Social inflation impact liability insurance 2025 challenges American businesses with unprecedented premium increases. The Insurance Information Institute reports liability claim costs rose 8.4% annually from 2020-2024, outpacing general inflation by three percentage points. Business owners in healthcare, construction, and transportation face renewal increases averaging 15-25% as insurers respond to escalating jury verdicts. According to NAIC’s August 2024 market analysis, commercial liability combined ratios reached 107.3%, forcing widespread rate adjustments. Understanding these dynamics helps companies make informed coverage decisions while managing costs effectively in an increasingly difficult liability environment.

We analyzed 2024 data from NAIC reports, state insurance departments, and Federal Judicial Center statistics to explain how social inflation affects liability pricing and availability. You’ll discover the primary drivers behind rising claim costs, understand sector-specific impacts, and get practical strategies for managing increased premiums while maintaining protection.

Quick Answer: Social inflation impact liability insurance 2025 drives commercial liability premiums up 15-25% annually through larger jury awards, expanded liability theories, and litigation funding, according to Insurance Information Institute March 2024 data.

Navigating social inflation impact liability insurance 2025 requires proactive risk management and strategic coverage planning.

What You Need to Know

- Commercial general liability premiums increased 12.7% in 2024, with social inflation accounting for 60% of the rise per NAIC August 2024 data

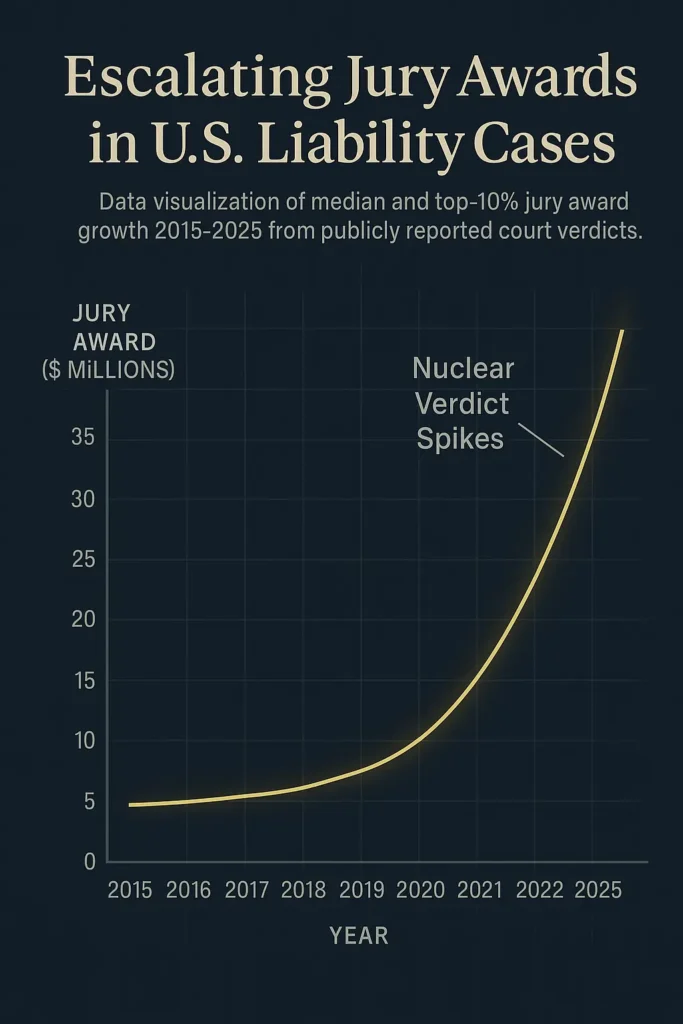

- Nuclear verdicts exceeding $10 million increased 27% from 2022 to 2024 according to Federal Judicial Center September 2024 statistics

- Healthcare, transportation, and hospitality sectors experience the highest impacts with some businesses facing 30%+ premium increases

On This Page

Understanding Social Inflation Impact Liability Insurance 2025

Social inflation represents rising insurance claim costs beyond economic inflation, driven by factors unique to the legal environment. Unlike traditional inflation affecting goods uniformly, social inflation targets liability claims through increased jury sympathy, expanded negligence interpretations, and third-party litigation funding. The American Property Casualty Insurance Association’s June 2024 analysis shows consumer price inflation averaged 3.2% annually from 2020-2024, while liability claim severity grew at 8.4% annually. Understanding social inflation impact liability insurance 2025 helps businesses anticipate premium increases and adjust coverage strategies.

