Picture this: Your neighbor just received a $14,000 insurance check for their storm-damaged roof, while you got only $6,500 for identical damage. Same storm, same roof age, same insurance company. What made the difference? The answer lies in understanding actual cash value vs replacement cost coverage—a decision that could save or cost you thousands when disaster strikes.

Here’s the shocking reality: The average claim payout across property damage claims between 2018 and 2022 was $15,749, but homeowners with depreciated value policies often receive significantly less due to depreciation calculations. In fact, about one in 35 insured homes has a property damage claim related to wind or hail, making this knowledge essential for every homeowner.

The stakes couldn’t be higher. When severe weather hits, your coverage choice determines whether you’ll pay hundreds or thousands out of pocket. Let’s say you have a 10-year-old roof that costs $20,000 to replace. With depreciated coverage, you might receive only $10,000 after depreciation. With full replacement coverage, you’d get the entire $20,000 (minus your deductible).

This comprehensive guide reveals the seven critical differences between these coverage types, supported by real 2025 data and insider insights. You’ll discover how depreciation schedules actually work, why insurers are shifting away from replacement cost for older roofs, and exactly how to calculate your potential out-of-pocket exposure.

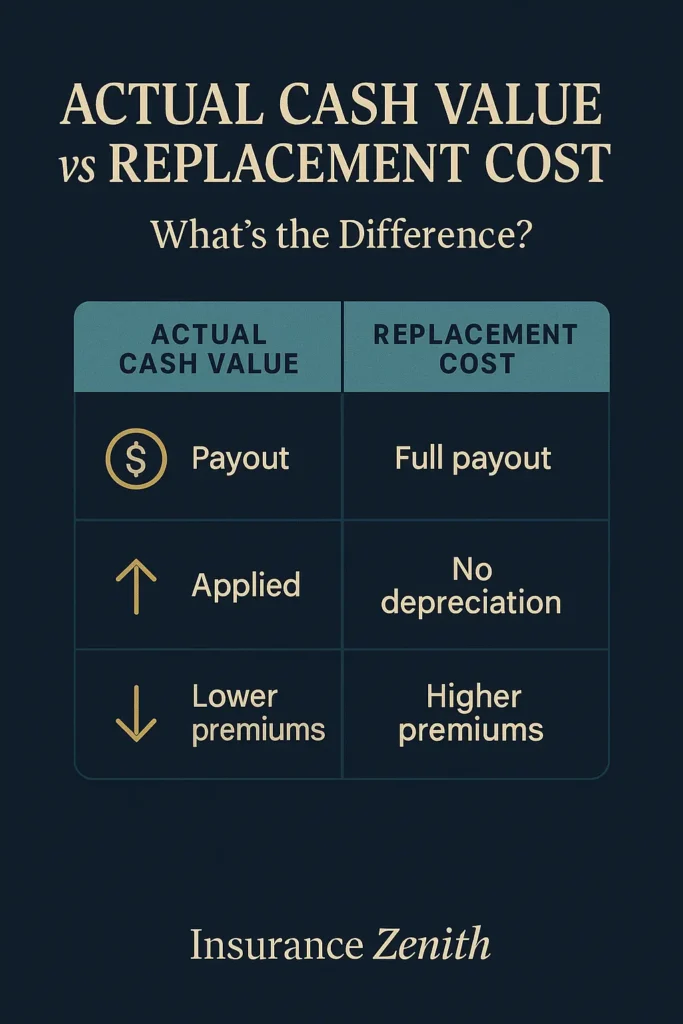

Quick Reference: Coverage Impact Analysis

| Coverage Aspect | Actual Cash Value | Replacement Cost |

|---|---|---|

| Depreciation Factor | Yes – reduces payout | No – full value |

| Typical Premium | 15-25% lower | Higher cost |

| Claim Payout | Current market value | Full replacement |

| Risk Exposure | High out-of-pocket | Lower financial risk |

Most importantly, you’ll learn the strategic steps successful homeowners take to optimize their coverage before they need it. Because the worst time to discover coverage gaps is after filing a claim.

On This Page

1. The Fundamental Coverage Mechanics That Determine Your Payout

Understanding how insurance companies calculate payouts under each coverage type reveals why this choice matters so much. These aren’t just different pricing models—they represent completely different philosophies about property value and risk transfer.

