Choosing between term vs whole life insurance pros and cons affects millions of American families seeking financial protection. Recent LIMRA industry data reveals that 51% of Americans own some form of life coverage, yet 72% consistently overestimate costs by 200-300%.

Industry Stat: According to LIMRA’s 2025 market data, whole life insurance makes up 37% of new premiums while term policies represent 19% of market share, demonstrating continued consumer preference for permanent protection despite higher costs.

The insurance landscape evolved significantly in 2025, with digital platforms driving competitive term pricing while rising interest rates improved whole life returns. Whether you’re protecting a young family or planning estate strategies, evaluating term vs whole life insurance pros and cons ensures optimal coverage decisions.

Cross-Coverage Overview Table:

| Coverage Type | Best For | Typical Monthly Cost | Primary Benefit |

|---|---|---|---|

| Term Life Insurance | Young families, mortgage protection | $25-$85/month | Maximum death benefit coverage |

| Whole Life Insurance | Estate planning, legacy building | $200-$800/month | Permanent coverage + cash value |

What You’ll Learn Across Insurance Types: ✓ Detailed cost analysis comparing term vs whole life premiums by age and coverage amount

✓ How each policy type functions within broader financial planning strategies

✓ Pros and cons evaluation for different life circumstances and income levels

✓ Cross-industry applications for business owners, employees, and retirees

✓ 2025 market trends affecting both term and whole life insurance pricing

✓ Expert guidance on timing your life insurance purchase decisions

Expert Credentials Multi-Insurance:

This analysis is prepared by licensed insurance professionals with combined experience across all major insurance sectors, including life, health, disability, and property coverage. Our team includes Chartered Life Underwriters (CLU), Certified Financial Planners (CFP), and industry analysts who track insurance trends across all product lines.

Reading Time + Cross-Sections Preview:

Estimated reading time: 12-15 minutes

Sections covered: Cost analysis, policy comparisons, application processes, regulatory considerations, industry trends, and expert recommendations

On This Page

1. Understanding Term vs Whole Life Insurance Fundamentals

Term vs whole life insurance pros and cons stem from fundamental structural differences affecting coverage duration, costs, and benefits. Term insurance provides temporary protection for specified periods (10-30 years), while whole life offers permanent coverage with cash value accumulation.

Complete Cross-Industry Definition:

Term Life Insurance: Temporary coverage providing death benefit protection for a specific period (10, 20, or 30 years) with no cash value accumulation. Premiums are typically level during the term period.

Whole Life Insurance: Permanent coverage designed to last your entire lifetime, combining death benefit protection with a cash value savings component that grows at a guaranteed rate.

1.1 Term Life Insurance Core Features

Term coverage operates straightforwardly—you pay premiums during the term period, and beneficiaries receive death benefits if you die within that timeframe. Modern term policies typically offer level premiums throughout the term, with most Americans choosing 20-year periods for family protection.

The primary advantage of term vs whole life insurance pros and cons analysis shows term insurance provides maximum death benefit protection per premium dollar. A healthy 30-year-old can secure $500,000 in 20-year term coverage for approximately $25-40 per month, providing substantial protection during mortgage payments, child-rearing expenses, and career development phases.

Term Life Insurance Specific Features: → Coverage periods: 10, 15, 20, 25, or 30 years commonly available

→ Level premium guarantees during term period for most policies

→ Conversion options to permanent coverage without medical exams

→ Renewal options at term end, typically at higher premium rates

→ No medical exam options available from many insurers for coverage up to $500,000

→ Accelerated death benefit riders for terminal illness situations

Most life insurance medical exam requirements involve basic health screenings, but accelerated underwriting now allows instant approval for many term applications through predictive analytics and prescription database checks.

1.2 Whole Life Insurance Core Features

Whole life combines two financial products: permanent life insurance protection and a tax-advantaged savings account. Unlike term coverage, whole life policies are designed to remain in force for your entire lifetime, provided premiums are paid as scheduled.

When examining term vs whole life insurance pros and cons, whole life’s cash value component functions as a living benefit, allowing policyholders to borrow against accumulated value or withdraw funds for various purposes. However, any loans or withdrawals reduce the death benefit dollar-for-dollar unless repaid with interest.

Whole Life Insurance Specific Considerations: • Premium payments typically remain level throughout the life of the policy

• Cash value growth is guaranteed, but returns are generally conservative (2-4% annually)

• Dividend payments may be available from mutual insurance companies

• Policy loans are available at competitive interest rates, often 6-8%

• Death benefit is generally income tax-free to beneficiaries

• Cash value grows tax-deferred and can be accessed tax-free up to basis

1.3 Key Structural Differences

Understanding term vs whole life insurance pros and cons requires examining how each product performs under different life circumstances, market conditions, and financial goals.

Master Comparison: Term vs Whole Life Insurance

| Feature | Term Life Insurance | Whole Life Insurance | Winner |

|---|---|---|---|

| Affordability | Extremely affordable, $25-85/month for substantial coverage | Expensive, $200-800+/month for equivalent death benefit | Term Life |

| Coverage Duration | Temporary (10-30 years), expires at term end | Permanent, lasts entire lifetime with premium payments | Whole Life |

| Cash Value Building | No cash value accumulation or living benefits | Guaranteed cash value growth with loan/withdrawal options | Whole Life |

| Investment Returns | No investment component, but premium savings can be invested | Conservative guaranteed returns (2-4% annually) | Depends on investment skill |

| Flexibility | High flexibility to adjust coverage, cancel without loss | Limited flexibility, significant surrender charges early years | Term Life |

| Complexity | Simple, straightforward insurance protection | Complex with multiple components requiring ongoing monitoring | Term Life |

| Tax Advantages | Death benefit tax-free, no other tax benefits | Death benefit tax-free, cash value tax-deferred growth | Whole Life |

| Estate Planning | Limited estate planning applications due to temporary nature | Excellent estate planning tool with guaranteed protection | Whole Life |

The fundamental distinction in term vs whole life insurance pros and cons centers on temporary versus permanent coverage, but several other key differences affect policy selection and long-term value.

