect to pay substantially more for whole life insurance than younger buyers. For $500,000 in coverage, annual premiums typically range from $8,000-$15,000 depending on health, gender, and the specific insurance company. Women generally pay less than men due to longer life expectancy. At this age, many people discover that term insurance has become prohibitively expensive too, which makes some consider whole life despite the high cost.

When to stop paying for whole life insurance?

You can stop paying whole life premiums once the cash value grows large enough to cover future premium payments through automatic loans or withdrawals. This typically happens after 15-20 years of payments, depending on the policy design and performance. Some people also stop payments when their insurance needs disappear – like when their kids become financially independent and their mortgage gets paid off. However, stopping payments early might mean losing money due to surrender charges.

What type of life insurance is best?

For most Americans, term life insurance provides the best value during their peak earning years when dependents need protection. It delivers maximum coverage at minimum cost, allowing families to invest the premium difference for potentially better returns. Whole life makes sense only for specific situations: high net worth individuals needing estate planning tools, business owners requiring permanent key person coverage, or people who prefer guaranteed returns over market investments. The “best” type depends entirely on your financial situation, coverage timeline, and personal preferences.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.