The smell of fried bacon hangs in the small kitchen of Norman, Oklahoma. Thirty-nine-year-old Chris Bell, forklift operator, stands at the counter, coffee cooling, checking his wrist where an old scar from last summer’s work accident reminds him—things can flip fast. His wife, Mia, is wrangling their toddler in the background, ESPN playing on mute as she waits on hold with their pediatrician.

On the fridge, a bright envelope reads: “AD&D Insurance: New Options for All Staff.” Chris stares at it, thinking about last week’s warehouse slip—nobody got hurt, but it was close. According to the National Safety Council’s 2024 report, accidental injuries led to more than 224,000 deaths in the US last year—most during daily routines, just like his.

He wonders: Does this accidental death and dismemberment insurance actually protect a family like his, or is it just another box to tick on HR forms? This article digs into what AD&D Insurance really covers, what’s left out, and how it might—just might—change the safety net for people who work, hustle, and worry about tomorrow.

On This Page

1. What Is AD&D Insurance? 7 Facts Most People Ignore

1.1 The Basics: What Does AD&D Insurance Actually Cover?

Ashley rolled into the lot a bit early, like she often does. The building was still locked up, nothing moving yet behind the chain-link fence. She sat for a minute in her car, flipping through some HR papers she’d meant to hand in last week.

One section caught her eye:

Accidental Death and Dismemberment Insurance.

She blinked. That sounded intense. Almost distant—like something that happens to someone else.

But she didn’t toss the papers aside. Not right away.

Ashley spends her workdays moving freight, walking concrete floors, and working around machines that don’t stop. Some shifts are uneventful. Others leave her with a sore back—or reminders of close calls she doesn’t always talk about.

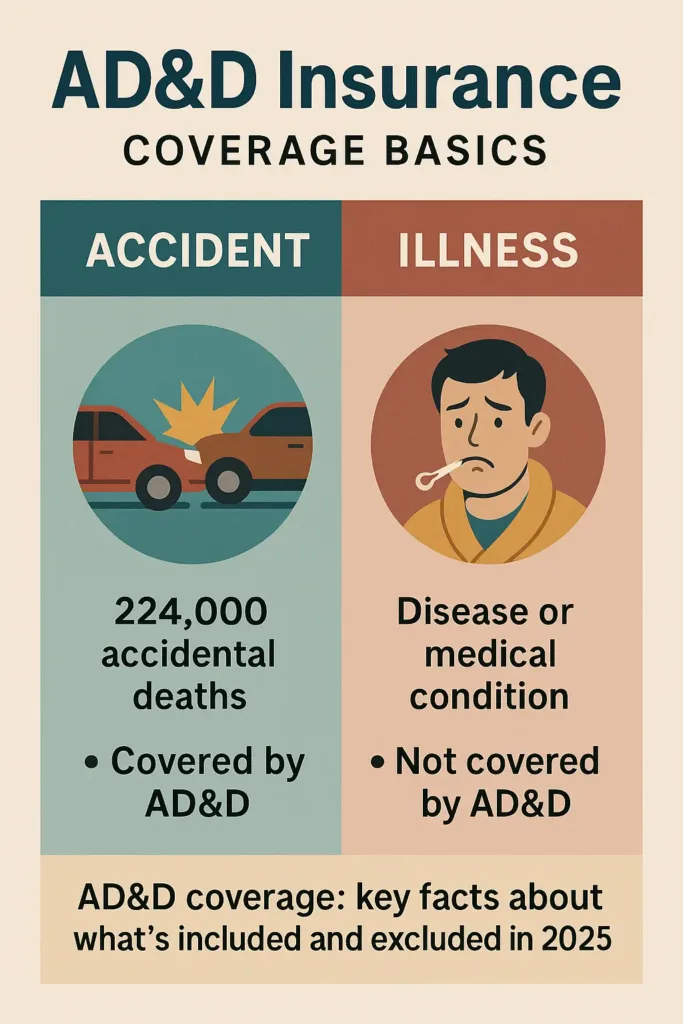

That’s where AD&D insurance steps in. It pays out when someone dies or suffers a serious injury—like losing a limb or eyesight—but only if it happens in an accident. Illnesses or natural causes don’t qualify.

And it’s not just rare freak events.

The CDC reported that in 2024, accidental injuries were the fourth leading cause of death in the U.S. Not extreme sports or stunts—just everyday situations. A misstep at work. A fall at home. A driver blowing through a red light.

This kind of policy isn’t dramatic—it’s practical. Understanding how AD&D works alongside your comprehensive life insurance strategy helps create complete protection. And for someone like Ashley, it’s a reminder that regular days can still carry real risks.

