Running a business with vehicles puts you at serious financial risk without proper commercial vehicle insurance protection. Most business owners don’t realize their personal auto policy won’t cover work-related accidents, leaving them personally liable for potentially devastating costs. Understanding commercial vehicle insurance becomes critical for any business using vehicles for work purposes.

Here’s what happened to Mike, a contractor in Texas: He used his personal pickup truck to haul equipment to job sites. When he rear-ended another vehicle while carrying tools, his personal insurer denied the claim entirely. Mike faced $47,000 in property damage and medical bills out of pocket.

The Current Market Reality: Commercial vehicle insurance premiums have reached record highs in 2025. According to the Bureau of Labor Statistics, commercial auto insurance costs increased dramatically, with physical damage coverage rising 20-25% and auto liability jumping 10-20%. The global commercial vehicle insurance market, valued at $50 billion in 2023, projects reaching $75 billion by 2032.

Quick Decision Framework:

| Business Type | Risk Level | Coverage Priority |

|---|---|---|

| Delivery Services | High | Liability + Cargo |

| Construction | Very High | Comprehensive + Tools |

| Professional Services | Medium | Basic Liability |

You’ll discover the seven essential commercial vehicle insurance coverage types that protect your business, understand state-specific requirements that could trigger penalties, and learn cost-saving strategies that work despite 2025’s challenging market conditions.

On This Page

1. Why Commercial Vehicle Insurance Differs From Personal Coverage

Commercial vehicle insurance operates under fundamentally different rules than personal auto coverage. Understanding these distinctions helps you avoid dangerous coverage gaps that could bankrupt your business.

The Business Use Exclusion: Personal auto policies contain specific language excluding business activities. Even occasional work use can void your coverage entirely. If you deliver a single pizza or transport one client, you’ve crossed into commercial territory.

1.1 Legal Requirements Across Industries

Every state except New Hampshire requires commercial vehicle insurance for business-owned vehicles. However, requirements vary significantly based on vehicle weight, passenger capacity, and cargo type.

Federal Requirements Apply When:

- Vehicles exceed 10,001 pounds gross vehicle weight

- Transportation crosses state lines

- Carrying 16+ passengers (including driver)

- Hauling hazardous materials requiring placards

According to 49 CFR Part 387, the Federal Motor Carrier Safety Administration won’t grant operating authority until minimum financial responsibility levels are filed.

The complexity increases for specialized business operations. For instance, construction companies face unique challenges because their vehicles often transport expensive equipment while navigating dangerous job sites. These factors elevate risk profiles significantly beyond typical business use.

1.2 Coverage Limits Comparison

Commercial policies typically offer much higher liability limits than personal coverage:

Personal Auto Limits (typical state minimums):

- Bodily injury: $25,000 per person/$50,000 per accident

- Property damage: $25,000 per accident

Commercial Auto Recommendations:

- Bodily injury: $500,000-$1,000,000 per occurrence

- Property damage: $500,000-$1,000,000 per occurrence

The disparity becomes stark when you consider real-world accident costs. A serious injury requiring emergency surgery, intensive care, and rehabilitation can easily exceed $500,000. Property damage to expensive vehicles or commercial buildings can reach similar levels.

1.3 Real-World Cost Examples

Data from leading insurers shows dramatic cost differences between coverage levels:

- Basic liability only: $600-$1,500 annually for light commercial vehicles

- Comprehensive commercial coverage: $2,000-$6,000 annually for similar vehicles

- For-hire trucking: $5,000-$15,000 annually per vehicle

These costs reflect the increased exposure businesses face. Commercial vehicles typically drive more miles, operate in higher-risk environments, and face greater liability exposure than personal vehicles.

Understanding business insurance fundamentals helps you see how commercial auto fits into your overall risk management strategy.

1.4 Industry-Specific Risk Factors

Different industries face unique commercial vehicle insurance challenges that impact both coverage needs and costs.

High-Risk Industries: Food delivery services face constant time pressure, encouraging speeding and aggressive driving. Construction companies operate heavy vehicles on dangerous job sites with expensive equipment. Medical transport services carry vulnerable passengers requiring specialized care during emergencies.

Moderate-Risk Industries: Professional services like consulting or real estate typically involve lighter vehicles with occasional business use. However, they still need commercial coverage when visiting clients or transporting business materials.

Emerging Risk Categories: E-commerce delivery has exploded since 2020, creating new insurance challenges. Gig economy drivers often blur the lines between personal and commercial use, creating coverage gaps that traditional policies struggle to address.