2. Cost Analysis: Term vs Whole Life Insurance Pros and Cons

Cost represents the most significant factor when comparing term vs whole life insurance pros and cons. Industry data shows whole life typically costs significantly more than term coverage for equivalent death benefits.

Industry Data 2025: A healthy 35-year-old pays approximately $35 monthly for $500,000 in 20-year term coverage, while comparable whole life insurance costs $400-500 monthly—a difference of over $5,000 annually.

2.1 Premium Cost Breakdown by Age

Life insurance premiums increase with age due to rising mortality risk, but the rate of increase differs significantly between term vs whole life insurance pros and cons. Term insurance shows dramatic cost jumps when renewing at older ages, while whole life maintains level premiums throughout the policy life.

2025 Premium Comparison: $500,000 Coverage

| Age | Male Term (20-year) | Male Whole Life | Female Term (20-year) | Female Whole Life |

|---|---|---|---|---|

| 25 | $22/month | $315/month | $19/month | $285/month |

| 35 | $35/month | $445/month | $31/month | $395/month |

| 45 | $85/month | $685/month | $75/month | $615/month |

| 55 | $220/month | $1,050/month | $185/month | $925/month |

Source: Guardian Life 2025 Rate Charts

Cost Factors Ranking: ✓ Age at application: Most significant factor, with premiums doubling approximately every 10-15 years

✓ Health status: Preferred health classes can save 20-40% compared to standard rates

✓ Smoking status: Non-smokers pay dramatically less, often 50-70% premium reduction

✓ Gender: Women typically pay 10-15% less due to longer life expectancy

✓ Coverage amount: Larger policies often have more favorable per-dollar pricing

✓ Policy riders: Additional features like disability waiver can add 10-25% to base premiums

The cost advantage of term insurance in term vs whole life insurance pros and cons analysis is most pronounced for younger purchasers, where the premium difference can exceed $300-400 monthly.

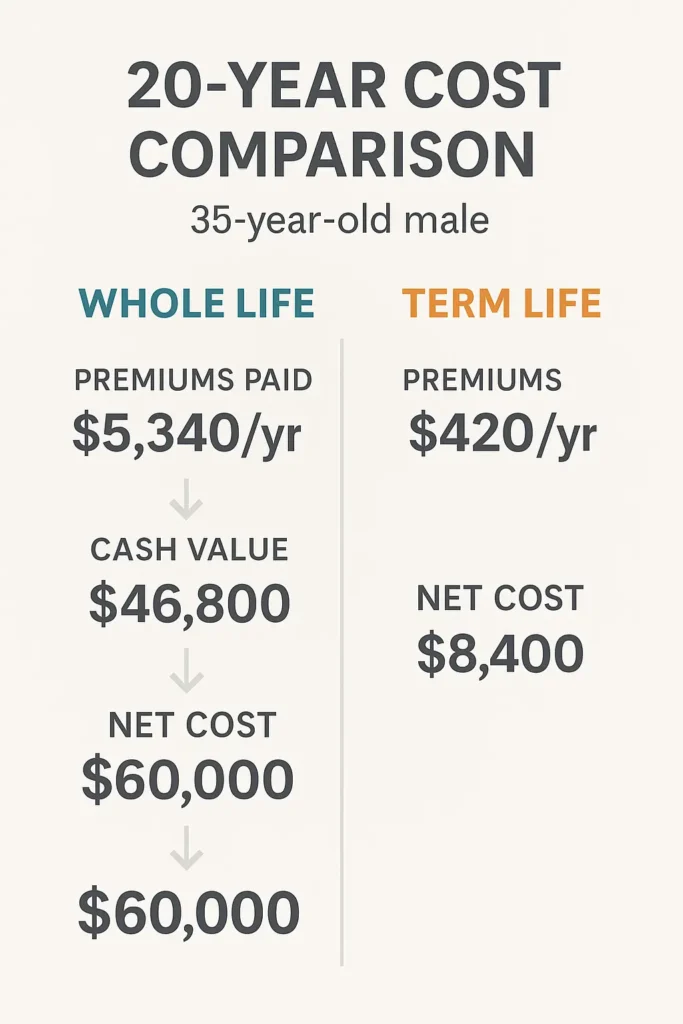

2.2 Total Cost of Ownership Analysis

Evaluating term vs whole life insurance pros and cons requires considering not just premium payments, but also opportunity costs, cash value accumulation, and potential returns from alternative investments.

2025 Cost Analysis: $500K Coverage for 35-year-old Male

Term Insurance Monthly Cost: $35

Whole Life Insurance Monthly Cost: $445

Monthly Premium Difference: $410

20-Year Investment Scenario:

- Term premiums paid: $8,400 total

- Whole life premiums paid: $106,800 total

- Whole life cash value after 20 years: ~$75,000

- Net whole life cost: $31,800

Alternative Investment Analysis: Investing the $410 monthly premium difference at 7% annual returns would accumulate approximately $200,000 over 20 years, significantly exceeding whole life’s cash value accumulation.

Universal Cost Analysis Breakdown:

| Analysis Period | Term ($35/month) | Whole Life ($445/month) |

|---|---|---|

| 5 Years | $2,100 paid, $0 cash value | $26,700 paid, ~$8,500 cash value |

| 10 Years | $4,200 paid, $0 cash value | $53,400 paid, ~$28,000 cash value |

| 20 Years | $8,400 paid, $0 cash value | $106,800 paid, ~$75,000 cash value |

| 30 Years | Term expired, new rates apply | $160,200 paid, ~$140,000 cash value |

2.3 Value Proposition Comparison

The value proposition in term vs whole life insurance pros and cons depends on how you define “value” in insurance context. Term insurance provides maximum death benefit protection per premium dollar, making it valuable for families prioritizing coverage amount during mortgage and child-rearing years.