1.2 How Does AD&D Insurance Work in Real Life?

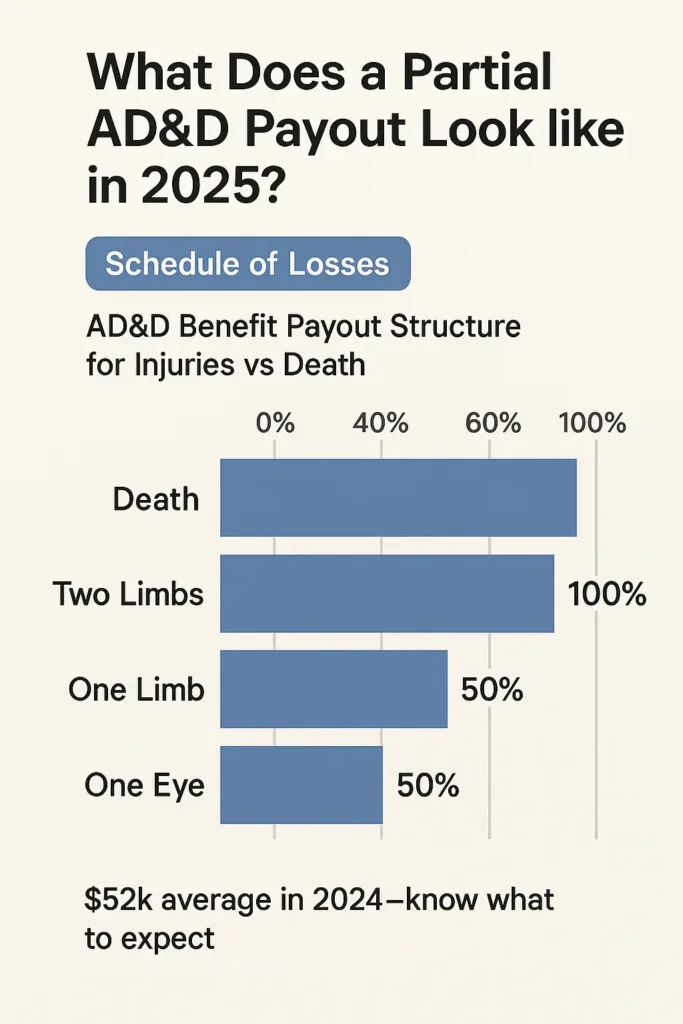

Let’s make it real. Imagine Chris (yep, from Oklahoma—again), three weeks after signing up for his accidental death and dismemberment coverage at work. One rainy Tuesday, a forklift mishap leaves him with a broken hand and, after the dust settles, the loss of his left thumb. In this case, his AD&D policy pays out a portion of the total benefit, calculated by a payout chart—sometimes called a “schedule of losses.”

Lose your life to an accident? Your beneficiary gets the full sum. Lose a limb or eyesight? The percentage depends on what was lost. It’s messy and feels impersonal (I know), but those numbers on a page turn into real grocery bills and car payments when disaster hits.

1.3 What’s Usually Excluded? (Hint: Read the Fine Print)

Let me tell you about Marcus, a friend of mine in Tampa, who learned the hard way that insurance exclusions matter. After a nasty fall off a jet ski, he filed a claim, but the payout never came. Turns out, the insurer flagged his blood alcohol content—denied, no appeal. This is more common than you’d think. Typical exclusions include anything related to illness, intentional self-harm, substance use, risky sports (like skydiving or racing), and military events.

There’s no such thing as “total protection”—some situations will always be left out. According to a 2023 NAIC bulletin, denial rates spike around alcohol, drug use, or excluded activities. So here’s my advice: before you count on a payout, scrutinize your exclusions section line by line. I once overlooked a single clause and almost lost out on a benefit—an easy mistake that could have cost a small fortune. Don’t let that be your story.

Learning about life insurance beneficiary rules helps you avoid these costly surprises with any insurance policy.

1.4 Is AD&D Insurance Worth It for Families?

Let’s get real: everyday life for American families means budgeting for groceries, school trips, and the next repair (washer, car, whatever breaks first). So, is it practical to sign up for accidental coverage? According to LIMRA research published in 2024, less than a fifth of U.S. families actually have AD&D insurance, yet a big majority of those who do say it brings real peace of mind—enough to justify a little less in the paycheck.

Take it from Marcus, 37, dad of two in Kansas City, who told me, “Ten bucks comes out before I even see my pay. Feels like cheap insurance against stuff I can’t control.” That “backup” is often the difference between losing sleep and knowing, deep down, your people will be alright—even when life gets messy.

1.5 One Dialogue, One Truth

‘I’m paying $9.50 every month for accidental death insurance at the plant in Nebraska. Is that a rip-off?’ — Jake, 43, steelworker, asked over break, grease still on his hands. We shot straight: “Honestly? For what your union offers, that sounds about right—nothing wild, not a scam either. But here’s the catch—always skim through your coverage details, especially those pages about exclusions and payout caps. (I missed something once and nearly lost a benefit, not fun.) Little stuff in the fine print can trip you up when it matters most—don’t let that be you.”

1.6 Micro-Story: When the Unthinkable Happens

When Mike’s Chevy Silverado rolled on an icy stretch near Billings, Montana last February, he was lucky to walk away with a shattered wrist. His wife, Megan, later shared, “The AD&D payout covered our mortgage for three months while Mike recovered.” Sure, it didn’t erase the pain, but it kept the lights on—and in moments like that, you really notice the details. (I mean, who expects an insurance policy to feel…personal?)