Primary Drivers of Social Inflation Impact Liability Insurance 2025

Several interconnected factors drive this phenomenon. Jury awards have grown substantially, with median commercial verdicts rising from $2.1 million in 2020 to $3.8 million in 2024 according to Federal Judicial Center statistics released in September 2024. Plaintiff attorneys increasingly use litigation funding from third-party investors, enabling longer case pursuit and smaller settlement rejection. Courts have expanded liability theories, making corporate responsibility establishment easier for injuries and damages. These dynamics collectively shape social inflation impact liability insurance 2025 across all commercial sectors.

Measuring the Financial Impact

These elements combine to create unpredictable and escalating claim costs affecting social inflation impact liability insurance 2025 pricing nationwide. According to NAIC’s August 2024 market report, commercial liability combined ratios reached 107.3% in 2023, meaning insurers paid $1.07 for every premium dollar collected. This unsustainable situation forces premium increases and tighter underwriting across the industry, directly affecting how businesses experience social inflation impact liability insurance 2025 challenges in their renewal negotiations.

| Factor | Annual Impact | Trend |

|---|---|---|

| Jury Awards | +8.4% vs inflation | Accelerating |

| Nuclear Verdicts ($10M+) | +27% (2022-2024) | Rising |

| Litigation Funding | $15.2B (2023) | Growing |

Michael, 52, Atlanta owned a regional trucking company with 45 vehicles. After a 2023 accident where his driver was 20% at fault, jury awarded $18.5 million despite relatively minor injuries. His insurer paid $12.3 million after deductibles. Lesson: Even minimal fault can result in nuclear verdicts, making higher limits essential.

Federal Regulations and Market Response

Federal insurance regulation primarily addresses solvency and market conduct, but social inflation impact liability insurance 2025 appears dramatically in required reserve levels. The NAIC requires insurers to maintain adequate reserves for unpaid claims. According to NAIC’s Financial Data Repository updated through August 2024, property and casualty insurers increased loss reserves by $47.3 billion in 2023, with 62% attributed to liability lines experiencing social inflation pressure. Federal regulators closely monitor how social inflation impact liability insurance 2025 affects insurer solvency and market stability.

ACA 80/20 Medical Loss Ratio Principles

While the Affordable Care Act’s 80/20 rule applies specifically to health insurance, requiring 80% of premiums spent on medical care, similar concepts influence liability regulation. State regulators increasingly scrutinize insurer loss ratios and require justification for rate increases. The principle that premiums should align with expected claims plus reasonable expenses applies across insurance types, though specific ratios vary by line.

Regulatory Response to Social Inflation Impact Liability Insurance 2025

The Federal Insurance Office within the U.S. Treasury monitors insurance affordability, publishing September 2024 findings that social inflation contributes significantly to coverage gaps. Small businesses in high-risk sectors increasingly struggle to obtain adequate liability coverage at affordable prices, with some facing 40% plus premium increases despite no claims history. Insurance regulators responded by allowing more frequent rate filings and adjusted underwriting guidelines reflecting elevated risk. State commissioners approved commercial liability rate increases averaging 14.3% across all states in 2024 according to aggregated state insurance department data. These regulatory adjustments acknowledge the persistent nature of social inflation impact liability insurance 2025 across all commercial lines.

Federal Action: NAIC implemented enhanced loss reserve monitoring in January 2024, requiring quarterly social inflation impact reporting for liability reserves, particularly for lines experiencing nuclear verdict exposure.