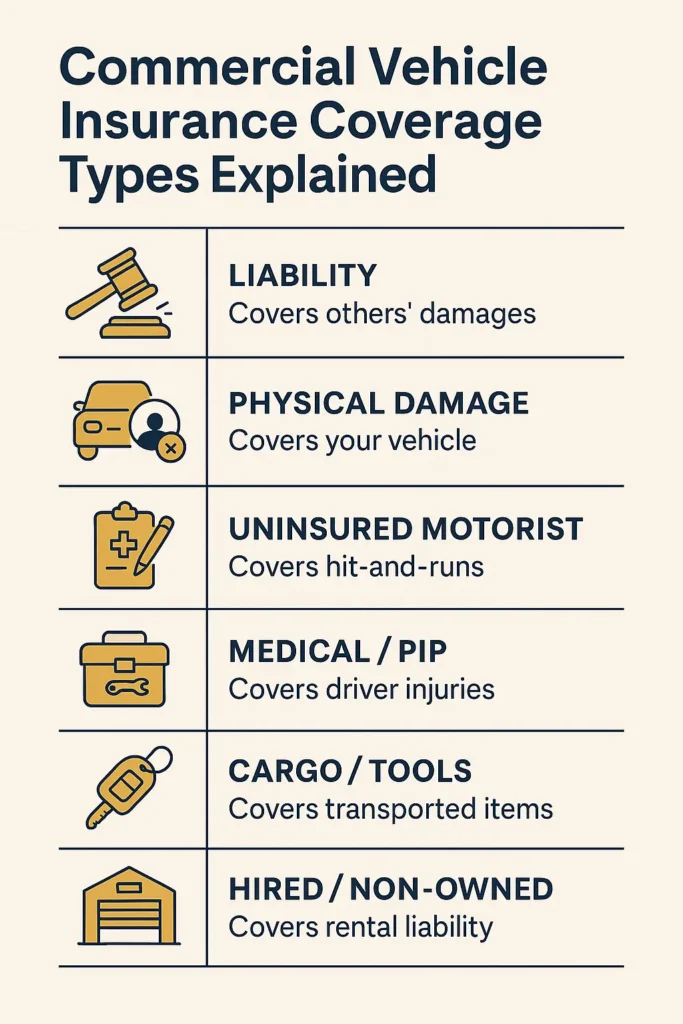

2. The 7 Essential Commercial Vehicle Insurance Coverage Types

Smart business owners layer multiple coverage types to create comprehensive protection. Each type addresses specific risks that could otherwise devastate your company’s finances.

2.1 Commercial Auto Liability (Foundation Coverage)

This mandatory coverage protects you when your business vehicle causes accidents resulting in injury or property damage to others.

What Liability Coverage Includes:

- Medical expenses for injured parties

- Property damage to other vehicles or structures

- Legal defense costs and court fees

- Settlement payments up to policy limits

- Lost wages for injured parties

- Pain and suffering compensation

2025 Market Data: Progressive Corp leads the commercial auto market with 15.2% market share and $10 billion in direct premiums written. Their data shows liability claims averaging $75,000 for serious accidents involving commercial vehicles.

Professional Insight: Nuclear verdicts (jury awards exceeding $10 million) have doubled in the trucking sector over the past decade. Even small businesses face exposure to seven-figure settlements.

Real-World Example: A landscaping company’s truck ran a red light, striking a luxury sedan carrying a software executive. The executive suffered spinal injuries requiring multiple surgeries and rehabilitation. The jury awarded $2.3 million in damages, far exceeding the company’s $300,000 liability limit. The business owner had to sell personal assets and declare bankruptcy.

Coverage Optimization Tips: Consider umbrella policies providing $1-5 million in excess liability coverage. These policies cost relatively little compared to the protection they provide. Many successful businesses carry $2-5 million in total liability coverage to protect against catastrophic claims.

2.2 Physical Damage Protection (Comprehensive + Collision)

Physical damage coverage protects your actual vehicles from theft, vandalism, weather, and collision damage.

