When her bumper got smashed outside a grocery store in Tulsa, Oklahoma, Monica figured it was a quick fix. The guy who hit her apologized, handed over his insurance—then vanished. A week later, his policy only covered $10,000, but Monica’s SUV repairs came in at nearly $17,000. Guess who paid the rest?

So what is property damage liability, and how much do you actually need when things go wrong?

It’s the part of your car insurance that pays for damage you cause to other people’s vehicles or property. Most states require it, but not all minimums come close to covering real-world costs. According to the NAIC (2024), the average property damage claim now exceeds $5,300, with totals often higher in urban areas.

If you’ve never really looked at your coverage limits—or assumed “minimum” meant “enough”—you might be more exposed than you think. Let’s unpack what really matters in 2025.

On a foggy morning in Cincinnati, Ohio, James was driving to work like any other Tuesday. He wasn’t speeding, but he glanced at his phone for a second too long. In that brief moment, his car swerved slightly and clipped a parked Lexus. The damage? Over $12,000—just for a fender and bumper. His insurance covered only $10,000 in property damage liability. The remaining $2,000? That came straight from his savings. And that wasn’t even counting the legal letter he received two weeks later.

Too many drivers assume that if they meet their state’s minimums, they’re protected. But in 2025, those minimums haven’t caught up with the real cost of vehicle repairs, which have surged over 31% since 2020 according to Statista. A single luxury car, a fence, or even a utility pole can easily push a claim past the average coverage limits. And when that happens, you’re not just dealing with a bill—you could be sued, lose wages, or even face liens on your property.

Here’s the thing no one tells you when you sign that policy: property damage liability isn’t just a box to check. It’s a legal and financial shield—one that’s only as strong as the numbers behind it. And while it’s mandatory in most states, the required amounts often haven’t changed in decades. They were designed for a time when replacing a bumper cost $600, not $6,000.

Now pause for a second and think this through—if you’re responsible for an accident tomorrow, and the other person’s car is worth $80,000, would your policy even come close? Most Americans carry $10K to $25K in property damage liability, but lawsuits related to damage claims now routinely seek $50K+, especially in metro areas.

Pro Tip: Many insurers default to state minimums unless you ask. Review your limits annually, especially if you drive in high-density or high-value vehicle zones (think Los Angeles, Miami, Dallas). Don’t wait until a claim exposes the gap.

In 2025, with more electric vehicles on the road, complex ADAS systems, and inflated parts costs, property damage liability has become less of a technicality and more of a legal survival tool. It still matters—more than ever—because the financial fallout from being underinsured doesn’t care if you “thought you had enough.”

On This Page

2. What Property Damage Liability Actually Covers

2.1 Covered Situations You Didn’t Expect

When Marcus clipped a stop sign pulling out of a tight parking spot in Fresno, California, he figured his deductible would take the hit. What surprised him was that his property damage liability—not his collision coverage—ended up footing the bill. Why? Because the damage involved public property. And in 2025, cities don’t take kindly to unpaid municipal repairs.

Most drivers associate property damage liability with other vehicles, but it covers much more than just bumpers and fenders. If you hit a mailbox, a garage, a traffic light, or even a storefront window, your liability coverage steps in. The key rule: if you damage someone else’s physical property in an at-fault accident, this portion of your insurance pays for it.

It also covers rental car companies if you damage their property, utility equipment like telephone poles or power boxes, and even parked cars—regardless of whether someone is inside. And here’s one few people know: if you cause a multi-car pileup, your property damage liability will be stretched across every car you hit.

That’s where most people get blindsided. A $25K limit may seem generous—until you’re on the hook for four vehicles and a fire hydrant. According to the Insurance Information Institute (2025), the average multi-car property damage claim now totals $46,700.

Real-World List: What Property Damage Liability Typically Covers

✅ Other people’s cars

✅ Fences, garages, mailboxes

✅ City property (signs, poles, hydrants)

✅ Storefronts and commercial damage

✅ Public rental vehicles or business fleet damage

✅ Legal costs tied to covered property damage

If you ever thought “I don’t need more than the minimum,” think again. The coverage isn’t just for big crashes—it quietly shields you from daily risks you rarely consider.

