Which life insurance is right for you depends on your financial obligations, family circumstances, and long-term protection goals. Choosing appropriate coverage requires understanding the fundamental differences between term and permanent policies, evaluating your income replacement needs, and aligning coverage amounts with your budget constraints.

This comprehensive guide examines the critical factors determining optimal life insurance selection for American consumers, drawing from National Association of Insurance Commissioners (NAIC) regulatory guidance and current industry data. Whether you need temporary coverage for specific financial obligations or permanent protection for estate planning purposes, you’ll discover evidence-based frameworks for evaluating options and selecting appropriate coverage levels that protect your beneficiaries’ financial future.

On This Page

Essential Overview — Which Life Insurance Is Right for You: What You Need to Know

Life insurance fundamentally serves as a financial safety net, providing death benefits to your named beneficiaries upon your passing. According to the NAIC consumer life insurance guide, all life insurance policies share this core purpose of paying money to “named beneficiaries” when you die, though they differ significantly in structure, cost, and additional features.

Answer Box: Life insurance selection depends on five key factors: income replacement needs, outstanding debt obligations, coverage timeline requirements, available premium budget, and health status considerations.

The decision-making process involves systematic evaluation of several critical components:

- Financial dependency assessment: Determining how many people rely on your income for ongoing support

- Outstanding debt obligations: Including mortgages, personal loans, credit cards, and business liabilities requiring payment

- Future expense projections: Children’s education costs, retirement income needs, and estate settlement requirements

- Current asset evaluation: Existing savings, investments, retirement accounts, and employer-provided group coverage

- Budget capacity analysis: Available funds for premium payments throughout the policy term

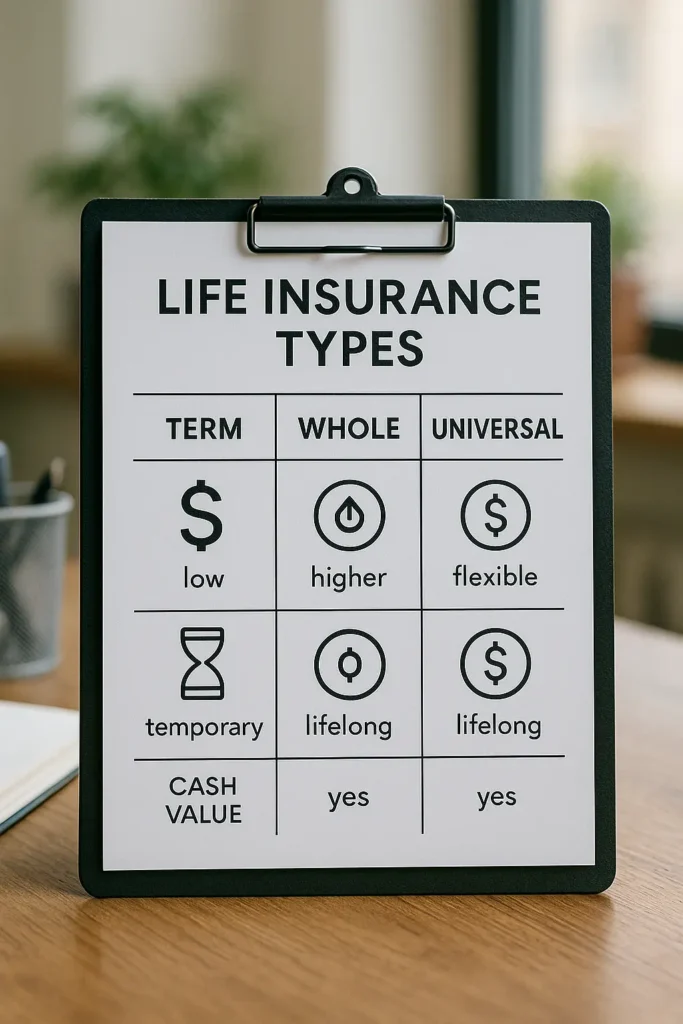

Like other NAIC-regulated products, life insurance policies fall into two primary categories designed to serve different protection needs and financial circumstances.