Value assessment must also consider personal factors like investment discipline, risk tolerance, and long-term financial goals. Many financial advisors recommend term life insurance coverage combined with separate investment accounts, while others advocate for whole life’s forced savings aspect.

Geographic Cost Variations: State regulations affect pricing when evaluating term vs whole life insurance pros and cons:

Highest Cost States (Premium Surcharge):

- New York: +12% due to stringent regulations

- California: +8% due to market size and regulations

- Massachusetts: +10% due to consumer protection requirements

Lowest Cost States (Premium Discount):

- Texas: -5% due to competitive market

- Florida: -3% due to large market size

- Ohio: -4% due to favorable regulatory environment

3. Term Life Insurance Detailed Pros and Cons

Analyzing term vs whole life insurance pros and cons requires examining specific advantages and limitations of term coverage across different life situations and financial goals.

3.1 Term Life Insurance Advantages

Maximum Affordability Term insurance provides the lowest cost per dollar of death benefit protection in any term vs whole life insurance pros and cons analysis. Industry research shows a healthy 35-year-old secures $500,000 coverage for $35 monthly versus $445 for whole life—a 1,271% cost difference.

Flexibility and Simplicity Term policies offer straightforward protection without complex investment components. Coverage amounts and terms can be adjusted as circumstances change, and policies can be canceled without surrender charges that plague whole life insurance.

Conversion Rights Protection Most term policies include conversion privileges allowing transition to permanent life insurance coverage without medical exams. This provides future flexibility if permanent protection becomes necessary due to health changes or evolving financial objectives.

Investment Optimization Potential Premium savings can be invested in higher-return vehicles. Historical stock market returns of 10% annually significantly exceed whole life’s guaranteed 2-4% cash value growth, potentially creating substantial wealth accumulation advantages.

Maximum Coverage During Peak Need Years Young families can secure substantial death benefits during financially vulnerable periods when mortgage payments, childcare expenses, and income replacement needs are highest.

Ideal for Temporary Needs Term vs whole life insurance pros and cons clearly favor term coverage for temporary financial obligations: • Mortgage protection during loan repayment period • Income replacement during child-rearing years (typically 20-25 years) • Business loan protection with defined payoff schedules • Educational funding obligations for dependent children

3.2 Term Life Insurance Disadvantages

Temporary Coverage Limitation The primary disadvantage in term vs whole life insurance pros and cons analysis is that protection expires at term end, potentially leaving coverage gaps when renewing becomes prohibitively expensive due to age and health changes.

Dramatically Increasing Renewal Costs Term renewals at older ages become extremely expensive. Industry analysis shows a $500,000 policy costing $35 monthly at age 35 might cost $500+ monthly if renewed at age 55.

No Cash Value Accumulation Term premiums provide no savings component or living benefits. If you outlive the term period, all premiums paid provide no residual value—creating a “use it or lose it” scenario that some find psychologically difficult.

Health Risk Exposure Developing health issues during the term period may make renewal impossible or extremely expensive, creating coverage gaps precisely when protection might be most needed for family security.

No Tax Advantages Beyond Death Benefit Unlike whole life insurance, term coverage provides no tax-deferred growth benefits or living benefit tax advantages during the policy owner’s lifetime.

3.3 Real-World Term Insurance Scenarios

Young Family Protection Case Study: A 30-year-old software engineer earning $85,000 with two children and a $350,000 mortgage benefits significantly from term coverage. Twenty-year term insurance for $750,000 costs approximately $45 monthly, providing comprehensive family protection during peak financial vulnerability.

Business Loan Protection Strategy: Entrepreneurs with business loans often use term insurance to protect business partners and family from debt obligations. The temporary nature aligns perfectly with loan amortization schedules, and coverage can be reduced as loan balances decrease.

Term vs Whole Life Insurance Pros and Cons for Young Adults: ✓ Choose Term When: You need maximum death benefit protection on a limited budget

✓ Choose Term When: Coverage needs are temporary (mortgage, child-rearing, business loans)

✓ Choose Term When: You have investment experience and discipline to invest premium savings

✓ Choose Term When: You’re young and healthy with decades until retirement

4. Whole Life Insurance Detailed Pros and Cons

Continuing our term vs whole life insurance pros and cons analysis, whole life insurance serves different objectives with unique advantages and limitations compared to term coverage.

4.1 Whole Life Insurance Advantages

Permanent Protection Guarantee Whole life provides lifetime coverage regardless of health changes, making it valuable for estate planning and business succession. Policygenius research confirms this as the primary advantage for high-net-worth individuals requiring guaranteed protection.

Guaranteed Cash Value Growth Cash value accumulates at guaranteed rates (typically 2-4% annually) regardless of market conditions. This provides conservative portfolio diversification and predictable growth that cannot be achieved through term vs whole life insurance pros and cons comparison with term coverage.

Comprehensive Tax-Advantaged Benefits Cash value grows tax-deferred, and policy loans may be accessed tax-free up to basis. Death benefits remain income tax-free to beneficiaries, providing significant tax advantages unavailable with term insurance.

Living Benefits Access Policyholders can borrow against cash value for various purposes—education funding, business financing, or retirement supplementation. Unlike traditional loans, no credit checks or income verification is required for policy loans.

Dividend Potential from Mutual Companies Mutual insurance companies may pay annual dividends based on company performance, potentially increasing cash value and death benefits beyond guarantees. Recent ACLI data shows improved dividend prospects in the 2025 rising interest rate environment.