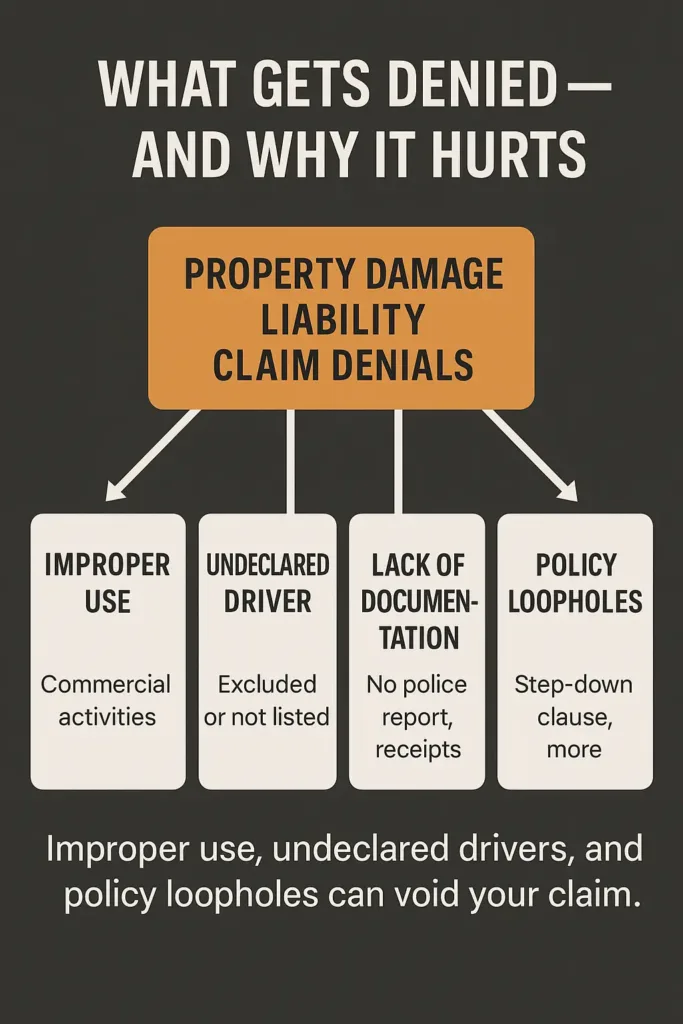

2.2 What Gets Denied — And Why It Hurts

Jessica, a rideshare driver in Phoenix, rear-ended a small landscaping truck. The damage to the trailer-mounted mower exceeded $9,000. Her property damage liability kicked in—only to be partially denied. Why? Because the trailer wasn’t registered, and the insurer disputed whether it qualified as “covered property.”

Not everything is guaranteed. Despite being broad, property damage liability has clear exclusions—and some are easy to overlook. It never covers your own car—even if you were completely at fault. That’s collision territory. It also excludes damage to personal belongings inside vehicles, like laptops or luggage, and won’t pay for harm to shared property if you live with the person affected.

Another tricky edge case: damage to company-owned assets while driving for work. Unless your policy includes specific endorsements or your employer’s insurance covers the incident, your personal property damage liability won’t apply.

Many claims are denied due to technicalities in policy language—like improper use of the vehicle, undeclared drivers, or lack of documentation. In 2025, insurers have become more aggressive in applying these clauses, especially under economic pressure.

Pro Tip: Always get clear written definitions from your insurer about what counts as “covered property.” Take photos at the scene, keep police reports, and never assume “liability” means unlimited.

If you’re blindsided by a denied claim, it’s not just frustrating—it can put you in serious legal jeopardy. Lawsuits stemming from contested damage claims are up 22% since 2022, according to LexisNexis Risk Solutions (2024). And the most common reason? Assuming your policy covers more than it does.

