After a summer flood hit parts of Peoria in July 2024, dozens of residents discovered their homeowners insurance didn’t cover flood damage. One couple faced $42,000 in repairs—out of pocket. According to the Illinois Department of Insurance, nearly 1 in 5 policyholders in Illinois lacked optional flood coverage despite living in moderate-risk zones (August 2024).

Illinois insurance isn’t one-size-fits-all. Whether it’s auto, home, renters, health, or small business coverage, each policy must align with state mandates, local risks, and personal needs. Skipping key endorsements or misunderstanding exclusions can leave you dangerously unprotected—especially in areas like Cook County or Champaign.

So how do you make sure your Illinois insurance policy truly covers what matters in 2025?

Start by reviewing critical add-ons in your flood insurance for homeowners before the next storm hits.

On This Page

1. Understand Why Illinois Insurance Matters in 2025

In December 2024, a small business owner in Rockford saw her bakery shut down for six weeks after a burst pipe—only to learn her basic policy didn’t cover water damage from frozen plumbing. She lost over $28,000. According to the Illinois Department of Insurance, 1 in 6 commercial claims in Illinois were denied in 2024 due to coverage misunderstandings (April 2024).

Illinois insurance isn’t just paperwork—it’s your legal and financial safety net. From auto liability limits to flood exclusions in homeowners policies and mandatory workers’ compensation, navigating insurance in Illinois means understanding what’s required and what’s quietly missing from your policy.

So how do you avoid surprise exclusions and make informed decisions about your Illinois coverage in 2025?

Start with our guide on business insurance in Illinois to secure the protection your operation truly needs.

2. Define Illinois Insurance: Rules, Laws, and Protections

2.1 What Exactly Does Illinois Insurance Include? (By Law)

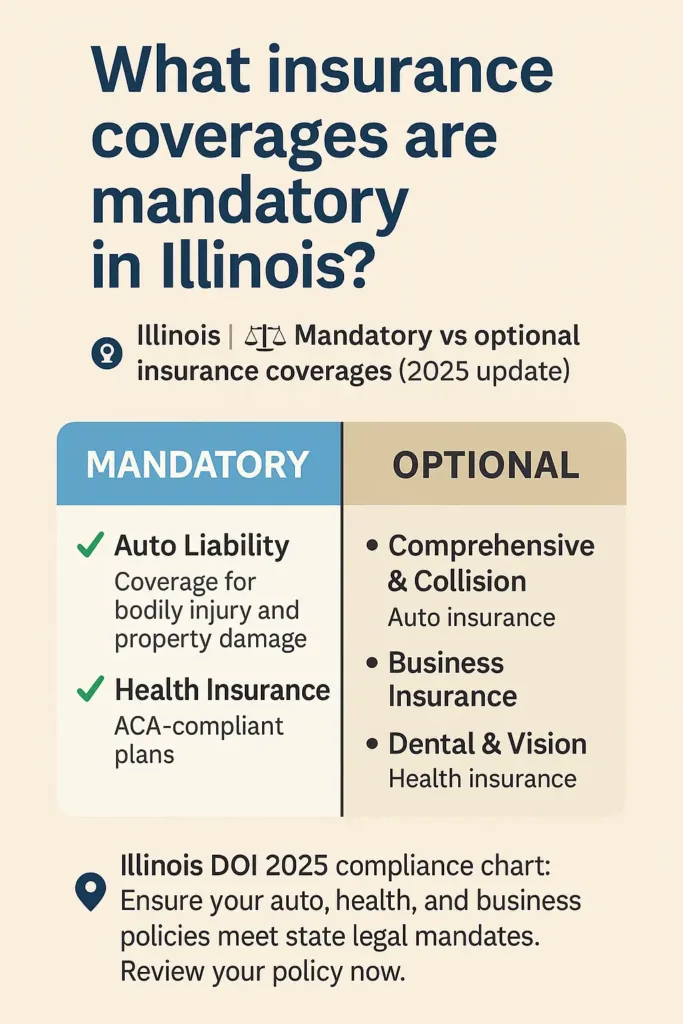

Illinois insurance refers to a set of regulated protections—required or optional—covering auto, homeowners, renters, health, and business risks within the state. Under Illinois law (215 ILCS 5/), minimum liability coverage for auto insurance is mandatory, while health plans must meet ACA-compliant standards. However, coverage like flood or earthquake insurance remains optional and often misunderstood.