How Actual Cash Value Really Works

Actual cash value coverage operates on current market worth, not replacement cost. When you file a claim, adjusters calculate what your damaged property would sell for on the day of loss, factoring in age, condition, and depreciation. Think of it like selling your car—you don’t get what you paid for it; you get its current value.

Here’s a real-world example that happened in Colorado in 2024: A homeowner’s 8-year-old roof sustained $18,000 in hail damage. The roof had depreciated at 4% annually according to the insurer’s schedule. Total depreciation: $5,760 (8 years × 4% × $18,000). The actual cash value payout was $12,240 minus a $1,000 deductible, leaving the homeowner $11,240 to cover an $18,000 repair.

The Depreciation Calculation Process

If your dwelling has a 25-year composition shingle roof, it would depreciate at 4% a year under normal conditions. Insurance companies use standardized depreciation schedules:

- Asphalt shingles: 20-25 year lifespan, 4-5% annual depreciation

- Metal roofing: 40-70 year lifespan, 1.5-2.5% annual depreciation

- Tile roofing: 50+ year lifespan, 1-2% annual depreciation

1.1 Replacement Cost Coverage Mechanics

Replacement cost coverage asks a different question entirely: “What would it cost to rebuild this with equivalent materials at today’s prices?” This approach ignores depreciation and focuses solely on current construction costs.

The magic happens in how payments work. Even with replacement cost coverage, insurers typically issue two checks. The first covers actual cash value immediately. The second—called recoverable depreciation—comes after you prove completion of repairs with receipts.

Two-Payment Process Example:

- Roof replacement cost: $25,000

- Depreciated value: $15,000

- Your deductible: $2,500

- First check: $12,500 (ACV minus deductible)

- Second check: $10,000 (recoverable depreciation after proof of repair)

In most instances, you should notify your Claim professional of your intent to recover your depreciation within 6 months or 180 days of the date of loss. Miss this deadline, and you forfeit thousands in recoverable depreciation.

1.2 The Market Reality Behind Industry Changes

Insurance mathematics are brutal. On average, insurance companies who wrote Texas home policies in 2016 paid $1.30 out in storm related claims last year for every $1.00 of premium they received. This unsustainable loss ratio is driving significant changes in how insurers handle roof claims.

The 2025 Industry Shift

Some insurers in high-risk hail areas are changing the way they cover roof claims, moving from full replacement to depreciated value, which factors in depreciation and reduces their burden by lowering payouts. States experiencing these changes include:

- Oklahoma: 41% increase in tornadoes from 2022-2023

- Iowa: 133% increase in hail events from 2022-2023

- Colorado: Projected to become 4th most expensive state for home insurance by end of 2025

- Texas: Multiple major insurers stopping new policy issuance

The result? Homeowners are increasingly facing depreciated coverage whether they want it or not, especially for roofs over 10-15 years old.

2. Real-World Financial Impact Analysis: What Your Coverage Choice Actually Costs

Let’s examine actual claim scenarios using 2025 data to understand the true financial implications. These aren’t theoretical examples—they’re based on real claims data from major insurers across different regions and property types.

2.1 Roof Replacement Cost Analysis by Region

Regional construction costs dramatically affect your potential exposure. The average annual home insurance premium in the U.S. is $2,377 for a $300,000 dwelling policy, but claim payouts vary significantly by coverage type and location.

2025 Regional Roof Replacement Costs (per square foot):

| Region | Asphalt Shingles | Metal Roofing | Tile Roofing |

|---|---|---|---|

| Northeast | $4.50-$7.00 | $8.00-$12.00 | $10.00-$15.00 |

| Southeast | $3.50-$5.50 | $6.50-$10.00 | $8.00-$12.00 |

| Midwest | $3.00-$5.00 | $6.00-$9.50 | $7.50-$11.00 |

| West Coast | $5.00-$8.00 | $9.00-$14.00 | $12.00-$18.00 |

For a typical 2,000 square foot roof, replacement costs range from $6,000 in the Midwest to $36,000 on the West Coast. The coverage choice becomes even more critical with these higher values.

2.2 Personal Property Depreciation Schedules

Most homeowners underestimate how quickly personal property depreciates. Say you bought a refrigerator in 2016 for $1,500, and the fridge’s useful life is estimated to be 14 years. In this example, for each year of the fridge’s life, it would depreciate by roughly $107.