3. How Much Property Damage Liability You Need to Avoid Regret

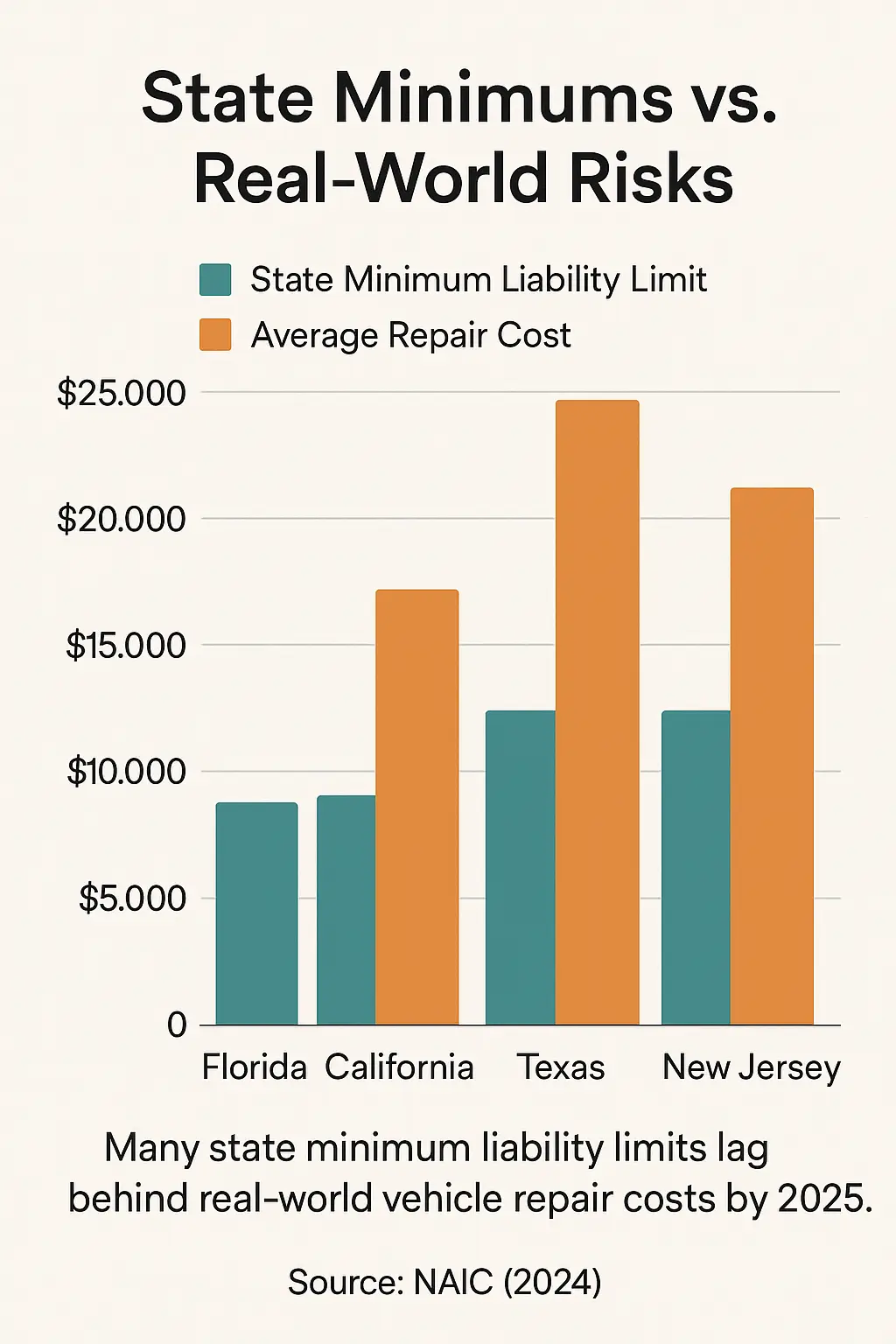

3.1 State Minimums vs. Real-World Risks

In Nevada, you’re legally expected to carry at least $20,000 in property damage liability, but that figure hasn’t kept pace with today’s repair costs—even for basic fender benders. Rear-end a luxury SUV, and you might easily trigger a chain reaction involving multiple vehicles. Throw in towing, parts delays, legal claims, and you’re easily facing $40,000+ in damages.

The reality is: most state-mandated minimums are dangerously outdated. Many were set back when car parts were simpler and cheaper. But in 2025, even mid-range vehicles come loaded with sensors, cameras, and electric systems that send repair estimates soaring.

Data from the NAIC (2024) reveals that the typical property damage liability claim in the U.S. has risen above $5,300, and it’s even higher in metro areas where repair bills spike quickly. For example, in Los Angeles and New York, it’s not unusual to see damage claims approach $10,000—sometimes without even involving injuries.

UX Add-on — Minimums vs. Modern Costs

State Required Minimum (2025) Avg Urban Claim Florida $10,000 $9,200 California $5,000 $10,400 Texas $25,000 $8,750 New Jersey $25,000 $11,800

The disconnect is clear: legal thresholds are lagging, while repair bills climb. If you’re relying solely on minimums, you’re betting your own savings that the damage won’t exceed them. And that’s a bet more drivers lose than win.

If you’re found responsible in a crash, your property damage liability acts like a financial buffer between you and a lawsuit—but that buffer has limits most drivers don’t realize.