State law sets the framework, but providers determine policy exclusions, coverage ceilings, and premium adjustments. For example, all auto policies in Illinois must include uninsured motorist coverage, but property insurance can legally exclude damage from sewer backups unless added manually. You should also understand what is a deductible in insurance and how it impacts what you’ll actually pay before coverage kicks in.

| Insurance Type | Mandatory in Illinois? | Governing Body |

|---|---|---|

| Auto Liability | Yes | Illinois Secretary of State |

| Homeowners | No (Required by lenders) | Illinois Department of Insurance |

| Health (Marketplace) | Yes (ACA-compliant) | Get Covered Illinois |

| Flood | No | FEMA / NFIP |

As of May 2024, over 28% of Illinois homeowners lacked flood insurance in high-risk zones (FEMA.gov).

See our breakdown of auto coverage requirements to make sure your policy meets Illinois legal standards.

Understanding coverage basics becomes clearer with our comprehensive home insurance analysis, which breaks down what Illinois homeowners truly need for adequate protection.

2.2 How Illinois Insurance Compares to Neighboring States

Compared to Indiana, Wisconsin, and Missouri, Illinois insurance laws are stricter in auto coverage but more flexible in home and business policies. For example, Illinois mandates higher auto liability minimums—$25,000 per person and $50,000 per accident—while Indiana still follows the outdated 25/50/10 model without uninsured motorist requirements.

Conversely, homeowners in Missouri benefit from broader storm coverage built into base policies, while Illinois policies often require riders. Illinois small businesses, on the other hand, gain stronger legal protections through mandatory workers’ compensation coverage, regardless of the number of employees.

| State | Auto Minimum Liability | Mandatory Workers’ Comp? |

|---|---|---|

| Illinois | 25/50/20 + UM/UIM | Yes (1+ employee) |

| Indiana | 25/50/10 | No (if under 5 employees) |

| Wisconsin | 25/50/10 | Yes |

| Missouri | 25/50/25 | Yes |

The Illinois Department of Insurance updates state-level compliance requirements annually—make sure your policy is aligned with the latest updates (insurance.illinois.gov).

Need help choosing a compliant policy? Explore our guide to small business insurance in Illinois to stay protected and legal.