Comprehensive Coverage Protects Against:

- Theft and vandalism (affecting 2.1 million vehicles annually)

- Weather damage from storms, hail, flooding

- Fire damage and animal collisions

- Falling objects and glass breakage

- Civil disturbances and riots

Collision Coverage Handles:

- Multi-vehicle accidents

- Single-vehicle crashes (poles, trees, barriers)

- Hit-and-run incidents

- Rollover accidents

- Backing accidents in parking lots

Real Cost Analysis: Deductible choices significantly impact premiums. Raising deductibles from $500 to $1,000 saves approximately 13% on annual premiums, according to industry data.

Advanced Considerations: Agreed value coverage ensures you receive predetermined amounts for total losses, eliminating depreciation disputes. This option particularly benefits businesses with specialized vehicles or equipment that may not have standard market values.

Technology Integration: Modern commercial vehicles often contain expensive electronics, GPS systems, and specialized equipment. Ensure your physical damage coverage accounts for these additions, as standard policies may not cover aftermarket equipment.

2.3 Uninsured/Underinsured Motorist Protection

This critical coverage becomes essential when other drivers lack adequate insurance to cover your damages.

Startling Statistics:

- 13% of US drivers operate without insurance

- 20% carry only minimum liability limits

- Commercial vehicles face higher exposure due to increased road time

- Uninsured driver rates vary dramatically by state, from 4.5% in Massachusetts to 23.5% in Mississippi

Coverage Includes:

- Medical expenses for you and employees

- Lost wages during recovery

- Property damage when other drivers can’t pay

- Legal costs for pursuing uninsured drivers

- Pain and suffering compensation

Case Study: A delivery company’s van was hit by an uninsured drunk driver, causing $85,000 in medical bills and lost wages for the injured employee. Without uninsured motorist coverage, the company would have faced these costs directly. The coverage paid all expenses and allowed the business to continue operations.

For businesses operating across multiple states, understanding workers compensation requirements becomes equally important for comprehensive protection.

2.4 Medical Payments and Personal Injury Protection (PIP)

These coverages handle medical expenses for vehicle occupants regardless of fault in accidents.

Medical Payments Coverage:

- Covers immediate medical expenses for vehicle occupants

- Typically ranges from $1,000 to $10,000 per person

- No fault determination required

- Covers ambulance, hospital, and initial treatment costs

Personal Injury Protection (PIP):

- Required in no-fault states

- Covers medical expenses, lost wages, and essential services

- Higher limits than medical payments coverage

- May include rehabilitation costs and disability benefits

Strategic Value: These coverages provide immediate financial relief after accidents, preventing cash flow problems while liability determinations proceed. They also demonstrate good faith to injured employees and can help maintain positive workplace relationships.

2.5 Cargo and Equipment Coverage

Standard commercial vehicle insurance doesn’t automatically cover cargo, tools, or equipment transported in vehicles.

What Standard Policies Exclude:

- Tools and equipment not permanently attached

- Cargo being transported for customers

- Personal property of employees

- Electronic equipment like laptops or tablets

Specialized Coverage Options:

- Inland Marine Coverage: Protects tools and equipment anywhere

- Cargo Insurance: Covers goods being transported for others

- Contractors Equipment Coverage: Protects specialized tools and machinery

Real-World Scenarios: A plumbing contractor’s van was broken into overnight, resulting in $15,000 in stolen tools. Standard commercial auto coverage excluded the tools because they weren’t permanently attached. The contractor needed separate inland marine coverage for protection.

2.6 Hired and Non-Owned Auto Coverage

This coverage addresses liability when employees use personal vehicles for business or when you rent vehicles.

When You Need HNOA:

- Employees run errands in personal cars

- Employees travel to job sites in personal vehicles

- You occasionally rent vehicles for business use

- Employees pick up supplies in personal cars

Coverage Limitations: HNOA provides liability coverage but doesn’t protect the actual vehicle. Employees’ personal insurance typically handles physical damage to their own vehicles.

Cost-Effective Solution: HNOA coverage is relatively inexpensive, often costing $200-500 annually for substantial liability protection. It’s essential for businesses that rely on employee vehicle use but don’t want to maintain company fleets.

2.7 Garage Liability and Garagekeepers Coverage

Businesses that service, store, or work on vehicles need specialized coverage beyond standard commercial auto insurance.

Garage Liability Coverage:

- Protects against liability arising from garage operations

- Covers accidents during test drives

- Addresses liability for defective repairs

- Includes product liability for parts and services

Garagekeepers Legal Liability:

- Covers customer vehicles in your care, custody, and control

- Protects against theft, vandalism, or damage while serviced

- Essential for repair shops, dealerships, and parking operations

These specialized coverages become crucial for automotive service businesses, parking operations, and any company that regularly works on customer vehicles.

