Last spring, Mike Alvarez—an independent hauler from California’s Central Valley—learned a $592 lesson about cutting corners. After selling his aging Silverado and upgrading to a Ford F-250, he figured he could delay insurance until after securing financing. That gamble backfired when CHP officers flagged him during a routine commercial vehicle inspection near Bakersfield.

The solution he missed? One week truck insurance. These flexible policies provide:

- Short-term protection (typically 7-14 days)

- Full legal compliance for pickups, box trucks, and semis

- Customizable coverage from basic liability to comprehensive protection

“Demand for temporary truck policies jumped 42% in early 2024,” reveals PolicyTrack Analytics’ May market report.

Key advantage: Unlike annual policies, these short-term solutions work for:

✔️ DMV paperwork delays

✔️ Seasonal contract work

✔️ Test-driving used trucks

✔️ Rental truck supplements

Critical question: How do you secure proper coverage without overpaying or getting stuck with useless paperwork? We’ll break down the smart strategies that actual owner-operators use.

On This Page

1. The Smart Driver’s Guide to 7-Day Truck Coverage

1.1 How Short-Term Truck Insurance Works (And When It Saves You Money)

Picture this: You’ve just bought a used Ram 3500 from a private seller, but your permanent insurance won’t start for five days. A one week truck insurance policy acts as your financial safety net during these gaps.

Key features:

- 7-day coverage window (some providers offer 1-14 day terms)

- Available through specialty insurers like CoverWallet or traditional providers with temporary endorsements

- Core protections include mandatory liability plus optional add-ons:

- Collision ($500+ deductibles common)

- Comprehensive (theft/vandalism protection)

- Cargo coverage (up to $15,000 for movers)

- 24/7 roadside assistance (towing, lockouts)

Real-world example: When Tampa contractor Danisha Williams needed to test-drive three work trucks before purchasing, she used back-to-back 2-day policies at $38/day instead of committing to a $2,400 annual plan.

*”36 states now formally recognize short-duration truck policies,”* confirms the NAIC’s 2024 Commercial Vehicle Report.

Watch for: Coverage restrictions in high-risk states like Florida and Nevada, where only 3-5 insurers offer legitimate temporary policies.

1.2 The 5 Situations Where Short-Term Beats Annual Coverage

Why pay for a year when you only need a week? Here’s when savvy truck owners opt for temporary insurance:

- Between Vehicle Ownership

- Average savings: $420 (based on 2024 DMV transaction data)

- Covers test drives and title transfers

- Seasonal Work Spikes

- Landscapers: 78% use 3-6 month policies unnecessarily

- Snowplow operators can save $1,100+/year with strategic 7-day blocks

- Special Hauling Jobs

- Weekend equipment moves

- One-time event logistics

- Rental Truck Gaps

- U-Haul’s $15,000 liability often falls short

- Supplemental coverage starts at $9/day

- Gig Economy Flexibility

- 63% of Hotshot drivers use per-job policies (2024 FreightWaves report)

*”Metro areas saw a 38% surge in short-term policy searches last year,”* notes Statista’s April 2024 mobility study.

Pro Tip: Always verify your insurer’s USDOT number if using coverage for commercial purposes – 22% of claims get denied due to improper classification.

2. Situations That Call for One Week Truck Insurance

2.1 Using a Borrowed or Rented Truck for Short-Term Needs

In May 2024, Rachel borrowed her uncle’s Chevy Silverado to move her studio apartment across town in Kansas City. She figured his insurance would cover her. It didn’t. After a minor collision at a stoplight, her claim was denied since her name wasn’t on the policy. One week later, she was still dealing with out-of-pocket repairs.

One week truck insurance is built for these short-term situations. Whether you’re borrowing a pickup to move furniture or renting a truck for a quick weekend job, it gives you your own coverage—separate from the owner’s policy. That means no legal gray area, no awkward phone calls, and no surprise claim denials.

Driver: “I’m only using it for two days—can’t we skip insurance?”

Agent: “If you’re not named on their policy, you’re not covered. One week truck insurance makes sure you’re protected from the minute you take the keys.”