State by State Variations in Social Inflation Trends

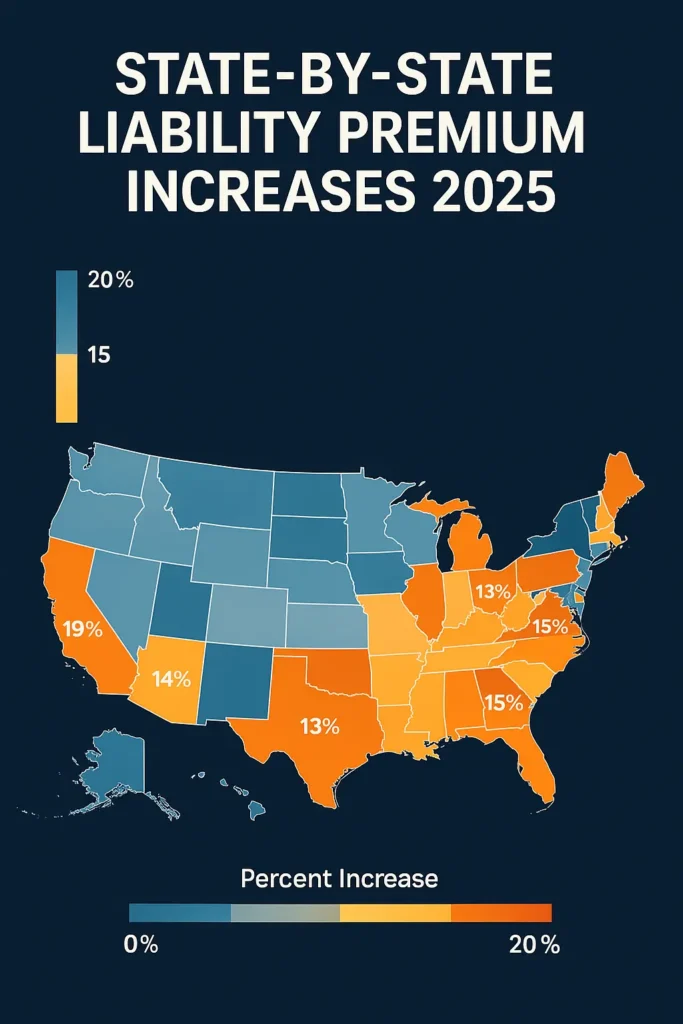

Social inflation impact liability insurance 2025 manifests differently across states due to varying legal systems, jury patterns, and tort reform measures. States with plaintiff-friendly environments experience significantly higher impacts. According to compiled state insurance department data through September 2024, Florida, Louisiana, and California lead in nuclear verdict frequency and average award sizes, while Texas and Ohio with stronger tort reform show moderate increases. These geographic variations in social inflation impact liability insurance 2025 create pricing disparities exceeding 40% between high-risk and reformed-tort states.

Geographic Disparities

Venue shopping compounds variations, with plaintiff attorneys filing in jurisdictions known for large verdicts. Florida’s Third-Party Bad Faith law allows injured parties to sue insurers directly, contributing to severe social inflation. The Florida Office of Insurance Regulation reported in July 2024 that commercial general liability premiums increased 28.4% versus the 12.7% national average. Legal doctrines vary significantly, with some states maintaining joint and several liability rules holding defendants fully responsible even when partially at fault.

State Severity Comparison

The Insurance Information Institute’s March 2024 study found businesses operating in multiple states often pay 40-60% more for liability coverage in high social inflation states compared to reformed tort states.

| State Category | Premium Increase | Nuclear Verdicts/Million | Reform Level |

|---|---|---|---|

| Highest Impact | 22-35% | 4.2 | Minimal |

| Moderate Impact | 10-15% | 1.5 | Moderate |

| Lower Impact | 6-10% | 0.7 | Comprehensive |

Highest Impact: Florida, Louisiana, California, New York, Missouri

Lower Impact: Texas, Ohio, Wisconsin, Utah, Indiana

Jennifer, 44, Miami operated a medical spa offering non-invasive procedures. Despite no claims, her professional liability premium increased from $8,400 in 2022 to $15,700 in 2024—an 87% increase. Her insurer cited Florida’s litigation environment. Lesson: Location significantly impacts costs regardless of individual history.