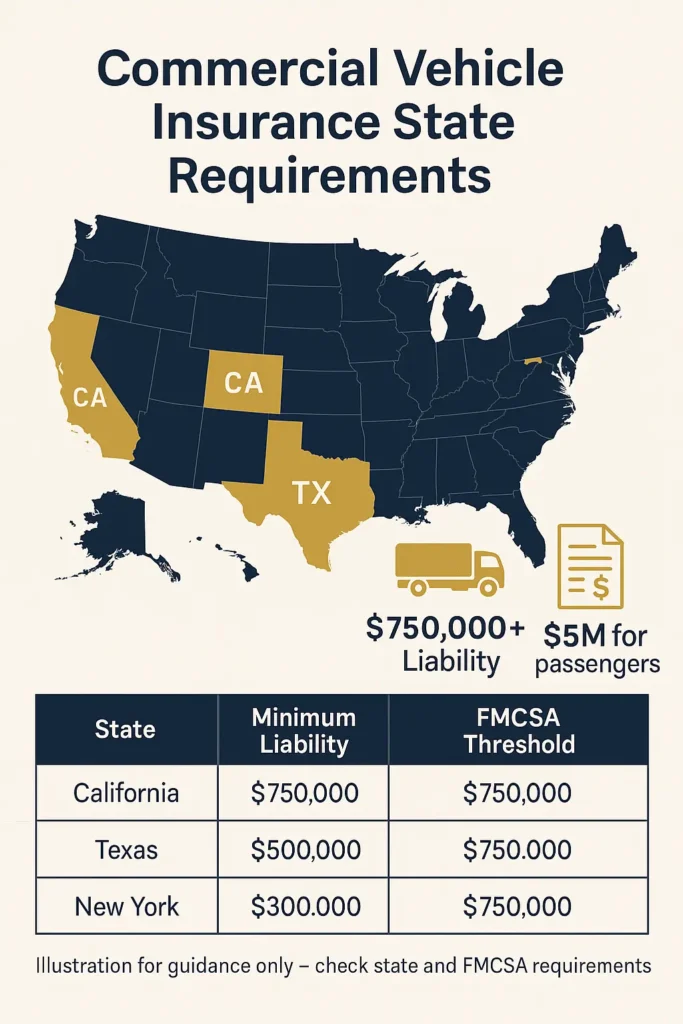

3. State-by-State Commercial Vehicle Insurance Requirements

Commercial vehicle insurance requirements create a complex web of state and federal regulations. Non-compliance triggers immediate penalties including license suspension and hefty fines.

3.1 Minimum Liability Requirements by Region

Requirements vary dramatically across states, creating challenges for multi-state operations:

High-Requirement States:

| State | Minimum Liability | Special Notes |

|---|---|---|

| Alaska | 50/100/25 | Harsh weather factors |

| California | 30/60/15 | Increased from 15/30/5 in 2025 |

| Hawaii | 20/40/10 | Island-specific risks |

| New York | 25/50/10 | No-fault state requirements |

Moderate-Requirement States:

| State | Minimum Liability | Special Notes |

|---|---|---|

| Texas | 30/60/25 | Federal rules for interstate |

| Florida | 25/50/10 | PIP required, no-fault |

| Illinois | 25/50/20 | Urban density factors |

| Ohio | 25/50/25 | Standard commercial requirements |

Lower-Requirement States:

| State | Minimum Liability | Special Notes |

|---|---|---|

| Alabama | 25/50/25 | Additional federal requirements |

| Arizona | 25/50/15 | Hazmat transport variations |

| Arkansas | 25/50/25 | Property carrier requirements |

| Colorado | 25/50/15 | Mountain driving considerations |

3.2 Federal Interstate Commerce Rules

Operating across state lines triggers additional Federal Motor Carrier Safety Administration requirements that exceed state minimums.

Weight-Based Requirements:

- Vehicles 10,001+ pounds: $750,000 minimum liability

- General freight trucks: $750,000 minimum

- Passenger vehicles (16+ capacity): $5,000,000 minimum

- Household goods carriers: $300,000 minimum

Cargo-Specific Requirements:

- Household goods: $300,000 minimum

- Oil transport: $1,000,000 minimum

- Hazardous materials: $1,000,000-$5,000,000 depending on substance

- General freight: $750,000 minimum

Interstate vs. Intrastate Operations: The distinction between interstate and intrastate commerce significantly impacts insurance requirements. Interstate commerce includes any transportation that crosses state lines or affects interstate commerce, even if the route stays within one state.

