Last year in Chicago, a motorcycle courier struggled with unexpected medical bills after an accident revealed gaps in his insurance coverage. Many couriers nationwide face similar surprises when basic policies don’t fully protect against the risks of delivery work.

Motorcycle courier insurance provides specific coverage types like liability, cargo protection, and medical benefits, guided by standards from organizations such as the National Association of Insurance Commissioners (NAIC). Knowing what this insurance entails is key to protecting your livelihood on the road.

Curious about how to avoid common insurance mistakes? This article covers costs, coverage details, legal requirements, and expert advice to help motorcycle couriers find the right insurance.

On This Page

1. Understand Motorcycle Courier Insurance

1.1 What Is Motorcycle Courier Insurance and Why It Matters

Motorcycle courier insurance covers the unique risks faced by riders delivering goods in urban and suburban areas. Unlike standard motorcycle insurance, it protects against liabilities like cargo damage, third-party injury, and business interruption. Given the growing gig economy, more couriers rely on specialized policies designed to meet delivery demands.

According to the National Association of Insurance Commissioners (NAIC), these policies often include liability, physical damage, and uninsured motorist coverage, essential for couriers who transport items under tight deadlines. Understanding this insurance reduces financial risks and supports business continuity.

1.2 Key Coverage Types Included in Motorcycle Courier Insurance

Motorcycle courier insurance includes a range of protections tailored for delivery professionals. Liability coverage steps in when you accidentally cause harm to someone else or damage their belongings during your deliveries. This protection is critical for motorcycle couriers who navigate busy streets and handle valuable packages daily. It helps cover legal and repair costs if you are found responsible. Cargo coverage safeguards the items you transport, while collision and comprehensive insurance cover damage to your motorcycle from accidents or other unforeseen events. Medical payments coverage helps with healthcare expenses after a crash, ensuring quicker recovery and less downtime.

Each coverage type addresses risks specific to motorcycle couriers, creating a safety net that keeps businesses running smoothly and riders protected on the road.

| Coverage Type | Description | Why It Matters for Motorcycle Couriers |

|---|---|---|

| Liability Insurance | Covers injuries or property damage caused to others | Protects against costly lawsuits and claims |

| Cargo Insurance | Protects the goods you deliver | Essential for high-value or fragile shipments |

| Collision Coverage | Covers damage to your motorcycle after an accident | Ensures your vehicle can be repaired or replaced |

| Comprehensive Coverage | Covers non-collision risks like theft or vandalism | Protects against a wide range of unexpected events |

| Medical Payments | Covers medical expenses for injuries sustained | Helps speed recovery and reduce lost work time |

2. Analyze Costs of Motorcycle Courier Insurance

2.1 Factors Influencing Motorcycle Courier Insurance Costs

Several key elements impact the price of motorcycle courier insurance. Your age, driving history, and the type of motorcycle you use all affect premiums. Additionally, how often you make deliveries and the kinds of items you transport influence the risk assessment. Urban environments, with their heavy traffic and increased accident chances, usually lead to higher rates.

Insurance providers review official data from agencies like the National Highway Traffic Safety Administration (NHTSA) to calculate risk. Riders who keep clean records and invest in safety gear often benefit from lower premiums. Understanding these cost drivers empowers couriers to find coverage that fits both their budget and protection needs.