Fundamental Policy Type Comparison

| Feature | Term Life Insurance | Cash Value Insurance |

|---|---|---|

| Coverage Duration | Specific term periods (10-30 years) | Lifetime coverage with premium payments |

| Premium Structure | Lower initial costs, increasing with age | Higher consistent premiums throughout |

| Investment Component | Pure insurance protection only | Built-in savings or investment features |

| Death Benefit Options | Level or decreasing benefit amounts | Level, increasing, or flexible benefits |

| Cash Accumulation | No cash value buildup | Accumulates cash value over time |

| Policy Flexibility | Limited modification options | Extensive customization capabilities |

Understanding these fundamental distinctions helps consumers evaluate which approach aligns with their specific protection requirements and long-term financial planning objectives.

Key Takeaway: Term life insurance provides maximum death benefit protection per premium dollar during peak financial responsibility years, while cash value policies serve permanent protection needs with additional wealth-building capabilities.

How Do I Know Which Life Insurance Is Right for Me?

Determining your optimal life insurance choice requires comprehensive analysis of your personal circumstances, financial obligations, and protection timeline. This systematic evaluation process helps identify coverage types and amounts providing adequate security without creating unsustainable premium burdens.

Income Replacement Calculation Framework

Your primary consideration focuses on quantifying how much family income requires replacement if you’re no longer able to provide financial support. With current U.S. life expectancy at 78.4 years according to 2023 CDC mortality data, financial planning must account for extended family support periods and changing economic conditions.

Baseline coverage calculation methodology:

- Annual income analysis: Multiply current gross salary by anticipated years of family support need

- Debt obligation assessment: Include mortgage balances, student loans, credit card debt, and business liabilities

- Future education funding: Estimate college or trade school costs for dependent children

- Final expense coverage: Account for funeral costs, medical bills, probate fees, and estate taxes

- Existing asset deduction: Subtract current savings, retirement accounts, and group life insurance benefits

Determining Which Life Insurance Is Right for Your Personal Situation

Your optimal life insurance strategy varies significantly based on current life phase, family circumstances, and anticipated future changes requiring different protection approaches:

Young professionals (ages 25-35): Term life insurance often provides the most cost-effective solution during early career years when income is growing but available discretionary funds remain limited. High coverage amounts protect against mortgage obligations and growing family responsibilities while maintaining affordable monthly premiums.

Mid-career adults (ages 40-50): Combination strategies frequently prove beneficial, utilizing term coverage for temporary high-need periods while building permanent protection through whole or universal life policies. This approach balances immediate protection needs with long-term wealth transfer objectives.

Pre-retirement individuals (ages 55-65): Permanent life insurance becomes increasingly attractive as term policy renewal costs escalate significantly and estate planning considerations gain importance. Cash value accumulation provides additional retirement funding flexibility while maintaining lifetime coverage guarantees.

Similar to other insurance products regulated by state departments of insurance, life insurance needs evolve throughout different life phases, making periodic coverage reviews essential for maintaining appropriate protection levels.

Health Status and Lifestyle Impact Assessment

Your current health condition and lifestyle choices significantly influence both policy availability and premium cost structures. Insurance companies assess mortality risk through comprehensive medical evaluations, health questionnaires, and additional testing procedures depending on requested coverage amounts. According to the NAIC guide on what type of life insurance is right for you, understanding these factors is essential for selecting appropriate coverage.

Primary underwriting consideration factors:

- Medical history evaluation: Chronic conditions, surgical procedures, family health patterns, and prescription medication usage

- Lifestyle risk assessment: Smoking status, alcohol consumption patterns, exercise habits, and dietary considerations

- Occupational hazard analysis: High-risk professions requiring specialized coverage or premium adjustments

- Recreational activity review: Dangerous hobbies like skydiving, rock climbing, or motorcycle racing affecting risk classifications

Early application submission while maintaining good health typically secures more favorable rate classifications and broader policy selection options, as insurers cannot adjust premiums for future health deterioration once policies are issued and in force.

