Mark, 45, a contractor from Dallas, Texas, once faced a contract delay because his client requested a certificate of liability insurance (COI) he didn’t have on hand. In 2024, over 60% of U.S. small businesses require a COI before starting work, according to the National Association of Insurance Commissioners (NAIC).

Many business owners don’t fully understand what a certificate of liability insurance is or why it matters. Lacking this document often causes project delays, elevates liability exposure, and creates challenges in meeting legal requirements.

The process to obtain and verify a COI can feel complex and confusing.

This article will guide you through everything essential about certificates of liability insurance—from their purpose and legal importance to how to get, verify, and manage them effectively. Whether you’re a contractor, vendor, or client, understanding COIs will help you protect your business and avoid costly delays.

On This Page

1. Understanding What a Certificate of Liability Insurance Is

1.1. Definition and Purpose of a COI

A Certificate of Liability Insurance (COI) is a formal document issued by an insurance provider to confirm that a business or individual carries valid liability coverage. This certificate acts as tangible proof of insurance, often required by clients, regulatory bodies, or business partners to ensure financial protection against potential risks such as bodily injury, property damage, or legal claims.

A Certificate of Liability Insurance typically outlines critical policy details, including the effective coverage period, policy limits, and the specific types of liability coverage provided.

2024 U.S. Statistic: According to the National Association of Insurance Commissioners (NAIC), nearly two-thirds of small and mid-sized businesses in the U.S. now require a Certificate of Liability Insurance before signing agreements with service providers or contractors.

Local Anecdote: Sarah, a 38-year-old event planner in Denver, Colorado, couldn’t secure a venue until she submitted her Certificate of Liability Insurance, emphasizing how essential this document has become in modern business transactions.

1.2. Who Needs a Certificate of Liability Insurance?

A wide range of professionals and businesses require a Certificate of Liability Insurance to demonstrate proof of liability coverage. This is particularly important in industries where contractual compliance and risk mitigation are critical. Examples include construction firms, consultants, vendors, and event organizers.

Construction companies, for instance, routinely present a Certificate of Liability Insurance to confirm coverage for potential on-site injuries or property damage. Similarly, event vendors are often asked to submit a COI to meet venue requirements and gain access to event spaces.

Real-life Example: Mike, a 50-year-old contractor from Atlanta, Georgia, successfully secured new clients by providing a Certificate of Liability Insurance upfront—proving both professionalism and readiness to meet contractual demands.

1.3. Common Situations Requiring a COI

There are numerous situations where businesses must present a Certificate of Liability Insurance to move forward with operations or finalize agreements. Common scenarios include:

- Construction projects or subcontracting agreements

- Leasing commercial properties or renting office spaces

- Hosting events that require venue approval

- Participating in fairs or trade shows as a vendor

- Performing services on a client’s premises

Dialogue:

Jessica (Portland, OR, 42): “I was surprised when the client requested a Certificate of Liability Insurance before signing the contract.”

Agent: “That’s standard practice. It ensures both parties are protected.”