Accelerated Depreciation Items:

- Electronics: 15-20% annually

- Appliances: 7-10% annually

- Furniture: 5-8% annually

- HVAC systems: 4-6% annually

Consider electronics in your home office. A $3,000 computer setup purchased in 2022 would have an actual cash value of approximately $1,200 in 2025 due to rapid technological depreciation. Replacement cost coverage would provide the full $3,000 (minus deductible) to purchase equivalent new equipment.

2.3 The Compound Effect of Multiple Claims

In the 5-year period between 2015 – 2019, 5.7% of insured homeowners filed a claim. In other words, about 1 in 20 insured homes file a claim each year. For homeowners who experience multiple losses, the coverage choice becomes exponentially more important.

Case Study: Multiple Loss Scenario A homeowner in Oklahoma experienced three separate weather events in five years:

- Year 1: Hail damage to roof and gutters ($15,000 replacement cost)

- Year 3: Wind damage to siding and windows ($8,000 replacement cost)

- Year 5: Tornado damage to roof and personal property ($22,000 replacement cost)

Total exposure comparison:

- With actual cash value: $31,500 out-of-pocket (after depreciation and deductibles)

- With replacement cost: $7,500 out-of-pocket (deductibles only)

- Savings with replacement cost: $24,000

This dramatic difference explains why our homeowners insurance guide emphasizes understanding coverage types before purchasing a policy.

3. Advanced Depreciation Calculations and Industry Standards

Insurance companies don’t guess at depreciation—they use sophisticated methodologies based on actuarial data, construction industry standards, and economic factors. Understanding these calculations helps you anticipate claim payouts and identify potential disputes.

3.1 Industry-Standard Depreciation Schedules

Insurance companies determine how long your roof should last based on its materials (typically 20 years depending on materials). This depreciation schedule is usually found in your policy declaration pages. However, the calculation methods vary significantly between insurers.

Straight-Line Depreciation Formula: Annual Depreciation Rate = 100% ÷ Expected Useful Life

Common Roof Depreciation Schedules (2025 Standards):

| Material Type | Expected Life | Annual Depreciation | 10-Year Value Loss |

|---|---|---|---|

| 3-tab Asphalt | 20 years | 5.0% | 50% |

| Architectural Asphalt | 25 years | 4.0% | 40% |

| Metal Standing Seam | 50 years | 2.0% | 20% |

| Clay/Concrete Tile | 50+ years | 1.5% | 15% |

Advanced Calculation Example: A $30,000 architectural shingle roof installed in 2015 (10 years old in 2025):

- Annual depreciation: $30,000 × 4% = $1,200

- Total depreciation: $1,200 × 10 years = $12,000

- Actual cash value: $30,000 – $12,000 = $18,000

- With $2,000 deductible, payout: $16,000

3.2 Factors That Modify Standard Depreciation

Real-world depreciation calculations involve multiple variables beyond simple age. Insurance companies may evaluate the homeowner’s efforts in maintaining the roof, such as regular inspections, repairs, and cleaning. Adequate maintenance can help prolong the roof’s lifespan and minimize depreciation.

Depreciation Acceleration Factors:

- Poor maintenance history: +1-2% annual depreciation

- Storm damage history: +0.5-1% annual depreciation

- Exposure to extreme weather: +0.5% annual depreciation

- Below-standard installation: +1-3% annual depreciation

Depreciation Reduction Factors:

- Regular professional maintenance: -0.5% annual depreciation

- Premium materials/installation: -0.5-1% annual depreciation

- Protective features (gutters, ventilation): -0.5% annual depreciation

Understanding these factors helps homeowners make strategic decisions about maintenance and documentation. Learn more about optimizing your flood insurance coverage as part of a comprehensive protection strategy.

3.3 New Industry Innovation: Roof Payment Schedules

Many insurance companies are now automatically adding limited roof endorsements, also known as roof surfacing payment schedules at renewal time with minimal explanation. These predetermined schedules eliminate subjective depreciation calculations.

Sample Roof Payment Schedule (Major Carrier 2025):

| Roof Age | Coverage Percentage | $20,000 Roof Payout |

|---|---|---|

| 0-2 years | 100% | $20,000 |

| 3-5 years | 90% | $18,000 |

| 6-8 years | 80% | $16,000 |

| 9-11 years | 70% | $14,000 |

| 12-15 years | 60% | $12,000 |

| 16+ years | 50% | $10,000 |

This transparency helps homeowners understand exactly what to expect, but often results in lower payouts than traditional replacement cost coverage. For specialized coverage needs, explore our guide on gap insurance coverage to understand how depreciation affects auto insurance claims.