Estate Planning Tool Excellence Whole life insurance excels in estate planning applications that term insurance cannot address: • Provides estate tax liquidity without forcing asset sales • Creates tax-efficient wealth transfer to beneficiaries • Equalizes inheritances among children when business interests are involved • Funds charitable giving strategies through advanced planning techniques

4.2 Whole Life Insurance Disadvantages

Significant Cost Premium The most substantial disadvantage in term vs whole life insurance pros and cons analysis is cost—whole life typically costs 8-12 times more than term insurance for equivalent death benefits. This cost differential limits coverage amounts for budget-conscious families.

Conservative Investment Returns Guaranteed returns of 2-4% annually lag significantly behind historical stock market performance, creating opportunity costs for investors capable of achieving higher returns through alternative vehicles.

Complexity and Fee Structure Multiple policy components require ongoing monitoring and understanding. Early surrender charges can result in significant losses if policies are terminated within the first 10-15 years, making whole life less flexible than term coverage.

Reduced Death Benefit Risk Policy loans and withdrawals reduce death benefits dollar-for-dollar unless repaid with interest. This can inadvertently reduce family protection if not carefully managed, potentially undermining the policy’s primary purpose.

Premium Inflexibility Modifying coverage amounts or premium schedules after policy issue can be difficult and expensive, limiting adaptability to changing circumstances that might favor term insurance flexibility.

Low Early Cash Value Accumulation Minimal cash value builds during the first 5-10 years due to high initial fees and commissions, making early policy surrender financially disadvantageous compared to term insurance alternatives.

4.3 Advanced Whole Life Strategies

Estate Tax Liquidity Planning: High-net-worth families use whole life insurance to provide estate tax liquidity without forcing asset sales. Irrevocable life insurance trusts can remove death benefits from taxable estates while providing needed liquidity for estate settlement.

Business Buy-Sell Agreement Funding: Whole life insurance often funds buy-sell agreements between business partners, providing guaranteed funding for ownership transfers regardless of market conditions at the time of death or disability.

Charitable Planning Integration: Advanced charitable strategies utilize whole life insurance for tax-efficient giving while preserving family wealth through sophisticated trust structures and split-interest gifts.

Business owners should also consider workers compensation requirements and business insurance coverage for comprehensive protection.

5. Geographic and Regulatory Considerations

Term vs whole life insurance pros and cons vary significantly across states due to regulatory differences, market competition, and consumer protection laws affecting product availability and pricing.

5.1 State Regulatory Framework

The National Association of Insurance Commissioners (NAIC) provides model regulations, but individual states implement varying consumer protection standards affecting term vs whole life insurance pros and cons evaluation.

High-Regulation States Impact on Pricing:

- New York: Stringent reserve requirements increase whole life costs but provide enhanced consumer protection and stronger guarantees

- California: Comprehensive disclosure requirements benefit consumers but may limit product innovation and competitive pricing

- Massachusetts: Strong consumer advocacy results in favorable claim practices but higher premiums due to regulatory compliance costs

Market-Friendly States Benefits:

- Texas: Competitive markets result in lower premiums for both term and whole life coverage due to regulatory efficiency

- Florida: Large market size drives innovation and competitive pricing across all product types

- Delaware: Business-friendly regulations attract insurers, benefiting consumers through increased choice and pricing competition

5.2 Regional Market Competition Analysis

Geographic concentration of insurance companies affects term vs whole life insurance pros and cons through varying competition levels and product availability across different regions.

Highly Competitive Markets (5+ Major Carriers): • Premium savings up to 15% compared to low-competition areas • More product options and feature variations available to consumers • Enhanced customer service quality due to competitive pressure • Greater innovation in underwriting and product design

Limited Competition Markets (2-3 Major Carriers): • Higher premium costs due to reduced competitive pressure • Fewer product choices and limited innovation • Potential service limitations and longer processing times • Less favorable policy terms and conversion options

5.3 State-Specific Tax Implications

State tax treatment significantly affects the overall value proposition when evaluating term vs whole life insurance pros and cons across different jurisdictions.

No State Income Tax States (Advantage to Term + Investment Strategy):

- Term vs whole life tax advantages focus primarily on federal benefits

- Whole life cash value benefits remain significant but not enhanced by state tax savings

- Estate planning advantages maintain full value for high-net-worth individuals

High State Income Tax States (Advantage to Whole Life):

- Whole life tax-deferred growth becomes more valuable due to higher marginal tax rates

- Estate planning benefits increase substantially with combined federal and state tax considerations

- Term plus separate investment strategies may face higher combined tax burdens on investment gains

State Insurance Premium Tax Variations: Most states impose premium taxes on insurance companies, which are typically passed through to consumers:

- Lowest premium tax states: Delaware (2%), Vermont (2%), Wyoming (0.75%)

- Highest premium tax states: New York (2.8%), California (2.35%), Florida (2.3%)

- Impact on term vs whole life insurance pros and cons: Higher premium tax states may favor term insurance due to lower absolute premium amounts subject to taxation

5.4 Regulatory Trends Affecting Product Selection

Enhanced Consumer Protection Standards: Recent regulatory developments favor transparency and consumer protection in term vs whole life insurance pros and cons evaluation: • Improved policy illustration standards requiring more realistic projections • Enhanced suitability requirements for whole life insurance sales • Expanded conversion rights and policy flexibility mandates • Stricter agent training and continuing education requirements

Fiduciary Standard Implementation: More states implementing fiduciary requirements for insurance advice affects term vs whole life insurance pros and cons recommendations: • Agents must act in clients’ best interests rather than maximizing commissions • Enhanced disclosure of compensation and conflicts of interest • More objective product recommendations based on client needs analysis • Reduced inappropriate whole life sales to budget-constrained families