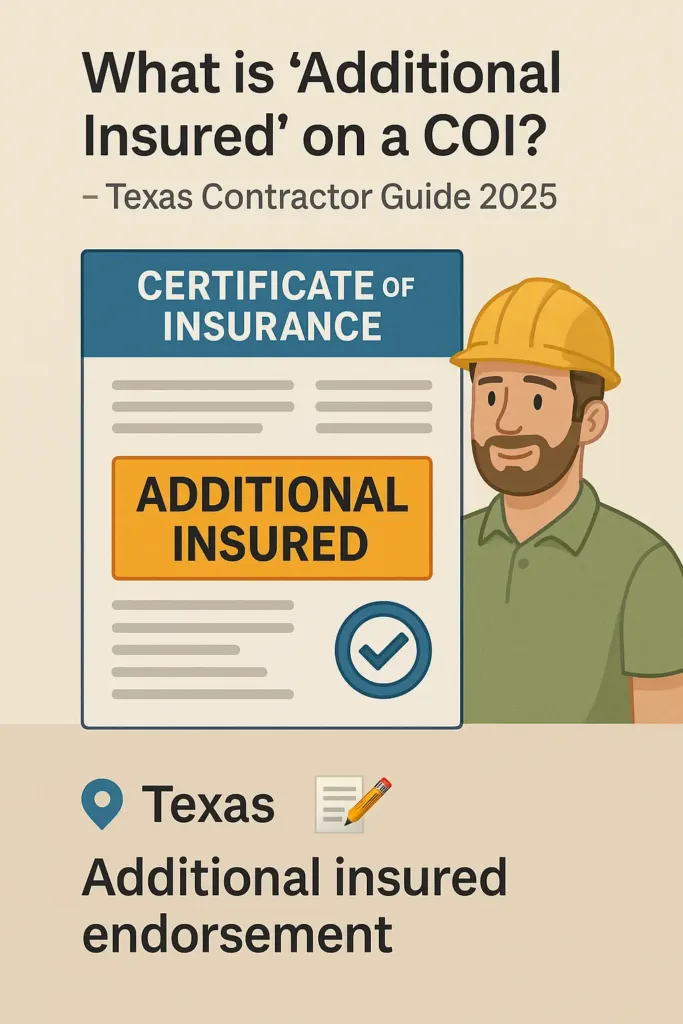

Pro Tip: In Texas, contractors must list the hiring entity as an additional insured party on the Certificate of Liability Insurance. This provides the client with extended protection under the contractor’s liability policy (TX Ins. Code § 1954.103).

Comparison Table: Common COI Requirements by Industry

| Industry | Typical Coverage Types | Additional Insured Required? | Common Policy Limits |