3.3 Registration and Compliance Process

The FMCSA requires specific insurance forms filed by authorized insurance companies:

Required Forms:

- Form MCS-90: Motor carrier liability endorsement

- Form BMC-91/91X: Public liability insurance proof

- Form BMC-34: Cargo insurance filing

- Form BOC-3: Process agent designation

Critical Deadline: Insurance companies must file appropriate forms within 20 days of authority application publication. Failure results in automatic application dismissal.

New 2025 Requirements: FMCSA transitioned to a secure portal system requiring Login.gov authentication and multi-factor authentication for all insurance filings.

3.4 Penalties for Non-Compliance

States impose severe penalties for operating commercial vehicles without proper insurance:

Common Penalties:

- Fines ranging from $500 to $5,000 for first offenses

- License suspension for 30-90 days

- Vehicle registration suspension

- Impoundment of vehicles in some states

- SR-22 filing requirements for reinstatement

Repeat Offender Consequences:

- Increased fines up to $10,000

- Longer license suspensions (6 months to 2 years)

- Permanent revocation of commercial privileges

- Criminal charges in some jurisdictions

Business Impact: Beyond direct penalties, non-compliance creates serious business consequences including loss of operating authority, customer confidence, and potential civil liability if accidents occur while uninsured.

Companies operating specialized commercial vehicles should also consider professional liability insurance for service-related risks.

4. Commercial Vehicle Insurance Costs and Industry Analysis

Understanding cost drivers helps you budget effectively and identify savings opportunities in today’s expensive insurance market.

4.1 Industry-Specific Cost Breakdown

Commercial vehicle insurance costs vary dramatically by industry risk profile:

Low-Risk Industries:

| Industry | Average Monthly Cost | Primary Risks | Annual Cost Range |

|---|---|---|---|

| Auto Services | $69 | Garage liability | $828-$1,200 |

| Consulting | $147 | Limited vehicle use | $1,764-$2,400 |

| Professional Services | $200 | Client property visits | $2,400-$3,600 |

| Office Services | $125 | Minimal exposure | $1,500-$2,000 |

High-Risk Industries:

| Industry | Average Monthly Cost | Primary Risks | Annual Cost Range |

|---|---|---|---|

| Construction | $173 | Heavy equipment transport | $2,076-$4,500 |

| Installation Services | $184 | Tool/equipment exposure | $2,208-$4,800 |

| Landscaping | $190 | Equipment and chemicals | $2,280-$4,200 |

| For-hire Trucking | $816+ | Highway exposure, cargo liability | $9,792-$18,000+ |

Market Analysis 2025: The commercial auto insurance market reached $182.65 billion in 2024, with projected growth to $398.46 billion by 2032 at a 9.2% CAGR, according to Market Research Future.

4.2 Vehicle Type Impact on Premiums

Different vehicle classifications carry distinct risk profiles affecting insurance costs:

Light Commercial Vehicles (under 10,000 lbs):

- Pickup trucks: $600-$1,500 annually

- Cargo vans: $800-$2,000 annually

- Box trucks: $1,200-$3,000 annually

- Service vehicles: $900-$2,200 annually

Heavy Commercial Vehicles (over 10,000 lbs):

- Specialty trucks: $8,952 annually average

- For-hire transport: $11,448 annually average

- Tow trucks: $7,428 annually average

- Dump trucks: $6,500-$12,000 annually

Fleet Size Impact:

- Single vehicle: Base rates

- 2-5 vehicles: 5-10% discount potential

- 6-15 vehicles: 10-15% discount potential

- 16+ vehicles: 15-25+ discount potential

4.3 Technology-Driven Cost Factors

Telematics and safety technology significantly impact premiums in 2025:

Usage-Based Insurance (UBI) Programs: Progressive’s Snapshot ProView program offers discounts for safe driving behavior and fleet management tools. UBI participants save approximately 3% on premiums according to recent industry data.

Safety Technology Discounts:

- Electronic stability control: $8 annual savings

- Blind-spot monitoring: Minimal savings currently

- Automatic emergency braking: 5-15% potential discounts

- Lane departure warning: 3-8% potential discounts

- Dashboard cameras: 5-20% potential discounts

Fleet Management Systems: Advanced fleet management systems providing real-time tracking, driver behavior monitoring, and maintenance scheduling can qualify for significant discounts. Some insurers offer up to 25% premium reductions for fleets demonstrating consistent safety improvements.