According to the National Association of Insurance Commissioners, claims involving unauthorized drivers are among the top causes of coverage denial in temporary use cases (Q1 2024).

2.2 Contract jobs or short-term deliveries

Not every job lasts a month—but even one-day contracts can come with insurance requirements. Whether you’re hauling tools to a job site or delivering equipment for a festival, many companies want to see proof of liability coverage, even if the work is brief. One week truck insurance lets you meet those demands without locking into a long-term commercial plan.

Take Damien, a carpenter in Colorado Springs. He picked up a three-day gig delivering reclaimed barn wood to a pop-up showroom. He didn’t own a truck, so he rented one—and grabbed a 7-day policy with basic liability and cargo protection. The job paid $800. His insurance cost? Just $76.

Need to check if your state requires commercial classification for short-term hauling? The Federal Motor Carrier Safety Administration keeps updated guidance on vehicle use and licensing.

3. Decoding Your 7-Day Coverage Options

3.1 The Core Protections: What’s Included (And What Costs Extra)

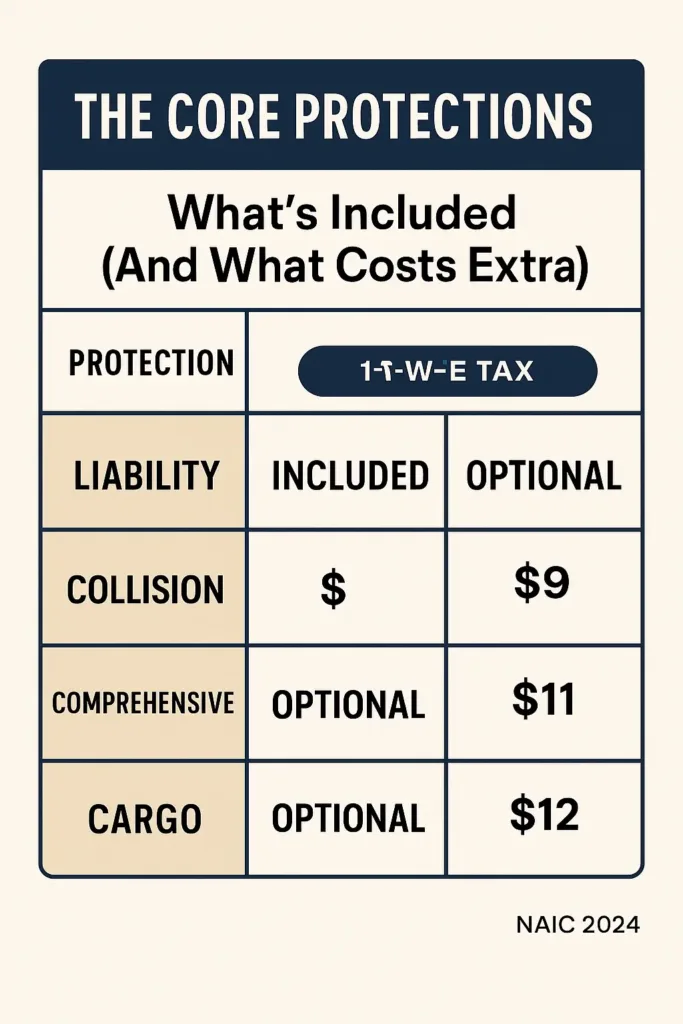

Every one week truck insurance policy starts with non-negotiable liability coverage – your financial responsibility shield if you cause an accident. But the real value comes from understanding your add-on options:

The Coverage Menu:

| Protection Type | Standard? | Smart For | Avg. Cost/Day |

|---|---|---|---|

| Liability | Required | All drivers | Included |

| Collision | Optional | Newer trucks | $9-$18 |

| Comprehensive | Optional | All climates | $7-$15 |

| Medical Payments | State-dependent | No-fault states | $4-$10 |

| Rental Coverage | Rare | Primary vehicles | $12+ |

Real-World Example: Phoenix contractor Marco Lopez learned the hard way when hail damaged his uninsured box truck during a 3-day job. Adding comprehensive coverage would’ve cost him $11/day – far less than the $3,200 repair bill.