|---|---|---|---|

| Construction | General Liability, Workers’ Comp | Yes | $1M – $5M |

| Event Planning | General Liability, Liquor | Sometimes | $1M – $3M |

| Vendors | General Liability | Depends on Venue | $500K – $2M |

| Consultants | Professional Liability | Rarely | $1M – $3M |

2. How to Obtain a Certificate of Liability Insurance

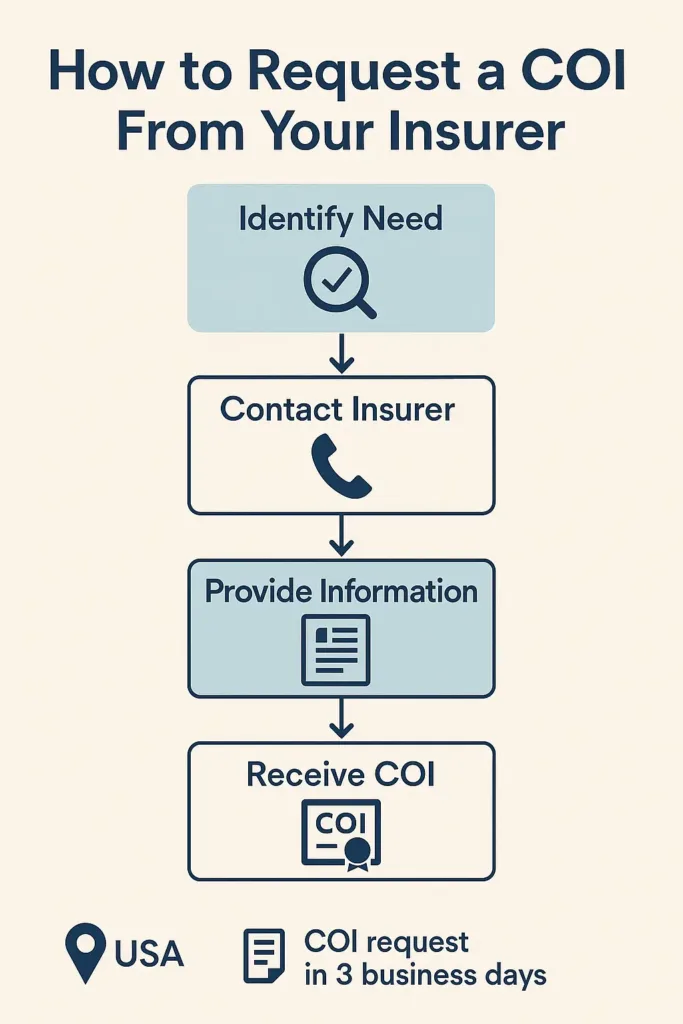

2.1. Steps to Request a COI from Your Insurer

Requesting a Certificate of Liability Insurance begins by contacting your insurance provider. You’ll need to supply the name of the certificate holder (the entity requesting the COI), the type of liability coverage needed, and whether any additional insureds must be listed. Most insurers include Certificate of Liability Insurance issuance in their standard services, though some may charge nominal fees depending on the complexity of the request.

It’s important to request the Certificate of Liability Insurance well in advance of contract deadlines to allow sufficient time for review and revisions.

2024 U.S. Statistic: According to NAIC data, 72% of businesses receive their Certificate of Liability Insurance within three business days—thanks to improvements in digital processing systems.

Local Anecdote: Linda, a freelance consultant in Seattle, Washington, was able to save a contract after quickly providing a Certificate of Liability Insurance following a last-minute client request.

2.2. What Information Is Included on a COI?

A standard Certificate of Liability Insurance includes essential details that confirm the existence and scope of the insurance policy. Key elements typically found on the COI are:

- The insured party’s name and contact information

- The insurance provider’s name and policy number

- Types of coverage, such as general or professional liability

- Policy effective and expiration dates

- Liability coverage limits

- Certificate holder’s name

- Any applicable endorsements, such as additional insured status

Understanding the components of a Certificate of Liability Insurance ensures it meets the requirements of contracts and adequately protects your business from potential liabilities.

2.3. Typical Timeframes and Costs

The time it takes to obtain a Certificate of Liability Insurance can vary depending on the insurer and the complexity of the request. Most insurance companies issue COIs within 1 to 5 business days, while some online platforms offer instant digital delivery.

Typically, the cost of a Certificate of Liability Insurance is included in your liability insurance premium. However, some insurers may charge additional fees for issuing multiple COIs or naming numerous certificate holders.

Pro Tip: Always check with your insurer about potential fees when requesting several Certificates of Liability Insurance, especially if your business deals with multiple clients or projects.

Comparison Table: COI Issuance Time and Fees by Provider Type

| Provider Type | Typical COI Issuance Time | Common Fees |

|---|---|---|

| Large National Insurer | 1–3 Business Days | Usually Free |

| Regional Insurer | 2–5 Business Days | $10–$25 per certificate |

| Online Platforms | Instant or Same Day | Usually Free |

Dialogue:

Jason (Miami, FL, 40): “How long will it take to get my Certificate of Liability Insurance?”

Agent: “Most requests are processed within 48 hours, but some online services provide instant delivery.”

3. Legal and Contractual Importance of COIs

3.1. COI Requirements in Business Contracts

Certificates of Liability Insurance are often mandated by contract to ensure all parties have appropriate liability coverage. This requirement protects businesses from potential financial losses stemming from accidents, property damage, or lawsuits related to contracted work or services. Many contracts include explicit COI clauses detailing the minimum coverage amounts, policy types, and proof deadlines.

Failure to provide a COI as required can result in contract delays, withheld payments, or even termination of agreements.

2024 U.S. Statistic: A recent survey by the NAIC found that over 70% of commercial contracts now include explicit COI provisions as part of risk management practices.

Local Anecdote: Tom, a 44-year-old supplier in Houston, Texas, experienced a delay in payment when his COI was not submitted promptly, underlining the contract’s strict compliance demands.

3.2. State-Specific Legal Mandates and Variations

While the use of COIs is widespread, state laws differ on how certificates are regulated and enforced. Some states require contractors to name the hiring party as an additional insured, while others set minimum liability limits or mandate specific wording on COIs.