1.7 2024 Snapshot: Stats & Trends

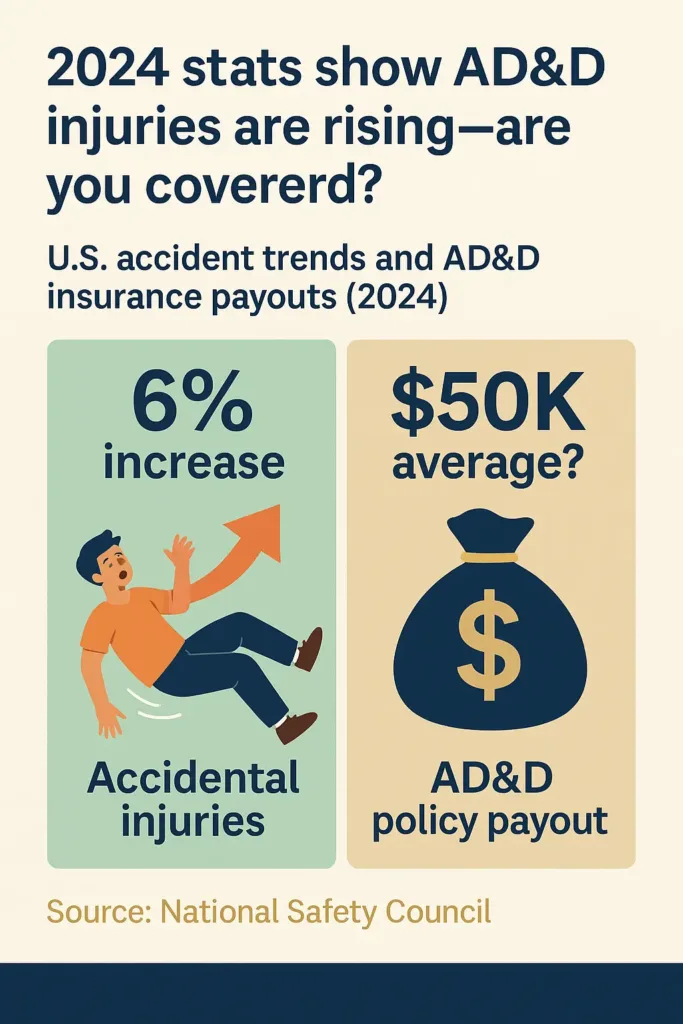

Accidents aren’t some distant concern—they’re becoming more common, and not in the ways most people expect. In its 2024 findings, the National Safety Council reported a 6% rise in accidental injuries across the U.S. These weren’t linked to high-risk hobbies. They happened in everyday moments—on the job, at home, doing the usual.

When it comes to AD&D insurance, it’s not designed to provide long-term financial security. In 2023, the average payout was close to $50,000. That’s not enough to replace a salary—but in the middle of a crisis, it can offer real breathing room. Rent. Groceries. A little time to get back on your feet.

So, will it cover everything? Probably not. But if something unexpected happens, it might be the one thing standing between you and a financial free fall.

2. How Does AD&D Insurance Actually Pay Out?

2.1 Real Payouts: What Happens When You File a Claim?

Let me tell you about Tanya, 38, a package courier in Boise, Idaho. A biking accident caused her to lose part of her pinky finger. Her husband scrambled to find the AD&D paperwork, but honestly, they hadn’t thought much about the coverage before. The claim process felt overwhelming—documents piled up, phone calls to doctors, and a waiting game that stretched over two months. Tanya recalls with a chuckle, “I thought the money would be in my bank by next week—guess not.” When the benefit finally landed, it helped pay the rent and buy groceries, giving them some breathing room while she healed.

2.2 Payout Structure: Not Always All or Nothing

AD&D insurance is not a one-size-fits-all payout. Policies use a “schedule of losses,” meaning the cash amount depends on what actually happened. For example, the death benefit pays out 100% of the policy’s face value, but the loss of one limb or eye typically pays 50%—and multiple losses may add up differently. According to the National Safety Council 2024 summary, the average accidental injury payout in the US was $52,000 last year—but real-world claims range from just a few thousand up to six figures.

2.3 What Can Delay or Deny a Payout?

Let’s be honest, most people (myself included) dread paperwork and fine print. But if there’s a missing document or the cause of the injury is unclear, payment gets held up. Sometimes, as with Trevor, 51, a welder in Detroit, a single missed doctor’s note delayed his family’s benefit for weeks. “One nurse signature, that’s all it took to stall the whole thing,” he grumbled. Also, claims linked to excluded situations—like injuries while intoxicated—are simply refused. According to the Insurance Information Institute, nearly a quarter of denied AD&D claims in 2023 were tied to paperwork mistakes or late submissions.

2.4 Micro-Story: When AD&D Makes the Difference

April started like any other month for Jessica and her husband. He was a 41-year-old auto technician in Des Moines, the kind of guy who could diagnose engine problems by sound alone. Then came what should have been a simple lift job – until the hydraulics failed. The impact shattered his wrist in three places.

That evening, Jessica sat at their kitchen table with hospital paperwork spread before her. The glow of the TV flickered against the walls, some late-night ad about vegetable choppers playing at low volume. She remembers how surreal it felt – this mundane background noise against their suddenly upended lives.

Later, she would tell me about the moment she realized what their AD&D policy really meant. Not abstract coverage concepts, but concrete survival. The $15,000 payment arrived within eleven days. Not enough to replace his income long-term, but enough to prevent disaster. Enough to keep their mortgage current while he recovered. Enough to maintain some semblance of normalcy for their kids.