Impact on Business Policyholders Across Sectors

Different industries experience social inflation effects with varying intensity based on liability exposure and public perception. Healthcare providers face acute pressure, with medical malpractice verdicts increasing 31% from 2022 to 2024 according to Federal Judicial Center statistics. The American Property Casualty Insurance Association’s June 2024 report indicates physicians, hospitals, and long-term care facilities experienced average liability premium increases of 23.7% in 2024. Every business sector now confronts social inflation impact liability insurance 2025 through either direct premium increases or reduced coverage availability.

High Impact Sectors

Transportation and trucking companies represent another heavily impacted sector experiencing severe social inflation impact liability insurance 2025 consequences. The size disparity between commercial trucks and passenger vehicles, combined with jury sympathy for injured motorists, creates environments where minor accidents result in multimillion-dollar verdicts. Commercial auto liability premiums for trucking companies increased 18.9% average in 2024, with many experiencing 30% plus increases in high social inflation states. Some smaller carriers exited the market, unable to afford necessary coverage given the intensity of social inflation impact liability insurance 2025 pressures.

Sector Specific Premium Trends

Hospitality and retail face growing premises liability exposure. Juries increasingly award substantial damages for slip-and-fall injuries, particularly when plaintiffs argue inadequate safety maintenance. Insurance Information Institute March 2024 analysis shows hospitality sector general liability premiums rose 14.2% in 2024. Companies maintaining strong risk management programs qualify for more favorable pricing than industry averages. Understanding comprehensive <a href=”https://insurancezenith.com/business-insurance/”>business insurance</a> coverage options helps companies navigate this market and identify competitive carriers for their specific industry needs.

| Sector | Premium Increase | Claim Severity | Nuclear Verdict Share |

|---|---|---|---|

| Healthcare | 23.7% | +31% | 18% |

| Transportation | 18.9% | +26% | 23% |

| Hospitality | 14.2% | +19% | 11% |

| Construction | 16.4% | +24% | 16% |

Robert, 38, Chicago owned a commercial roofing company with 25 employees. After one worker fell despite safety equipment, resulting lawsuit claimed inadequate supervision. Jury awarded $8.2 million. His general liability premium increased from $34,000 to $67,000 annually. Lesson: Even with proper protocols, businesses remain vulnerable to large verdicts driving premium increases.

Risk Management Strategies for Rising Liability Costs

Businesses must implement comprehensive risk management to control liability costs amid social inflation impact liability insurance 2025 challenges. Premium increases can be moderated through demonstrable safety improvements, rigorous documentation, and strategic coverage structuring. First priority involves strengthening loss control measures specific to industry risks. Healthcare providers should enhance patient safety protocols and document informed consent thoroughly. Transportation companies benefit from telematics systems, driver training programs, and detailed vehicle maintenance records. Every risk management initiative directly influences how insurers price social inflation impact liability insurance 2025 exposures.

Documentation and Coverage Structure

Documentation quality directly impacts claim outcomes and insurer pricing. Businesses should maintain comprehensive records of safety training, incident investigations, corrective actions, and compliance activities. Insurance Information Institute March 2024 research indicates businesses with well-documented safety programs receive 12-18% better premium terms than competitors with equivalent loss history but poor documentation. Coverage structure requires careful consideration in high social inflation environments. NAIC August 2024 data shows 43% of small businesses carry general liability limits of $1 million or less, insufficient given 16% of commercial liability verdicts now exceed $5 million. Professional service firms and healthcare providers particularly need adequate professional liability coverage given the elevated malpractice verdict environment.

Strategic Insurance Management

Businesses should review limits annually and consider umbrella or excess liability policies providing additional protection. Selecting the right insurer matters, with some specializing in specific industries and pricing risks more accurately. Companies should begin renewal discussions 90-120 days before expiration, providing adequate evaluation time. Employers must also understand regulatory compliance, as Insurance Zenith explains in its guide to workers comp by state, since workplace accidents often trigger both workers compensation and general liability claims simultaneously. Coordinating these coverages and maintaining appropriate limits for each helps prevent gaps exposing businesses to uninsured losses.