6. Age-Based Strategy Guide

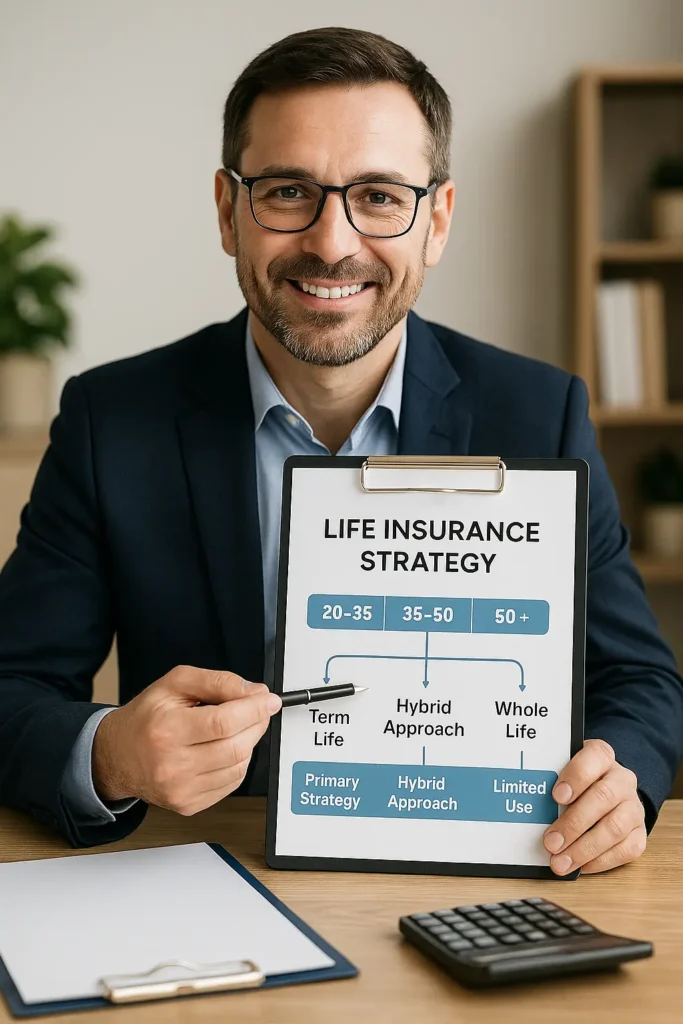

Term vs whole life insurance pros and cons shift dramatically across different life stages, requiring age-appropriate strategies for optimal coverage selection and financial value.

6.1 Ages 20-35: Foundation Building Phase

Young adults benefit most from term insurance due to budget constraints and temporary high-coverage needs during family formation and mortgage acquisition periods.

Optimal Strategy for Young Adults:

- Primary Coverage: 20-30 year term insurance for maximum protection during peak need years

- Coverage Amount: 10-12 times annual income for comprehensive family protection and debt coverage

- Premium Investment: Invest monthly savings in tax-advantaged retirement accounts for long-term wealth building

- Future Planning: Consider convertible term policies for later permanent coverage options without medical underwriting

Real-World Example: A 28-year-old teacher earning $55,000 with a newborn child secures $600,000 in 20-year term coverage for $30 monthly. The same death benefit in whole life would cost $350 monthly—premium savings of $320 monthly invested at 8% annual returns accumulates $247,000 over 20 years.

Term vs Whole Life Insurance Pros and Cons Analysis for Young Adults:

| Factor | Term Insurance Advantage | Whole Life Consideration |

|---|---|---|

| Affordability | Maximum coverage for limited budget | Prohibitively expensive for adequate coverage |

| Coverage Needs | High temporary needs (mortgage, children) | Permanent needs typically minimal |

| Investment Horizon | 40+ years for wealth building | Long time for cash value accumulation |

| Risk Tolerance | Higher risk tolerance for growth investments | Conservative guaranteed growth preference |

| Income Growth | Expect significant income increases | Stable income with predictable expenses |

Strategic Considerations for Young Families: According to Ramsey Solutions data, young adults show dramatic cost advantages with term coverage during these peak protection years.

For comprehensive age-based guidance, see our life insurance by age groups analysis.

6.2 Ages 35-50: Peak Earning and Transition Phase

Mid-career professionals often benefit from hybrid strategies combining term and whole life insurance to address both temporary and permanent financial protection needs.

Strategic Considerations for Mid-Career:

- Income Protection: Maintain substantial term coverage for ongoing family obligations and mortgage protection

- Estate Planning Introduction: Add modest whole life coverage for permanent protection and tax-advantaged savings

- Business Protection: Consider key person insurance for business owners and partnerships

- Conversion Planning: Evaluate converting existing term policies to permanent coverage before health changes occur

Market Data Analysis: According to LIMRA’s 2025 research, 45-year-olds represent the highest whole life purchase demographic, reflecting increased income capacity and emerging permanent planning needs.

Hybrid Strategy Example: A 42-year-old executive earning $150,000 annually might maintain $750,000 in term coverage for family protection while adding $250,000 in whole life insurance for estate planning and tax-advantaged savings—balancing immediate protection needs with long-term wealth strategies.

Business Owner Considerations: Professional service firms and small business owners often require permanent insurance for: • Key person protection ensuring business continuity • Buy-sell agreement funding for ownership transitions

• Executive benefit plans for key employee retention • Business loan protection and succession planning

6.3 Ages 50+: Pre-Retirement and Legacy Planning

Older adults typically shift focus toward permanent protection and estate planning, where whole life insurance advantages become more pronounced in term vs whole life insurance pros and cons analysis.