What surprised her most wasn’t the money itself, but what it represented: time. The luxury to make decisions based on healing rather than desperation. No family plans for financial ruin, but as Jessica put it, the policy gave them guardrails when life veered off course.

3. What Are the Key Exclusions in AD&D Insurance?

3.1 Common Exclusions You Should Know About

Imagine this: It’s a rainy afternoon in Portland, Maine. Sam, 29, a construction worker, thought he was fully covered after signing up for AD&D through his employer. Then, during a weekend hike, he slipped and injured his ankle badly—but because the policy excludes injuries from “high-risk recreational activities,” his claim was denied. Typical exclusions often trip people up—these include injuries caused by illness, suicide attempts, drug or alcohol intoxication, and activities like skydiving or racing. The National Association of Insurance Commissioners (NAIC) regularly reports that claims linked to excluded activities form a large chunk of denials. So, it’s crucial to read your policy’s fine print before counting on any payout.

3.2 Why Exclusions Matter: Real-Life Examples

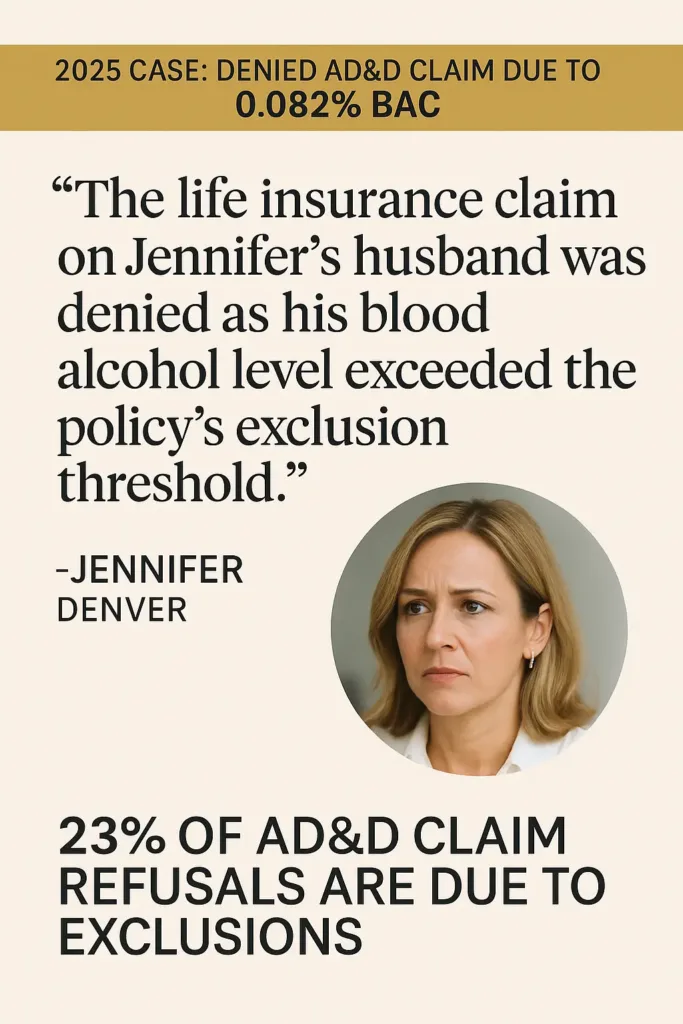

Jennifer R., a 36-year-old emergency room nurse from Denver, thought she understood risk – until her own car accident became an $18,000 lesson in insurance fine print. After a birthday lunch where she’d enjoyed two glasses of wine over four hours, her drive home ended when an SUV ran a red light and plowed into her sedan. At the hospital, the blood test revealed what would become the crucial detail: a 0.082% BAC – just 0.002% over Colorado’s legal limit.

Her AD&D claim for $18,327 in medical bills was denied, citing the intoxication exclusion buried in section 4.B.2 of her policy. “I passed every field sobriety test,” Jennifer recalls, “but insurance companies don’t care about impairment – just numbers on a lab report.”

This wasn’t some obscure loophole. Nearly 1 in 4 AD&D claims get denied for similar policy violations. What stings most? Jennifer realizes now she’d carefully reviewed every consent form for her patients, but only skimmed the insurance documents meant to protect her own family.

The takeaway isn’t about assigning blame – it’s about recognizing how easily anyone can become part of that 23% statistic. Those dense policy sections we all gloss over? They’re not just legal formalities. They’re the difference between coverage and financial catastrophe when life suddenly veers off course.

3.3 How to Avoid Surprises: Tips to Navigate Exclusions

Here’s something most people get wrong about insurance: we all skim right past the “exclusions” section like it’s just fine print. Big mistake. Those few paragraphs actually determine whether you’ll get paid when you need it most.

Do yourself a favor – take 5 minutes to ask your HR rep or insurance agent: “Does my job count as high-risk?” “Are my weekend hobbies covered?” You might be surprised by the answers. And when it’s time to file a claim, remember: insurance companies love to nitpick. Missing paperwork or unclear medical reports can delay your payment for months.

The smart move? Keep everything. Photos from the accident scene. Doctor’s notes with specific diagnoses. Every email receipt. That one extra minute you spend being thorough now could save you thousands later. Insurance isn’t about hoping for the best – it’s about preparing for the worst-case scenario.