2.2 Average Motorcycle Courier Insurance Rates in the USA

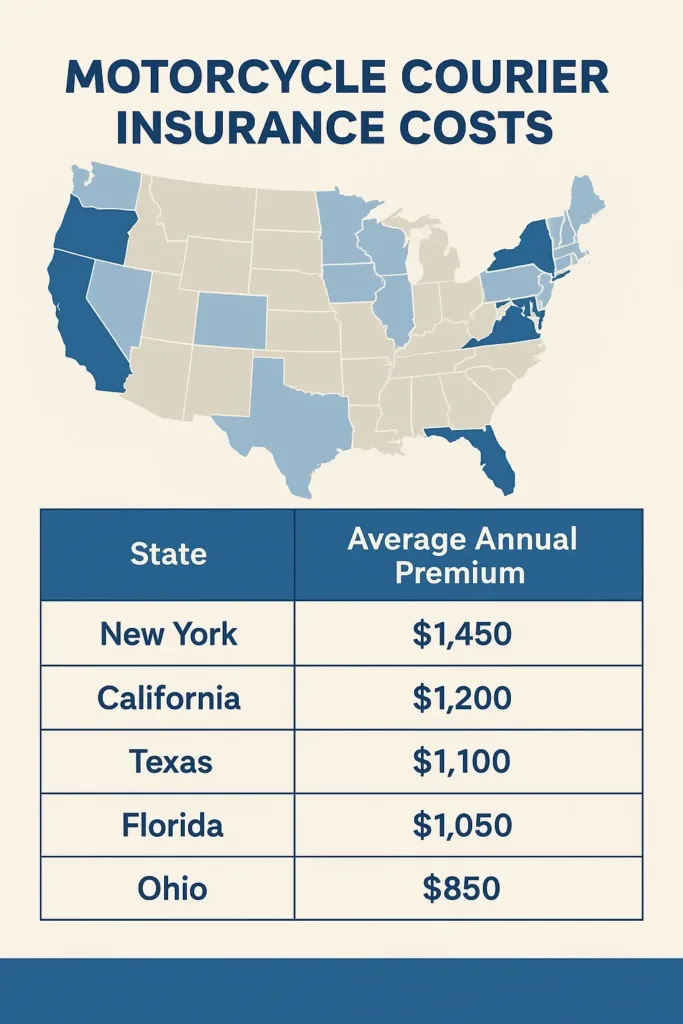

On average, motorcycle courier insurance costs between $800 and $1,500 per year. Rates differ significantly depending on location and coverage. For instance, Couriers working in cities like New York or Los Angeles often face higher premiums due to increased theft and accident risks.

This price range generally includes liability, cargo protection, collision, and medical coverage. Knowing these averages helps riders prepare financially and make informed insurance choices.

| State | Average Annual Premium | Reason for Variation |

|---|---|---|

| New York | $1,450 | Dense traffic and higher accident rates |

| California | $1,350 | Elevated theft and vandalism incidents |

| Texas | $900 | Less congested roads but variable weather |

| Florida | $1,200 | Weather-related risks like storms and flooding |

| Ohio | $850 | Lower traffic density, fewer claims |

Source: NHTSA 2024 Insurance Data

3. Explore Legal Requirements for Motorcycle Courier Insurance

3.1 State-by-State Motorcycle Courier Insurance Regulations

Insurance rules for motorcycle couriers vary depending on the state, reflecting local traffic conditions and safety standards. For instance, California sets higher minimum liability limits due to its busy roads, while Texas enforces basic coverage but leaves room for additional protections. Each state’s Department of Motor Vehicles (DMV) and insurance agencies publish clear guidelines to help riders stay compliant.

Knowing these laws is crucial to avoid fines or operational restrictions. Checking official state resources regularly ensures you have the latest requirements for operating legally as a motorcycle courier.

3.2 Compliance Tips for Motorcycle Courier Insurance Policies

Staying within legal requirements means confirming your insurance meets or exceeds the mandated coverage levels. Many states also require couriers to carry proof of insurance while on duty. Without it, you risk penalties like fines or even impoundment of your motorcycle.

Beyond the minimums, consider coverage options that protect your cargo and yourself from uninsured drivers. Partnering with an agent who understands courier risks can help you build a policy that aligns with both the law and your business needs.

| State | Minimum Liability Coverage | Courier-Specific Requirements |

|---|---|---|

| California | $15,000 bodily injury per person / $30,000 per accident / $5,000 property damage | Must carry proof of insurance during deliveries |

| Texas | $30,000 bodily injury per person / $60,000 per accident / $25,000 property damage | Basic liability required; cargo insurance advised |

| Florida | $10,000 bodily injury per person / $20,000 per accident / $10,000 property damage | Insurance documents must be available at all times |

| New York | $25,000 bodily injury per person / $50,000 per accident / $10,000 property damage | Higher minimums due to urban density |