4.4 Geographic Cost Variations

Insurance costs vary significantly by geographic location due to different risk factors:

High-Cost Areas:

- Urban centers with heavy traffic

- Areas with high crime rates

- Regions prone to severe weather

- States with high litigation rates

Cost-Saving Locations:

- Rural areas with less traffic density

- States with tort reform limitations

- Regions with lower crime rates

- Areas with fewer severe weather events

Urban vs. Rural Cost Differences: Urban commercial vehicle insurance can cost 25-50% more than rural coverage due to increased accident frequency, higher repair costs, and elevated theft risks.

For construction companies, combining vehicle coverage with business interruption insurance provides comprehensive operational protection.

5. Choosing Optimal Commercial Vehicle Insurance Coverage

Selecting appropriate coverage requires balancing comprehensive protection with manageable costs while considering your specific business risk profile.

5.1 Risk Assessment Framework

Evaluate your business’s exposure level using these key criteria:

High-Risk Indicators:

- Multiple daily trips or long-distance routes

- Valuable cargo or equipment regularly transported

- Urban driving or construction zone exposure

- New or inexperienced drivers on payroll

- Previous accidents or insurance claims

- Operations in high-crime areas

- Time-sensitive delivery requirements

Lower-Risk Indicators:

- Occasional business vehicle use only

- Experienced drivers with clean records

- Suburban routes with limited traffic

- Standard cargo with minimal value

- Strong safety training programs

- Comprehensive maintenance programs

- Office-based operations with minimal driving

Medium-Risk Indicators:

- Regular but predictable routes

- Moderate-value cargo or equipment

- Mixed urban and suburban driving

- Experienced drivers with minor violations

- Standard business operations

5.2 Coverage Level Strategies

Minimum Compliance Strategy (High Risk): Only choose state minimums if you have limited business assets and accept significant financial exposure. This approach saves money short-term but creates long-term bankruptcy risk.

Recommended for: New businesses with minimal assets and tight cash flow Risks: Personal liability for excess damages, potential business closure

Balanced Protection Strategy (Recommended): Most businesses benefit from:

- $500,000-$1,000,000 liability coverage

- Comprehensive and collision with $500-$1,000 deductibles

- Uninsured/underinsured motorist protection matching liability limits

- Medical payments coverage of $5,000-$10,000

Recommended for: Established businesses with moderate assets Benefits: Good protection-to-cost ratio, covers most scenarios

Maximum Protection Strategy (Asset-Rich Businesses): High-revenue companies should consider:

- $1,000,000-$2,000,000 primary liability

- Umbrella policies providing $5,000,000+ excess coverage

- Lower deductibles ($250-$500) for faster claims resolution

- Additional coverages like rental reimbursement

Recommended for: High-revenue businesses with significant assets Benefits: Comprehensive protection against catastrophic losses

5.3 Specialized Coverage Considerations

Hired and Non-Owned Auto (HNOA): Essential when employees use personal vehicles for business errands or you rent vehicles occasionally. HNOA provides liability coverage but doesn’t protect the actual vehicle.

Coverage Scenarios:

- Employee picks up office supplies in personal car

- Sales representative visits clients in personal vehicle

- Occasional rental vehicle use for business trips

- Temporary vehicle needs during repairs

Tools and Equipment Coverage: Standard commercial auto policies exclude tools and equipment unless permanently attached to vehicles. Consider separate inland marine coverage for valuable tools, typically costing $200-$500 annually per $10,000 of equipment.

Gap Coverage for Financed Vehicles: Protects against the difference between vehicle actual cash value and remaining loan balance. Particularly important for new commercial vehicles that depreciate rapidly.

Rental Reimbursement: Covers rental vehicle costs while your commercial vehicle undergoes covered repairs. Typical coverage ranges from $30-75 per day for 30-60 days.

5.4 Multi-State Operations Considerations

Businesses operating across multiple states face complex coverage requirements:

Interstate Commerce Requirements:

- Must meet highest state requirements of all operating states

- Federal requirements may exceed state minimums

- MCS-90 endorsement required for interstate carriers

- Proof of insurance must be filed with FMCSA

Coverage Strategy: Choose coverage levels that meet the highest requirements of all operating states to ensure compliance everywhere. This approach simplifies administration and ensures consistent protection.