3.4 Micro-Story: Learning the Hard Way

Jason, a 31-year-old electrician from Raleigh, found out the hard way that injuries sustained while intoxicated aren’t covered. After a fall on a Friday night, his claim was flat-out denied. “It was a tough lesson, but at least now I read everything with a magnifying glass,” he jokes. These stories aren’t rare, and they remind us that even “accidental” policies have strict boundaries.

4. Is AD&D Insurance Worth the Cost?

4.1 What Does AD&D Insurance Typically Cost?

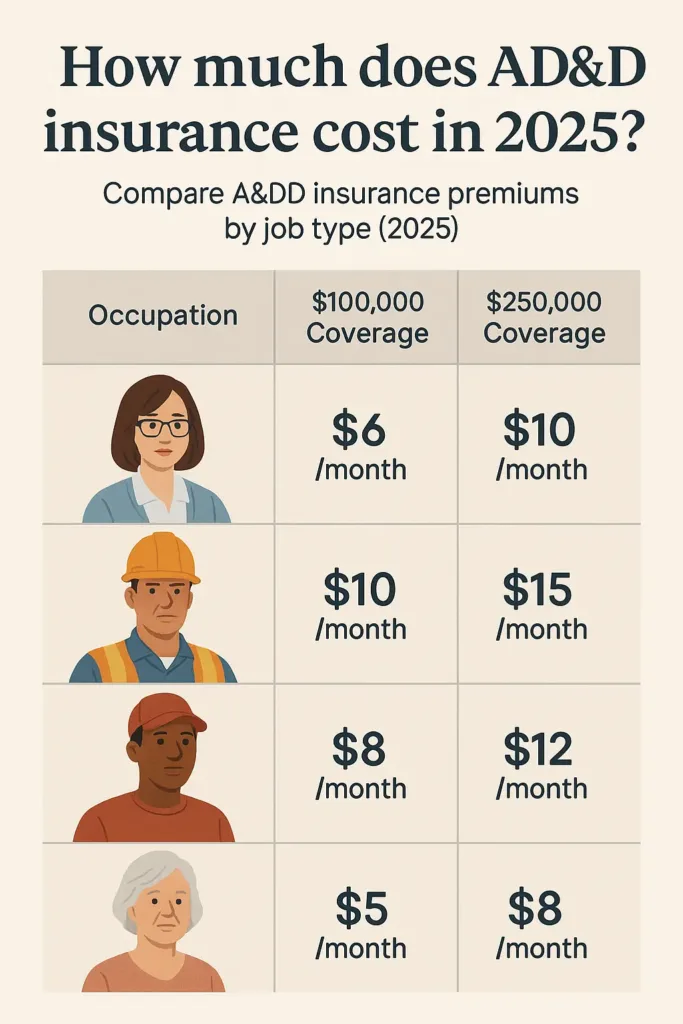

When budgeting for AD&D insurance, think about what you’d spend on coffee each month. Recent industry data shows most individual plans cost between $5-$15 monthly – about the price of two lattes. Through employer group plans, it’s often even cheaper. Take Sam R., that 28-year-old middle school teacher in Columbus: his coverage costs $7 per paycheck. “That’s less than I spend on Spotify,” he notes, “and way cheaper than the stress of wondering ‘what if?'”

But prices aren’t one-size-fits-all. Your:

• Job (construction worker vs. accountant)

• Age (30-year-old vs. 55-year-old)

• Coverage amount ($100k vs. $500k)

…all swing the final number. The key? Those few dollars today could cover what your health insurance won’t if life takes a bad turn.

For comparison, this makes AD&D significantly more affordable than traditional life insurance coverage for young professionals, though both serve different protective purposes.

4.2 What Are the Pros and Cons?

Think of AD&D insurance as emergency cash for life’s worst-case scenarios. When accidents strike, it delivers fast financial support without the months-long waiting game of traditional life insurance. For roughly what you’d pay for Netflix each month, it adds an important safety net to your existing coverage.

But here’s what many don’t realize until it’s too late:

• That “accidental” definition is strict – slip-and-fall? Covered. Stroke at work? Not a chance

• Common exclusions (like alcohol-related accidents) can void claims unexpectedly

• Natural causes and illnesses don’t qualify, no matter how sudden

It’s the insurance equivalent of keeping a first aid kit in your car – absolutely vital for certain emergencies, but you’d never rely on it as your only medical protection. For complete peace of mind, pair AD&D with comprehensive life insurance. Together, they create full-spectrum financial protection.

For complete peace of mind, exploring your options for term vs whole life insurance alongside AD&D creates the most comprehensive protection strategy.

4.3 Who Should Consider AD&D Insurance?

Meet real people who’ve made AD&D part of their financial safety plan:

Maria G., 45, lifts heavy packages daily at an Atlanta distribution center. “After seeing a coworker get hurt last year,” she says, “the $9/month premium feels worth it.” Then there’s John T., a 32-year-old digital marketer working remotely in Austin. He admits, “I’m mostly at my desk, but between cycling weekends and that one scary Uber ride, the coverage gives my wife peace of mind.”

