Last August in Arizona, Josh’s Harley broke down in the middle of the Sonoran Desert. No cell signal, no shade, and worse—he’d assumed his regular motorcycle insurance covered roadside help. It didn’t. A 200-mile tow ended up costing him $840 out of pocket.

Motorcycle breakdown insurance exists for exactly that reason. It’s a separate policy—offered by companies like AAA or through add-ons—that covers roadside assistance, towing, battery jumps, flat repairs, and more. While basic motorcycle insurance protects against accidents or theft, it usually won’t help when your engine stalls in 110° heat. According to AAA’s May 2024 data, motorcycle-related roadside calls rose 12% year-over-year, especially in the Southwest.

But how do you know if motorcycle breakdown insurance is worth the extra cost—or if you’ll even qualify? Let’s unpack the key coverage options, state-specific rules, and what most riders miss.

On This Page

1. Understand Motorcycle Breakdown Insurance

1.1 What is motorcycle breakdown insurance exactly?

Motorcycle breakdown insurance is a service contract that helps riders cover unexpected mechanical or electrical failures while on the road. Unlike liability or collision coverage, which deals with accidents, this specific policy activates when your bike simply won’t start—or stalls mid-ride. It typically includes towing, flat tire repairs, battery jumpstarts, emergency fuel delivery, and locksmith services for keys locked in saddlebags.

Unlike car roadside plans, motorcycle breakdown insurance is usually a standalone product or an optional rider on a motorcycle insurance policy. According to a March 2024 survey by AAA, 1 in 3 riders mistakenly believed their regular motorcycle coverage included towing—leading to out-of-pocket surprises averaging $550 per incident.

Pro tip: Not all breakdown plans cover all bike types. Custom-built, vintage, or electric motorcycles may require specialized coverage with added fees or exclusions.

Learn the difference between custom and standard motorcycle insurance if you ride a modified or non-standard model.

| Feature | Basic Motorcycle Insurance | Motorcycle Breakdown Insurance |

|---|---|---|

| Accident Coverage | ✔️ | ❌ |

| Mechanical Failure | ❌ | ✔️ |

| Towing Service | Limited or None | Often Included |

| Battery/Flat Tire Assistance | ❌ | ✔️ |

| Available as Add-On | Sometimes | Yes |

1.2 How motorcycle breakdown insurance differs from regular motorcycle insurance

At its core, regular motorcycle insurance covers damages from accidents, theft, or liability—while motorcycle breakdown insurance strictly handles mechanical failures. That means if your clutch fails 30 miles from home and you’re not in a crash, your standard policy won’t help. But a breakdown plan will dispatch roadside support within the hour.

Breakdown insurance often has no deductible, which contrasts sharply with collision policies that may require $500–$1,000 upfront before benefits kick in. According to NAIC data (April 2024), the average deductible on motorcycle policies was $622—making breakdown coverage an appealing low-cost safeguard.

Real case: In Illinois, a rider with full coverage had to pay the full towing bill because the issue was a snapped belt—not a crash. It cost $780 out of pocket. That wouldn’t have happened with motorcycle breakdown insurance in place.

2. Explore the Key Features of Motorcycle Breakdown Insurance

2.1 What motorcycle breakdown insurance typically covers

Motorcycle breakdown insurance usually covers emergency towing (typically up to 100 miles), flat tire assistance, battery jumpstarts, fuel delivery, lost key recovery, and even limited trip interruption benefits. Some plans also include labor costs if minor repairs can be done on-site. These services are active 24/7 and are available nationwide—ideal for long-distance or interstate riders.

For example, PremiumPlus Rider Assist—a policy add-on offered in several states—includes towing, mechanical dispatch, and hotel coverage if you’re stranded more than 100 miles from home. According to April 2025 pricing data from Statista, the average standalone motorcycle breakdown policy in the U.S. costs $45 to $110 per year, depending on the bike and location.

Pro tip: Look for policies that offer GPS-enabled dispatch and allow mobile claim tracking—it saves hours in case of rural breakdowns.

Breakdown coverage vs roadside assistance—what’s the real difference?