3. Analyze the Real Costs of Illinois Insurance

3.1 Average Insurance Costs in Illinois by Type (2024–2025)

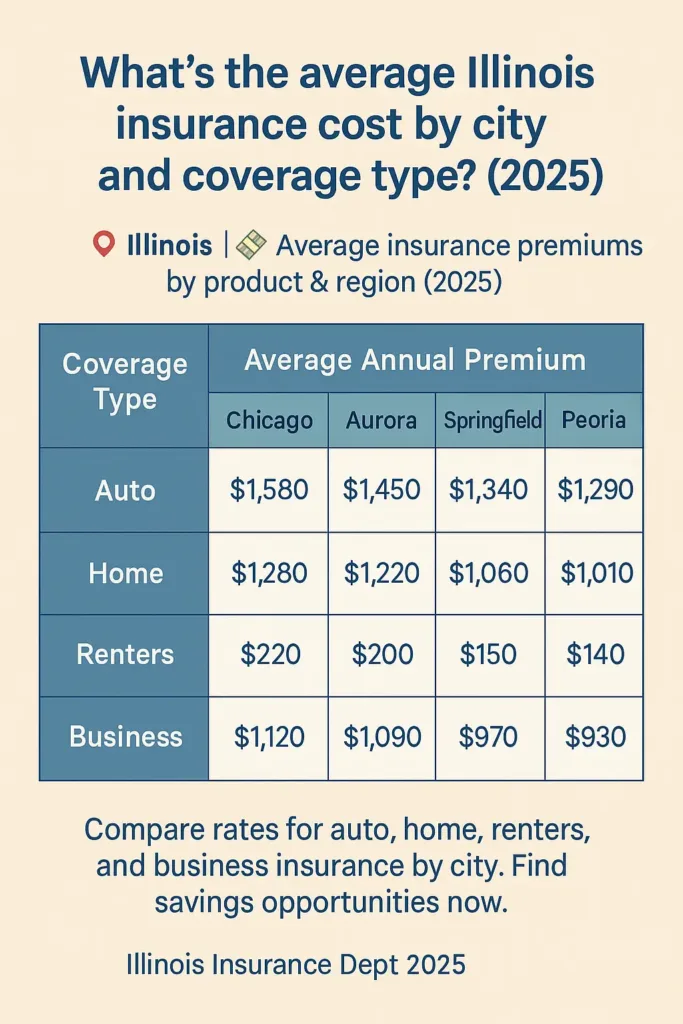

As of Q2 2025, the average cost of Illinois insurance varies significantly by product and location. For example, auto insurance premiums in Chicago average $1,880/year, compared to $1,240 in Rockford. Homeowners in flood-prone areas like Naperville pay nearly 23% more than those in drier counties, due to risk ratings and mandatory riders.

Health insurance remains highly variable, with ACA-compliant silver plans ranging from $430 to $670/month depending on ZIP code and household income. Business insurance has also spiked—especially liability and commercial auto—rising 11% since 2024 due to inflation and litigation risk (NAIC.org).

| Insurance Type | Average Annual Cost (IL, 2025) | Notable Variation by City |

|---|---|---|

| Auto Insurance | $1,560 | Chicago: $1,880 / Springfield: $1,330 |

| Homeowners | $1,470 | Naperville: +23% / Rockford: –15% |

| Renters Insurance | $198 | Champaign: $160 / Cicero: $225 |

| Health (Silver Plan) | $6,480 | Peoria: $5,740 / Evanston: $6,970 |

| Business Liability | $1,820 | Cook County: +14% over state avg. |

Looking to save money on housing coverage? Check our guide on how to reduce home insurance costs for practical Illinois strategies.

For vehicle coverage specifics, our detailed car insurance guide helps Illinois drivers understand state requirements and cost-saving strategies.

3.2 5 Hidden Factors That Raise Illinois Insurance Premiums

Most Illinois residents don’t realize that credit score, ZIP code, and even job title can impact their Illinois insurance premiums. For example, two drivers in Springfield—same age and car—can pay drastically different rates if one lives in a high-theft zone or has subprime credit. Likewise, homeowners near floodplains may face mandatory NFIP premiums, regardless of previous claims.

According to the Illinois Department of Insurance, 58% of premium adjustments in 2024 were driven by algorithmic risk models, not claims history (insurance.illinois.gov). Here’s how some hidden factors affect cost:

| Premium Factor | Impact on Cost |

|---|---|

| Credit Score (below 650) | +20% on auto & renters policies |

| Proximity to Flood Zone | +25% on homeowners |

| Occupation (delivery, rideshare) | +12–18% on auto premiums |

| Roof Age (15+ years) | –10% to +18% depending on material |

| Local Crime Rates | +15% for auto & renters |

To estimate your premium across providers, try the official Illinois Rate Comparison Tool.

4. Get Covered: How to Secure the Right Illinois Insurance

4.1 The 6-Step Process to Buy Insurance in Illinois

Securing Illinois insurance in 2025 requires more than filling out an online quote form. Whether you’re insuring a car in Aurora or a business in Evanston, state compliance and policy options vary widely. Following a clear process helps avoid coverage gaps, denials, or costly add-ons later.

Here’s the standard 6-step process to purchase insurance in Illinois:

- Determine required coverages (auto, home, health, business)

- Check Illinois minimums and legal mandates (via DOI)

- Compare quotes from licensed providers using state tools

- Request full policy breakdown, including exclusions and deductibles

- Verify financial ratings (AM Best, NAIC) before committing

- Sign and retain proof of insurance (required for auto and business)

According to the Illinois Department of Insurance, 15% of auto insurance complaints in 2024 stemmed from consumers not understanding what their policy excluded. Taking time to compare before you buy is more than smart—it’s essential. Carefully read your insurance policy details to avoid missing critical exclusions or costly surprises.

Not sure where to start? Our certificate of insurance guide shows what to look for once you’re covered.