*”68% of temporary policies are liability-only, leaving many drivers underprotected,”* warns NAIC’s 2024 report.

3.2 The Game-Changing Add-Ons Most Drivers Overlook

Beyond basics, these often-ignored options can make or break your protection:

- Roadside Assistance ($5-8/day)

- Covers:

- 25-mile towing

- Lockout service

- Jump starts

- Best for: Older trucks or solo haulers

- Covers:

- Uninsured Motorist (12% of drivers lack coverage)

- Pays when others can’t

- Required in 22 states

- Cargo Protection (Up to $25,000)

- Critical for:

- Movers ($15k+ minimum recommended)

- Trade show transporters

- Equipment haulers

- Critical for:

Pro Tip: Snap photos of your truck’s condition and cargo before activation – 40% of claims get delayed without proper documentation (FMCSA 2024 data).

Did You Know? In California, cargo coverage requires separate certification for commercial vehicles over 10,000 lbs.

4. How Much Does One Week Truck Insurance Cost?

4.1 Key factors that affect the price

The cost of one week truck insurance varies widely, but most drivers pay between $65 and $180 for seven days of coverage. Rates are based on a combination of your personal profile and the type of truck you’re driving. A 24-year-old driving a diesel Ford F-250 in Ohio will pay more than a 45-year-old with a clean record in Kansas using a light-duty pickup.

Pricing is influenced by:

- Truck type and weight: Heavy-duty or commercial trucks typically cost more to insure.

- Driver profile: Age, driving history, and ZIP code all impact risk assessment.

- Coverage selected: Basic liability is cheaper than full coverage with add-ons like roadside or cargo.

- Usage: Business use or delivery work usually triggers higher premiums than personal errands.

Insurers also consider the location where the truck is garaged. For example, dense metro areas with high accident rates (like Los Angeles or Atlanta) see higher premiums.

Need official rate guidance? Visit your state’s DOI, such as the New York Department of Financial Services.

4.2 Real-world examples by truck type and state

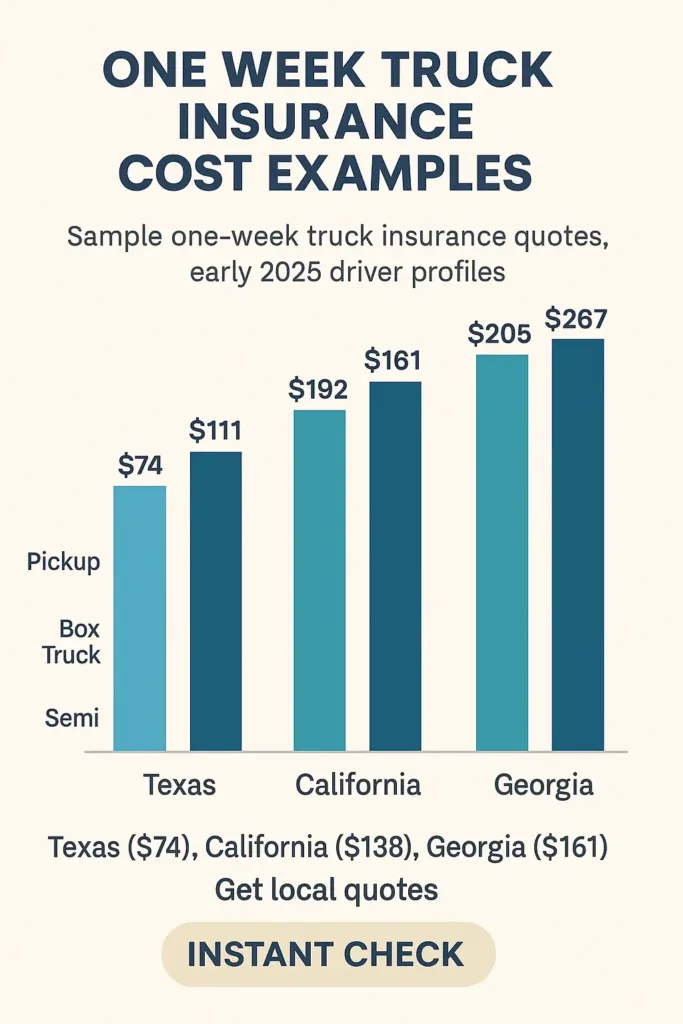

To give you a clearer idea of what one week truck insurance might cost, here’s a breakdown of sample quotes based on real driver profiles from early 2025—similar to how renters insurance pricing works.:

| Location | Truck Type | Driver Age | Coverage Level | 7-Day Price |

|---|---|---|---|---|

| Texas (Houston) | Ram 1500 (Personal) | 32 | Liability Only | $74 |

| California (Fresno) | Box Truck 14′ | 41 | Liability + Cargo | $138 |

| Georgia (Savannah) | Chevy Silverado | 27 | Full Coverage | $161 |

| Ohio (Toledo) | F-250 Super Duty | 36 | Liability Only | $89 |

Important: commercial use, multiple drivers, or older vehicles may change the pricing significantly. Always disclose usage details when applying.

5. Who Offers One Week Truck Insurance in the U.S.?

5.1 Major insurers and alternatives (digital platforms)

Unlike standard auto policies, not every big-name carrier offers one week truck insurance directly. Traditional providers like GEICO, Progressive, or State Farm rarely advertise short-term truck coverage—but may issue limited-use endorsements if requested through an agent.

For most drivers, the fastest way to secure one week coverage is through licensed **digital insurance platforms**. These companies specialize in flexible terms and quick activation—some issuing policies in minutes with no phone calls or paperwork. Popular options include regional brokers and usage-based platforms that cater to gig drivers, temporary movers, or contractors needing short-term compliance.

| Provider Type | Availability | Best For |

|---|---|---|

| Traditional Insurers (e.g. Progressive) | Limited – by request only | Existing customers needing add-ons |

| Digital Brokers | Nationwide – instant online quotes | New drivers, renters, gig workers |

| Commercial Insurance Specialists | Varies by state | Short-term business or fleet use |

Still unsure which route fits your truck and purpose? Consider checking with a licensed broker who works with both personal and commercial lines.

5.2 What to check before buying temporary coverage

Before clicking “buy,” make sure your one week truck insurance quote matches your actual use. Some policies exclude commercial or cargo transport. Others won’t activate unless you provide a vehicle VIN and proof of address. Coverage gaps can lead to denied claims—even if you’re technically “insured.”

Here’s a quick checklist to run through before finalizing your purchase:

- ✅ Verify your state allows short-term auto policies

- ✅ Confirm the policy includes liability (minimum required)

- ✅ Add collision or comprehensive only if the truck has value to protect

- ✅ Ask about driver exclusions, towing radius, and mileage caps

Pro Tip: Some platforms advertise “instant insurance” but delay activation for commercial trucks pending verification. Always confirm the exact policy start time in writing.

6. Legal Requirements by State for Temporary Truck Coverage

6.1 Where one week truck insurance is allowed—and where it gets tricky

One week truck insurance is permitted in most U.S. states, but not under the same rules everywhere. In some states, short-term policies are widely accepted and easy to obtain. In others, especially for trucks used in business, insurance companies must file special approvals or limit these offerings to specific use cases.

Here’s a look at how selected states handle temporary truck coverage:

| State | Policy Status | Details |

|---|---|---|

| Texas | ✅ Permitted | Common for short-term personal or contractor use |

| California | ✅ Permitted | Policy must meet state minimum liability limits |

| New York | ➖ Limited | Only certain licensed commercial brokers can issue policies under 30 days |

| Florida | ✅ Permitted | Disclosure of intended use required during application |

| Hawaii | ❌ Restricted | Minimum policy term is 30 days by law |

And for compliance verification, the National Association of Insurance Commissioners (NAIC) publishes state-by-state filings and consumer access laws for temporary vehicle coverage.