Businesses expanding should explore cyber insurance options as vehicles become increasingly connected and vulnerable to digital threats.

6. 2025 Market Challenges and Emerging Trends

The commercial vehicle insurance landscape faces unprecedented disruption in 2025, with rate increases, coverage restrictions, and technological changes reshaping the industry.

6.1 Current Market Hardening Conditions

The commercial auto insurance market continues experiencing significant challenges affecting both insurers and businesses.

Premium Increase Data:

- Physical damage coverage: 20-25% increases in 2025

- Umbrella liability: 10-30% increases

- Auto liability: 10-20% increases

- Overall market growth: 9.2% CAGR through 2032

Underlying Cost Drivers: Social inflation has particularly impacted commercial auto insurance. According to the American Transportation Research Institute, trucking verdicts increased over 50% annually for the past decade, with nuclear verdicts doubling during this timeframe.

Insurer Response: Many commercial auto insurers decreased risk appetites, restricted coverage offerings, or exited markets entirely. This consolidation reduces competition and increases costs for businesses seeking coverage.

6.2 Nuclear Verdicts and Litigation Trends

The surge in extreme jury awards creates significant challenges for commercial vehicle operators.

Litigation Statistics:

- Average statutory closed claim payments increased 39% from 2019-2023

- Nuclear verdicts (awards exceeding $10 million) doubled in trucking

- Third-party litigation funding increases case severity

- Attorney representation in auto claims reached record levels

Market Response: Many commercial auto insurers decreased risk appetites, restricted coverage offerings, or exited markets entirely. This leaves businesses with fewer options and higher costs.

Defensive Strategies:

- Implement comprehensive safety programs

- Invest in driver training and monitoring

- Consider higher liability limits and umbrella coverage

- Establish strong legal representation relationships

- Document safety procedures and compliance efforts

6.3 Electric Vehicle Integration Challenges

Commercial fleets increasingly adopt electric vehicles, but insurance challenges persist.

EV Insurance Complications:

- Higher purchase prices increase comprehensive/collision premiums

- Cybersecurity risks from connected technologies

- Specialized repair requirements and longer downtime

- Battery fire hazards requiring unique emergency response

- Limited repair facility networks

Market Adoption Data: US commercial and government fleets had over one million EVs by 2021, representing a 233% increase from 2019. Projections exceed four million EVs by 2030.

Insurance Industry Response: While EV fleet premiums start higher, long-term outlooks are positive as technology advances and markets mature. Insurers develop specialized programs addressing EV-specific risks.

6.4 Telematics and Data-Driven Insurance

Advanced telematics systems reshape how insurers assess and price commercial vehicle risks.

Telematics Benefits:

- Real-time driver behavior monitoring

- Accident prevention through alerts and coaching

- Theft recovery assistance

- Maintenance optimization

- Route efficiency improvements

Privacy and Data Concerns:

- Employee privacy rights regarding tracking

- Data security and cyber protection

- Compliance with state privacy laws

- Proper consent and disclosure procedures

Usage-Based Insurance Growth: UBI programs continue expanding, with participation saving businesses 5-25% on premiums for demonstrably safe operations.

6.5 Autonomous Vehicle Impact

Self-driving technology begins affecting commercial vehicle insurance as pilot programs expand.

Current Development:

- Limited autonomous features in commercial vehicles

- Pilot programs for highway trucking

- Warehouse and port automation

- Local delivery autonomous vehicles

Insurance Implications:

- Liability shifts from drivers to manufacturers

- Product liability becomes more prominent

- Cyber security risks increase significantly

- Traditional risk models require complete revision

For businesses preparing for future challenges, understanding small business insurance costs helps with comprehensive planning.

7. Practical Implementation and Cost Management

Successfully managing commercial vehicle insurance requires strategic planning, ongoing monitoring, and proactive risk management.

7.1 Insurance Procurement Best Practices

Shop Multiple Carriers: Obtain quotes from at least 3-5 insurance companies, as rates can vary significantly for identical coverage. Work with agents who specialize in commercial auto insurance and understand your industry’s specific risks.