- ✔ Towing (usually up to 100 miles per incident)

- ✔ Flat tire repair or replacement assistance

- ✔ Emergency fuel/oil/coolant delivery

- ✔ Dead battery jumpstart

- ✔ Key/lockout assistance

- ✔ Optional: trip interruption reimbursement (meals, hotel, transit)

2.2 What’s usually excluded in motorcycle breakdown insurance

Motorcycle breakdown insurance isn’t a catch-all. Most policies exclude pre-existing mechanical issues, routine maintenance (oil changes, worn-out tires), and breakdowns that occur off paved public roads. If your bike breaks down during a track day or off-road ride, you’ll likely be on your own.

Policies may also exclude certain bike types like antique models, scooters under 50cc, or electric motorcycles not manufactured by major brands. Plus, coverage is often denied if the failure resulted from neglect—like ignoring a known oil leak.

Agent–rider dialogue:

Rider: “So my engine seized. Will the policy cover it?”

Agent: “Was it due to wear and tear or a prior issue? If yes, it’s not eligible. Breakdown insurance only kicks in for sudden failures, not gradual ones.”

3. Compare Motorcycle Breakdown Insurance Plans

3.1 Side-by-side comparison of top motorcycle breakdown insurance plans

Choosing the right motorcycle breakdown insurance isn’t just about price—it’s about what happens at mile 72 when your throttle fails. Some plans only offer basic towing, while others include concierge-style benefits like hotel reimbursements, trip routing, or mobile app dispatch. The best fit depends on how often—and how far—you ride.

For those transporting bikes cross-country, driveaway insurance may offer better protection for long-distance delivery or relocation.

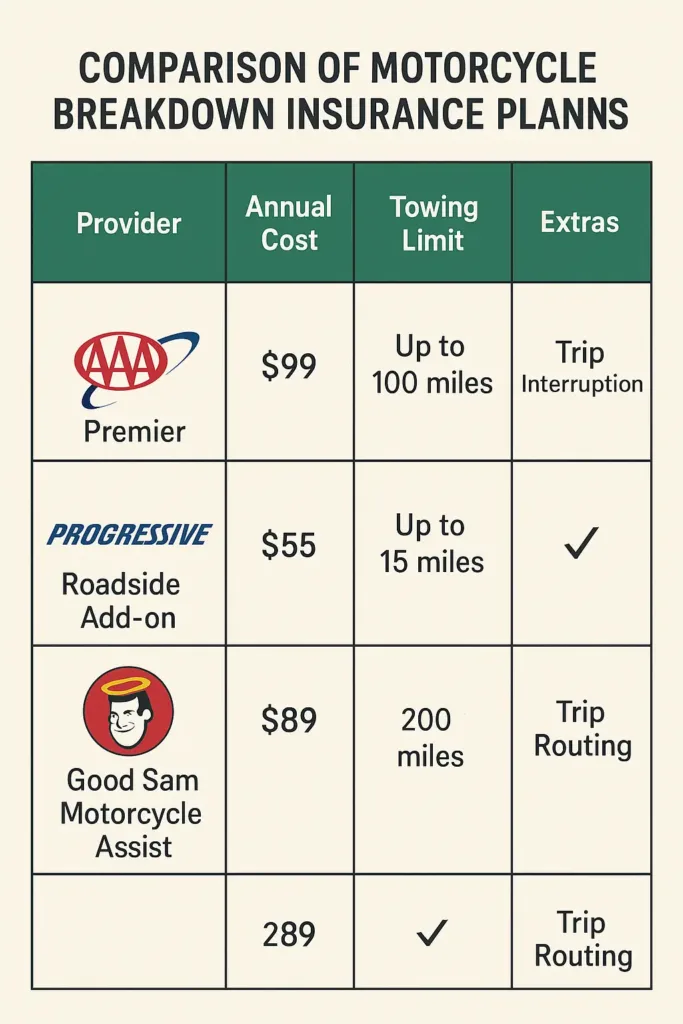

Below is a simplified comparison of three major providers offering motorcycle breakdown insurance in the U.S. as of May 2025:

| Provider | Annual Cost | Towing Miles | Extras |

|---|---|---|---|

| AAA Premier Motorcycle | $99 | Up to 100 miles | Trip interruption, legal referral |

| Progressive Roadside Add-On | $55 | Up to 15 miles | Battery jump, towing, lockout |

| Good Sam Motorcycle Assist | $89 | Unlimited towing to nearest repair facility | Flat repair, fuel, spouse coverage |

Stat check: In a February 2025 rider satisfaction survey from Consumer Reports, Good Sam earned the highest marks for rural response time and towing flexibility.