4.2 How to File a Claim in Illinois

Filing a claim on your Illinois insurance policy can feel intimidating, especially after a loss. Whether it’s water damage in your basement or a fender bender on I-55, acting quickly and correctly can make or break your reimbursement. Each insurer has unique procedures, but the legal framework in Illinois protects consumers under the Unfair Claims Settlement Practices Act. Learn exactly how to file an insurance claim to strengthen your reimbursement strategy and avoid common denials.

Example: In May 2024, a homeowner in Belleville filed a claim for hail damage. The insurer initially offered $4,100—well below repair estimates. After invoking the “appraisal clause,” the payout increased to $8,750 following a third-party assessment. Illinois law allows for independent appraisals when disputes arise.

Key claim steps with Illinois-specific considerations:

- Notify insurer immediately (within 14 days) – delays may reduce or void coverage

- Document all damage with photos and timestamps – strong evidence builds stronger cases

- Request copy of full adjuster report – this right is granted under state law

- Use appraisal clause if offer seems low – third-party review is allowed in Illinois

- Escalate to IDOI if claim feels unfair – consumer complaint forms are available online

Need help navigating your next claim? Review our flood insurance for homeowners guide to learn what to do before and after water damage.

5. Learn From Real Illinois Insurance Cases

5.1 How a Chicago Renter Saved $540 on Coverage (2024 Case)

In late 2024, Maya, a 29-year-old renter in Chicago’s Logan Square, was paying $312 annually for a basic renters policy. After reviewing her coverage, she realized she was overpaying for personal property she no longer owned and lacked liability protection. With the help of an independent agent, she adjusted her Illinois insurance to fit her actual needs—cutting unused add-ons and increasing her liability limit.

By customizing her policy and switching providers, she lowered her premium to $198/year while improving coverage. According to the Insurance Information Institute, renters who shop annually can save up to 30%—especially in urban ZIP codes where pricing algorithms fluctuate monthly.

| Before Adjustment | After Adjustment |

|---|---|

| $312/year for renters insurance | $198/year |

| Low liability limit ($25,000) | Increased to $100,000 |

| Unnecessary personal item coverage | Removed for unused electronics |

| Standard deductible | Raised deductible, lowered premium |

Want to tailor your own coverage? Check our guide on renters insurance in Illinois to avoid common overcharges.

5.2 The 2023 Tornado That Reshaped Illinois Insurance Policies

On March 31, 2023, an EF-3 tornado struck Belvidere, Illinois, destroying homes and small businesses across Boone County. One local restaurant had $180,000 in structural damage—but their policy excluded wind damage under a cost-cutting endorsement. The denied claim sparked a class-action suit and triggered statewide policy revisions in 2024.

Following the disaster, the Illinois Department of Insurance issued Bulletin 2024-03 requiring insurers to disclose wind exclusions in bold font on the declarations page. It also prompted revisions in how Illinois insurance policies define “named peril” versus “all-risk” coverage for residential and commercial structures.

| Policy Change (Pre-2023) | Update (Post-2024) |

|---|---|

| Wind exclusions buried in policy fine print | Now must be disclosed on front page |

| No state-mandated formatting | Bold, 12pt font now required |

| Limited access to disaster mediation | Fast-track claims process now in place |

| Ambiguous “named peril” wording | Clearer definitions in all new policies |

Learn how to review storm-related clauses in your homeowners insurance in Illinois to avoid similar surprises.

6. Discover Expert Tips & Legal Loopholes in Illinois Insurance

6.1 Smart Legal Gaps in Illinois Insurance That Can Lower Your Premium

Many Illinois residents are unaware that certain legal flexibilities within Illinois insurance rules can work in their favor. Insurance professionals often apply these strategies to optimize premiums—without breaking any laws or compromising coverage. These are not tricks, but built-in options that most people overlook.

Here are three smart, legal ways to adjust your insurance without sacrificing protection:

| Strategy | Impact |

|---|---|

| Bundle Auto + Renters via Multi-Line Discount | Up to 20% savings—even across affiliated providers |

| Switch to “Named Non-Owner” Policy Temporarily | Useful when not currently driving but maintaining coverage |

| Re-Quote After Minor Address Adjustment | Triggers new risk tier, especially within ZIP code ranges |

In 2024, 31% of Illinois drivers who requested a mid-term re-quote were able to reduce their rate without changing their coverage (NAIC.org).