4. Strategic Decision Framework for Coverage Selection

Choosing between actual cash value and replacement cost requires analyzing your specific financial situation, property characteristics, and risk tolerance. Smart homeowners use a systematic approach to this critical decision.

4.1 Financial Capacity Assessment Matrix

Budget Impact Analysis: Your decision should start with honest financial assessment. Premium differences typically range from 15-25% for replacement cost coverage, but claim gap exposure can be 50-80% of replacement value.

Annual Cost vs. Risk Exposure Calculator:

| Property Value | Annual Premium Difference | Potential Claim Gap | Break-Even Analysis |

|---|---|---|---|

| $200,000 | $300-500 | $10,000-25,000 | Gap occurs every 20-40 years |

| $400,000 | $600-1,000 | $20,000-50,000 | Gap occurs every 20-50 years |

| $600,000+ | $900-1,500 | $30,000-75,000+ | Gap occurs every 20-60 years |

Consider this framework: If you cannot comfortably absorb a $20,000 unexpected expense, replacement cost coverage provides essential financial protection. The extra premium acts as insurance against insurance gaps.

4.2 Property Risk Profile Evaluation

High-Risk Indicators for Replacement Cost Coverage:

- Home age: 10+ years (higher depreciation exposure)

- Roof age: 8+ years (approaching significant depreciation)

- High-value personal property: Electronics, appliances, furniture over $50,000 total

- Regional factors: Hail-prone areas, hurricane zones, wildfire regions

Hail events, which can cause significant roof damage, increased in Iowa by 133% from 2022 to 2023. If you live in areas experiencing increasing severe weather frequency, the mathematical probability of claims increases, making replacement cost coverage more valuable.

Regional Risk Assessment (2025 Data):

| Risk Level | States/Regions | Recommended Coverage |

|---|---|---|

| Very High | TX, OK, KS, CO, FL, CA | Replacement Cost Essential |

| High | LA, AR, MS, AL, NC, AZ | Replacement Cost Preferred |

| Moderate | Most other states | Coverage choice flexible |

| Lower | VT, NH, ME, ND, WY | ACV acceptable for budget-conscious |

For homeowners looking to assess their specific regional weather risks and understand long-term climate trends affecting their property, the NOAA Climate Data Online portal provides comprehensive historical weather data and projections that can inform coverage decisions.

4.3 Implementation Strategy and Policy Optimization

Hybrid Coverage Approaches: Many insurers offer flexible combinations allowing strategic risk management:

- Dwelling replacement cost + Personal property ACV: Protects major investment while controlling premiums

- Scheduled item coverage: Replacement cost for specific high-value items (jewelry, art, electronics)

- Extended replacement cost: Provides 125-150% of dwelling limits for major losses

Policy Review Triggers: Review and potentially upgrade coverage when:

- Home value increases 20%+ (renovations, improvements)

- Personal property value increases significantly

- Regional risk factors change (increasing severe weather)

- Financial capacity improves substantially

Understanding these strategic elements helps homeowners make informed decisions rather than defaulting to the cheapest option. For comprehensive protection planning, explore our average home insurance cost analysis to budget appropriately for adequate coverage.

5. 2025 Market Trends and Regulatory Changes

The homeowners insurance landscape is experiencing unprecedented changes that directly impact coverage availability and pricing. Understanding these trends helps homeowners anticipate changes and make proactive decisions.

5.1 Premium Escalation and Market Dynamics

Home insurance costs are projected to rise in all 50 states by the end of 2025, with particularly dramatic increases in weather-prone regions. The overall market shows concerning trends that affect coverage decisions.

2025 Premium Projection by State Category:

| Risk Category | Average Increase | Sample States | Key Drivers |

|---|---|---|---|

| Extreme Risk | 15-25% | FL, CA, TX, CO | Wildfire, hurricane, hail frequency |

| High Risk | 8-15% | OK, KS, LA, NC | Severe weather, flooding |

| Moderate Risk | 5-10% | Most others | General inflation, construction costs |

| Lower Risk | 3-7% | VT, NH, WY, ND | Baseline inflation adjustment |

Florida is the most expensive state for home insurance, with an average annual premium of $10,996 for a $300,000 dwelling policy. These dramatic cost differences make coverage optimization even more critical.