Key Takeaway: Your life insurance needs assessment should account for both current circumstances and anticipated future changes, with health optimization and early application timing providing significant long-term cost advantages.

How Much Does a $1,000,000 Life Insurance Policy Cost Per Month?

The monthly cost of $1 million in life insurance coverage varies dramatically based on policy type, applicant age, health classification, and additional underwriting factors. Understanding typical premium ranges across different coverage approaches helps establish realistic budget expectations and product selection criteria.

Term Life Insurance Premium Analysis

For healthy individuals meeting preferred underwriting classifications, term life insurance provides the most cost-effective access to substantial coverage amounts during peak financial responsibility periods.

Age-based monthly premium estimates for $1 million 20-year term coverage:

- Ages 25-35: $35-$65 monthly for preferred plus health ratings in non-smoking applicants

- Ages 35-45: $55-$110 monthly for standard to preferred classifications with good health profiles

- Ages 45-55: $120-$280 monthly depending on health status, lifestyle factors, and carrier underwriting standards

- Ages 55-65: $280-$550 monthly with increasing premium costs for extended term lengths

These premium estimates reflect non-smoking applicants with favorable health profiles applying through major insurance carriers offering competitive rate structures. Tobacco use typically doubles or triples premium costs, while significant health issues may result in higher rate classifications or coverage limitations.

Permanent Life Insurance Cost Structure

Cash value policies providing $1 million death benefits require substantially higher premium investments due to lifetime coverage guarantees, administrative costs, and integrated investment components:

Whole life insurance premiums: Monthly costs typically range from $850-$1,600 for healthy 35-year-old applicants, remaining level throughout the policy’s lifetime with guaranteed cash value accumulation features.

Universal life insurance costs: Flexible premium structures allow monthly payments ranging from $650-$1,300, with adjustment capabilities for coverage amounts and payment schedules based on policy performance and changing financial circumstances.

Variable life insurance premiums: Cost structures similar to universal life products, but policy values fluctuate based on underlying investment performance in policyholder-selected sub-account portfolios.

Premium Optimization Strategies

Several evidence-based approaches can help reduce life insurance costs while maintaining adequate death benefit protection:

Annual payment discounts: Most insurance companies offer premium reductions of 3-6% for annual rather than monthly payment arrangements, providing significant long-term cost savings.

Health improvement initiatives: Maintaining optimal health, eliminating tobacco use, and addressing medical conditions before application can improve rate classifications substantially.

Coverage laddering techniques: Using multiple smaller policies with different term lengths allows systematic coverage reductions as financial obligations decrease over time.

As with other financial products overseen by federal and state regulators, understanding cost structures and optimization opportunities helps consumers make informed decisions aligned with their protection needs and budget constraints.

Key Takeaway: Term life insurance offers maximum death benefit per premium dollar during high-need periods, while permanent policies serve long-term estate planning and wealth transfer objectives with higher but stable ongoing costs.

What Is the 7 Year Rule for Life Insurance?

The seven-year rule in life insurance refers to Modified Endowment Contract (MEC) regulations established under federal tax code Section 7702A to prevent life insurance policies from being used primarily as tax-sheltered investment vehicles rather than legitimate insurance protection arrangements.

Modified Endowment Contract Classification Criteria

When life insurance policies receive premium payments exceeding specific federal thresholds during their initial seven-year period, they lose standard tax treatment benefits and become classified as Modified Endowment Contracts under IRS regulations.

Seven-pay test methodology: The cumulative premiums paid during the first seven policy years cannot exceed the total amount required to fully fund the contract based on its death benefit and the insurance company’s actuarial assumptions. This calculation prevents excessive premium funding that would primarily serve investment rather than insurance purposes.