Explore how bundling affects your quote in this auto and renters insurance bundle comparison.

6.2 What Insurers Don’t Tell You About Illinois Coverage Gaps

Even the best-rated Illinois insurance policies come with exclusions—some of which aren’t clearly explained unless you ask. Agents often highlight mandatory coverage but rarely explain what’s missing. Common exclusions like sewer backups, mold remediation, and extended loss-of-use coverage can lead to massive out-of-pocket costs.

The Illinois Department of Insurance noted in 2024 that 18% of consumer complaints involved hidden exclusions, often buried in policy fine print (insurance.illinois.gov).

| Common Exclusion | Real-World Impact |

|---|---|

| Sewer backup | $6,000+ in water damage, often denied |

| Mold (non-catastrophic) | No coverage for repairs or health mitigation |

| Temporary housing over 30 days | Uncovered relocation costs post-disaster |

| Sinkholes and minor earth movement | Full denial unless specific rider added |

To avoid these gaps, review your policy thoroughly—especially limits and exclusions. You can also consult our breakdown on average home insurance cost and policy coverage to compare what’s typically included in Illinois.

7. Anticipate the Future of Illinois Insurance

7.1 Insurance Trends in Illinois (2025–2030)

The landscape of Illinois insurance is shifting fast. Between climate-related risks, AI-driven underwriting, and rising litigation, policyholders can expect significant changes by 2030. In particular, extreme weather events and inflation are expected to keep premiums rising, especially for homeowners and business coverage.

According to the National Association of Insurance Commissioners (NAIC), Illinois saw a 17% spike in average homeowners premiums from 2023 to 2025—driven by increased claims from floods, tornadoes, and hailstorms. Insurers are now piloting parametric coverage models, where payouts are triggered by specific events (e.g., 2-inch hailstones), not adjuster inspections.

| Trend | Impact on Policyholders |

|---|---|

| Parametric insurance pilots | Faster payouts but limited by predefined triggers |

| AI-based risk scoring | More personalized pricing, but harder to dispute |

| Climate-based zoning updates | Flood insurance may become mandatory in more areas |

| Litigation-driven liability pricing | Small businesses to face higher premiums in urban counties |

To see how premiums have already changed, explore the latest Illinois insurance cost guide with ZIP code data and 5-year comparisons.

7.2 How AI and Automation Are Reshaping Illinois Insurance

Artificial intelligence isn’t just changing tech—it’s revolutionizing Illinois insurance. Claims processing, fraud detection, and quote generation are increasingly handled by machine learning models. In fact, a 2025 report by the McKinsey Global Institute estimates that over 40% of auto insurance claims in the Midwest are now auto-adjusted by AI within 24 hours of submission.

While this improves efficiency, it also raises questions about transparency. Illinois regulators have started requiring disclosures when AI models influence pricing, as seen in Bulletin 2025-02 issued by the Department of Insurance. Consumers should now receive “explanation of pricing” notices if a quote or denial was algorithm-driven.

| Automation Area | Pros | Risks |

|---|---|---|

| Claims adjustment (AI) | Faster resolution | Opaque decision criteria |

| Fraud scoring | Reduces false payouts | Bias against high-risk ZIPs |

| Quote generation | Customized pricing | Can penalize non-disclosed data |

| Chatbot customer service | 24/7 availability | Lacks nuance for complex cases |

Want to understand how technology may affect your next claim? Review this resource on Illinois car insurance estimation tools that now integrate AI-based scoring.

8. Your Most Pressing Questions, Answered

8.1 Can You Get Illinois Insurance With a Pre-Existing Condition?

Yes—but it depends on the type of Illinois insurance you’re applying for. Health insurers in Illinois cannot deny coverage due to pre-existing conditions thanks to protections under the Affordable Care Act (ACA). This applies whether you’re buying through Get Covered Illinois or directly from a licensed carrier.