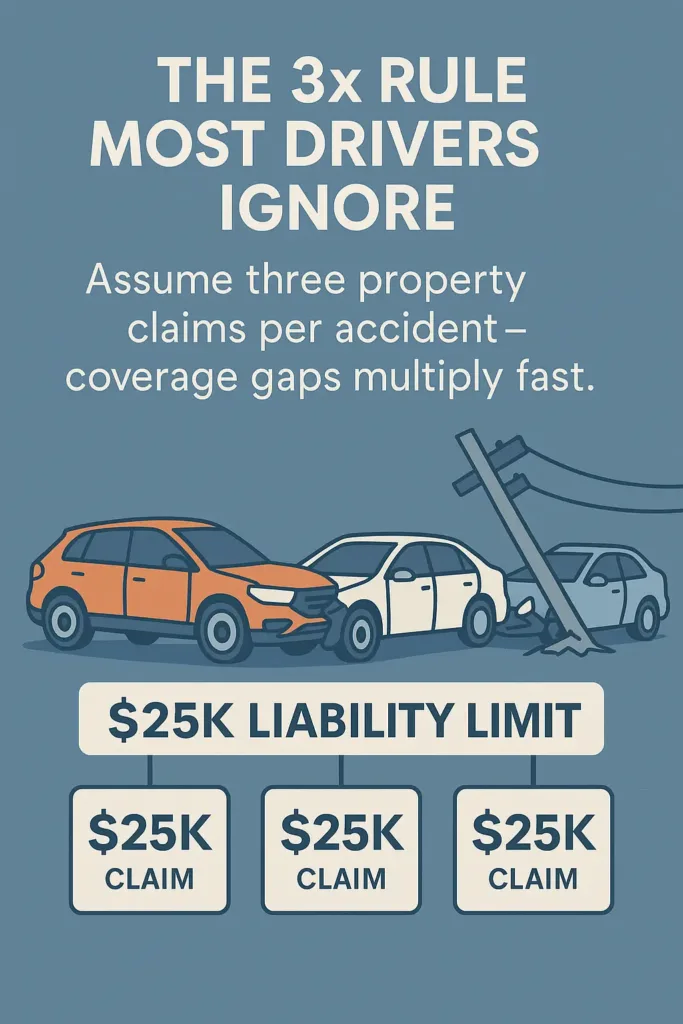

3.2 The 3x Rule Most Drivers Ignore

Let’s say you’re insured for $25,000. That might cover one car, maybe two. But what if you skid into a three-car accident, break a fence, and take out a small business sign? That’s when the 3x Rule becomes painfully real.

The 3x Rule is an unofficial but widely recognized insurance metric: for each accident, assume you’ll be liable for three separate property claims. That might be three cars, or two cars and one piece of infrastructure. And in cities with tight intersections or high-density traffic, this scenario is far from rare.

Here’s what most people miss: property damage liability limits aren’t split per object. They’re shared. That $25,000? It’s not per car—it’s per incident. Once it’s gone, you’re on the hook for the rest.

That’s why more cautious drivers don’t settle for bare-minimum limits. Many industry professionals now urge drivers to raise their property damage liability to between $50K and $100K, particularly if they commute through busy cities or high-traffic zones every week.

Pro Tip: Some insurers even provide interactive calculators to estimate how your property damage liability limit would be distributed across multiple impacted vehicles or structures in a single incident.

In short, property damage liability isn’t just about being legal—it’s about being protected when things get messy. And in 2025, things get messy fast.

4. The Legal Fallout of Being Underinsured

4.1 Real Stories: When $10K Wasn’t Enough

Carlos, a 27-year-old from Atlanta, clipped the side of a parked delivery truck while weaving through morning traffic on his way to a job interview. He didn’t see the van until it was too late—and the damage was worse than he thought. Not only was the delivery vehicle dented, but a nearby fire hydrant burst and flooded the street. The total property damage? $18,600. His property damage liability coverage? Just $10,000—the minimum required by Georgia law.

He thought insurance would cover everything. Instead, the city billed him for infrastructure repair, the company sued for downtime, and his bank account was frozen due to a judgment lien. A single mistake turned into months of wage garnishment and a long-lasting credit issue.

These stories are more common than you’d think. A 2024 study from the Insurance Research Council found that nearly 20 % of drivers in at-fault property damage claims were underinsured. Of those, 62 % paid out-of-pocket for damages that exceeded their policy limits.

Témoignage client (UX Add-on)

“If I had just bumped my coverage to $50K, this would’ve been a blip. Instead, it derailed my entire year.”

— Carlos M., Atlanta, GA

When your property damage liability runs out, the legal system doesn’t pause. Judgments are filed. Wages get garnished. Property liens follow. You go from driver to defendant in a matter of weeks.

4.2 What Lawyers and Judges Really Consider

Once a claim escalates into a courtroom, your property damage liability limit becomes a point of scrutiny. It’s not just about fault—it’s about preparedness and prudence. Legal professionals will often question whether your insurance decisions reflect what a “reasonable driver” would carry in your situation.

Take Illinois, where a driver with $15,000 in coverage caused over $45,000 in damages during a pile-up. The court held him responsible for the remaining $30K plus attorney fees, partly because he was commuting daily through downtown Chicago—an area with high collision risk. The judge stated that his liability limit was “grossly inadequate” given the environment he regularly drove in.