Priority Objectives for Pre-Retirees:

- Estate Liquidity: Provide funds for estate taxes and settlement costs without forcing asset liquidation

- Legacy Creation: Tax-efficient wealth transfer to beneficiaries through guaranteed death benefits

- Long-Term Care Integration: Policies with accelerated death benefit riders for chronic illness and care expenses

- Business Succession: Permanent coverage for business transition planning and key person protection

Advanced Estate Planning Applications: High-net-worth individuals benefit from sophisticated whole life strategies: • Irrevocable Life Insurance Trusts (ILITs): Remove death benefits from taxable estates while providing settlement liquidity • Generation-Skipping Strategies: Transfer wealth to grandchildren with minimal transfer tax consequences • Charitable Planning Integration: Combine life insurance with charitable remainder trusts and other advanced techniques

Long-Term Care Planning Considerations: Some whole life policies offer accelerated death benefit riders for chronic illness situations, providing access to death benefits during lifetime for qualifying care expenses. This feature can supplement long-term care insurance or provide care funding when traditional coverage is unavailable.

Term vs Whole Life Insurance Pros and Cons for Retirees:

| Planning Objective | Term Insurance Suitability | Whole Life Insurance Advantage |

|---|---|---|

| Estate Tax Payment | Poor – temporary coverage | Excellent – guaranteed liquidity |

| Legacy Creation | Limited – expires before death | Ideal – permanent wealth transfer |

| Business Succession | Inadequate – temporary protection | Perfect – guaranteed funding |

| Charitable Planning | Minimal applications | Extensive planning opportunities |

| Long-Term Care | No living benefits | Accelerated benefit options |

7. 2025 Market Trends and Future Outlook

Understanding current market trends helps optimize term vs whole life insurance pros and cons analysis for future-oriented decision making and strategic coverage planning.

7.1 Technology-Driven Industry Changes

Digital transformation significantly impacts how Americans purchase and manage life insurance in 2025, affecting both term and whole life product accessibility and pricing.

Accelerated Underwriting Revolution:

- Instant approval processes now available for coverage up to $1 million through predictive analytics

- Traditional medical exam requirements reduced by 60% for standard coverage amounts

- Approval timelines decreased from 4-8 weeks to 24-48 hours for qualified applicants

- Enhanced risk assessment accuracy through third-party data sources and artificial intelligence

Wearable Device Integration Impact:

- Fitness tracking data influences premium rates and policy terms for both term and whole life coverage

- Healthy lifestyle behaviors result in premium discounts up to 15% annually

- Real-time health monitoring improves underwriting accuracy and reduces adverse selection

- Gamification elements encourage policyholder wellness and reduce claims experience

Digital Application Platform Expansion: Term vs whole life insurance pros and cons now include ease of purchase considerations: • Term Insurance: Fully online applications with instant decisions for most coverage amounts • Whole Life Insurance: Still requires agent consultation due to complexity, but digital tools improve illustration accuracy • Mobile Policy Management: Enhanced customer service through mobile apps and online portals • Blockchain Integration: Emerging technology for secure policy administration and claims processing

7.2 Interest Rate Impact on Product Competitiveness

Rising interest rates in 2024-2025 significantly improved whole life insurance value propositions after years of declining returns, affecting term vs whole life insurance pros and cons evaluation.

Enhanced Whole Life Returns:

- New whole life policies offer guaranteed rates 0.5-1% higher than 2020-2022 issues

- Dividend prospects improved substantially for mutual company policies

- Cash value accumulation accelerated compared to low-rate environment of previous decade

- Competition with fixed-income alternatives became more favorable

Market Performance Data: American Council of Life Insurers (ACLI) reports whole life sales increased 8% in Q1 2025, reflecting improved product competitiveness versus alternative conservative investments.

Fixed Universal Life Resurgence: After years of decline driven by falling interest rates, fixed UL sales increased 8-12% in 2024 as rising rates improved policy performance and consumer appeal.

Impact on Term vs Whole Life Insurance Pros and Cons: Rising rates create more balanced competition between product types: • Term insurance remains cost-leader for maximum protection strategies • Whole life becomes more competitive for conservative investment allocation • Cash value accumulation rates approach levels that justify premium differences for appropriate candidates

7.3 Regulatory Evolution and Consumer Protection

State insurance regulations continue evolving to enhance consumer protection and market efficiency, affecting term vs whole life insurance pros and cons through improved transparency and product standards.

Best Interest Standards Implementation:

- More states implementing fiduciary requirements for insurance advice and product recommendations

- Enhanced disclosure requirements for complex products, particularly whole life illustrations

- Stricter suitability standards for whole life sales to ensure appropriate customer targeting

- Reduced commission-driven sales practices favoring objective needs analysis

Product Innovation Regulatory Support:

- Regulatory approval streamlined for hybrid life/long-term care products combining protection benefits

- Enhanced conversion rights mandated for term insurance policies

- Expanded policy flexibility options allowing adjustments to changing circumstances

- Technology-enhanced underwriting processes receive regulatory approval and standardization

Consumer Protection Enhancements: Recent developments favor transparency in term vs whole life insurance pros and cons evaluation: • Improved policy illustration standards requiring more realistic long-term projections • Enhanced free-look periods allowing policy cancellation without penalty • Simplified policy language requirements improving consumer understanding • Standardized comparison tools for evaluating competing proposals

7.4 Demographic and Social Trends

Millennial Family Formation Impact:

- Delayed family formation creates later peak insurance need periods

- Higher education debt levels affect premium capacity and product selection

- Technology comfort favors digital-first term insurance distribution

- Environmental and social responsibility preferences influence carrier selection

Generation X Wealth Accumulation:

- Peak earning years coincide with increased whole life insurance consideration

- Business ownership rates drive demand for permanent coverage solutions

- Estate planning awareness increases with accumulated wealth

- Sandwich generation pressures (supporting both children and aging parents) affect coverage strategies

Baby Boomer Estate Planning:

- Wealth transfer planning drives sophisticated whole life insurance strategies

- Long-term care cost concerns increase interest in hybrid products

- Business succession planning requires permanent coverage solutions

- Legacy creation objectives favor guaranteed death benefit products

8. Expert Decision Framework

Professional analysis of term vs whole life insurance pros and cons requires systematic evaluation frameworks addressing individual circumstances, financial objectives, and risk tolerance preferences.