However, for other types of insurance—like life, disability, or long-term care—pre-existing conditions can still affect approval or pricing. A 2024 analysis by the Kaiser Family Foundation found that 34% of Illinois applicants for life insurance were quoted higher premiums due to declared medical history.

| Insurance Type | Pre-Existing Condition Rules |

|---|---|

| Health (ACA-compliant) | Guaranteed issue; no surcharge allowed |

| Life Insurance | Underwritten; may result in higher rates or exclusions |

| Disability Insurance | May exclude condition or impose waiting periods |

| Long-Term Care | Often denied if condition is recent or ongoing |

For Illinois-specific health options, check our breakdown of short-term health insurance for transitional or non-ACA plans.

Explore comprehensive health insurance options available to Illinois residents through our detailed coverage analysis.

8.2 The #1 Illinois Insurance Mistake 90% of People Make

The most common mistake? Assuming your policy covers everything by default. In 2024, the Illinois Department of Insurance reported that over 56% of consumer complaints involved uncovered claims—usually due to misreading exclusions or skipping optional riders (insurance.illinois.gov).

Here’s a real case: A Naperville homeowner believed their policy included roof replacement coverage after hail damage. But it only reimbursed “actual cash value” (ACV), not full replacement cost—leaving them with a $9,300 shortfall. The endorsement for replacement cost would have added just $83/year.

| Mistake | Result | How to Avoid |

|---|---|---|

| Assuming full coverage | Claim partially or fully denied | Request side-by-side quote comparisons |

| Ignoring exclusions | Surprise out-of-pocket costs | Ask for full declarations page |

| Skipping endorsements | Loss not covered (e.g. water, roof, theft) | Add riders as needed for property type |

Want to protect yourself from this mistake? Start with our checklist on flood insurance for homeowners—a common rider often overlooked in Illinois.

9. Your 5-Step Action Plan to Get Illinois Insurance Today

9.1 Recap: Everything You Need to Know About Illinois Insurance

Before choosing a provider or clicking “Get Quote,” take a moment to review what matters most in Illinois insurance. Your location, coverage type, budget, and risk level all shape your premium—and your protection. From mandatory auto liability to optional riders for flooding and mold, Illinois insurance laws give you options, but not always clarity.

Here’s a recap of the most important takeaways covered in this guide:

| Key Element | What to Know |

|---|---|

| Minimum Requirements | Auto liability and workers’ comp are mandatory in IL |

| Cost Factors | ZIP code, credit score, property age, and coverage gaps matter |

| Legal Exclusions | Flood, sewer backup, and mold often excluded by default |

| Claim Filing | Use appraisal clause for disputes; document everything |

| Emerging Trends | AI pricing, climate zoning, and fast-track parametric models |

To revisit typical rates and variables, see our full Illinois insurance cost guide with ZIP-level insights.

9.2 Start Smart: Your First Steps to Get Illinois Insurance in 2025

Getting the right Illinois insurance starts with one essential step: identifying what you truly need. Many buyers rely on default bundles or marketing-driven quotes, but that approach often leaves out crucial protections. Instead, use a structured method to compare options, clarify exclusions, and choose a policy aligned with your real-world risks.

Here’s a five-step plan you can follow right now to move forward confidently:

| Step | What to Do |

|---|---|

| 1 | Identify required coverage (auto, home, health, business) |

| 2 | Review Illinois legal minimums and exclusions |

| 3 | Use comparison tools from insurance.illinois.gov |

| 4 | Request full declarations page and quote breakdowns |

| 5 | Document everything and keep proof of coverage |

Need a quick primer before choosing a provider? Review our breakdown of what a certificate of insurance includes and how to verify it before you sign.

10. Official Resources & Free Tools for Illinois Insurance

10.1 Who Regulates Illinois Insurance, and What You Can Use as a Consumer

Every Illinois insurance policy sold by a licensed company is regulated by the Illinois Department of Insurance, a state agency based in Springfield. It’s your main point of reference for checking legal protections, understanding your rights, and resolving conflicts with insurers.

In addition to laws and updates, the department offers tools to help consumers track complaints, review insurance company ratings, and verify if a provider is licensed to operate in the state. These tools are free and updated regularly.

| Service Provided | Use for Illinois Residents |

|---|---|

| Company License Lookup | Check if an insurer is legally authorized in Illinois |

| Filing a Complaint | Submit a report if you believe your insurer acted unfairly |

| Bulletin Archive | Access legal and regulatory changes by year |

| Coverage Mandates List | See what’s required by law in auto, health, and workers’ comp |

For all official resources, visit the Illinois Department of Insurance for current regulations and consumer protections.