Tax treatment consequences of MEC designation:

- Cash value withdrawals: Treated as taxable income using Last-In-First-Out (LIFO) accounting rather than tax-free policy loans

- Policy loan taxation: Subject to ordinary income taxation and potential early withdrawal penalties

- Death benefit preservation: Generally remains tax-free to designated beneficiaries regardless of MEC status

- Early distribution penalties: 10% penalty tax applies to withdrawals before age 59½, similar to retirement account early distributions

MEC Classification Prevention Strategies

Insurance companies and licensed agents monitor premium payment schedules to prevent inadvertent MEC classification, which can occur through various overfunding scenarios:

Common MEC trigger situations:

- Large single premium payments: Attempting to fully fund policies quickly rather than spreading payments over time

- Excessive early payments: Making premium contributions significantly above minimum required amounts

- Dividend reinvestment additions: Adding too much paid-up coverage through automatic dividend purchase options

Industry compliance mechanisms: Most insurance carriers provide annual MEC threshold calculations and will automatically reject premium payments that would trigger MEC status, protecting policyholders from unintended tax consequences while maintaining policy flexibility.

Impact on Product Selection and Financial Planning

The seven-year rule influences life insurance product design and policyholder decision-making across different coverage objectives:

Product development considerations: Universal life and variable life products often incorporate built-in safeguards preventing MEC violations while maximizing allowable cash value growth potential within federal limitations.

Estate planning implications: Individuals seeking maximum tax-advantaged cash accumulation must carefully balance premium payment strategies against MEC limitations to optimize policy performance for wealth transfer and retirement income purposes.

Like other insurance regulations enforced by federal tax authorities, the seven-year rule ensures life insurance maintains its primary risk protection purpose while preserving favorable tax treatment for legitimate insurance arrangements.

Key Takeaway: The seven-year rule protects life insurance’s fundamental tax advantages by preventing excessive investment funding, requiring careful premium planning to maintain optimal tax treatment while achieving coverage objectives.

Which Life Insurance Type Is Better: 20 or 30-Year Term Coverage?

Choosing between 20-year and 30-year term life insurance requires careful evaluation of your coverage timeline needs, budget considerations, and anticipated family circumstances during different protection periods. Each option provides distinct advantages based on when you expect to no longer require life insurance coverage.

20-Year Term Coverage Advantages

Twenty-year term policies typically offer lower initial premiums and align effectively with specific financial obligations that decrease predictably over time, making them suitable for targeted protection needs.

Optimal scenarios for 20-year term selection:

- Mortgage protection alignment: Coverage periods matching remaining mortgage payment obligations

- Child dependency coverage: Protection until children achieve financial independence typically by age 22-25

- Peak earning period protection: Coverage during prime income-generating years before retirement transition

- Business debt obligations: Protection for commercial loans or partnership agreements with defined payoff schedules

Budget optimization benefits: Monthly premiums for 20-year terms are generally 15-30% lower than comparable 30-year coverage, making this option more accessible for families managing tight cash flow during high-expense periods.

30-Year Term Protection Benefits

Thirty-year term policies provide extended protection periods with premium level guarantees, offering significant advantages for younger applicants and those with long-term financial responsibilities requiring extended coverage.

Ideal circumstances for 30-year term selection:

- Young family protection: Parents in their 20s or early 30s with newborn children requiring extended dependency support

- Extended education funding: Coverage through children’s undergraduate, graduate school, and early career establishment periods

- Business ownership obligations: Protection for long-term commercial commitments and key person insurance arrangements

- Health risk mitigation: Securing current favorable health ratings for three-decade periods against future medical developments

Rate lock protection advantages: Locking in current premium rates for thirty years provides protection against future health changes that could make coverage significantly more expensive or completely unavailable.