3.2 Breakdown coverage for new vs older motorcycles

New motorcycles (under 3 years old) often come with limited factory roadside coverage—but it’s basic and usually tied to warranty terms. Older bikes, especially those over 10 years old, are more prone to mechanical failures and may face exclusions or surcharges in breakdown plans. Some providers may even require an inspection or odometer reading before approval.

Example: A 2021 Yamaha MT-09 might still qualify for OEM assistance. But a 2008 Harley-Davidson Softail with 40,000+ miles could require a premium surcharge or be denied coverage altogether without a pre-approval check.

Pro tip: If you own a classic, consider a specialty breakdown plan with a provider that explicitly covers vintage motorcycles.

4. Know the Cost of Motorcycle Breakdown Insurance

4.1 What’s the typical yearly cost of motorcycle breakdown insurance?

In most situations, the yearly cost of motorcycle breakdown insurance is lower than what you’d spend on a single unexpected tow or roadside bill. Plans generally fall between $45 and $110 per year, based on the type of coverage, service limits, and how the policy is packaged.

Some policies stick to essentials—like short-range assistance or a couple of service calls—while others offer broader protection with added benefits. The most comprehensive options cover hotel stays if you’re stranded far from home, longer towing distances, and even trip interruption benefits.

Starter-level coverage usually handles the urgent stuff: towing your motorcycle to the nearest garage or helping you out if your battery dies. Higher tiers often include extras like nationwide support, priority dispatch, or extended travel assistance.

Real example: Trevor, a rider from Asheville, added breakdown coverage to his main policy for just $60 a year. Unexpected vehicle-related expenses—whether dental costs without insurance or a surprise tow—can hit hard without coverage in place. He ended up using it twice that year—first when his chain snapped, then again when his battery died during a workday ride.

| Plan Type | Estimated Cost (Annual) | Best For |

|---|---|---|

| Basic Add-On | $45–$65 | Local riders, occasional use |

| Standalone Breakdown Plan | $70–$110 | Daily commuters, rural zones |

| Vintage or Specialty Bike Plan | $90–$130 | Older or high-mileage motorcycles |

Stat: According to the NAIC’s 2025 consumer data brief, over 58% of policyholders who bought standalone motorcycle breakdown plans used them at least once within the first 18 months.

4.2 What factors shape the price of your motorcycle breakdown insurance?

Several details shape your premium—how old your bike is, where and how often you ride, and whether it’s stored safely or left out in the elements. These are the signals insurers use to calculate how likely you are to need help on the road.

Geography matters too. If you live in a remote area, service providers may be farther apart, which raises both cost and risk. Climate conditions also come into play—bikes exposed to extreme heat or freezing winters wear down faster and are more likely to fail.

Example: Lisa rides a 2011 Yamaha year-round in Phoenix’s dry heat and pays $104 annually. Paul, her cousin in Seattle, rides a 2022 Honda mostly on weekends and pays just $49 for the same level of protection.

5. Learn When Motorcycle Breakdown Insurance Makes Sense

5.1 Who really needs motorcycle breakdown insurance?

Breakdown insurance isn’t just for unlucky riders—it’s a practical tool for those who depend on their motorcycle as a daily or long-distance vehicle. If you’re commuting year-round, road-tripping across multiple states, or riding a bike with more than 25,000 miles, you’re in the zone where mechanical issues are more than just possible—they’re likely. In fact, a January 2025 report by NHTSA revealed that 14.2% of non-crash motorcycle incidents were caused by mechanical failure—mostly batteries, tires, and electrical issues.