The common thread? They both recognized:

✓ Workplace risks (even for remote workers)

✓ Everyday accident potential

✓ Affordable crisis cushion

At these prices – often less than $15/month – AD&D works as sensible backup insurance, especially when paired with health and life coverage.

4.4 Dialogue: Is It Worth It?

‘I’m paying $8 a month for AD&D at my job in Phoenix. Should I bother?’ — asked Luis, 29, graphic designer. We told him: “If the price fits your budget, it can’t hurt. But read your exclusions closely. Don’t assume it covers everything—it’s more like a safety net for specific worst-case scenarios, not your full financial backup.”

4.5 Micro-Story: Small Cost, Big Relief

Tanya M. never expected her restaurant’s slippery floors to land her in the ER last December. The 37-year-old Minneapolis server shattered her elbow during the dinner rush – an injury that meant six weeks without tips or paychecks.

Her AD&D policy paid out $3,200. “Not life-changing money,” she admits, “but exactly enough to cover my rent for two months while I did physical therapy.” At $8.50/month, the math worked out: “That’s what I’d spend on one takeout order. For something that actually saved my apartment? No brainer.”

It’s these unglamorous but crucial lifelines – the rent money, the car payment, the groceries – where AD&D shows its real value after accidents. Not a fortune, but often just enough to keep life from unraveling.

5. Picking Your Best AD&D Insurance Plan: Key Tips for Smart Coverage

5.1 Evaluate Your Risk and Needs

You gotta look at your day-to-day. Like Kevin, 43, a firefighter in Tucson, Arizona, who faces real danger every shift—that’s why he picked a policy with a higher payout. Then there’s Emma, 27, who works from home as a freelance graphic designer in Portland, Oregon. She went for something simple, mostly to cover freak accidents. The bottom line? Think about your work, your habits, and who depends on your paycheck to decide what amount makes sense for you. No cookie-cutter solution here, just what fits your life.

5.2 Understand Policy Limits and Payout Schedules

Not all policies pay the same. The “schedule of losses” will define how much you get for each injury. For example, losing a hand might pay 50% of the policy’s face value, while losing eyesight pays more. Check carefully: some policies have caps on total payout or limits per incident.

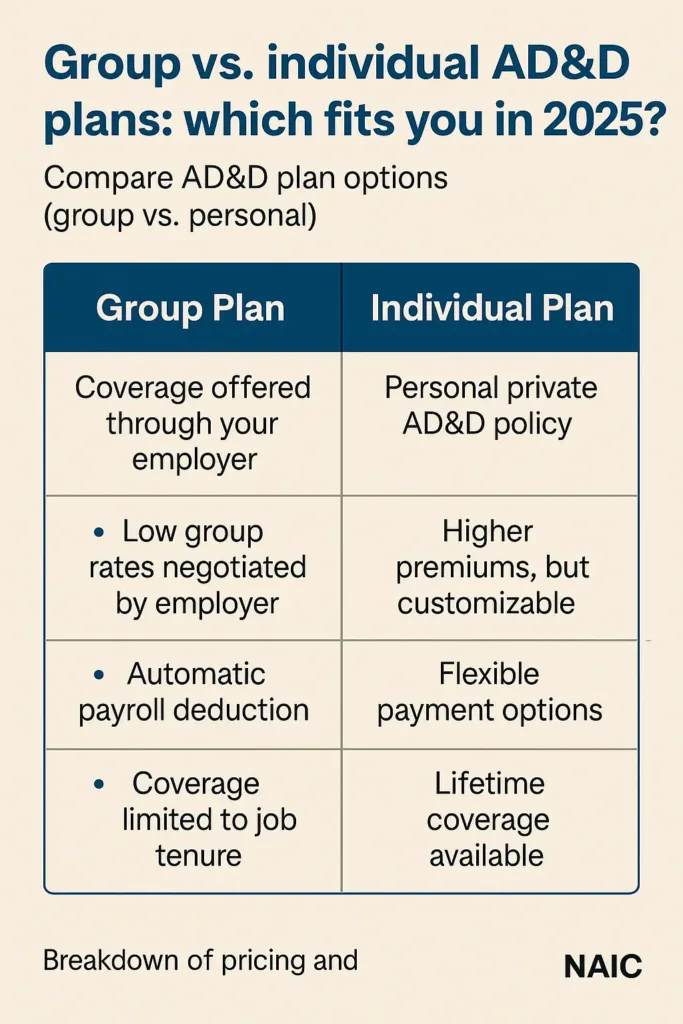

5.3 Compare Group vs Individual Plans

Sarah Chen didn’t set out to become an insurance expert. But after three brutal years in Boston’s COVID ICUs, the 35-year-old nurse made two practical decisions about her AD&D coverage that others might find worth copying.

First, she kept her hospital’s group plan – $11.73 gets automatically deducted from each paycheck for $150,000 in coverage. Then she added a personal policy through New York Life for another $100,000, paying $16.50 monthly. “I watched too many colleagues burn out and leave healthcare,” she tells me over coffee at Mass General. “This way, if I transition to telemedicine or leave bedside nursing, my protection doesn’t disappear.”

The numbers tell an interesting story:

- Employer plans average $5-$18/month but cap at 1.5x salary

- Private policies run $15-$50/month but allow 5-10x income coverage

- Combined, they cost less than most phone bills—making comprehensive life coverage surprisingly affordable for working families.