Source: DMV.org State Insurance Requirements

4. Compare Motorcycle Courier Insurance Providers

4.1 Major Motorcycle Courier Insurance Companies and Their Offerings

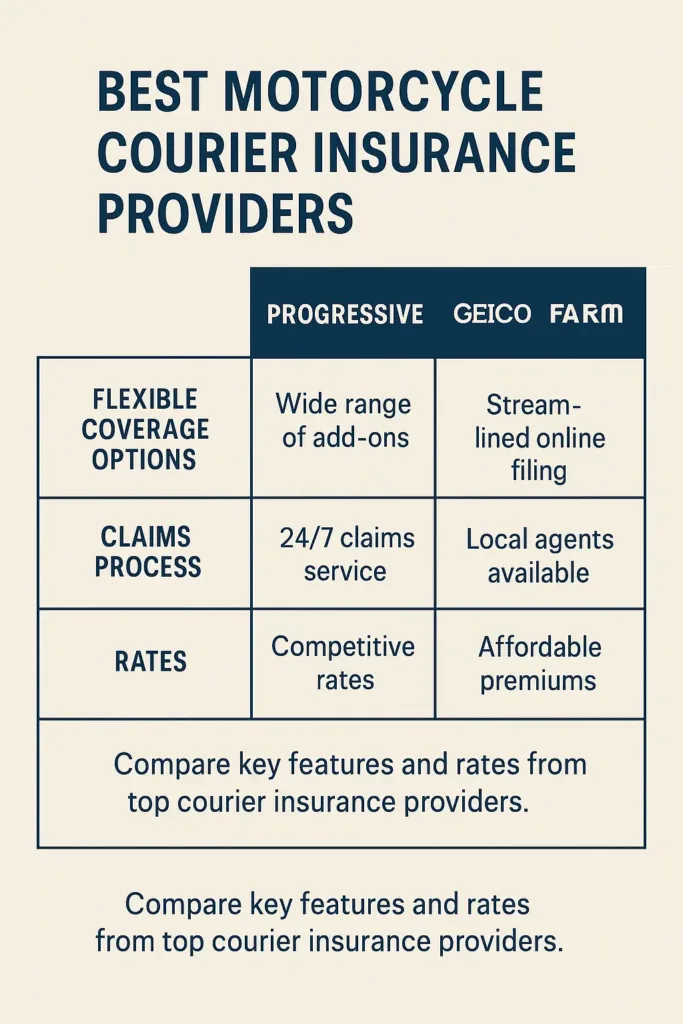

Several insurance companies specialize in policies tailored for motorcycle couriers. Providers like Progressive, GEICO, and State Farm offer coverage packages that include liability, cargo, collision, and medical payments. These companies leverage extensive data to customize premiums based on courier-specific risks and delivery patterns.

Some insurers provide add-ons such as roadside assistance and equipment protection, enhancing the value for couriers who depend on timely deliveries. For couriers transporting vehicles or working in specialized logistics, driveaway insurance may offer essential protections beyond standard courier policies. Checking customer reviews and claim response times can help riders choose a reliable provider.

4.2 How to Choose the Best Motorcycle Courier Insurance for Your Business

Choosing the right insurance means balancing the protection you require with your budget limits. It’s crucial to consider how frequently you make deliveries, the value of the packages you transport, and the level of risk along your routes. Comparing quotes from various insurers allows you to find coverage that meets your needs without breaking the bank.

Additionally, evaluate insurers on their efficiency in processing claims and customer service quality. Policies designed specifically for motorcycle couriers usually cover risks that standard motorcycle insurance overlooks, making them a worthwhile choice for professional couriers.

| Provider | Key Features | Best For |

|---|---|---|

| Progressive | Flexible coverage options, competitive pricing, roadside assistance | Couriers needing customizable plans |

| GEICO | Low premiums, fast claims processing, good customer service | Budget-conscious riders |

| State Farm | Comprehensive coverage, strong local agent network | Couriers preferring personalized support |

Source: Insurance Information Institute 2024

5. Evaluate Risks Covered by Motorcycle Courier Insurance

5.1 Common Risks Faced by Motorcycle Couriers

Motorcycle couriers encounter a variety of risks on the job, including traffic accidents, theft, weather hazards, and liability for cargo damage. Urban areas bring heavy traffic and unpredictable drivers, increasing accident chances. Additionally, carrying valuable or fragile items adds the risk of cargo loss or damage, which can lead to financial setbacks.