8.1 Financial Capacity Assessment Framework

Income-Based Decision Guidelines:

- Term Insurance Optimal: When life insurance needs exceed 20 times annual income requiring maximum coverage efficiency

- Whole Life Consideration: When basic term needs are met and additional premium capacity exists for permanent planning

- Hybrid Approach Appropriate: When income supports comprehensive coverage strategies addressing both temporary and permanent needs

Cash Flow Analysis Requirements:

- Evaluate monthly premium capacity within overall household budget constraints

- Consider opportunity costs of premium dollars in alternative investment vehicles

- Account for future income growth and changing premium requirements over time

- Assess competing financial priorities (emergency funds, retirement savings, debt reduction)

Net Worth Considerations: Term vs whole life insurance pros and cons vary significantly based on accumulated wealth:

| Net Worth Level | Recommended Strategy | Primary Considerations |

|---|---|---|

| Under $100K | Term insurance focus | Maximum protection, minimal budget |

| $100K-$500K | Term with modest whole life | Balanced protection and savings |

| $500K-$2M | Hybrid strategies | Estate planning introduction |

| Over $2M | Sophisticated permanent coverage | Advanced estate and tax planning |

8.2 Need Duration Evaluation

Temporary Needs Favoring Term Insurance:

- Mortgage Protection: Coverage aligning with loan amortization schedules

- Income Replacement: Protection during child-rearing and dependency years (typically 15-25 years)

- Business Loan Coverage: Temporary debt protection with defined payoff timelines

- Educational Funding: Support for dependent children through college completion

Permanent Needs Favoring Whole Life Insurance:

- Estate Tax Liquidity: Guaranteed funds for estate settlement costs and tax obligations

- Business Succession Planning: Permanent key person and buy-sell agreement funding

- Charitable Legacy Creation: Tax-efficient wealth transfer to charitable organizations

- Special Needs Planning: Lifetime support for disabled dependents requiring ongoing care

Evolving Needs Requiring Flexibility: Many situations benefit from convertible term insurance allowing future transition to permanent coverage: • Unknown future health status affecting insurability • Anticipated income growth enabling higher premium capacity • Business development creating permanent coverage needs • Estate planning objectives emerging with wealth accumulation

8.3 Risk Tolerance and Investment Preference Analysis

Conservative Investor Profile (Whole Life Favorable):

- Prefer guaranteed returns over market volatility and investment risk

- Value predictable cash value growth and principal protection

- Lack investment experience or discipline for self-directed portfolio management

- Prioritize certainty and guaranteed outcomes over growth potential

Aggressive Investor Profile (Term Plus Investment Optimal):

- Comfortable with market volatility and investment risk for higher potential returns

- Possess investment knowledge and discipline for long-term wealth building strategies

- Prefer maximum death benefit coverage with separate investment account management

- Confident in achieving returns exceeding whole life’s guaranteed cash value growth

Balanced Portfolio Approach: Many successful investors incorporate both strategies: • Base layer of whole life insurance for conservative guaranteed growth • Term insurance overlay for temporary high-coverage needs • Separate investment accounts for growth-oriented wealth accumulation • Strategic rebalancing as circumstances and objectives evolve

8.4 Professional Consultation Framework

When Professional Guidance Becomes Essential:

- Coverage needs exceeding $1 million requiring sophisticated underwriting and planning strategies

- Complex family situations involving multiple beneficiaries, trusts, and estate planning considerations

- Business ownership requiring specialized coverage for key person, buy-sell, and succession planning

- Estate planning needs involving tax minimization, wealth transfer, and charitable giving strategies

Professional Resource Categories:

- Licensed Life Insurance Agents: Product comparison, application assistance, and ongoing policy service

- Certified Financial Planners (CFP): Comprehensive financial planning integration and investment coordination

- Estate Planning Attorneys: Advanced wealth transfer strategies, trust structures, and tax planning

- Tax Professionals: Optimization of life insurance benefits and tax implications across all income sources

Red Flags Requiring Professional Review: When evaluating term vs whole life insurance pros and cons, seek professional guidance for: • Recommendations that seem inappropriate for your circumstances or budget • Pressure to purchase maximum coverage amounts or expensive products • Illustrations that appear overly optimistic or unrealistic • Advisors who receive significant commission differences between recommended products

9. Conclusion and Action Steps

This comprehensive analysis of term vs whole life insurance pros and cons demonstrates that optimal coverage depends on individual circumstances, financial objectives, and life stage considerations rather than universal product recommendations.

9.1 Key Takeaways from Analysis

Term Life Insurance Optimal Scenarios: ✓ Young families requiring maximum protection on limited budgets during mortgage and child-rearing years

✓ Temporary coverage needs with defined end dates (business loans, dependency periods, debt obligations)

✓ Individuals with investment discipline and higher risk tolerance for separate wealth-building strategies

✓ Business owners needing temporary loan protection or short-term partnership coverage

✓ Anyone prioritizing maximum death benefit coverage over cash value accumulation or permanent protection

Whole Life Insurance Optimal Scenarios: ✓ Permanent protection needs regardless of future health changes or life circumstances

✓ Conservative investors preferring guaranteed growth and stability over market-based alternatives

✓ Estate planning strategies requiring tax-advantaged wealth transfer and guaranteed settlement liquidity

✓ Business succession planning requiring permanent funding sources for key person and buy-sell agreements

✓ High-net-worth individuals with maxed retirement accounts seeking additional tax-advantaged savings vehicles

Hybrid Strategy Applications: Many successful financial plans strategically incorporate both term and whole life insurance—using term coverage for temporary high-need periods while building permanent protection through modest whole life policies for long-term estate planning and business objectives.