Anecdote: Tyler, a field technician in Colorado Springs, rides 80 miles a day on a 2016 Yamaha FJR1300. When his fuel pump failed last fall, he was stranded on I-25 during rush hour. His breakdown coverage had a tow truck on-site in under 40 minutes—and even covered part of his Uber ride home.

Why commuter motorcycles require tailored protection—and how to avoid service gaps.

- ✅ Long-distance riders or tourers

- ✅ Motorcycles over 7 years old

- ✅ Commuters relying on bikes as primary transport

- ✅ Riders in rural zones far from service shops

- ✅ Owners of touring or heavyweight models prone to wear

5.2 When motorcycle breakdown insurance is probably not worth it

Not every rider gets value from breakdown insurance. If you only ride a few weekends per year, rarely leave your ZIP code, and keep your bike in top mechanical shape, it might be smarter to skip the annual fee and handle any rare issue out-of-pocket. Low-mileage riders often go years without needing help—and some never call in once.

Case example: Jen, a part-time rider from Sacramento, owns a 2020 Ducati Monster she only uses during dry months. It’s stored indoors, regularly maintained, and she lives near three reputable shops. In her case, she’s chosen to skip breakdown coverage and keep $90 in a savings account—just in case.

Pro tip: Some insurers and credit card companies offer one-time roadside coverage as a pay-per-use service. If you only ride occasionally, a short-term vehicle insurance option could be more cost-effective than a full breakdown plan. It’s a good middle ground if you’re unsure about full-time coverage.

Which motorcycle add-ons are truly worth it—and which to skip

6. Understand How Claims Work with Motorcycle Breakdown Insurance

6.1 Step-by-step guide to filing a motorcycle breakdown insurance claim

Breakdowns don’t give you time to plan. That’s why the claim process for motorcycle breakdown insurance is built to be fast and frictionless. No red tape—just a quick tap or call, and help is already on the move, no forms or waiting required.

Here’s how it typically goes:

- Report the breakdown: Call your provider’s roadside line or use the mobile app. Give them your location and describe the problem (battery dead, tire flat, engine won’t crank).

- Confirm coverage: You’ll need your policy number or phone/email on file. The rep checks your eligibility and sends a service team.

- Get real-time updates: Most providers now offer GPS tracking and live ETAs for the tow or tech team heading your way.

- Receive service: Whether it’s a tow, fuel delivery, or minor on-site fix, your plan will cover it according to the limits in your contract.

- Wrap-up: You might need to sign digitally or provide a quick follow-up confirmation, especially if a third-party contractor handled the job.

6.2 Real-life examples of accepted and denied claims

Accepted: In May 2025, Sean broke down outside of Flagstaff with a seized clutch. He called his provider, who confirmed he was within coverage and had a tow truck there within 40 minutes. His plan even covered a hotel since he was over 50 miles from home.

Denied: Alicia from New Jersey had her request turned down after a roadside stall. Why? Her bike had a long-known oil leak that she’d ignored for months. The failure was considered preventable—an exclusion noted in her breakdown policy.

Quick fact: A recent 2025 NAIC report found that over 85% of motorcycle breakdown claims are approved within 2 hours—but nearly 12% are denied due to excluded mechanical conditions or pre-existing issues.

Know the exclusions in your policy before relying on roadside support—some surprises aren’t covered.

