State car insurance requirements are mandatory legal obligations that vary significantly across the United States, with each state setting specific minimum coverage levels for legal driving. Understanding these state car insurance requirements is crucial for legal compliance and financial protection, especially with recent legislative changes affecting millions of drivers across California, North Carolina, Virginia, and Utah in 2025.

On This Page

In the next section, we’ll break down the essential requirements every driver needs to understand for legal compliance.

Essential Overview — What You Need to Know

All states require car insurance except New Hampshire, though the minimum amounts vary from place to place. According to the National Association of Insurance Commissioners, depending on the state, minimum car insurance requirements may include bodily injury liability, property damage liability, uninsured/underinsured motorist and personal injury protection coverage.

Key Takeaway: Every state except New Hampshire mandates minimum car insurance coverage, with liability insurance being the universal requirement across all mandatory states.

Core Insurance Components Required by States

Liability Coverage forms the foundation of state requirements:

- Bodily Injury Liability: Covers medical expenses for others you injure in an accident

- Property Damage Liability: Pays for damage to others’ vehicles or property

Additional Required Coverage (varies by state):

- Personal Injury Protection (PIP): Required in no-fault states, covers your medical expenses regardless of fault

- Uninsured/Underinsured Motorist: Protects you when hit by inadequately insured drivers

| Coverage Type | States Requiring | Average Minimum Limits |

|---|---|---|

| Bodily Injury Liability | 49 states + DC | $25,000/$50,000 |

| Property Damage Liability | 49 states + DC | $10,000-$25,000 |

| Personal Injury Protection | 12 states | $2,500-$8,000 |

| Uninsured Motorist | ~20 states | Varies by state |

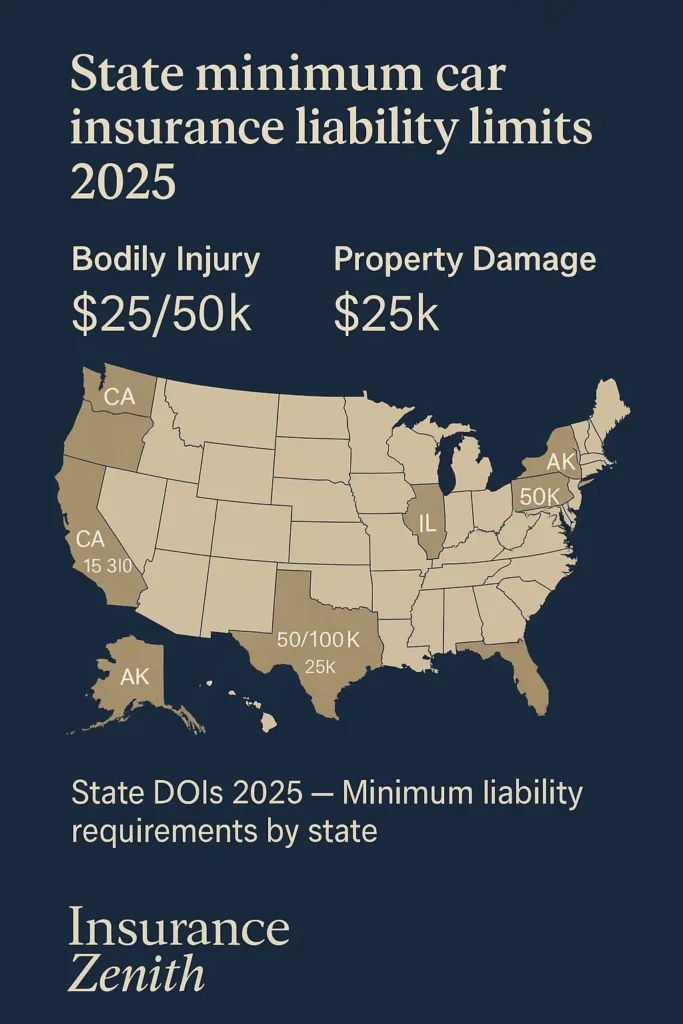

Most states require at least $25,000 in bodily injury liability per person and $50,000 per accident, though these amounts often prove insufficient for serious accidents.

Understanding life insurance beneficiary requirements works similarly to car insurance, where proper designation ensures coverage functions as intended during claims.

Coming up next, we’ll examine the specific minimum requirements that apply across different states.

What Are the Minimum Requirements for Car Insurance?

State minimum car insurance requirements establish the lowest legally acceptable coverage levels drivers must maintain. Minimum auto insurance refers to the least amount of coverage drivers are required by law to have in their state, typically including liability insurance for bodily injury and property damage.