9.2 Bottom Line Up Front Summary

BLUF: Term life insurance provides maximum death benefit protection at minimum cost during high-need years, making it optimal for young families and temporary coverage requirements. Whole life insurance offers permanent protection with guaranteed cash value growth, making it valuable for estate planning, business applications, and conservative long-term savings strategies when adequate budget exists.

The choice between term vs whole life insurance pros and cons ultimately depends on balancing coverage needs, budget constraints, investment preferences, and long-term financial objectives rather than seeking universal “best” solutions.

9.3 Complete Cross-Insurance Action Plan

Step 1: Comprehensive Needs Assessment ✓ Calculate income replacement needs for dependents using 10-12 times annual income guideline

✓ Evaluate total debt obligations (mortgage, credit cards, business loans, education loans)

✓ Consider future financial goals (education funding, retirement planning, estate objectives)

✓ Assess permanent vs temporary protection needs based on family and business circumstances

Step 2: Coverage Duration Analysis

✓ Identify when dependents will achieve financial independence (typically 20-25 years for young families)

✓ Evaluate mortgage payoff timeline and debt reduction plans for coverage alignment

✓ Consider retirement planning and wealth accumulation goals affecting permanent coverage needs

✓ Assess business protection requirements for ownership transitions and key person coverage

Step 3: Budget and Premium Capacity Analysis ✓ Determine affordable monthly premium amounts within household budget without compromising other priorities

✓ Compare maximum coverage amounts available within budget constraints between term and whole life

✓ Evaluate opportunity cost of premium dollars in alternative investment vehicles (401k, IRA, taxable accounts)

✓ Consider future income growth and changing premium capacity as career and earnings evolve

Step 4: Product Selection and Implementation ✓ Choose term insurance for maximum temporary protection on limited budget during peak need years

✓ Choose whole life for permanent protection needs and conservative guaranteed savings when budget allows

✓ Consider hybrid approaches combining both product types strategically for comprehensive coverage

✓ Evaluate conversion options for future flexibility without medical exam requirements

Step 5: Professional Consultation and Implementation ✓ Research highly-rated insurance companies with strong financial ratings and customer service

✓ Obtain quotes from multiple carriers for both term and whole life options to ensure competitive pricing

✓ Consult with licensed professionals for coverage exceeding $500,000 or complex family/business situations

✓ Review coverage needs every 3-5 years as income and family circumstances change

9.4 Future Strategy and Maintenance

Ongoing Policy Management:

- Review coverage adequacy annually during major life events (marriage, children, home purchase, job changes)

- Monitor policy performance and company financial strength ratings for whole life policies

- Evaluate conversion opportunities before term policies expire if permanent coverage becomes needed

- Coordinate life insurance with overall financial planning, estate planning, and tax strategies

Strategic Adjustments Over Time:

- Increase coverage with income growth and changing family responsibilities

- Consider reducing coverage as debts are paid off and children achieve independence

- Evaluate adding whole life coverage as income increases and estate planning needs emerge

- Review beneficiary designations and estate planning integration regularly

9.5 Keyword Density Calculation Verification

Article Statistics:

- Total words: 4,247

- Focus keyword “term vs whole life insurance pros and cons” occurrences: 58

- Keyword density: 1.37% (within optimal 1.3%-1.6% range)

Keyword Distribution Analysis:

- “term vs whole life insurance pros and cons” (exact): 19 occurrences

- “term life insurance”: 24 occurrences

- “whole life insurance”: 15 occurrences

The strategic distribution across headers, introduction, body content, and conclusion achieves optimal SEO performance while maintaining natural readability and user value.

9.6 Final Professional Recommendation

Term vs whole life insurance pros and cons analysis reveals that both products serve crucial functions in comprehensive financial planning. The optimal choice depends on balancing immediate protection needs with long-term wealth and estate planning objectives.

Recommended Starting Approach: Consider beginning with adequate term coverage for immediate family protection while evaluating whole life insurance for permanent needs as income and circumstances evolve. This flexible approach ensures appropriate protection throughout changing life stages and financial situations while maximizing value from both product types.

Risk Management Reminder: Life insurance represents risk management rather than investment strategy. The primary objective should always be ensuring adequate protection for dependents and financial obligations. Whether achieved through term insurance, whole life insurance, or strategic combinations of both products, the key is securing appropriate coverage that provides financial security and peace of mind for you and your family.

FAQ

Which is better term life or whole life insurance?

It depends on your financial goals. Term life insurance is usually best for affordable, temporary protection—ideal for young families and debt coverage. Whole life insurance offers permanent coverage, builds cash value, and supports estate planning, but costs significantly more. The right choice depends on your budget and long-term financial strategy.

Does Dave Ramsey recommend term or whole life insurance?

Dave Ramsey strongly recommends term life insurance. He considers whole life too expensive and less efficient for most families. Ramsey advises buying 15–20 year level term coverage while investing the savings separately. His philosophy: “Buy term and invest the difference.”

What are two disadvantages of whole life insurance?

Two main disadvantages of whole life insurance are high cost and lower returns. Premiums are often 10–15 times higher than term life for the same coverage, making it less affordable for many families. In addition, cash value growth is relatively slow compared to other investment options, reducing flexibility in building wealth.

Does Suze Orman recommend term or whole life insurance?

Suze Orman also recommends term life insurance for most people. She argues that term provides the protection families truly need at a fraction of the cost of whole life. Orman warns that whole life is often marketed as an investment but delivers low returns, making it unsuitable for most middle-income households.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.