For example, California mandates clear disclosure of coverage limits on certificates and enforces penalties for false documentation, while Florida emphasizes timely COI submission in public contracting.

Pro Tip: Review your state’s insurance codes to ensure your COI complies with all local legal requirements (e.g., CA Ins. Code § 11580.2, FL Stat. § 287.093).

3.3. Key Legal Clauses to Watch On Certificates

When examining a Certificate of Liability Insurance, it is important to carefully review several critical provisions to ensure the coverage is adequate and current. Key areas include:

- The start and end dates of the insurance policy, confirming that the coverage period is valid for the duration of the contract.

- Inclusion of additional insured endorsements, which extend the insurance protections to the certificate holder beyond the insured party.

- Cancellation terms that specify how much advance notice must be given if the policy is terminated or altered.

- Policy exclusions that define what risks or scenarios are not covered, which may impact liability exposure.

- The required minimum coverage amounts as stated in the contractual agreement.

Reviewing these clauses thoroughly helps prevent unexpected gaps in coverage and potential financial risk during the performance of work or services.

Dialogue:

Angela (Sacramento, CA, 37): “What does ‘additional insured’ mean on my COI?”

Insurance Broker: “It means the client is protected under your insurance policy for claims related to your work.”

Comparison Table: Common Legal Clauses on COIs by State

| State | Additional Insured Required | Minimum Liability Limits | Cancellation Notice |

|---|---|---|---|

| California | Yes | $1M per occurrence | 30 days |

| Florida | Varies by contract | $500K – $1M | 15 days |

| Texas | Yes | $1M – $5M | 30 days |

4. Common Types of Liability Insurance Covered by a COI

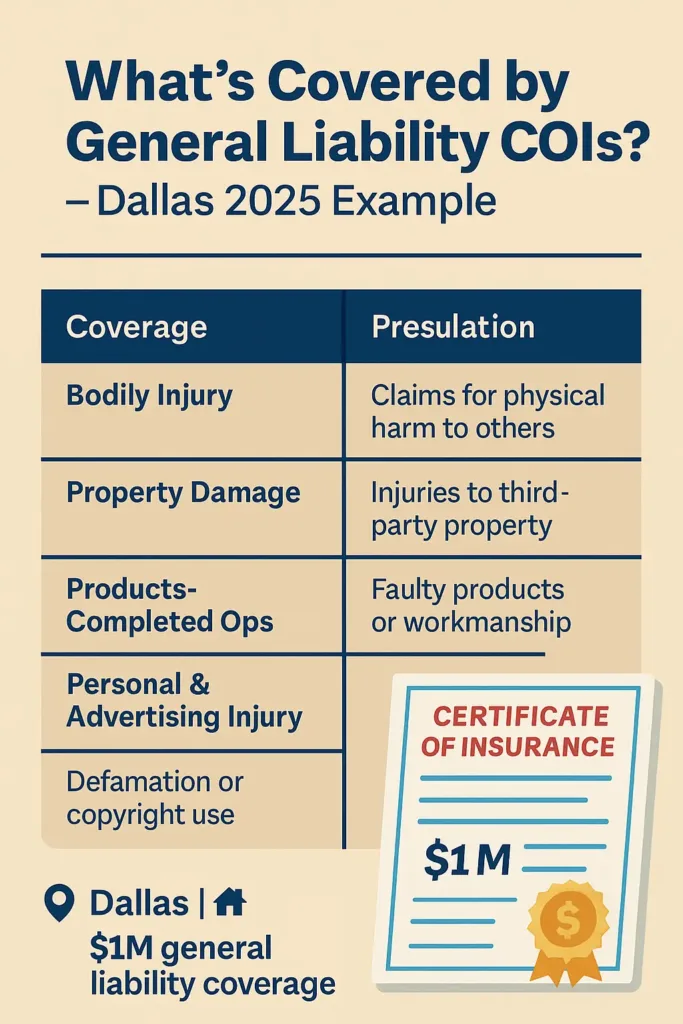

4.1. General Liability Insurance

General liability insurance is the most common type covered by certificates of liability insurance. It protects businesses against claims of bodily injury, property damage, and related legal costs arising from everyday operations. This coverage is essential for contractors, vendors, and service providers who interact with customers or work on client premises.