Standard Minimum Coverage Framework

Primary Requirements:

- Bodily Injury Liability Per Person: Typically $15,000-$50,000

- Bodily Injury Liability Per Accident: Usually $30,000-$100,000

- Property Damage Liability: Generally $5,000-$50,000

Important: These minimums represent basic legal compliance but may not provide adequate protection for serious accidents involving modern vehicle repair costs and medical expenses.

Recent Legislative Changes for 2025

California, North Carolina, Virginia, and Utah are increasing liability limits in 2025, marking significant updates to decades-old requirements:

California Changes (Effective January 1, 2025):

- $30,000 for bodily injury or death per person (up from $15,000)

- $60,000 for bodily injury or death per accident (up from $30,000)

- $15,000 for property damage per accident (up from $5,000)

According to the California Department of Insurance, these changes represent the first adjustment in nearly 60 years.

North Carolina Changes (Effective July 1, 2025):

- $50,000 per person and $100,000 per accident for bodily injury

- $50,000 for property damage

Key Takeaway: These increases reflect rising medical costs and vehicle values, with California’s changes representing the first adjustment in nearly 60 years.

For drivers managing multiple insurance policies, understanding how to change life insurance beneficiaries demonstrates similar processes for updating coverage as needs change.

Next, we’ll dive deeper into California’s specific new requirements that took effect in 2025.

What Are the Minimum Insurance Requirements in California?

California implemented the most significant insurance requirement changes in 2025, doubling previous minimums through Senate Bill 1107, known as the Protect California Drivers Act.

Updated California Requirements

As of January 1, 2025, this includes: $30,000/$60,000 in bodily injury liability and $15,000 in property damage liability. These changes represent the first increase since 1967.

Previous vs. Current Requirements:

| Coverage Type | Pre-2025 | 2025 & Beyond |

|---|---|---|

| Bodily Injury (Per Person) | $15,000 | $30,000 |

| Bodily Injury (Per Accident) | $30,000 | $60,000 |

| Property Damage | $5,000 | $15,000 |

Implementation and Compliance

For renewal policies effective on or after January 1, 2025, any policies with coverage limits below the new state-mandated minimums will automatically be adjusted to meet the updated requirements. Drivers don’t need to take manual action as insurance companies handle compliance automatically.

Financial Impact: With increased coverage requirements, many drivers may see higher insurance premiums, particularly those previously carrying only minimum coverage.

Important: California also offers the California Low Cost Auto (CLCA) Insurance Program for income-eligible drivers, with limits remaining at the previous minimums to maintain affordability.

What Auto Insurance Is Required in Every State?

While specific limits vary, nearly all states share common insurance requirements, with liability coverage serving as the universal foundation.

Universal Liability Requirements

Almost all states require a minimum amount of liability insurance, covering:

- Bodily Injury Liability: Medical expenses for others you injure

- Property Damage Liability: Repair costs for others’ property you damage

State-by-State Variations

At-Fault vs. No-Fault Systems:

- There are 38 at-fault states, as well as the District of Columbia

- There are 12 no-fault states, including the 3 choice no-fault states

No-Fault States Requiring PIP Coverage: Florida, Hawaii, Kansas, Massachusetts, Michigan, Minnesota, New York, North Dakota, and Utah mandate Personal Injury Protection alongside liability coverage.

Special Considerations by State Type

At-Fault States: Focus on higher liability coverage to protect against lawsuits from injured parties.

No-Fault States: Emphasize PIP coverage that pays your own medical expenses regardless of who caused the accident.

Choice No-Fault States: Allow drivers to choose between no-fault and traditional tort systems, affecting required coverage types.

| State System | Primary Focus | Additional Requirements |

|---|---|---|

| At-Fault (38 states) | High liability limits | Varies by state |

| No-Fault (9 states) | PIP coverage | Lower liability acceptable |

| Choice No-Fault (3 states) | Flexible options | Depends on election |

Official Regulations and Standards

State car insurance requirements operate within a comprehensive regulatory framework overseen by state insurance departments and guided by National Association of Insurance Commissioners (NAIC) standards.

Federal and State Regulatory Authority

In 1945, Congress passed the McCarran-Ferguson Act, which reaffirmed the pivotal role of states in insurance regulation. This legislation ensures each state maintains authority over insurance requirements within its borders.

Regulatory Hierarchy:

- Federal Level: McCarran-Ferguson Act provides framework

- NAIC Guidelines: Model laws and best practices

- State Implementation: Specific requirements and enforcement

The NAIC consumer resources provide comprehensive guidance for understanding state-specific requirements and connecting with appropriate regulatory authorities.