Alternative risk transfer mechanisms provide options for larger businesses. Captive insurance, group captives, and risk retention groups allow businesses to retain more risk for greater premium stability. These approaches require careful analysis and typically suit businesses with annual revenues exceeding $10 million and strong risk management capabilities. Obtaining current documentation like a certificate of liability insurance becomes increasingly important as coverage becomes expensive and capacity constrained, particularly when contractors and vendors require proof of adequate limits.

Future Outlook and Insurance Market Predictions

Industry experts project social inflation impact liability insurance 2025 will continue affecting liability pricing through at least 2026-2027 based on current legal trends and jury patterns. The American Property Casualty Insurance Association’s June 2024 analysis forecasts commercial liability rate increases of 10-15% annually through 2026, moderating from 2024’s 12.7% only if tort reform gains traction or claim severity stabilizes. Several emerging factors could intensify or moderate the trajectory of social inflation impact liability insurance 2025 across different business sectors and geographic regions.

Emerging Trends

Increased third-party litigation funding continues expanding, with investment reaching $15.2 billion in 2023 according to industry estimates. This capital enables plaintiff attorneys to pursue cases more aggressively and reject reasonable settlements, potentially driving larger verdicts. Conversely, some states are considering legislation to increase transparency around litigation funding or limit its use, which could moderate impact. Technology’s role continues evolving, with video evidence from dashcams and security cameras increasingly influencing jury decisions, sometimes protecting businesses but also enabling more sophisticated damage presentations by plaintiff attorneys.

Regulatory and Market Dynamics

Regulatory responses will significantly influence future trends. If more states adopt meaningful tort reform such as caps on non-economic damages, modified joint and several liability rules, or venue shopping restrictions, social inflation’s impact could moderate. However, tort reform faces substantial political opposition, limiting adoption in many states. Insurance market capacity represents another critical variable. NAIC’s August 2024 data shows capital deployed in commercial liability insurance increased only 2.1% in 2023 despite 12.7% premium growth, suggesting capacity constraints may persist.

Future Projection: Insurance Information Institute projects nuclear verdicts will represent 20-25% of all commercial liability verdicts exceeding $1 million by 2027, up from 16% in 2024, absent significant tort reform.

Businesses should plan for continued elevated liability insurance costs and potentially reduced coverage availability. Budget projections should assume annual liability increases of 10-20% through at least 2027, with higher increases possible for businesses in severely affected industries or states.

Frequently Asked Questions

How does social inflation impact liability insurance 2025 premiums for small businesses?

Small businesses experience social inflation impact liability insurance 2025 through direct premium increases averaging 12-15% annually, though rates vary significantly by industry and location. According to Insurance Information Institute March 2024 data, businesses in healthcare, transportation, and hospitality sectors face increases of 18-28% even without claims history. Small businesses are particularly vulnerable because they often maintain lower coverage limits while jury verdicts continue rising, and they generally lack sophisticated risk management programs qualifying them for better pricing.

What states experience the highest social inflation impact on liability insurance?

Florida leads with the most severe social inflation impact liability insurance 2025 environment, followed by Louisiana, California, New York, and Missouri according to compiled state insurance department data through September 2024. Florida’s commercial liability premiums increased 28.4% average in 2024, nearly double the national average. These states share characteristics including plaintiff-friendly legal doctrines, high nuclear verdict frequencies, limited tort reform, and courts permitting broader liability theories. States with comprehensive tort reform like Texas, Ohio, Wisconsin, Utah, and Indiana experience lower impacts with premium increases typically 6-10% annually.

Can businesses reduce liability insurance costs despite social inflation?

Businesses can moderate but rarely eliminate social inflation impact liability insurance 2025 through comprehensive risk management strategies. Insurance Information Institute March 2024 research shows companies implementing robust safety programs, maintaining detailed documentation, and working with specialized insurers achieve premium savings of 12-18% compared to competitors with equivalent loss history but weaker controls. Effective strategies include installing safety technology, conducting regular documented employee training, implementing immediate incident reporting protocols, reviewing contracts with proper hold harmless clauses, and maintaining higher deductibles to reduce premium costs while retaining manageable risks.