If you also own property, understanding your average home insurance cost is vital to manage total business and personal financial exposure.

2024 U.S. Statistic: Research from the Insurance Information Institute (III) reveals that the vast majority—about 85%—of small business owners maintain general liability insurance to manage operational risks effectively.

Local Anecdote: Carlos, a landscaper aged 47 in Tampa, Florida, avoided major financial repercussions when a client slipped on wet grass. His general liability insurance, verified via his COI, took care of the resulting legal costs and damages.

4.2. Professional Liability (Errors & Omissions)

Professional liability insurance, commonly called errors and omissions (E&O) coverage, protects businesses from claims related to negligence, mistakes, or failure to fulfill professional responsibilities. This insurance is especially important for consultants, designers, and service providers offering specialized advice or creative services.

Real-life Example: Emily, a 35-year-old IT consultant from San Diego, California, was covered by her professional liability insurance when a client alleged data loss following a software deployment, shielding her from personal financial responsibility.

4.3. Product Liability and Other Specialized Coverages

Product liability insurance safeguards companies against monetary losses resulting from claims tied to injuries or damages caused by products they create, distribute, or sell. This type of coverage plays a critical role in helping businesses mitigate the financial risks associated with defective or unsafe products.

Additionally, businesses may require specialized insurance policies tailored to their industry, such as liquor liability for establishments serving alcohol, cyber liability for technology firms, or environmental liability for companies handling hazardous materials.

Pro Tip: Ensure your certificate of liability insurance accurately reflects any specialized coverage necessary to comply with contractual obligations and regulatory standards.

Comparison Table: Liability Insurance Types Covered by COIs

| Type of Insurance | Commonly Required By | Typical Coverage Limits | Purpose |

|---|---|---|---|

| General Liability | Most service contractors, vendors | $1M – $5M | Bodily injury, property damage |

| Professional Liability (E&O) | Consultants, IT, design professionals | $1M – $3M | Claims of negligence or errors |

| Product Liability | Manufacturers, distributors, retailers | $1M – $5M | Injury or damage from products |

| Specialized Coverages | Bars, tech firms, environmental services | Varies widely | Industry-specific risks |

5. How to Verify and Manage a Certificate of Liability Insurance

5.1. Verifying the Authenticity of a COI

Confirming the validity of a certificate of liability insurance is a critical step to ensure it satisfies contractual standards. This process often requires reaching out directly to the insurance provider or utilizing insurer portals to authenticate policy details. To protect your business, meticulously verify the policy number, coverage dates, and limits with the issuing company to avoid fraudulent documents.

In certain cases, requesting a formal letter of coverage can strengthen documentation and streamline compliance with client audits.

5.2. Managing COI Renewals and Updates

Since certificates correspond with underlying policies that expire, it’s important to monitor renewal timelines carefully and promptly obtain new certificates to guarantee uninterrupted compliance. Many organizations employ automated tools or software solutions to send alerts and efficiently manage COI documentation.

5.3. Common Challenges and Solutions in COI Management

Managing multiple COIs across different clients and projects can be complex, leading to missed renewals or incomplete documentation. Common issues include inconsistent certificate formats and lack of clarity on additional insured requirements.

Pro Tip: Implement centralized COI management systems and standardized procedures to streamline collection, verification, and storage of certificates.

Comparison Table: COI Management Tools and Features

| Tool Type | Key Features | Best For |

|---|---|---|

| Dedicated COI Software | Automated tracking, notifications, digital storage | Large contractors, insurance brokers |

| General Document Management | Storage, access control, version tracking | Small to medium businesses |

| Manual Tracking (Spreadsheets) | Customizable, low cost, manual input required | Very small businesses, startups |

Dialogue:

Samantha (Atlanta, GA, 45): “How can I keep track of all my COIs without missing deadlines?”