Attorneys look for signs of negligence beyond the accident itself. If you declined higher coverage, lived in a dense urban zone, or drove for work and still chose the minimum, those facts may be used against you.

Judges may evaluate:

- Whether your liability amount reasonably reflects the kind of property damage claims common in your city or neighborhood

- If you turned down higher coverage even when your insurer recommended it

- Whether you’ve had past collisions or insurance claims that could indicate a pattern of risk

- How you and your insurer handled the claim process from start to finish

Pro Tip: The courtroom isn’t the place to realize your limits were too low. By then, it’s not about protection—it’s about damage control.

In 2025, legal consequences tied to property damage liability are no longer rare or limited to major crashes. They’re real, they’re fast, and they can financially devastate the unprepared.

5. Compare Property Damage Liability with Other Coverages

5.1 Collision, Comprehensive, and Confusion

You’ve probably heard these terms tossed around—collision, comprehensive, and property damage liability—as if they’re interchangeable. But they cover very different realities, and mixing them up could cost you thousands.

Let’s clear it up.

Property damage liability pays for other people’s stuff when you’re at fault. That includes their car, a fence, a storefront, even public property. It’s required in nearly every U.S. state.

Collision coverage, on the other hand, pays to fix your own car—regardless of fault. You back into a pole? You hydroplane into a tree? That’s collision. No one else needs to be involved.

Comprehensive coverage deals with non-collision events: theft, fire, falling objects, vandalism, or even a deer leaping across the freeway. It’s the most misunderstood.

The confusion happens when people assume property damage liability protects their own vehicle. It doesn’t. Not even a little.

Pro Tip (UX)

Ask your insurer: “If I hit a parked car and mine is also damaged, which policy fixes mine?” If they say not liability—you’re listening correctly.

And yet, many drivers in places like Texas or Ohio skip collision and comprehensive entirely, thinking liability is enough. But without those add-ons, your car sits wrecked in the driveway—on your dime.

| Coverage Type | Pays for Your Car | Pays for Others’ Property | Required by Law |

|---|---|---|---|

| Property Damage Liability | ❌ | ✅ | ✅ |

| Collision | ✅ | ❌ | ❌ |

| Comprehensive | ✅ (non-collision) | ❌ | ❌ |

So next time you’re reviewing your policy, don’t just nod at the terms. Understand them. Because once the accident happens, it’s too late to untangle the difference.

5.2 Liability vs. “Full Coverage” (That Isn’t Full)

Let’s bust the biggest myth in car insurance: “full coverage” doesn’t mean fully covered. It just means you have some combination of liability, collision, and comprehensive. But the devil’s in the details.

Say you have “full coverage” with $10K property damage liability, plus standard collision. Then you rear-end a Mercedes and push it into two other vehicles. The total damage? $55,000. Collision helps repair your own car, sure. But property damage liability is still on the hook for the other three cars—and you’re $45K short.

Most people don’t realize that “full” doesn’t mean “high limits.” It means “you have the basics.” But if those basics are underfunded, you’re still exposed.

Worse, insurance agents often package “full coverage” to hit price points, not reality. And in places like New Jersey or California, where average property claims top $7,000–$8,500, that can leave you wide open to personal lawsuits or wage garnishment.

Here’s what full should actually mean:

- Property damage liability well above state minimums

- Collision with a reasonable deductible

- Comprehensive that accounts for real-world risks (floods, hail, theft)

- Optional umbrella or excess liability if you drive frequently or own assets

Dialogue client-agent (UX Add-on)

Client: “So I’m good, right? It says ‘full coverage.’”

Agent: “Well, yes… but your liability limit is $15,000. That won’t cover a three-car pileup.”

Client: “Then what exactly am I paying for?”

Bottom line: property damage liability is the legal floor—but it’s nowhere near the ceiling. “Full” only matters when the coverage matches the cost of the accident.

6. How Claims Really Work for Property Damage Liability

6.1 The Process: From Incident to Payout

When you cause an accident, the property damage liability process kicks off before your adrenaline even settles. But behind the scenes, the clock is ticking—and each step matters more than you think.

Let’s say Janelle, a nurse in Raleigh, North Carolina, sideswipes a BMW while parallel parking after a long shift. No one is hurt, but the other car has deep scratches and a dented panel. Within 15 minutes, the BMW’s owner calls his insurer—and within 72 hours, a property damage liability claim is filed against Janelle’s policy.

Here’s how the chain typically unfolds:

- Claim notification – You must inform your insurer ASAP. Most policies require it within 24–48 hours.

- Adjuster assignment – A claims adjuster reviews the scene, estimates repair costs, and gathers third-party statements.