You can also explore our guide to business insurance in Illinois to see how regulations apply to small companies.

10.2 Trusted Tools to Estimate Insurance Costs in Illinois for Free

You don’t need to pay an agent or use a commercial quote site to get a rough estimate of your insurance costs. Several public websites offer free calculators and tools that are available to all Illinois residents. These help you explore health plans, compare auto rates by ZIP code, or check your flood risk before adding endorsements to a home policy.

While they don’t replace a formal quote, these tools are a useful starting point—especially when you’re deciding between coverage types or evaluating multiple providers.

Essential free tools for Illinois residents:

- IL Auto Rate Comparison – review base prices by region and carrier

- Get Covered Illinois – explore ACA-compliant health plans with subsidy checks

- NFIP Flood Map Lookup – check FEMA-designated flood zones

- Healthcare.gov Illinois – apply for federal marketplace health plans

Want to understand how flood zones affect your rates? Start with our updated article on flood insurance for homeowners in Illinois.

FAQ

What is the cheapest car insurance in Illinois?

The cheapest car insurance in Illinois varies by driver profile and location, but GEICO, State Farm, and Progressive consistently offer competitive rates. For minimum liability coverage, Illinois drivers can expect to pay $800-$1,200 annually. However, the cheapest option isn’t always the best—many low-cost policies exclude crucial protections like uninsured motorist coverage or comprehensive damage protection. Compare our car insurance options to find the right balance between cost and coverage.

What is Illinois state insurance called?

Illinois doesn’t operate a single “state insurance” program. Instead, the state oversees several insurance markets through the Illinois Department of Insurance. For health coverage, Illinois uses the federal marketplace (Healthcare.gov) rather than a state-run exchange. The state does provide specialized programs like the Illinois FAIR Plan for high-risk homeowners and the Illinois Automobile Insurance Plan for high-risk drivers who can’t obtain coverage in the standard market.

Which health insurance is the best in Illinois?

The “best” health insurance in Illinois depends on your budget, health needs, and preferred providers. Blue Cross Blue Shield of Illinois holds the largest market share and offers extensive provider networks statewide. Other highly-rated options include Health Alliance, Humana, and Cigna. For comprehensive coverage comparisons, review our health insurance analysis to evaluate plans based on your specific needs rather than general rankings.

How much is Blue Cross Blue Shield of Illinois per month?

Blue Cross Blue Shield of Illinois premiums range from $350-$750 per month for individual coverage, depending on your age, location, and plan tier. Bronze plans start around $350/month with high deductibles, while Gold plans can exceed $650/month but offer lower out-of-pocket costs. Family coverage typically costs $900-$1,800 monthly. Actual costs depend on your ZIP code, with Chicago-area residents paying 15-20% more than downstate Illinois residents.

How do I look up an Illinois insurance license?

Use the Illinois Department of Insurance company search tool to verify any insurance company or agent license. Enter the company name or individual’s name to confirm they’re authorized to sell insurance in Illinois. This verification is crucial before purchasing any policy, as unlicensed providers offer no consumer protection if claims arise.

What is the Illinois marketplace for insurance?

Illinois uses the federal Health Insurance Marketplace (Healthcare.gov) for individual and family health plans. The state doesn’t operate its own exchange like California or New York. Open enrollment typically runs from November 1 to January 15, though qualifying life events can trigger special enrollment periods year-round.

How do I file a complaint with the Illinois Department of Insurance?

File complaints online through the Illinois Department of Insurance website, by calling 1-866-445-5364, or by mailing written complaints to 320 West Washington Street, Springfield, IL 62767. Include your policy number, insurer name, detailed description of the issue, and copies of relevant documentation. The department investigates consumer complaints and can mediate disputes between policyholders and insurers.

What is the Illinois insurance center?

The “Illinois Insurance Center” typically refers to regional offices of the Illinois Department of Insurance or private insurance agencies serving multiple carriers. There’s no single official “Illinois Insurance Center”—instead, the state operates regulatory offices in Springfield and Chicago to serve consumers statewide.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.