According to the Insurance Information Institute (III), motorcycle couriers face higher injury rates compared to other delivery professionals, highlighting the need for specialized coverage.

Understanding these risks helps couriers choose insurance that truly fits their unique exposure.

5.2 How Motorcycle Courier Insurance Protects Against These Risks

Specialized motorcycle courier insurance packages address the specific risks couriers face by bundling liability, cargo, collision, comprehensive, and medical coverage. Liability insurance protects against lawsuits and claims from third parties, while cargo insurance covers losses related to goods being delivered. Collision and comprehensive policies cover physical damage to the motorcycle, and medical payments help with healthcare costs.

This comprehensive protection ensures couriers can continue operating even after unexpected setbacks, minimizing financial disruption.

If you’re a courier with available capital seeking future financial security, single premium term insurance may help protect your family’s income in case of loss.

| Risk | Description | Covered By |

|---|---|---|

| Traffic Accidents | Collisions with other vehicles or objects | Liability, Collision, Medical Payments |

| Theft or Vandalism | Motorcycle or cargo stolen or damaged | Comprehensive, Cargo Insurance |

| Cargo Damage | Loss or damage to goods during delivery | Cargo Insurance |

| Injury to Rider | Physical harm requiring medical care | Medical Payments |

6. Learn About Motorcycle Courier Insurance Claims

6.1 Filing a Motorcycle Courier Insurance Claim: What You Need to Know

When an accident or loss occurs, promptly filing a claim is crucial to ensure timely compensation. Motorcycle couriers should document all relevant details such as accident reports, photos, and witness statements. After an accident or loss, it’s important to get in touch with your insurance company quickly to start the claim process and find out exactly what documents and information they need from you.

Most insurers have dedicated claims teams familiar with courier-specific situations, which helps speed up processing and payouts. Keeping thorough records and following your insurer’s instructions carefully reduces the chance of delays or claim rejections.

6.2 Common Motorcycle Courier Insurance Claim Denials and How to Avoid Them

Claim denials can happen due to missed deadlines, incomplete documentation, or coverage exclusions. For motorcycle couriers, delays in reporting accidents or not informing the insurer about the business use of the motorcycle are common reasons claims get denied. It’s essential to fully understand your policy’s terms and notify your provider accurately to avoid these pitfalls.

Working closely with your insurance agent and maintaining open communication throughout the claim process helps address potential issues early. Also, investing in a policy tailored for couriers reduces the chances of coverage gaps that cause denials.

| Common Denial Reason | Explanation | How to Prevent |

|---|---|---|

| Late Reporting | Delaying claim submission beyond policy deadlines | Report accidents immediately to insurer |

| Incomplete Documentation | Missing accident reports, photos, or witness statements | Gather and submit full documentation promptly |

| Undisclosed Commercial Use | Not informing insurer that the motorcycle is used for deliveries | Disclose business use when purchasing policy |

| Policy Exclusions | Claims involving risks not covered by the policy | Review and understand coverage limits and exclusions |

Source: National Association of Insurance Commissioners (NAIC)

7. Discover Tips to Lower Motorcycle Courier Insurance Costs

7.1 Practical Methods to Reduce Motorcycle Courier Insurance Costs

For motorcycle couriers, one of the most impactful ways to lower insurance expenses is by consistently practicing safe riding habits. Keeping a spotless driving record shows insurers that you pose less risk, which often results in reduced premiums. Adding anti-theft devices such as GPS trackers or security alarms can also protect your motorcycle and qualify you for further discounts.