- Investigation – If facts are disputed (speed, fault, location), further evidence is gathered (photos, police reports, witness calls).

- Coverage verification – Your insurer checks whether your property damage liability covers the event and how much.

- Payout authorization – If you’re at fault, the insurer pays the damaged party directly (not you) up to your liability limit.

The whole process can take 5 days to 3 weeks, depending on the complexity and cooperation of all parties involved.

Pro Tip (UX Add-on)

Always photograph the damage, license plates, street signs, and even weather conditions. Claims adjusters rely heavily on visual evidence—especially when versions of the story differ.

If your property damage liability limit is too low, the other party’s insurer may demand the rest from you directly. That’s where things escalate—and where the next subsection comes in.

6.2 Why Delays (and Denials) Happen More Than You Think

Even when it seems straightforward, property damage liability claims can stall—or worse, get denied. And when they do, you’re left vulnerable to legal threats, rising premiums, and a whole lot of frustration.

Here’s why things break down:

- Late reporting – Waiting more than 48 hours to notify your insurer can delay or jeopardize coverage.

- Incomplete information – If your report is vague or lacks photos, adjusters need more time—and opposing insurers might challenge your version.

- Disputed fault – In states like Florida or California, comparative fault rules mean insurers will investigate aggressively before issuing payouts.

- Excluded scenarios – Some policies exclude rental car accidents or private property damage without explicit add-ons.

Take Daniel, a contractor from Boise, Idaho. He gently backed into a mailbox in a private condo lot. The HOA sent a $1,800 repair bill, but Daniel’s insurer initially refused coverage—claiming the incident happened on “non-public property” without proper documentation. A three-week delay, multiple phone calls, and a formal complaint finally resolved it.

Dialogue client-insurer (UX Add-on)

Client: “I thought my liability covered everything?”

Agent: “It does—when it’s documented and falls within the defined use area. That part gets tricky.”

And sometimes, your own insurer might lowball the repair estimate to avoid paying the full amount. If the other party disagrees, they might sue you instead—yes, even if you have property damage liability on paper.

Bottom line? Delays and denials happen not because you weren’t covered, but because the process favors documentation, speed, and clarity. Without those, your coverage is only as good as your paperwork.

7. The Hidden Costs of Low Property Damage Limits

7.1 When Your Property Damage Liability Runs Out Too Soon

Imagine hitting a 2024 Tesla Model X in downtown San Diego. The fender alone? $3,200. Sensors behind the bumper? Another $1,800. And that’s before labor, paint, or recalibration. If your property damage liability cap is set at $10,000—a common state minimum—you could be personally responsible for several thousand dollars.

Most drivers assume the legal minimum is “good enough.” It’s not. In fact, over 40 % of liability payouts exceed state minimums, according to a 2024 NAIC brief. And with the average repair bill climbing above $5,500, even a “minor” crash can push you into out-of-pocket territory fast.

Take Rachel, an office manager in Cleveland. She sideswiped two parked cars on a snowy day. Her policy paid the first claim in full. But the second car’s damage? $6,400. Her property damage liability limit had already been exhausted. The rest came out of her savings.

Pro Tip (UX Add-on)

Check if your state minimum is below $25,000. If so, you’re likely underinsured for modern car values—and exposure doubles in multi-car collisions.

In most cases, the true cost of low limits only becomes clear after the crash, when collections notices or lawsuits arrive. That’s when the sticker shock hits.

7.2 The Domino Effect on Your Wallet, Credit, and Record

When your property damage liability limit doesn’t cover all damages, you don’t just pay more—you enter a cascade of financial and legal consequences.

Here’s what tends to happen next:

- Out-of-pocket payments – If your insurer hits the cap, the balance becomes your legal responsibility.

- Subrogation claims – The other party’s insurer may sue you directly to recover the unpaid amount.

- Credit impact – If you can’t pay, it may go to collections, tanking your score.

- Driver’s record – In states like Texas or New Jersey, unpaid damages can suspend your license until you settle.

Témoignage UX (extrait réel reformulé)

“I thought $10K was enough. Then I hit a BMW and a fire hydrant. My insurance covered the car, not the city’s property. I ended up with a $12,000 bill—and a lien on my paycheck.”

— Ethan D., contractor, Denver

The irony? Raising your property damage liability from $10,000 to $50,000 often costs less than $5/month. But skipping it? That could cost you thousands.

If you’re relying on minimum coverage to “get by,” you’re gambling with your financial future—and the odds are stacked against you in 2025.