Sarah’s analogy sticks with me: “It’s the difference between having just anti-lock brakes versus ABS plus collision avoidance. When you’ve seen what I’ve seen, you want every available safeguard.”

5.4 Check for Additional Benefits and Riders

Some AD&D plans throw in extras like hospital cash, rehab benefits, or even coverage for paralysis. Sounds helpful, right? But here’s the catch: those ‘bonuses’ can sneakily hike up your premium—or come with fine print that’s a headache waiting to happen.

Before you sign anything, pause and ask yourself: Do I really need this? A flashy add-on might seem worth it today, but if it doesn’t fit your life, you’re just paying for peace of mind you’ll never use. And trust me—over-insuring hurts your wallet more than it helps.

5.5 Micro-Story: How Mark Found His Fit

Mark, 38, a warehouse supervisor in Detroit, shopped around for AD&D insurance after a coworker’s accident. “I compared the payouts and what wasn’t covered,” he said. “Ended up with a group plan at work and a small individual policy on the side—it gave me peace of mind without breaking the bank.”

6. Common Misconceptions About AD&D Insurance

6.1 Myth: AD&D Covers All Types of Death

Let me tell you about Emily from Des Moines. She’s 39, and like many of us, thought her uncle’s AD&D policy would help when he died suddenly from pneumonia. Tough lesson learned – it didn’t cover a dime. That’s because AD&D policies have this one big catch everyone should know about: they only pay out for accidental deaths. Not illnesses. Not natural causes. Just accidents.

I can’t tell you how many people get tripped up by this. You’d think insurance companies would make it clearer, right? But that’s why we’ve got to be our own advocates. Grab that policy document (yes, the one collecting dust in your drawer) and actually read what it says. I know, I know – it’s about as exciting as watching paint dry. But trust me, you’ll thank yourself later when you’re not facing nasty surprises during life’s worst moments.

Here’s what I tell my neighbors when they ask about AD&D: It’s like having a safety net that only works if you fall off a ladder, not if you get sick. Useful? Absolutely. But you’ve got to know exactly when it’ll catch you – and when it won’t.

This is why financial experts recommend pairing AD&D with traditional life insurance for seniors and younger families alike – each covers different scenarios.

6.2 Clearing Up Confusion: AD&D Isn’t Just Another Life Insurance

You know how sometimes we just assume we’re covered without really checking? Take my friend Jake – construction foreman out in Omaha. For years he figured his AD&D policy was basically life insurance with extra bells and whistles. Then one of his crew took a bad fall on the jobsite last spring.

That’s when Jake got the wake-up call: While the guy’s family got both payouts, Jake realized if it had been a heart attack instead of an accident? That AD&D policy wouldn’t have done squat.

Here’s the deal in plain terms:

- Life insurance = covers you no matter what (heart attack, cancer, old age)

- AD&D = only for accidents (falls, car crashes, that sort of thing)

Smart money says carry both – they’re like a hard hat and safety harness. Each protects you in different ways. But here’s what Jake tells his crew now: “Don’t wait until it’s too late to read the fine print.” Twenty minutes with your agent could save your family a mountain of stress down the road.

To make informed decisions, comparing life insurance policies side-by-side reveals exactly which combination works best for your family’s unique situation.

6.3 The Truth About AD&D Costs: Affordable or Overpriced?

Luis, 29, a graphic designer in Phoenix, said he thought AD&D would cost too much to bother. Turns out, his monthly premium is under $10, making it a low-cost safety net that offers peace of mind without breaking the bank. For many, it’s an affordable way to add extra coverage.

6.4 Myth: You Can Rely on Employer’s Coverage Alone

Sara, a 32-year-old nurse from Boston, learned the hard way that her work insurance wasn’t as solid as she thought. “I figured my hospital’s group plan had me fully covered,” she told me, “until I saw all the fine print about what they wouldn’t pay for.” Turns out, lots of employer plans come with hidden gaps – lower payout limits or specific injuries they just don’t cover.

What Sara realized? That company-provided coverage often works better as a starting point than a complete safety net. This mirrors how small business insurance works – employer plans provide basics, but comprehensive protection requires additional layers. For real protection, most folks need to add personal policies to fill those holes. It’s like how we nurses double-check our med carts – you want backups for your backups when people’s wellbeing is on the line.

6.5 Micro-Story: When Misunderstanding Costs You

Mark runs a warehouse in Detroit. At 36, he figured his AD&D policy had his back no matter what—until he laid his bike down on I-94 last spring. Turns out that “risky hobbies” clause buried in page 8? It meant his broken leg wasn’t covered. “I skipped the fine print because it looked like legal mumbo-jumbo,” he told us. “Now I keep a highlighter in my desk drawer for policy renewals.”

7. How to File an AD&D Insurance Claim: Step-by-Step Guide

7.1 Start with Your Employer or Insurer

Jennifer, an ER nurse from Raleigh, knows emergencies better than most. When she slipped on black ice last winter, her first call after 911? HR. “They walked me through every step,” she said. “Had I waited, I’d still be chasing paperwork instead of healing.” Pro tip: Most insurers give you 20-30 days to report—but doing it within 48 hours cuts processing time in half.