Another way to save is by consolidating your insurance policies—bundling your motorcycle coverage with other personal or business insurance can lead to meaningful savings. Choosing a higher deductible lowers your monthly payments, but it’s important to ensure you have enough funds set aside to cover that deductible if a claim arises.

Additional cost-cutting strategies include periodically reviewing your policy to remove unnecessary coverage and shopping around for competitive quotes to ensure you’re getting the best value.

7.2 How Driving Habits and Safety Practices Influence Insurance Rates

Your history behind the wheel plays a major role in your insurance rates. A spotless record signals responsibility and lowers your premium, while accidents or violations typically cause hikes. Taking safety courses and maintaining your motorcycle well demonstrate your commitment to safe riding and can earn you further discounts.

Many insurers provide incentives for riders completing certified training programs, rewarding safer behaviors with reduced costs.

| Strategy | Benefit | Why It Works |

|---|---|---|

| Maintain a Clean Driving Record | Lower premiums | Demonstrates low risk |

| Install Anti-Theft Devices | Discounted rates | Reduces theft risk |

| Bundle Insurance Policies | Cost savings | Insurance companies reward multiple policies |

| Choose a Higher Deductible | Lower monthly costs | Shifts more financial responsibility to the rider |

| Complete Safety Training | Eligible for discounts | Improves rider skills and reduces claims |

8. Understand Motorcycle Courier Insurance for Different Bike Types

8.1 Comparing Insurance Requirements for Scooters and Motorcycles Used by Couriers

Scooters and motorcycles vary significantly in their insurance demands due to differences in engine size, speed capacity, and cargo capabilities. Scooters typically feature smaller engines and lower maximum speeds, which usually translates into lower insurance premiums. However, their restricted cargo space can limit the volume or type of deliveries they are suitable for.

On the other hand, motorcycles with larger engines tend to have higher insurance costs because they carry a greater risk of accidents and theft. Understanding these differences helps couriers select insurance policies that align with the specific needs of their vehicles and delivery operations.

8.2 Specialized Insurance Coverage for Electric Motorcycles in Delivery Services

Electric motorcycles are gaining traction among couriers for their cost efficiency and environmental benefits. However, insuring electric motorcycles involves unique considerations, such as the cost of battery replacement and limited repair facilities. These factors make specialized insurance plans necessary to adequately cover the specific risks associated with electric bikes.

Many insurance companies now offer tailored policies for electric motorcycles, ensuring that riders are protected against the unique challenges these vehicles present. Couriers opting for electric motorcycles should verify their insurance thoroughly to avoid unexpected gaps in coverage.

| Type of Vehicle | Key Insurance Factors | Typical Insurance Cost Impact |

|---|---|---|

| Scooter | Lower engine power, reduced speed, limited cargo space | Generally lower premiums |

| Gasoline-Powered Motorcycle | Higher speeds, larger engine size, elevated risk of accidents and theft | Higher premiums |

| Electric Motorcycle | Battery replacement expenses, fewer repair options, new technology risks | Varies widely; often more costly than scooters |

9. Understand Claims Process and Tips for Motorcycle Courier Insurance

9.1 Steps to File a Motorcycle Courier Insurance Claim Efficiently

When an accident or loss happens, starting your insurance claim quickly and accurately is vital. Collect all relevant information like photos of the incident, police reports, and contact details of any witnesses. Notify your insurer promptly and provide them with the necessary documents to avoid delays.

Clear communication with your insurance company throughout the claims process helps ensure smooth handling. Keeping organized records and following up on claim status can prevent misunderstandings and speed up your payout.

9.2 Common Challenges in Claims and How to Avoid Them

Claims can sometimes be denied due to missing paperwork, late notifications, or policy exclusions. Motorcycle couriers should be especially careful to report incidents promptly and disclose all relevant information, including the commercial use of the motorcycle. Familiarizing yourself thoroughly with your insurance policy and communicating openly with your agent can prevent unexpected issues down the line.