8. When and How to Raise Your Property Damage Limits

8.1 Signs It’s Time to Raise Your Property Damage Limits

You probably don’t think about your property damage limits until something goes wrong. But certain life or location changes should trigger a serious rethink. Just moved to a dense urban area like Seattle or Boston? Parking lot scrapes and chain-reaction fender benders aren’t rare—they’re daily. And if you’ve upgraded your car or added a teen driver to your policy, your liability exposure has quietly skyrocketed.

Another red flag? If your current property damage liability coverage is hovering around $25,000, you’re likely underinsured. According to the NAIC (2024), the average property damage claim in the U.S. now exceeds $5,300—and that’s per incident. Hit more than one vehicle or a structure? That number can jump fast. In high-density zip codes, even modest repairs can exceed $30,000.

Pro tip: Ask your insurer for a breakdown of how your limits would play out across three simultaneous damage claims. Most drivers are surprised by how thin their coverage spreads.

8.2 How to Raise Your Property Damage Limits Without Breaking the Bank

Upping your property damage limits doesn’t always mean paying more. It’s about reallocating your premium intelligently. Start by reviewing your deductible: increasing it from $250 to $500 could instantly create budget space for more liability protection. And if you haven’t updated your policy in over 2 years, you’re likely missing out on discounts tied to driving record, loyalty, or telematics programs.

Next, compare multi-policy bundles. Many insurers offer better pricing when you combine auto with renters or homeowners coverage. Even shaving $8/month off one policy might be enough to bump your liability from $25K to $50K—a move that could save you from bankruptcy after a bad day.

Finally, don’t just copy what your neighbor carries. Ask your agent for a risk-adjusted recommendation based on your location, vehicle type, and commute pattern. One-size-fits-all doesn’t apply in insurance—and staying passive could cost you tens of thousands.

9. Legal Traps and Fine Print You’re Missing

9.1 The Fine Print That Can Undermine Your Property Damage Limits

Most drivers assume their property damage limits are rock-solid. But buried in the fine print of many policies are clauses that shrink those protections when you least expect it. Ever heard of the “step-down clause”? It’s a sneaky condition that reduces your liability coverage if someone other than a named insured was driving your car—even with your permission. Suddenly, your $50,000 limit becomes $15,000. And yes, that’s legal in several states.

Another trap? Exclusions for certain vehicles. If you rent a box truck for a weekend move and cause an accident, your personal auto policy might not apply at all—even if you have decent property damage limits. And if your vehicle is modified (think: aftermarket lift kits or engine swaps), some insurers use that to deny full payouts, citing “undeclared risk.”

Pro tip: Ask your insurer for a “coverage breakdown” that shows exactly which situations are not covered by your current policy. Most drivers are shocked by what’s omitted.

9.2 How Legal Language Can Void Your Property Damage Limits When You Need Them Most

Let’s say you’re in a multi-car crash and the police report shows you were distracted—even slightly. Now imagine your insurer pulling out the “intentional acts” exclusion buried in page 17 of your policy. That vague legal phrase has been used in courts to challenge payouts—even when the driver never meant harm.

Worse, courts don’t just look at the damage—you’re judged on whether your property damage limits aligned with your known risk. Live in a high-traffic zip code? Own a luxury vehicle? If you opted for state minimums despite recommendations, lawyers can argue you were negligent in your financial preparedness. That shifts the financial burden back to you—even with active insurance.

In one recent Florida case (2023), a driver was found liable for $47,000 in excess damages despite carrying $25K in coverage—because the court deemed his limit “grossly insufficient” given his known risk profile.

10. Checklist Before You Choose Your Property Damage Limit

10.1 Key Questions to Assess Your Property Damage Liability Needs

Choosing your property damage liability limit isn’t just about legality—it’s about financial survival. Before locking in a number, ask yourself: “What kind of cars do I see around me every day?” If you’re in Los Angeles or Miami, chances are it’s not 1998 Civics—it’s Teslas, BMWs, and luxury SUVs. That’s what you might end up paying to fix if you’re at fault. Now ask: “Do I drive during rush hour?” “Do I park on the street or in tight urban zones?” The more exposure you have, the higher the potential for multi-vehicle or high-ticket damage.

Don’t forget to check your own net worth. If your assets exceed your current coverage, you’re leaving them exposed to legal action. Property damage liability isn’t just a reimbursement—it’s a shield. Make sure it’s strong enough to deflect what’s coming at you.

Pro tip: Don’t just copy a friend’s policy. Their lifestyle, assets, and driving habits aren’t yours.

Try this: ask your agent to walk you through a few real-world scenarios using your driving routine and local traffic patterns. It only takes a few minutes, and you might be shocked by the gaps it reveals.