6.2 How states handle registration timing and proof of insurance

If you’ve recently bought a truck, you’ll likely need to register it within a few days. That process varies by state—but nearly all DMVs require active insurance before issuing plates or processing a title. That’s where one week truck insurance often comes into play: it satisfies the legal requirement even when you’re still finalizing paperwork or financing.

Let’s look at how some states handle the overlap between insurance and registration:

- Georgia: New truck owners have up to 7 days after purchase to submit proof of insurance and complete registration.

- Oregon: Temporary plates can last 21 days, but you’ll need valid insurance before they’re issued.

- Arizona: Insurance must be active at the time of registration—no grace period.

- Illinois: Allows 7-day temporary permits, but only if the driver is already insured.

- North Carolina: You must show proof of insurance before a title is issued, not just for road use.

According to the Oregon DMV (July 2024), short-term insurance policies are accepted in most states as valid proof for DMV processes like titling, registration, or emissions certification—if coverage is active at the time of submission.

7. Pros and Cons of One Week Truck Insurance

7.1 When it’s a smart move

One week truck insurance isn’t just convenient—it’s strategic when used in the right situation. If you’re borrowing, renting, or test-driving a truck for a few days, it gives you peace of mind without forcing a long-term commitment. It’s also ideal for people between policies or waiting on DMV paperwork.

Short-term policies are especially helpful for:

- ✅ Moving across town with a borrowed pickup

- ✅ Filling a coverage gap between truck purchases

- ✅ Short-term freelance gigs that require proof of insurance

- ✅ Insuring short test drives before committing to a used truck purchase

According to NAIC data, short-term auto coverage requests rose 31% from 2022 to 2024, driven largely by the gig economy and second-hand truck purchases.

8.2 Situations where it may fall short

While flexible, one week truck insurance doesn’t fit every situation. Some drivers assume they’re fully protected, only to discover exclusions buried in the fine print. Others end up paying more per day than they would with a monthly policy—especially for repeat short-term use.

That’s why it’s helpful to compare with other short-term coverages like dental costs without insurance, which also vary based on usage and duration.

Common drawbacks include:

- ⚠️ Not available in all states or for all truck types

- ⚠️ Often excludes commercial hauling or business use unless specifically added

- ⚠️ May lack optional protections like rental reimbursement or gap coverage

- ⚠️ Can be more expensive per day than traditional plans if used frequently

Expert Insight: “Short-term policies are great tools—but only when you understand exactly what they cover and what they don’t,” says a July 2024 advisory from the Consumer Financial Protection Bureau (CFPB).

8. Real Case: How a Texas Contractor Saved $340 With One Week Truck Insurance

8.1 Context and coverage details

In March 2024, Marco, a self-employed fencing contractor based in Lubbock, Texas, landed a quick three-day project for a local builder. He needed to transport post-hole equipment using a rented Ford F-250. The rental company offered basic liability, but the builder requested a copy of his own active truck insurance with cargo protection.

Buying a full commercial policy didn’t make sense—quotes started at $680 for a month. Instead, Marco secured a one week truck insurance policy online for $92, including:

- ✅ $100,000 liability coverage

- ✅ $10,000 cargo protection

- ✅ Basic roadside assistance

He received proof of insurance within 20 minutes and submitted it to the builder the same day, avoiding delays and upcharges from the rental company’s limited coverage.

8.2 Financial outcome and key lessons

Marco completed the $1,300 job in under 72 hours. The one week truck insurance cost him just $92. Compared to the $430 commercial policy he nearly purchased, he saved $338—while still meeting the legal and contractual requirements.

The temporary policy also covered a minor issue during the job: a loose bungee cord caused slight damage to one of the wood panels he was hauling. Thanks to the cargo protection add-on, his claim was processed and reimbursed in under two weeks.

Lesson: Short-term insurance isn’t just about legality—it’s about flexibility and avoiding overspending when you only need coverage for a few days.