Comparative Decision Framework

| Evaluation Factor | 20-Year Term | 30-Year Term |

|---|---|---|

| Initial Monthly Premium | 15-30% lower | Higher upfront cost |

| Total Premium Investment | Lower if coverage unnecessary beyond 20 years | Higher total cost but extended rate protection |

| Renewal Risk Management | Requires requalification at term end | Longer protection without health reassessment |

| Health Change Protection | Vulnerable to deteriorating health at renewal | Extended protection against health deterioration |

| Financial Flexibility | More manageable monthly obligations | Higher ongoing costs but longer rate certainty |

Which Life Insurance Option Fits Your Budget and Timeline

Age-based recommendations aligned with typical family lifecycle patterns:

- Ages 25-35: Consider 30-year terms for comprehensive protection during family formation and early career development

- Ages 35-45: Evaluate based on remaining mortgage obligations and children’s education funding timelines

- Ages 45-55: Twenty-year terms often sufficient for pre-retirement protection needs with manageable premium costs

Hybrid laddering strategies: Some individuals implement multiple policies with different term lengths, matching coverage amounts with decreasing financial obligations over time while optimizing total premium costs.

Similar to other insurance decisions regulated by state departments of insurance, term length selection should align with documented financial obligations and anticipated life changes rather than arbitrary time periods.

Key Takeaway: Twenty-year terms optimize cost-effectiveness for specific financial obligations with clear endpoints, while 30-year terms provide extended protection for younger applicants and those with long-term family responsibilities requiring extended coverage periods.

Official Regulations and Standards — Which Life Insurance Is Right for You Compliance

Life insurance regulation operates primarily at the state level throughout the United States, with the National Association of Insurance Commissioners coordinating standards and the federal government overseeing specific aspects of employer-sponsored coverage and tax treatment.

Federal Regulatory Framework

While states maintain primary authority over insurance company licensing and consumer protection, federal agencies oversee critical aspects of life insurance operations affecting American consumers:

Department of Labor oversight: The DOL’s Employee Benefits Security Administration regulates employer-sponsored group life insurance benefits under ERISA, ensuring proper plan administration and beneficiary protections. Recent enforcement actions have focused on evidence of insurability practices and streamlined claims processing procedures for group coverage participants.

Internal Revenue Service authority: The IRS establishes comprehensive tax treatment rules for life insurance policies, including Modified Endowment Contract regulations, qualification standards for tax-free death benefits, and coordination with retirement planning strategies.

Securities and Exchange Commission jurisdiction: The SEC oversees variable life insurance products containing investment components, requiring securities registration and detailed disclosure compliance for policies offering policyholder-directed investment options.

State Insurance Department Authority Structure

Each state’s Department of Insurance maintains comprehensive regulatory oversight through established frameworks designed to protect consumers while ensuring market stability:

Company licensing requirements: Insurance carriers must obtain state licenses demonstrating financial stability, actuarial soundness, and regulatory compliance capability before offering policies to state residents.

Rate review and approval processes: Many states implement premium rate structure reviews ensuring actuarial soundness and preventing discriminatory pricing practices against protected consumer classes.

Policy form approval procedures: Insurance contracts require state approval ensuring clear policy language, fair contractual terms, and adequate consumer protection provisions.

Market conduct supervision: Regular company examinations verify compliance with sales practices, underwriting standards, claims processing procedures, and consumer treatment requirements.

Consumer Protection Standards Framework

NAIC Model Regulations establish uniform standards nationwide for consumer protection, including:

- Policy illustration requirements: Mandating accurate presentation of policy benefits, assumptions, and performance projections

- Replacement regulation protections: Safeguarding consumers when switching from existing to new coverage arrangements

- Unfair trade practice prohibitions: Preventing discriminatory pricing, deceptive sales practices, and inappropriate policy recommendations

- Privacy protection standards: Establishing requirements for handling personal health information and financial data

📋 Important – Regulatory compliance: Insurance regulations continue evolving at both state and federal levels. Current developments may affect future policy options and consumer protections. Consumers should verify current requirements through their state Department of Insurance for the most recent regulatory updates and consumer protection standards.