10.2 The Property Damage Liability Coverage Checklist

Use this 7-point checklist to sanity-check your current or future property damage liability limit. Treat it like a diagnostic tool—if you check “yes” more than three times, it’s time to raise your coverage:

| Question | Yes/No |

|---|---|

| Do you drive daily in urban or high-density areas? | ✅ / ❌ |

| Are luxury vehicles common in your city? | ✅ / ❌ |

| Do you park your car on public streets? | ✅ / ❌ |

| Is your current limit under $50,000? | ✅ / ❌ |

| Have you ever been in a multi-vehicle incident? | ✅ / ❌ |

| Do you have assets exceeding $75,000? | ✅ / ❌ |

| Would a $20,000 repair bill put you at financial risk? | ✅ / ❌ |

Use the score honestly. Property damage liability is one of the cheapest parts of your policy to upgrade—but also the one that can cost you most if it’s underpowered.

11. Final Word: Don’t Let Property Damage Liability Be Your Blind Spot

11.1 The $20K Illusion That Still Fools Millions

It’s easy to assume that the state minimum—often $20,000—is “good enough.” After all, if the government requires it, it must be safe, right? Wrong. In 2025, that limit barely covers a bumper and a rental car. One rear-end collision involving a mid-range SUV and a light pole can eat that amount in a blink.

Even worse, once your property damage liability cap is hit, you’re personally on the hook for the rest—and creditors don’t wait. Lawsuits, wage garnishment, even liens on your home… all triggered by that one bad day. This is the hidden trap: people think insurance pays for everything, but limits are literal. Once they’re maxed, you pay.

This is not fear-mongering. It’s math. It’s policy language. It’s reality.

11.2 One Missed Detail Can Ruin a Decade

Let’s be blunt. Most drivers only find out they’re underinsured after the damage is done. Your limit isn’t just a number on a page—it’s the dividing line between financial stability and years of debt.

Take Melissa from Denver. Her property damage limit was $25,000. One icy morning, her car slid into two others—both electric. Final bill: $68,000. Her insurer cut a check for $25K. She’s still paying off the difference, one paycheck at a time.

The worst part? Upgrading her limit to $100,000 would have cost her $7 more per month. A Netflix subscription saved… in exchange for a five-year financial pitfall.

11.3 What to Do Next (And Why It Can’t Wait)

This is your wake-up call. Not tomorrow, not next renewal—now.

Here’s your next move:

- Pull up your current auto policy.

- Look at the property damage liability line.

- Ask yourself: “If I totaled a Lexus tomorrow, would this be enough?”

- If the answer is no—or even “not sure”—call your agent and adjust it.

Enrichissement UX (🧠 Action list):

- 🗂️ Compare your limit with average vehicle values in your city (e.g., Kelley Blue Book or Edmunds).

- 🧾 Run a 3-vehicle accident simulation using your zip code and rush hour density.

- 🧮 Use online tools (NAIC or insurer portals) to visualize how limits affect out-of-pocket costs.

Don’t treat property damage liability like a checkbox. It’s your firewall. And if the fire comes, you’ll want it thick, high, and built for the world we actually live in—not the one your state minimums imagined in 1998.

FAQ

What is property damage liability?

Property damage liability is a type of car insurance coverage that helps pay for damage you cause to someone else’s property, typically their vehicle, fence, building, or other physical assets, when you’re at fault in an accident.

How much property damage liability do I need?

While some states require only $10,000 to $25,000 in coverage, experts now recommend at least $50,000 to $100,000, especially in high-density urban areas. It’s about protecting your assets from lawsuits and major out-of-pocket expenses.

What does property damage liability cover?

It typically covers costs to repair or replace another person’s car, mailbox, garage, or storefront if you’re at fault. It doesn’t cover your own car—that’s handled by collision or comprehensive insurance.

What is liability property damage?

It’s simply another way of referring to property damage liability insurance, part of your auto policy that kicks in when you’re legally responsible for damaging someone else’s property.

Does general liability cover property damage?

Yes—but only for businesses. Commercial general liability (CGL) policies typically include property damage coverage related to business operations, but not personal auto accidents.

What does property damage liability mean in insurance terms?

It means your insurer pays for damages you cause to others’ property, up to the limit you’ve selected in your policy. It’s legally required in almost every U.S. state.

What does $100K/$300K/$100K mean in liability coverage?

This format represents split limits:

$100K: max per person for bodily injury

$300K: max total per accident for bodily injury

$100K: max per accident for property damage liability

What is the meaning of property damage in auto insurance?

It refers to physical harm to someone else’s belongings (vehicles, fences, buildings) caused by your driving. It does not cover mechanical failure or your own car repairs.

What are three things property damage liability can help cover?

Repairs to another driver’s car

Replacement of a damaged fence, mailbox, or garage

Legal defense costs if you’re sued for the damage caused