Tip from the Texas Department of Insurance: “Contractors operating vehicles they don’t own—even temporarily—should carry named coverage to avoid personal liability.” (TDI, 2024)

9. Pro Tips to Buy One Week Truck Insurance Without Getting Burned

9.1 What to ask before signing a temporary policy

Shopping for one week truck insurance sounds easy—until you’re hit with unclear terms or denied coverage after a claim. To avoid common pitfalls, you need to ask the right questions up front. A rushed policy can cost more in the long run than skipping coverage entirely.

Before purchasing, ask:

- ✅ Does this policy allow personal, rental, or commercial truck use?

- ✅ Is roadside assistance or cargo protection included or optional?

- ✅ When does the policy officially start—payment or approval time?

- ✅ Will I receive proof of coverage instantly in a DMV-accepted format?

It’s also smart to screenshot your quote and confirm any verbal coverage explanations in writing. Policies under 7 days often carry exclusions buried in the fine print.

9.2 Documents, truck types, and hidden exclusions

Most providers offering one week truck insurance require the following before activating your policy:

- ✔️ Valid driver’s license (state-issued)

- ✔️ Truck make, model, and VIN number

- ✔️ Intended use (personal, rental, or business)

- ✔️ State of operation or garaging location

But here’s what they don’t always tell you:

- ⚠️ Some policies exclude trucks over 10,000 lbs GVWR.

- ⚠️Similarly, AD&D insurance often comes with exclusions that can catch you off guard if you don’t read the fine print.

- ⚠️ Rentals may require additional verification from the rental agency

- ⚠️ Commercial hauling or towing must be declared in advance—or you’re not covered

Insider Warning: Many short-term policies look broad on paper but quietly exclude gig work, trailer towing, or contractor deliveries. Always check the “usage exclusions” section.

For regulatory questions, or to file a complaint about misleading policies, visit your state’s department of insurance—like the Ohio Department of Insurance.

FAQ

What is the cheapest insurance for a truck?

The cheapest truck insurance is typically liability-only coverage, which meets state minimum requirements but excludes protection for your own vehicle. For short-term needs, one week truck insurance can be significantly cheaper than a full-term commercial policy—especially if you’re borrowing, renting, or doing a quick contract job.

Example: In Texas, a 7-day liability-only policy for a personal-use pickup can start around $65–$85, depending on your age, location, and driving record.

To find the lowest rate:

Compare quotes from digital brokers who offer flexible terms.

Choose liability-only if you don’t need cargo or physical damage coverage.

Avoid overpaying for long-term plans if you only need a few days.

What insurance do I need for a truck?

At a minimum, you’ll need liability insurance to legally drive a truck in any U.S. state. This covers bodily injury and property damage to others if you’re at fault. Depending on how you use the truck, you may also need:

Collision (for crash damage)

Comprehensive (for theft, weather, or vandalism)

Cargo coverage (if transporting goods for work)

Commercial insurance (for business or contractor use)

Tip: If you’re renting or borrowing a truck for a short period, a one week truck insurance policy can provide fast, affordable protection without committing to a 6-month commercial plan.

Make sure your coverage matches the truck’s use—personal vs. business matters.

How much is insurance for a 16 ft box truck?

Insurance for a 16-foot box truck depends on usage, location, and driver profile. On average:

Personal use (short-term): ~$110–$160/week

Commercial use (delivery, transport): ~$150–$300/week

Long-term commercial policy: $600–$1,200/month

Real-world example: In Fresno, CA, a 7-day policy for a 14′ box truck with liability + cargo protection was $138 in early 2025.

For temporary work, a one week commercial truck insurance policy is often the most cost-effective way to meet legal and contract requirements—without paying for unused months of coverage.

Can you get temporary commercial insurance?

Yes, you can get temporary commercial truck insurance—including policies that last just 1 to 7 days. These short-term plans are ideal for:

Independent contractors working short gigs

Drivers using rented or borrowed trucks

Business owners waiting for full-term policy approval

Many digital platforms now offer instant 7-day commercial truck policies with add-ons like cargo protection, roadside assistance, or uninsured motorist coverage.

Just make sure the policy:

Clearly covers commercial use

Lists you as the named driver

Includes proper liability limits for your state and contract

Need proof of coverage for a job? Many providers issue downloadable certificates within minutes.