5.2 Industry Response to Loss Ratios

The fundamental mathematics of insurance are forcing structural changes. Insurers are implementing new strategies to manage risk exposure while maintaining market presence.

Coverage Limitation Trends:

- Roof age restrictions: Many insurers now limit replacement cost coverage to roofs under 10-15 years

- Inspection requirements: Mandatory roof inspections for homes over 10 years in high-risk areas

- Deductible increases: Higher percentage deductibles for wind/hail claims

- Sub-limits: Specific coverage limits for roof claims separate from dwelling limits

Market Consolidation Impacts: Several major insurers have reduced writing in high-risk states, creating capacity constraints. This reduction in competition often results in fewer coverage options and higher prices for consumers. For context on market alternatives, review our cheapest home insurance options analysis.

5.3 Regulatory Response and Consumer Protection

State insurance departments are implementing new regulations to balance market stability with consumer protection. These changes vary significantly by state but share common themes.

Emerging Regulatory Trends:

- Rate approval transparency: Faster approval processes for justified rate increases

- Climate risk modeling: Allowing insurers to use predictive models rather than just historical data

- Coverage disclosure requirements: Enhanced explanation of coverage limitations and depreciation schedules

- Consumer education mandates: Required explanations of ACV vs. replacement cost implications

California Innovation (2025): The California Department of Insurance (CDI) responded to the state’s home insurance crisis in part by allowing insurers to file for rate increases based on climate risk projections rather than solely using historical data, starting in January. This approach may spread to other high-risk states.

The regulatory environment continues evolving rapidly. Homeowners should stay informed about changes in their state that might affect coverage availability or requirements. Our home insurance cost reduction strategies guide provides current approaches for managing these market changes.

To stay current on specific regulatory changes in your state and understand how they might affect your coverage options, visit your state insurance commissioner’s website through the NAIC’s state directory, which provides direct access to official state insurance regulatory information.

Conclusion: Making Your Coverage Decision

The choice between actual cash value and replacement cost coverage represents one of the most financially significant decisions in homeowners insurance. As we’ve analyzed throughout this guide, this choice can result in tens of thousands of dollars difference in claim payouts when you need coverage most.

Critical Decision Factors Summary

The data clearly shows that replacement cost coverage provides superior financial protection, but comes with meaningfully higher premiums. The average homeowners insurance premium rose by 7.6 percent in 2021 from 2020, making budget considerations increasingly important for many families.

Your optimal choice depends on three primary factors: your financial capacity to absorb large unexpected expenses, your property’s risk profile and depreciation exposure, and your regional risk environment. Homeowners with aging roofs, valuable personal property, or high regional weather risk typically benefit most from replacement cost coverage despite the premium increase.

Industry Changes Requiring Immediate Attention

The 2025 market environment demands proactive management of your coverage. With insurers increasingly shifting to actual cash value coverage for older roofs and implementing new depreciation schedules, many homeowners will face reduced coverage at renewal without realizing the impact until filing a claim.

Review your current policy immediately to identify any recent changes to roof coverage or depreciation schedules. Whenever you replace your roof, be sure to notify your agent immediately so they can update your policy to reflect your roof’s new age. This simple step could significantly improve your coverage terms.

Strategic Action Steps

Document your property’s current condition with photos and maintenance records. This documentation becomes invaluable during claims adjustment and depreciation disputes. Consider scheduling professional inspections for major systems approaching significant depreciation milestones.

If budget constraints require choosing actual cash value coverage, ensure you understand exactly what depreciation schedules apply to your property. Build emergency reserves specifically for potential coverage gaps, particularly for roof and HVAC systems that depreciate significantly over time.

Next Steps for Optimal Protection

Start by reviewing your current policy declarations page to confirm your coverage types for dwelling and personal property. Contact your insurance agent to discuss your specific situation and get quotes for coverage upgrades if appropriate. Don’t wait until after severe weather threatens your area—insurance companies often restrict policy changes during active weather advisories.

For comprehensive guidance on optimizing your entire homeowners insurance strategy, including coverage limits, deductibles, and multi-policy discounts, explore our complete homeowners insurance guide. Understanding all aspects of your protection helps ensure you’re making informed decisions that align with your financial goals and risk tolerance.

The investment in time to understand and optimize your coverage now can save thousands when you need it most. Your future self will thank you for taking action today.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.