Timing Your Purchase:

- Renew policies 60-90 days before expiration

- Avoid last-minute shopping that limits options

- Consider mid-term policy changes for significant business changes

- Time fleet additions carefully to optimize pricing

Documentation Requirements: Prepare comprehensive information for accurate quotes:

- Driver motor vehicle records for all operators

- Vehicle identification numbers and specifications

- Business financial statements

- Loss history for past 3-5 years

- Detailed business operations descriptions

7.2 Claims Management Strategies

Immediate Response Procedures:

- Establish 24/7 claims reporting protocols

- Train drivers on proper accident procedures

- Implement immediate medical attention protocols

- Document all incidents thoroughly

- Notify insurance carriers promptly

Claims Investigation Support:

- Preserve accident scenes when possible

- Collect witness statements and contact information

- Photograph all damage and scene conditions

- Obtain police reports immediately

- Coordinate with legal counsel when necessary

Return-to-Work Programs: Effective programs minimize lost time and control claims costs:

- Modified duty assignments for injured employees

- Regular communication with medical providers

- Graduated return schedules based on capabilities

- Alternative work arrangements when appropriate

7.3 Fleet Safety Program Development

Driver Selection and Training:

- Comprehensive background checks and MVR reviews

- Initial safety training for all new drivers

- Regular refresher training sessions

- Performance monitoring and corrective action

- Recognition programs for safe driving

Vehicle Maintenance Programs:

- Regular preventive maintenance schedules

- Pre-trip and post-trip inspection requirements

- Prompt repair of safety-related issues

- Documentation of all maintenance activities

- Regular safety equipment inspections

Technology Integration:

- Dashboard cameras for incident recording

- GPS tracking for route optimization

- Driver behavior monitoring systems

- Regular safety reporting and analysis

- Integration with insurance carrier programs

7.4 Cost Control Strategies

Deductible Optimization: Higher deductibles significantly reduce premiums but increase out-of-pocket expenses for claims. Analyze your claims frequency to determine optimal deductible levels.

Fleet Right-Sizing:

- Regularly evaluate vehicle utilization

- Consider alternative arrangements (rentals, leasing)

- Optimize fleet size for actual business needs

- Dispose of underutilized vehicles promptly

Safety Incentive Programs:

- Driver safety bonuses and recognition

- Team safety competitions

- Insurance carrier discount programs

- Technology adoption incentives

- Regular safety training investments

Understanding how commercial vehicle insurance integrates with cyber insurance for small business becomes increasingly important as vehicles become more connected and data-dependent.

Conclusion: Essential Steps for Commercial Vehicle Insurance Success

Commercial vehicle insurance represents critical protection that can determine your business’s survival after a serious accident. With market premiums increasing 10-25% in 2025 and nuclear verdicts creating unprecedented exposure, adequate coverage is more important than ever.

Key Strategic Takeaways:

✓ Legal Compliance: All states except New Hampshire require commercial coverage for business vehicle use

✓ Coverage Adequacy: Consider $500,000-$1,000,000 liability minimums regardless of state requirements

✓ Cost Management: Leverage safety technology, driver training, and higher deductibles for premium savings

✓ Regular Reviews: Annual policy reviews ensure coverage keeps pace with business growth and market changes ✓ Risk Management: Implement comprehensive safety programs to control losses and qualify for discounts ✓ Technology Adoption: Embrace telematics and safety technology for both protection and cost savings

Immediate Action Steps:

- Assess Current Exposure: Determine if your business vehicles need commercial coverage based on usage patterns

- Research State Requirements: Verify minimum coverage levels and any special requirements for your vehicle types

- Obtain Multiple Quotes: Compare coverage options from at least three carriers to find optimal protection and pricing

- Implement Safety Programs: Establish driver training and vehicle maintenance programs to qualify for discounts

- Document Everything: Maintain detailed records of safety programs, training, and maintenance for insurance reviews

- Plan for Growth: Structure coverage to accommodate business expansion without coverage gaps

Market Outlook for 2025: Expect continued premium increases of 5-15% as insurers address profitability challenges. However, businesses investing in safety technology and driver training programs can achieve better rates than market averages.

Long-Term Strategic Considerations:

- Electric vehicle integration planning

- Autonomous vehicle technology preparation

- Cyber security risk management

- Climate change impact on operations

- Evolving regulatory requirements

The commercial vehicle insurance market will remain challenging throughout 2025, but companies that understand their risks and work proactively with experienced agents can still secure comprehensive protection. Don’t wait for an accident to discover coverage gaps – invest in proper commercial vehicle insurance today to protect your business’s future.

For comprehensive risk management, consider how commercial auto coverage integrates with your overall business insurance strategy to ensure complete protection across all operational areas.

Sources & References