7. State-by-State Considerations for Motorcycle Breakdown Insurance

7.1 Motorcycle breakdown insurance in California, Texas, and Florida

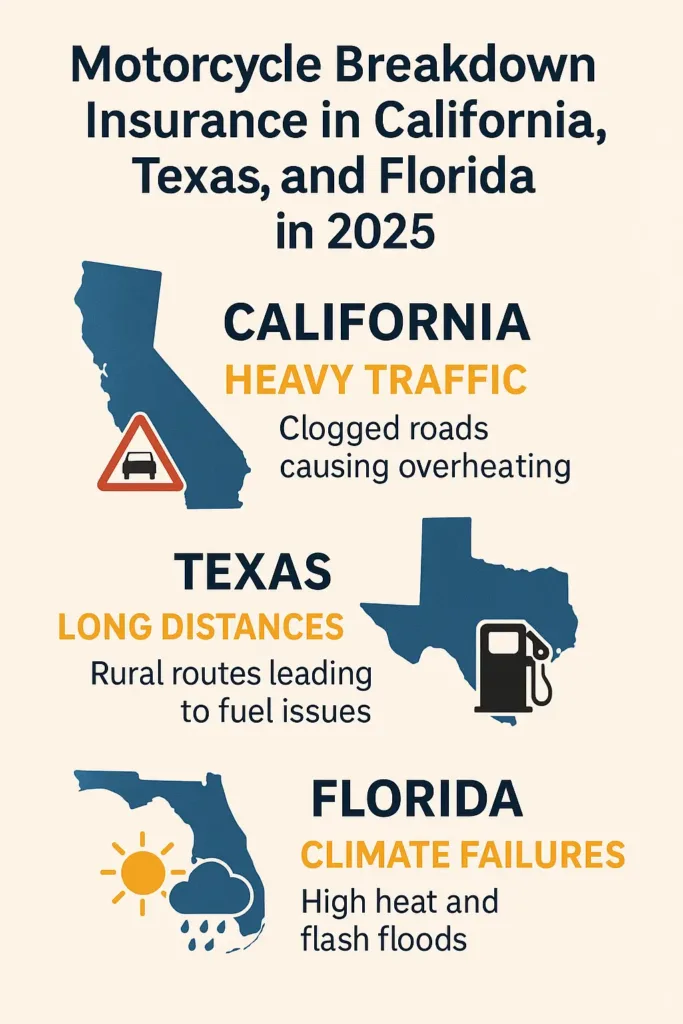

Motorcycle breakdown insurance isn’t applied the same way across the country—especially in states like California, Texas, and Florida, where climate, traffic, and regional regulations create specific challenges.

California: Riders in California face long commutes, high traffic density, and wildfire-prone areas. Plans with extended towing ranges and 24/7 response are highly recommended. Due to strict emissions rules, some providers exclude older models or require emissions compliance for service eligibility.

Texas: In rural parts of Texas, distance is the main challenge. A breakdown 70 miles from the nearest town isn’t rare. Look for policies offering 100+ miles of towing and broader network coverage across counties. Urban riders in Dallas or Houston may prefer app-based plans with GPS tracking.

Florida: Florida’s humidity and heat wear down batteries and cooling systems faster than in cooler climates. Breakdown plans here should include roadside diagnostics and lockout service—especially important for riders parking in unsecured areas during storm season.

Compare coverage types and see which add-ons make sense in your state

| State | Key Breakdown Risks | Recommended Plan Features |

|---|---|---|

| California | Traffic congestion, emission issues, wildfires | Extended towing, 24/7 dispatch, model eligibility check |

| Texas | Remote areas, highway breakdowns | Long-distance towing, rural network access |

| Florida | Heat damage, battery failure, flooding risk | Jumpstart, diagnostics, weather-ready response |

Source: A 2025 Weather.gov bulletin reports a 16% rise in motorcycle roadside calls in Florida between May and August—mostly linked to overheating and electrical failures.

7.2 Legal nuances that impact motorcycle breakdown insurance coverage

While breakdown coverage isn’t regulated like liability insurance, some states do enforce rules that affect how it’s marketed, priced, or triggered. For example, in New York, roadside service providers must be licensed. In Nevada, certain mechanical coverage is considered a “service contract” and must meet consumer disclosure laws.

Riders in California should also be aware that some counties restrict non-OEM parts during roadside repairs, which can delay service unless your provider partners with compliant mechanics.

Tip: Always read the fine print—some policies won’t activate if you’re off public roads, using a bike for business, or involved in unauthorized mechanical modifications.

8. Avoid Common Pitfalls with Motorcycle Breakdown Insurance

8.1 Most frequent misunderstandings about motorcycle breakdown insurance

A lot of riders believe their regular motorcycle insurance covers breakdowns—but in most cases, it doesn’t. Breakdown insurance is usually sold separately or added as an optional rider. Skipping the fine print can also lead to costly surprises: some plans limit how often you can use the service or charge extra after the second callout.