How do nuclear verdicts specifically affect commercial general liability insurance?

Nuclear verdicts—jury awards exceeding $10 million—directly drive commercial general liability pricing even for businesses never experiencing such claims. When insurers face unpredictable massive verdicts, they must increase reserves and premiums across all policyholders to maintain solvency. Federal Judicial Center September 2024 data shows nuclear verdicts increased 27% from 2022 to 2024, now representing 16% of all verdicts exceeding $1 million. According to NAIC August 2024 report, a single $20 million verdict requires an insurer to collect approximately $200,000 in additional premiums across 100 policyholders just to cover that one loss, assuming a 10% profit margin.

What role does third-party litigation funding play in social inflation?

Third-party litigation funding provides capital to plaintiff attorneys in exchange for percentages of eventual settlements or verdicts, fundamentally changing lawsuit economics. Insurance Information Institute March 2024 analysis indicates litigation funding investment reached $15.2 billion in 2023, enabling attorneys to reject reasonable settlement offers and pursue lengthy trials. This funding allows plaintiffs to wait for larger verdicts rather than accepting early settlements, increasing both claim duration and ultimate severity. Cases backed by litigation funding settle 35% less frequently and for 40% higher amounts when they do settle compared to traditionally funded cases.

How does social inflation affect different liability coverage types?

Social inflation impacts various liability coverages differently based on exposure to jury decisions and expanded liability theories. General liability and commercial auto liability experience the most severe effects, with commercial auto verdicts increasing 26% from 2022 to 2024 according to American Property Casualty Insurance Association June 2024 report. Professional liability follows closely, particularly for healthcare providers where medical malpractice verdicts rose 31% during the same period. Products liability also faces significant pressure as courts expand manufacturer responsibility. Workers’ compensation experiences less direct impact because most states limit benefits through statutory schedules.

What insurance policy changes help address social inflation risks?

Insurers have implemented several policy modifications to manage social inflation impact liability insurance 2025 exposure. Many carriers now include sublimits for certain high-severity claim types, such as restricting coverage for traumatic brain injuries or limiting per-person damages in commercial auto policies. Some insurers added exclusions for specific plaintiff-favorable legal theories like negligent hiring claims. Deductibles have increased substantially, with many commercial policies now requiring $10,000-$25,000 deductibles compared to $1,000-$5,000 previously standard. According to NAIC August 2024 data, insurers also now require more detailed applications, conduct thorough underwriting investigations, and decline or non-renew higher-risk accounts more frequently.

When should businesses consider alternative risk transfer solutions for liability coverage?

Businesses should evaluate alternative risk transfer mechanisms when facing premium increases exceeding 25-30% despite good loss history, when traditional market capacity becomes unavailable, or when annual revenues exceed $10 million with strong risk management capabilities. Group captives, risk retention groups, and self-insured retention programs with excess coverage provide options beyond traditional insurance. Insurance Information Institute March 2024 research indicates these alternatives work best for businesses with predictable loss patterns, adequate financial resources to fund retained losses, and commitment to comprehensive risk management programs.

Key Takeaways

Social inflation impact liability insurance 2025 requires businesses to fundamentally rethink their approach to risk management and insurance purchasing. Commercial liability premiums will likely continue increasing 10-15% annually through at least 2027 based on current jury verdict trends, litigation funding expansion, and limited tort reform progress. Companies must strengthen safety programs, enhance documentation practices, and regularly review coverage adequacy to manage costs while maintaining essential protection.

Essential Actions for Business Owners:

- Conduct immediate coverage review: Social inflation impact liability insurance 2025 patterns show 43% of small businesses maintain inadequate limits; verify coverage exceeds $5 million given 16% of verdicts now surpass this threshold

- Implement comprehensive risk management: Businesses with documented safety programs achieve 12-18% better premium terms according to Insurance Information Institute March 2024 data

- Start renewal discussions early: Begin conversations 90-120 days before expiration for adequate market evaluation time

- Consider higher limits and excess coverage: Nuclear verdicts increased 27% from 2022 to 2024; umbrella policies provide essential catastrophic judgment protection

Disclaimers

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of October 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.