7.2 Gather All Necessary Documents

James (Austin, TX) keeps a “go folder” in his truck cab after his semi collision. “Police report, ER discharge papers, even Uber receipts to the clinic—I threw everything in,” he said. His claim paid out in 11 days versus the usual 30. What to stash:

- Incident reports (dated)

- Itemized medical bills

- Photos of injuries/accident scene

7.3 Fill Out the Claim Forms Carefully

Portland designer Maria learned the hard way: “I was so shaken after my car wreck, I botched the form twice.” Her advice?

- Photocopy the blank form first to practice

- Use blue ink—easier to spot originals

- Tape a checklist to your fridge: □ Signatures □ Witness info □ Doctor’s stamp

7.4 Follow Up and Stay Organized

Denver firefighter Kevin’s system? A $3 notebook from Walmart. “Every Monday at 9 AM, I’d call the adjuster and jot down who I spoke to,” he said. “When they ‘lost’ my file the third time, my notes got it found fast.” Track:

- Call dates/times

- Reference numbers

- Next steps promised

7.5 Micro-Story: How Tim Navigated His Claim

Tim, 42, a delivery driver in Phoenix, had a work accident that fractured his wrist. He called HR right away, collected all documents, and stayed on top of the claim process. “It wasn’t fun, but staying organized made a huge difference. I got my payout in under three months.”

Conclusion

Let’s be real – AD&D insurance isn’t some magic shield that covers every bad thing that could happen. But for hardworking folks across America, it’s like an extra airbag in life’s passenger seat – not the whole car, but valuable protection when accidents happen.

Whether you’re:

• Working the line at the plant

• Crushing spreadsheets in a cubicle

• Running the nonstop circus of family life

…understanding exactly what this coverage does (and doesn’t) do could save you serious headaches later. Here’s my challenge to you: Grab that policy document with your morning coffee this week and actually read it. Not just skim – really read it. Because when life suddenly swerves (and we all know it can), you’ll want every layer of protection you’ve got working for you.

P.S. Want to build a complete safety net? Our comprehensive health insurance coverage guide breaks down everything you need to know – from deductibles to doctor networks – in plain English real people actually use. For complete family protection, also explore our life insurance tips for over 50 and young professional coverage options.

FAQ

What does the AD&D insurance cover?

Look, AD&D insurance is basically accident protection. If you die in a car crash or bad fall, it pays out cash to your family. Lose an arm or leg in an accident? You’ll get part of the benefit amount.

But here’s what it won’t do:

• Cover you if you die from cancer or a heart attack

• Pay for just any injury – it’s only for specific losses like limbs or eyesight

• Replace your regular life insurance

The money can help with medical bills or living expenses after something terrible happens. Just know that every policy has its own rules about what exactly counts as a covered injury.

Works best for:

– Construction workers

– Truck drivers

– Anyone with a dangerous job (like those needing commercial vehicle insurance)

– People who want extra accident coverage beyond basic health insurance

Is it worth getting AD&D insurance?

Let’s talk straight about AD&D insurance. It’s that extra layer of protection that could save your family financial stress if something unexpected happens. Picture this: you’re a construction worker or truck driver – jobs where accidents can happen. AD&D steps in when life takes a sudden turn, providing quick cash when you need it most.

But keep this in mind:

• It’s accident-only coverage (car crashes, falls, etc.)

• Won’t help if illness strikes

• Typically pays within days, not weeks

Who’s it good for?

• Hands-on workers with higher-risk jobs

• Young families on a budget

• Anyone wanting affordable accident protection

The smart move? Use it to supplement your regular life insurance, not replace it. Like adding steel-toe boots to your work gear – it’s that extra protection that makes all the difference when things go wrong.

Do I need both life insurance and AD&D?

You know what I tell all my buddies? Get both. Life insurance covers your family no matter what happens – cancer, heart attack, old age. AD&D? That’s your accident backup – worksite falls, car crashes, that kind of thing.

Here’s why the combo works:

• Life insurance = your safety net

• AD&D = your extra padding

Take my cousin Mike – union electrician in Chicago. Had both policies when he took that bad fall at a job site. His family got:

• Full life insurance payout

• AD&D benefit for losing use of his hand

Now he says: “That extra AD&D money kept us afloat during rehab.”

Bottom line? If your job or lifestyle comes with risks, stacking these coverages makes sense. Just don’t skip the life insurance thinking AD&D’s enough – that’s like wearing a hard hat but no harness.

How is AD&D different from term life insurance?

AD&D and term life insurance – they’re different tools for different jobs. Let me break it down simply:

AD&D is your accident-only coverage:

• Pays if you die or lose limbs in accidents

• Partial payouts for serious injuries (like 50% for losing an arm)

• Won’t cover deaths from sickness

• Cheaper, but full of “gotchas” (no extreme sports, no drinking)

Term life is your all-purpose protection:

• Pays no matter how you die (accident, cancer, heart attack)

• Costs more, but covers way more

• Simple rules – just keep paying premiums

Most smart folks use AD&D as cheap extra coverage, especially if they work dangerous jobs. But term life? That’s your must-have foundation. Like my buddy who’s a roofer – he carries both. The AD&D covers his daily risks, while term life protects his family no matter what.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations. Insurance products are regulated by state insurance departments.