How to Verify Requirements in Your State

Key Takeaway: Always verify current requirements through your state’s Department of Insurance, as requirements can change and enforcement varies.

Official Verification Sources:

- State Department of Insurance websites (.gov domains)

- NAIC consumer resources

- DMV registration requirements

- Licensed insurance agents

Just as life insurance for seniors requires understanding age-specific requirements, car insurance mandates vary by state demographics and risk factors.

Important – Regulatory compliance: Insurance requirements described are subject to regular updates through state legislative processes. To confirm current law status, consult your state’s Department of Insurance for latest official requirements.

State Variations

Car insurance requirements vary significantly across states, reflecting different approaches to driver financial responsibility and accident compensation systems.

| State | Regulator (DOI) | Key Specifics | Official Link |

|---|---|---|---|

| California | California Department of Insurance | New 30/60/15 limits as of 2025 | insurance.ca.gov |

| Florida | Florida Office of Insurance Regulation | Property damage only + PIP required | floir.com |

| New York | New York State Department of Financial Services | No-fault state with PIP requirements | dfs.ny.gov |

| Texas | Texas Department of Insurance | 30/60/25 minimum limits | tdi.texas.gov |

| Michigan | Michigan Department of Insurance | Highest PIP requirements in nation | michigan.gov/difs |

| Georgia | Georgia Office of Commissioner of Insurance | 25/50/25 standard requirements | oci.ga.gov |

| North Carolina | North Carolina Department of Insurance | New 50/100/50 limits effective July 2025 | ncdoi.gov |

| Virginia | Virginia Bureau of Insurance | Alternative uninsured motorist fee option | scc.virginia.gov |

| Ohio | Ohio Department of Insurance | 25/50/25 with optional UM coverage | insurance.ohio.gov |

| Pennsylvania | Pennsylvania Insurance Department | Choice no-fault system | insurance.pa.gov |

Similar to how comparing life insurance policies requires understanding different state regulations, car insurance varies significantly across jurisdictions.

In our next section, we’ll explore what changes may be coming in the future and how to stay prepared.

Regional Patterns and Trends

High-Requirement States: Generally include states with higher costs of living and medical expenses (California, New York, Michigan).

Economic Factors: States with recent requirement increases cite rising medical costs, vehicle values, and litigation expenses as primary drivers.

Special Programs: Many states offer low-income insurance programs with reduced requirements to maintain basic coverage access.

Advanced State Car Insurance Requirements & Future Outlook

The landscape of state car insurance requirements continues evolving, with several states considering additional changes beyond the 2025 updates already implemented.

Emerging Regulatory Trends

Technological Integration: States are increasingly considering how usage-based insurance (UBI) and telematics affect traditional coverage models. UBI ties insurance costs to driving habits, such as miles driven, time of day and hard stops.

Data-Driven Regulation: The Big Data (H) Working Group studies what type of data is collected and how it is used by insurers and third parties in the context of marketing, rating, underwriting, and claims.

Anticipated Legislative Developments

According to recent legislative proposals and state insurance department discussions, it is anticipated that additional states may consider requirement increases in the coming years. Current discussions suggest potential changes in:

- Florida: Proposals for increased PIP minimums under review

- Illinois: Legislative committees evaluating liability limit adequacy

- Arizona: Department studies examining current requirement sufficiency

Important: The information below is based on current proposals and may change. It does not represent binding law. Always verify updates directly from official sources such as your state’s Department of Insurance or NAIC resources.

Future Technological Considerations

Autonomous Vehicles: As self-driving technology advances, states are beginning to consider how insurance requirements may need adaptation for partially and fully autonomous vehicles.

Shared Mobility: The growth of ride-sharing and car-sharing services is prompting regulatory discussions about coverage requirements for commercial vs. personal use.

For drivers considering comprehensive coverage, understanding which life insurance is right for you demonstrates similar decision-making processes for evaluating insurance needs.

Key Takeaway: The insurance regulatory landscape will likely see continued evolution as states balance consumer protection with affordability and technological advancement.

Next, we’ll address the most frequently asked questions about state car insurance requirements.