State Variations in Life Insurance Regulation

Life insurance regulatory requirements vary significantly across states, with each jurisdiction maintaining specific standards for consumer protection, company operations, and policy administration affecting coverage availability and pricing.

State-by-State Regulatory Differences

| State | Primary Regulator | Notable Requirements | Official Resource |

|---|---|---|---|

| California | CA Department of Insurance | Enhanced replacement rules, extended free-look periods, strict illustration standards | www.insurance.ca.gov |

| New York | NY Department of Financial Services | Rigorous suitability standards, detailed policy illustration requirements, enhanced consumer disclosures | www.dfs.ny.gov |

| Texas | TX Department of Insurance | Streamlined policy approval processes, comprehensive consumer complaint tracking systems | www.tdi.texas.gov |

| Florida | FL Office of Insurance Regulation | Hurricane-related coverage considerations, senior citizen protection rules, fraud prevention measures | www.floir.com |

| Illinois | IL Department of Insurance | Comprehensive market conduct oversight, electronic filing requirements, expedited claim processing | www2.illinois.gov/insurance |

| Pennsylvania | PA Insurance Department | Enhanced fraud protection programs, accelerated claims processing standards, consumer education initiatives | www.insurance.pa.gov |

| Ohio | OH Department of Insurance | Simplified policy language requirements, online complaint resolution systems, transparent rate filing processes | www.insurance.ohio.gov |

| Michigan | MI Department of Insurance and Financial Services | No-fault insurance coordination rules, enhanced disclosure requirements, consumer advocacy programs | www.michigan.gov/difs |

Interstate Regulatory Coordination Mechanisms

The NAIC facilitates regulatory consistency across states through several coordinated programs and initiatives:

Uniform licensing systems: The Producer Licensing Model Act enables insurance agents to obtain licenses across multiple states through streamlined reciprocity agreements, improving consumer access to qualified professionals.

Interstate compact arrangements: Participating states coordinate regulatory oversight of multistate insurance companies and standardized policy forms, reducing compliance burdens while maintaining consumer protections.

Model law adoption processes: States voluntarily adopt NAIC model regulations creating greater uniformity in consumer protections, market conduct standards, and industry operational requirements nationwide.

State-Specific Compliance Verification

How to verify applicable regulations in your state:

- Locate your state insurance department through the NAIC consumer portal providing direct links to all state regulatory authorities

- Review published regulations specific to life insurance requirements, licensing standards, and consumer protection measures

- Verify company licensing status ensuring insurance carriers are authorized for business operations in your state

- Check agent credentials through state licensing databases confirming professional qualifications and regulatory compliance

- Access complaint records researching company performance history and consumer satisfaction data

Like other state-regulated financial services, life insurance oversight varies based on local market conditions, consumer protection priorities, and regulatory resource allocation across different jurisdictions.

Advanced Factors: Which Life Insurance Is Right for You in 2025 & Future Outlook

The life insurance industry continues evolving through technological innovations, changing consumer preferences, and regulatory developments that may impact future policy options, pricing structures, and coverage availability for American consumers.

Emerging Technology Integration

Digital underwriting advancement: Artificial intelligence and predictive analytics are streamlining application processes, with some insurers now offering instant coverage decisions for qualified applicants without traditional medical examination requirements, reducing approval timelines from weeks to minutes.

Wearable device integration programs: Selected insurance companies offer premium discount programs for policyholders sharing fitness tracking data, demonstrating healthy lifestyle maintenance through connected devices and biometric monitoring systems.

Blockchain policy administration: Distributed ledger technology development promises enhanced security for policy records, streamlined beneficiary claim processing, and improved fraud prevention capabilities, though widespread industry implementation remains under development.

Regulatory Evolution Projections

According to current legislative discussions and regulatory proposals under federal review, potential future developments may include:

SECURE Act expansion considerations: It is anticipated that future retirement legislation could enhance coordination between life insurance benefits and retirement planning strategies, based on ongoing discussions in congressional financial services committees as of September 2025.