Risk Manager: “Using specialized software can save time and reduce errors in managing COI compliance.”

6. Understanding Common COI Terms and Endorsements

6.1. Additional Insured

The “additional insured” endorsement grants liability protection to a party other than the primary insured. This provision typically benefits clients or subcontractors who need coverage under the primary policyholder’s insurance. It is essential in contracts to safeguard all involved parties from claims arising out of the work performed.

2024 U.S. Statistic: According to the National Association of Insurance Commissioners (NAIC), 78% of commercial contracts now require additional insured status to manage shared risks.

6.2. Waiver of Subrogation

A waiver of subrogation prevents the insurer from seeking reimbursement from third parties after settling a claim. This clause is commonly included in contracts to minimize litigation and facilitate smoother claim resolution among business partners.

Local Anecdote: In Austin, Texas, Sarah, a construction project manager, found that including a waiver of subrogation clause in her contracts helped maintain positive relationships with subcontractors and suppliers.

6.3. Primary and Non-Contributory

This provision establishes that the insurance policy referenced by the certificate is the primary source of coverage in the event of a claim, with no obligation for other policies to share the cost. This clarity helps prevent disputes over which insurance is responsible.

Pro Tip: Ensure these endorsements are explicitly stated on the COI when required by contract to avoid coverage conflicts.

Comparison Table: Key COI Endorsements and Their Purposes

| Endorsement | Purpose | Typical Usage |

|---|---|---|

| Additional Insured | Extends coverage to another party | Clients, contractors, landlords |

| Waiver of Subrogation | Prevents insurer from suing third parties | Business partners, subcontractors |

| Primary and Non-Contributory | Establishes primary coverage responsibility | Joint ventures, contractual agreements |

7. How to Choose the Right COI for Your Business Needs

7.1. Assessing Your Business Risks

Understanding your business’s unique risks is the first step in selecting appropriate liability coverage. Consider the nature of your operations, client requirements, and industry-specific exposures to determine which types of insurance should be included in your COI.

7.2. Comparing Insurance Providers and Policies

When evaluating insurance providers, review policy terms, coverage limits, exclusions, and claim handling reputation. Look for insurers experienced in your industry to ensure your COI accurately reflects necessary protections.

7.3. Special Considerations for Small and Large Businesses

Small businesses might prioritize affordable coverage with essential protections, while larger enterprises often require broader policies with higher limits and specialized endorsements. Tailor your COI strategy accordingly to fit your company’s size and complexity.

2024 U.S. Statistic: A survey by the Small Business Administration found that 62% of businesses improved risk management by customizing their insurance certificates to better align with operational risks.

Dialogue:

James (Dallas, TX, 50): “How do I know if my COI covers all the risks my company faces?”

Insurance Advisor: “Start by analyzing your contracts and industry standards, then work with your insurer to customize your coverage accordingly.”

Comparison Table: Key Factors When Choosing a COI

| Factor | What to Look For | Importance |

|---|---|---|

| Coverage Limits | Sufficient to meet contract and risk exposure | High |

| Policy Exclusions | Clear and minimal exclusions affecting key risks | Medium |

| Additional Insured & Endorsements | Required by contracts and clients | High |

| Claims Handling | Reputation for fair and prompt settlements | High |

8. Alternatives and Supplements to Certificates of Liability Insurance

8.1. Surety Bonds

Surety bonds serve as a financial assurance guaranteeing that contractual responsibilities will be fulfilled. Unlike standard insurance policies, these bonds protect clients by ensuring compensation if a business fails to meet its obligations or complete the agreed work.

8.2. Self-Insurance and Captive Insurance Programs

Some larger companies choose to self-insure or establish captive insurance arrangements, taking on their own risk instead of buying coverage from traditional insurers. These approaches provide greater control but require considerable financial backing and expertise in managing risk.

For individuals needing flexible, temporary solutions, short term health insurance can bridge gaps while longer-term coverage is arranged.