Dialogue – real scenario:

Rider: “So I get unlimited tows, right?”

Agent: “Actually, your plan includes up to three calls per year—then you pay out of pocket after that.”

Rider: “I wish I’d known that before my third breakdown this month.”

Other common assumptions include thinking all bike types are eligible. Many plans exclude custom builds, electric models, or motorcycles over a certain age or mileage. And using your bike for food delivery or rideshare? That could void the coverage entirely.

8.2 Pro tips for reading the fine print in breakdown policies

Before you sign anything, take five minutes to scan for these red flags: towing limits (by mileage or service count), regional coverage gaps, and conditions around pre-existing mechanical issues. Some plans won’t activate if the breakdown was “preventable,” like ignoring a known oil leak or skipping regular maintenance.

Pro tip: If your policy doesn’t clearly list towing distance, call the provider and ask for the written limit. Some advertise “nationwide coverage” but quietly cap towing at 15 miles unless you upgrade.

Stat: In a 2025 claim audit published by the NAIC, 1 in 7 denied motorcycle breakdown claims involved disputes over usage limits or service area restrictions.

9. Final Thoughts + Resources

9.1 Does motorcycle breakdown insurance actually pay off for everyday riders?

If you’ve ever been stuck on the side of the road, unsure who to call or how much it might cost to get home, you already understand the value of backup. That’s exactly what motorcycle breakdown insurance is: a safety buffer between you and an expensive, stressful surprise.

For riders who use their bike regularly, rack up serious mileage, or ride far from home, this coverage isn’t a luxury—it’s smart planning. But if your motorcycle stays in the garage 10 months a year and still has factory roadside support, you may not need the extra protection just yet.

Pro tip: Before buying a separate plan, double-check whether your current insurance or credit card already includes basic roadside help—it’s more common than you think.

9.2 Where to learn more about motorcycle protection and insurance strategies

Choosing the right coverage isn’t always about cost—it’s about knowing what fits your riding lifestyle. Whether you commute daily, ride across states, or just cruise on weekends, there’s no one-size-fits-all policy. Below are trusted guides that break down key decisions for every type of rider:

- How motorcycle insurance really differs from car insurance

- Roadside help vs. full breakdown plans: what’s actually covered?

- Best coverage features for cross-country and high-mileage riders

Insight: A 2025 Consumer Reports survey found that 68% of riders with active breakdown insurance felt “more confident” taking trips beyond their local area—especially those in rural states with fewer service stations.

FAQ

Does motorcycle breakdown insurance cover towing in all states?

Most motorcycle breakdown insurance plans offer nationwide towing, but coverage terms vary by state and provider. In some states, towing distance may be capped unless you pay for a premium plan. Always check if the policy includes rural or out-of-network zones.

Is motorcycle breakdown insurance required by law in any U.S. state?

No state currently mandates motorcycle breakdown insurance. However, some states regulate how these services are marketed and delivered. For example, NY Ins Law § 2131 requires roadside service providers to be licensed if they operate as part of a motor club or insurer.

Can a motorcycle breakdown plan deny coverage for modified bikes?

Yes. Many providers exclude custom-built, heavily modified, or electric motorcycles. Plans typically cover factory-standard models under a certain age or mileage. Riders with non-OEM parts should check policy eligibility to avoid denial at the time of service. See the NAIC’s 2025 breakdown policy compliance review.

Does breakdown insurance include trip interruption benefits?

Some higher-tier motorcycle breakdown insurance plans reimburse costs like hotel stays or alternative transport if you’re stranded far from home. This feature isn’t always included in basic plans—read the policy’s benefit section carefully.

Are there legal protections if a roadside provider fails to respond?

Certain states impose minimum service standards. For instance, CA Civ Code § 1750 (CLRA) protects consumers against misleading service promises, including delays or failures to dispatch roadside help. If a provider repeatedly fails, you may file a complaint with your state’s Department of Insurance.