Interstate insurance modernization: Current regulatory proposals suggest streamlined interstate insurance sales processes may be implemented, though specific implementation timelines remain under review by NAIC working groups and state insurance departments.

Tax code modification discussions: According to ongoing deliberations in the Senate Finance Committee, potential adjustments to life insurance tax treatment are being evaluated, though no specific legislative changes have been finalized or enacted.

Market Development Trends

Hybrid product innovation: Industry developers are creating new policy types combining traditional life insurance with long-term care benefits, critical illness coverage, and disability protection features in integrated product offerings serving multiple protection needs.

Demographic shift adaptations: As U.S. life expectancy continues increasing according to the latest CDC mortality report, reaching 78.4 years in 2023, insurance companies are adjusting actuarial assumptions, pricing models, and developing specialized products for extended retirement periods and aging population needs.

Environmental risk assessment: Climate change impact evaluations are beginning to influence underwriting practices and geographic risk assessments for certain coverage types, though comprehensive industry adoption remains in early development stages.

⚠️ Regulatory disclaimer: This information reflects current proposals and regulatory discussions as of September 2025. Legislative developments may change significantly before implementation, and specific timelines remain uncertain. Consumers should verify the latest updates from official government sources including congress.gov and relevant state insurance departments for current regulatory status.

FAQ – Frequently Asked Questions

How much life insurance coverage do I actually need for my family?

Calculate coverage needs by adding annual income replacement requirements (typically 5-10 times annual salary), outstanding debt obligations, future education costs for dependents, and final expense estimates. Subtract existing assets, retirement account balances, and employer-provided group coverage to determine additional individual insurance requirements.

Can I modify my life insurance policy after purchasing coverage?

Most policies offer various modification options including coverage amount adjustments, beneficiary designations updates, and conversion privileges from term to permanent insurance. Contact your insurance company to understand specific policy provisions, available options, and any associated administrative costs or underwriting requirements.

What happens if I stop making premium payments on my life insurance?

Term life policies typically lapse immediately when premium payments cease, ending all coverage benefits. Permanent life insurance policies may utilize accumulated cash values to continue coverage temporarily through automatic premium loans, but eventual policy lapse occurs without resumed payments or policy modifications.

Do I need life insurance if I’m single without financial dependents?

Life insurance may still provide value for covering final expenses, outstanding debt obligations, or providing inheritance benefits to designated beneficiaries. However, coverage needs are generally lower without financial dependents requiring ongoing income replacement support.

How do insurance companies determine my premium rate classification?

Insurers evaluate multiple factors including chronological age, comprehensive health status, lifestyle risk factors, occupational hazards, requested coverage amounts, and policy type selection through medical examinations, detailed health questionnaires, and sometimes additional testing procedures. Better health profiles typically result in lower premium rate classifications.

Can I purchase life insurance coverage on someone else’s life?

Yes, but you must demonstrate “insurable interest” in the proposed insured’s life, typically limited to spouses, dependent children, business partners, or others whose death would create significant financial hardship requiring protection.

What’s the difference between group and individual life insurance coverage?

Group coverage through employers typically offers lower premium costs but provides limited customization options and may not be portable between jobs. Individual policies offer greater control over coverage amounts, beneficiary designations, and policy features while remaining in effect regardless of employment status changes.

Are life insurance death benefits subject to income taxation for beneficiaries?

Generally, life insurance death benefits are received tax-free by designated beneficiaries under federal tax law. However, interest earned on delayed benefit payments may be subject to taxation, and certain policy ownership structures or estate planning arrangements could create tax implications requiring professional consultation.

Key Takeaways & Resources

Selecting appropriate life insurance requires systematic evaluation of your financial situation, protection timeline needs, and long-term planning objectives. Term life insurance provides maximum cost-effective coverage for temporary protection needs, while permanent policies offer lifetime security with additional wealth-building capabilities.