8.3. Risk Management and Safety Programs

Adopting robust risk management and safety measures can lower the chances of insurance claims and reduce premium costs. Many businesses complement their COIs by implementing documented safety initiatives, ongoing employee training, and routine compliance audits.

Pro Tip: Carefully consider these alternatives as they might not replace the necessity for COIs in contractual relationships.

Local Anecdote: In Denver, Colorado, a manufacturing firm reduced its insurance premiums by 20% after implementing comprehensive safety measures and supplementing COIs with a self-insurance program.

Comparison Table: Alternatives to Traditional COIs

| Alternative | Description | Best For |

|---|---|---|

| Surety Bonds | Guarantee contract fulfillment | Construction, service contracts |

| Self-Insurance / Captive | Internal risk retention | Large corporations |

| Risk Management Programs | Loss prevention strategies | All business sizes |

9. Legal Requirements and Regulatory Considerations for COIs

9.1. State-Specific COI Regulations

Certificate of liability insurance requirements vary by state, with some jurisdictions imposing specific mandates on coverage types, limits, and endorsements. Understanding these regulations is vital for compliance and avoiding contract disputes.

Pro Tip: Consult state insurance departments or official legal resources to stay updated on COI regulations in your operational areas.

9.2. Common Contractual COI Clauses

Contracts often include clauses specifying COI requirements such as minimum coverage amounts, additional insured endorsements, and notification of policy changes. Non-compliance with COI requirements may lead to contract cancellation or financial penalties.

Local Anecdote: In Houston, Texas, a subcontractor lost a contract after failing to provide an updated COI meeting the client’s requirements, illustrating the importance of adhering to contractual COI clauses.

9.3. Consequences of Non-Compliance

Non-compliance with COI requirements can lead to legal disputes, financial losses, and damaged business relationships. It may also expose companies to uninsured liabilities in case of claims or accidents.

2024 U.S. Statistic: A report by the National Association of Insurance Commissioners (NAIC) found that 22% of small businesses faced contract disputes related to COI issues in the past year.

Comparison Table: State COI Regulations Overview

| State | Key COI Requirements | Common Clauses |

|---|---|---|

| Texas | Additional insured mandatory, specific coverage limits | Notification of cancellation, endorsement clarity |

| California | Clear disclosure of policy limits and exclusions | Proof of insurance before contract execution |

| Florida | Standardized COI form requirements | Certificate holder named on policy |

Conclusion

Certificates of liability insurance are crucial tools for businesses to demonstrate proof of coverage, manage risk, and comply with contractual obligations. Understanding the types of insurance covered, key endorsements, and legal requirements helps ensure continuous protection and avoid costly disputes. While COIs provide important verification, thorough management and timely updates are essential to maintain compliance. For any uncertainties regarding COI specifics or requirements, consulting with a qualified insurance professional or legal advisor can provide clarity and safeguard your business interests.

FAQ

What is a certificate of liability for insurance?

A certificate of liability insurance (COI) is a formal document issued by an insurer that proves a business carries liability coverage. It outlines the policy’s coverage types, limits, effective dates, and any additional insured parties. COIs are commonly required in contracts to verify insurance protection against risks like bodily injury or property damage.

How much does a COI cost?

Typically, a certificate of liability insurance is included at no extra charge with your liability insurance policy. However, some insurers or brokers may charge fees ranging from $10 to $25 for issuing multiple certificates or naming several certificate holders.

How to get a COI for a small business?

To obtain a COI, contact your insurance provider or broker and request the certificate. You will need to provide details such as the certificate holder’s name, coverage requirements, and whether additional insured endorsements are needed. Most insurers issue COIs within 1 to 5 business days, with some digital platforms offering instant delivery.

How much is liability insurance for an LLC?

Liability insurance costs for an LLC vary based on industry, location, and coverage limits. General liability insurance typically ranges from $400 to $1,500 annually, while professional liability for service-based LLCs can range from $600 to $1,800. Higher-risk industries usually face higher premiums.