Maintaining thorough documentation and working closely with your insurer reduces the risk of claim rejections. Ensuring your coverage is specifically designed for courier work reduces the likelihood of coverage gaps that could complicate claims.

| Issue | Explanation | Prevention Tips |

|---|---|---|

| Late Reporting | Submitting claims past deadlines | Report incidents as soon as possible |

| Incomplete Documentation | Missing photos, reports, or witness info | Gather all necessary documents promptly |

| Undisclosed Business Use | Failing to inform insurer of commercial use | Disclose all motorcycle uses during policy setup |

| Policy Exclusions | Risks not covered under your policy | Understand your coverage limits and add endorsements as needed |

10. Explore Legal Requirements and Regulations for Motorcycle Courier Insurance

10.1 State-by-State Insurance Requirements for Motorcycle Couriers

It’s crucial for couriers to understand the specific insurance regulations in their state to stay compliant and avoid penalties or legal complications.

10.2 How Regulations Impact Insurance Costs and Coverage Options

Insurance regulations determine the types of coverage you can obtain and directly affect the cost of your policy. States with higher minimum coverage limits typically see increased premiums. Additionally, regulations mandating certain coverages, such as uninsured motorist protection or personal injury protection, add layers to insurance policies.

Understanding how local laws affect your insurance helps you better anticipate costs and select appropriate coverage.

| State | Minimum Liability Coverage | Additional Requirements |

|---|---|---|

| California | $15,000 per person / $30,000 per accident | Commercial endorsement required for couriers |

| New York | $25,000 per person / $50,000 per accident | Medical payments coverage often required |

| Texas | $30,000 per person / $60,000 per accident | Personal injury protection optional |

Conclusion

Choosing the right motorcycle courier insurance is vital to protect both your business and your personal assets. By understanding the specific risks couriers face—such as accidents, cargo loss, and liability—you can select coverage that meets your needs and budget. Keeping a clean driving record, staying informed about state regulations, and exploring available discounts will help optimize your insurance costs. Partnering with knowledgeable insurers ensures smooth claims handling and peace of mind, letting you focus on your delivery work with confidence.

FAQ

What type of insurance is needed for courier service?

Motorcycle couriers need specialized courier insurance that goes beyond standard motorcycle coverage. This typically includes liability insurance, cargo protection, collision and comprehensive coverage, and medical payments. Liability insurance covers injuries or property damage caused to others, while cargo insurance protects the goods being delivered. Comprehensive and collision insurance cover theft, vandalism, or damage to the courier’s motorcycle, and medical payments help with recovery after an accident. These types of insurance are crucial to protect couriers from the high risks associated with urban delivery work.

What is the average cost of courier insurance?

The average annual cost of motorcycle courier insurance in the U.S. ranges between $800 and $1,500, depending on location, driving history, and the type of coverage selected. For example, couriers in dense urban areas like New York may pay up to $1,450 per year, while those in states like Ohio typically pay closer to $850. Factors influencing the cost include accident history, the value of cargo, vehicle type, and regional risks such as theft or weather conditions. Discounts are often available for safe driving, bundling policies, or installing anti-theft devices.

How much is insurance for a Grom?

While the article doesn’t mention the Honda Grom specifically, this type of small-displacement motorcycle often falls under lower-cost insurance tiers due to its limited engine size and lower speeds. However, if used for commercial delivery purposes, the cost can increase significantly. Motorcycle courier insurance rates depend on usage more than the model itself—so using a Grom for courier work would still require liability, cargo, and commercial coverage, potentially costing $800–$1,200 annually, depending on location and risk factors.

How to be a motorcycle courier?

Becoming a motorcycle courier typically involves the following steps:

Own or lease a reliable motorcycle—preferably one suited to carrying cargo.

Obtain motorcycle courier insurance, including all required coverages like liability, cargo, and medical protection.

Meet state and local legal requirements, such as carrying proof of insurance and commercial endorsements.

Partner with courier companies or platforms, or start your own delivery service.

Practice safe driving habits and consider completing a certified motorcycle safety course to reduce risks and potentially lower insurance costs.

For success in the role, it’s essential to stay compliant, maintain your vehicle, and choose an insurance policy tailored to delivery work.