FAQ

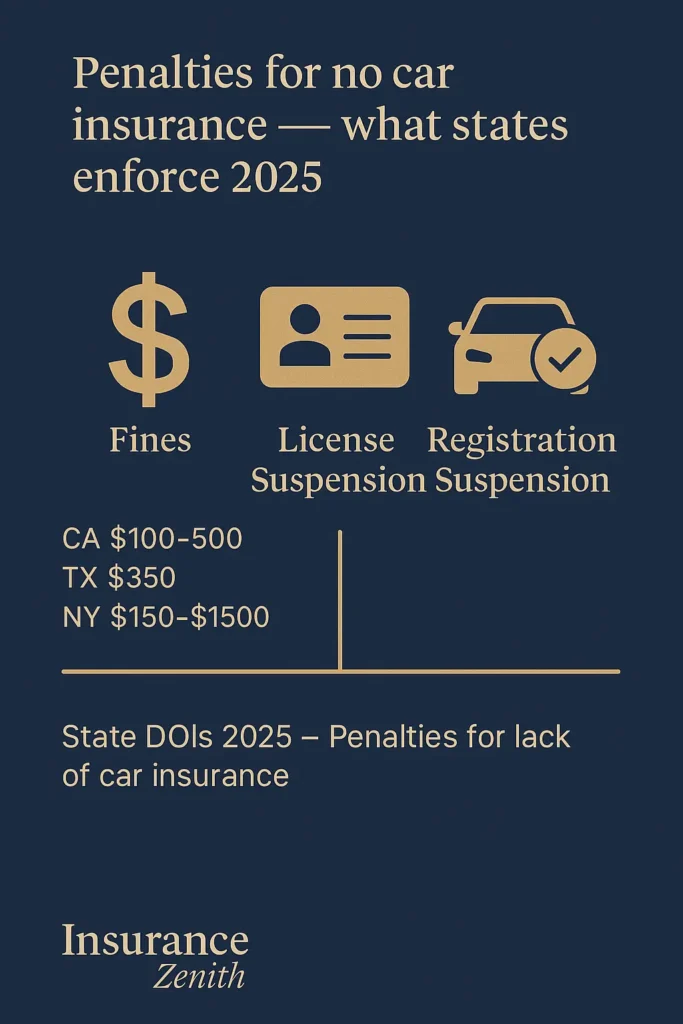

What happens if I don’t have the minimum required car insurance?

Penalties vary by state but typically include fines, license suspension, vehicle registration suspension, and potential liability for all accident costs. Some states also require SR-22 forms for future coverage.

Can I drive in other states with my home state’s minimum coverage?

There are no restrictions for driving in another state where the minimum requirements are higher; if you drive into a state that has higher minimum limits than yours, your minimum coverage policy will adjust up to that state’s limits.

Do I need additional coverage beyond state minimums?

While meeting minimums ensures legal compliance, experts typically recommend higher limits. Serious injuries will run much higher than these liability limits. Most insurance companies will recommend $100,000/$300,000 or higher.

How do no-fault states differ in requirements?

No-fault states require Personal Injury Protection (PIP) that covers your medical expenses regardless of who caused the accident. This often allows for lower liability requirements since each driver’s insurance handles their own costs.

Are there alternatives to traditional insurance in any states?

In some states, like New Hampshire, you may show a bond, certificate of deposit or cash to the DMV instead of the state minimum car insurance, though insurance typically offers better protection and value.

When do the new 2025 requirements take effect?

California’s changes took effect January 1, 2025, while North Carolina’s increases begin July 1, 2025. Requirements apply at policy renewal dates throughout the year.

Will insurance companies automatically adjust my coverage to meet new minimums?

Yes, licensed insurers cannot sell policies below state minimums and will automatically adjust coverage levels to ensure compliance with new requirements.

How often do states change insurance requirements?

Changes are relatively infrequent. California’s 2025 increase represented the first change in nearly 60 years, while North Carolina’s was the first in over 20 years.

Key Takeaways & Resources

State car insurance requirements serve as the foundation for driver financial responsibility, with significant variations across states reflecting different regulatory approaches and economic conditions. The 2025 updates in California, North Carolina, Virginia, and Utah demonstrate the ongoing evolution of these requirements to address rising costs.

Essential Action Items:

- Verify your state’s current minimum requirements through official Department of Insurance resources

- Review your policy to ensure compliance with any recent changes

- Consider coverage beyond minimums for adequate financial protection

- Understand your state’s fault system and how it affects coverage needs

Official Resources for Verification:

- National Association of Insurance Commissioners

- State Insurance Department Directory

- Your state’s Department of Motor Vehicles for registration requirements

- Licensed insurance professionals in your state

For those managing multiple insurance policies, our guide on life insurance beneficiary rules provides similar frameworks for understanding policy requirements and compliance.

Key Takeaway: While minimum requirements provide legal compliance, they often represent inadequate protection for serious accidents. Consider these minimums as starting points rather than optimal coverage levels for comprehensive financial security.