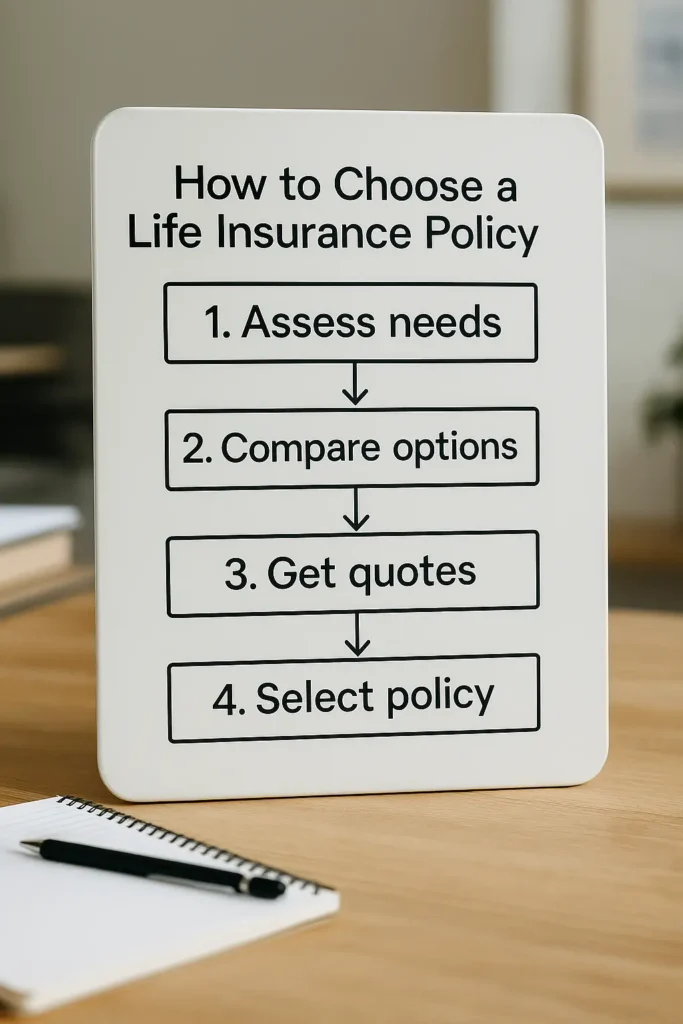

Essential action steps for optimal coverage selection:

- Conduct comprehensive needs assessment using income replacement calculations and debt obligation analysis

- Compare policy types and carriers based on your specific protection timeline and available budget constraints

- Obtain competitive quotes from multiple insurers ensuring optimal pricing and favorable contract terms

- Schedule annual policy reviews to maintain continued appropriateness as life circumstances and financial obligations change

- Consult licensed insurance professionals for complex situations involving estate planning, business ownership, or substantial coverage amounts

Official resources for additional consumer information:

- NAIC Consumer Resources: Comprehensive insurance department contacts and educational materials

- State Insurance Departments: Company licensing verification, complaint resolution services, and regulatory compliance information

- Federal Agency Guidance: ERISA oversight from the Department of Labor for employer-sponsored group coverage

- Professional Association Referrals: Certified financial planner and licensed insurance agent credentialing information

For comprehensive life insurance guidance, consumers should also reference our detailed coverage on term vs whole life insurance comparison, life insurance beneficiary designation requirements, and life insurance medical examination preparation. Additional information about no medical exam life insurance options provides alternatives for consumers with health concerns or time constraints.

Understanding the complete life insurance claims process ensures beneficiaries can access benefits efficiently when needed.

📋 Key Takeaway: Life insurance decisions impact your family’s financial security for decades into the future. Invest adequate time to understand available options, compare alternatives thoroughly, and select coverage providing appropriate protection within sustainable budget parameters while accounting for changing life circumstances and evolving financial obligations.

Remember that life insurance protection needs evolve significantly over time, making periodic comprehensive reviews essential to ensure your coverage continues meeting your family’s changing requirements, financial circumstances, and long-term security objectives.